Report Code: 10100 | Available Format: PDF

Cloud Computing Services Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2024-2030

- Report Code: 10100

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

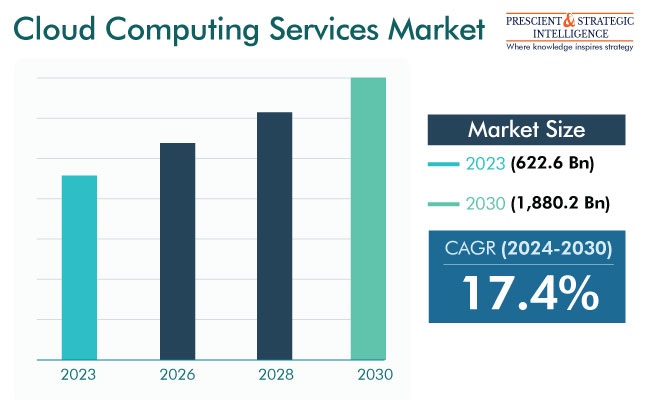

The revenue for the global cloud computing services market is estimated at USD 622.6 billion in 2023, and it will advance at a CAGR of 17.4% between 2024 and 2030, to reach USD 1,880.2 billion by 2030. This is attributed to the rapid digital transformation of businesses across industries, increase in the adoption of mobile phones and internet around the globe, and rise in the consumption of big data.

Storing, processing, and managing data on a network remotely, rather than on a local server, constitute cloud computing. The demand for these services is growing due to the need for automation and agility in business operations, cost savings associated with third-party data storage, surging requirement for enhanced customer experience, and booming trend of remote working.

Rising Usage of Machine Learning (ML) and Artificial Intelligence (AI)

The increasing adoption of ML, AI, big data, and other digital technologies is expected to drive the market growth. They help users in analyzing, monitoring, and visualizing unprocessed data. Additionally, the integration of these technologies into cloud solutions aids organizations in improving their visualization abilities and making complex data easy and accessible. With these technologies, data storage issues reduce, business productivity improves, operating costs lower, and decision-making processes enhance.

According to IBM, AI penetration rate in enterprises globally was 35% in 2022, which is a 4% increase from the previous year. AI generates solutions that are more efficient, strategic, and insight-driven for enterprises. An important reason behind the rising adoption of AI in the IT sector is the need for better monitoring workflows. Moreover, cloud solution and service providers are focusing on R&D activities, and new product launches to enable the integration of big data, AI, and ML.

Large Enterprises Category To Dominate Market

Based on enterprise size, the large enterprises bifurcation holds the greater share in the market. Large businesses have the financial resources to invest in foreign markets, establishing subsidiaries abroad, and expanding their reach without relying on the domestic market to support their business expansion. The essential factor for the adoption of the cloud computing approach by MNCs is their perpetual need for enhanced teamwork, lower operating costs, better flexibility, and a shorter time to market. For this, large enterprises are automating routine processes with cloud computing, to finish them more rapidly. Hence, as major enterprises grow in advanced and emerging economies, there will be a growth in the need for cloud computing services.

The SMEs category is expected to witness the higher growth rate over the forecast period. Small businesses face difficulties in coping with the introduction of disruptive business models and stay in business. Moreover, with digital transformation, a requirement for computer technology arises to enable SMEs to adapt and rethink critical business processes. Therefore, such businesses are concentrating on adopting a cloud-based technology to increase scalability and flexibility in business processes. Cloud platforms provide streamlined and fully integrated enterprise solutions, allowing businesses to move forward in their journey toward digital transformation, while providing cost advantages.

To increase the usage of these solutions among SMEs and expand the breadth and depth of their cloud offerings, to handle complicated combinations of technology, people, and processes, the market players are entering into acquisitions. For instance, in December 2020, IBM announced that it has acquired Nordcloud, a European cloud implementation and managed service provider, to become better at helping businesses move to the cloud. This is an important part of IBM’s strategy to expand the user base of its hybrid cloud platforms.

| Report Attribute | Details |

Market Size in 2023 |

USD 622.6 Billion |

Revenue Forecast in 2030 |

USD 1,880.2 Billion |

Growth Rate |

17.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

IaaS Adoption To Grow at Highest CAGR

The infrastructure as a service (IaaS) category will witness the highest CAGR within the service segment over this decade. IaaS solutions provide easy adoption, simple maintenance, and flexible payment models. Moreover, the rising demand for IaaS is because it enables remotely working teams to access data that was previously centralized, thus allowing for better collaboration.

