Cathode Material for Automotive Lithium-Ion Battery Market Analysis

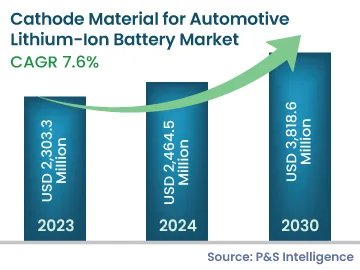

The global cathode material for automotive lithium-ion battery market was valued at USD 2,303.3 million in 2023, which is expected to grow at a CAGR of 7.6% during the forecast period (2024–2030), to reach USD 3,818.6 million by 2030. The growth of the industry is expected to be propelled by the increasing adoption of electric vehicles, continuous reduction in the prices of cathode materials, and expansion of the energy storage battery sector.

Currently, cathode materials hold about 25–30% of the production cost of a lithium-ion battery. Being affected by both upstream raw material suppliers and downstream battery manufacturers, the price of cathode materials is a major factor determining their demand.

One of the key focus areas for OEMs working on developing cathode materials is to develop them at a cheaper cost. The price reduction has driven the demand for cathode materials, and it is expected to have a major positive impact on the industry in the forecast period as well.

The cost reduction of lithium-ion battery cathode materials is being brought about not at the expense of the energy density but is rather also aimed at supplementing it. Thus, the continuous reduction in the price of the cathode materials is a major driver for the market growth.

Energy storage batteries can store energy in times of on-peak energy generation and release the stored energy at some later intervals of time. With the growing environmental concerns, governmental bodies and the public as a whole are shifting toward renewable sources of energy, such as solar energy and wind energy.

As these sources of energy cannot serve as continuous sources, there is a growing need for energy storage batteries, which mainly comprise lithium-ion batteries. These batteries have a lifespan of 5–15 years and up to 98% efficiency, thus making them a frontrunner for energy storage. The growth in the need for lithium-ion batteries is expected to drive the demand for cathode materials.