IaaS adoption is also driven by the increasing demands for reducing IT complications, hiring a skilled workforce to manage IT infrastructures, and saving on the deployment costs for data centers. Along with the growing need for digitalization among businesses, the surging need to deploy enterprise-based computing capabilities is expected to increase the usage of these cloud computing services. IaaS makes it possible for companies to launch new apps, gives customers the freedom to customize and access storage, and aids in the administration of the purchase of on-premises hardware.

Hybrid Cloud Category To Register Highest Revenue Growth Rate

The hybrid cloud category will be the fastest-growing, based on deployment mode, over the next few years. This mode has become popular among industries and businesses for cost reduction, business operation enhancement, resource usage & consumption optimization, user experience improvement, and application modernization. Essentially, hybrid clouds offer the benefits of both public and private clouds.

The private cloud category has been the highest revenue generator till now, a situation that will likely remain unchanged till 2030. The increasing demand for scalable, secure, and affordable solutions is projected to drive the demand for private clouds among large organizations. Private clouds are accessible to individuals on a smaller scale, rather than being available to the public at large. They provide businesses with the advantages of scalability, self-service, flexibility, customization, and control on all the software, applications, and databases hosted on on-premises computer systems. Furthermore, private clouds enhance data privacy and security by using internal hosting and firewalls, thus ensuring robust protection for sensitive information.

BFSI Sector To Be Highest Revenue Generator

Among all end users, the BFSI sector holds the largest share in the market. The surge in online banking activity, which is leading money lenders to embrace the digital revolution, leads to the category’s dominance. Businesses in the BFSI sector benefit in bringing innovations to their digital services, increasing flexibility, enhancing client relationships, and reducing costs by adopting cloud computing. The chief factor driving the market growth is the need for efficiently storing and flexibly managing vast volumes of financial data.

Some of the Top Cloud Computing Services Providers:

- Adobe Inc.

- Alibaba Group Holding Limited

- Amazon.com Inc.

- Oracle Corporation

- Dell Technologies Inc.

- Google LLC

- Cisco Systems Inc.

- Microsoft Corporation

- SAP SE

- Salesforce Inc.

- IBM Corporation

- Tencent Holdings Ltd.

- Hewlett Packard Enterprise Development LP

- Workday Inc.

- Rackspace Technology Inc.

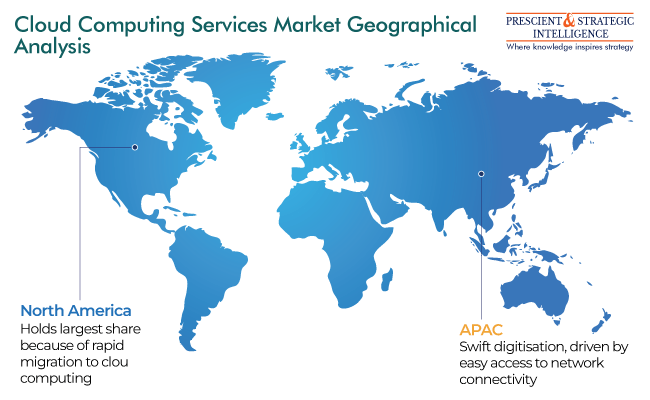

North America Is Largest Regional Market

North America is the largest market for cloud computing services as the U.S. and Canada are rapidly adopting this technology. Additionally, the region is home to all the top suppliers of such solutions, including Google, Adobe, IBM, and AWS. These companies are entering into partnerships and other initiatives to broaden their portfolios and attract more customers. For instance, in January 2023, through a partnership with Google Cloud, TTEC Holdings Inc. enabled clients to utilize the contact center as a service features of Google, to support real-time consumer interactions across digital channels.

Further, digital transformation is seen as a priority in the U.S. due to the rapid industrialization. Companies and individuals in the region are early to adopt technologies such as AI, virtual reality, big data analytics, internet of things, and 5G. All these result in the generation of massive amounts of data, which creates a requirement for efficient and cost-effective storage.

Asia-Pacific Market Is Growing at Highest Rate

The market in Asia-Pacific is expected to grow at the highest CAGR, of XX%, during the forecast period. Local players, especially Alibaba Group, have grown rapidly in recent years, boosted by the rampant digitization in India and China. Additionally, the Make in India initiative has expanded the demand for cloud computing solutions in the industrial sector, enabled by hefty FDIs. Moreover, players such as Google LLC, Amazon.com, and Microsoft Corporation, are building data centers in Thailand and Indonesia to meet governments’ data sovereignty demands.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws