Market Statistics

| Study Period | 2019 - 2030 |

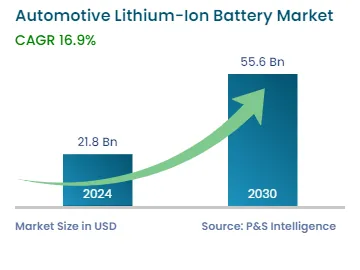

| 2024 Market Size | USD 21.8 Billion |

| 2030 Forecast | USD 55.6 Billion |

| Growth Rate(CAGR) | 16.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 11757

Get a Comprehensive Overview of the Automotive Li-ion Battery Market Report Prepared by P&S Intelligence, Segmented by Vehicle Type (Two-Wheeler, Passenger Car, Commercial Vehicle), Battery Type (Lithium–Iron Phosphate, Lithium–Manganese Oxide, Lithium–Nickel–Manganese–Cobalt, Lithium–Titanate Oxide, Lithium–Nickel–Cobalt–Aluminum Oxide), Vehicle Technology (Hybrid, Plug-in Hybrid, Fully Electric), Battery Form (Cylindrical, Prismatic, Pouch), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 21.8 Billion |

| 2030 Forecast | USD 55.6 Billion |

| Growth Rate(CAGR) | 16.9% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The automotive lithium-ion battery market is estimated to have generated a revenue of USD 21.8 billion in 2024, and it is expected to grow at a CAGR of 16.9% during the forecasted period, to reach USD 55.6 billion by 2030. The worldwide requirement for lithium-ion batteries is booming, due to the rising demand for hybrid and electric vehicles, strict and necessary government rules laid for environmental protection, and surging R&D attempts to amplify the performance of such batteries.

In addition, the newly established Corporate Average Fuel Economy (CAFE) standards have enforced higher fuel efficiency requirements for passenger cars and light commercial vehicles (LCVs), leading to the expansion of electric drive technologies.

Moreover, the batteries have been successfully perforating into the market due to their longevity, dense size, less charging time, and minimum maintenance costs as compared to traditionally used batteries, such as lead acid and nickel metal, and the increasing penetration of EVs, which give an advantage of reducing global carbon emission. For example, India is planning to sell only electric two-wheelers from 2025 onward. Similarly, South Africa targets the incorporation of 20% electric cars in its car fleet by 2030, while Mexico has a target to sell 5% zero-emission vehicles (ZEVs) of the total new automobile sales by 2030 and 50% by 2040.

In addition, the rising prominence of a continuous shift toward renewable electricity sources has generated enormous opportunities in the market in terms of renewable energy storage. To store energy, the demand for such batteries is rising. Thus, companies are collaborating with each other to improve their capacity. For instance, India’s largest lead-acid battery maker, Exide Batteries established a joint alliance with Switzerland-based Leclanche SA, which is one of the world’s dominating energy storage solution companies, in June 2019, to boost its production to 100% at its lithium-ion battery plant within four years.

Furthermore, the surging adoption of emission-free hybrid and all-electric vehicles, as a consequence of health and environmental concerns, government support and financial inducement for the adoption of EVs integrated with rigid emission norms on standard vehicles, overburden on public transport, and governments drive for the electrification of commercial vehicles, along with the descending prices of batteries and the rising fossil fuel prices, is forecasted to drive the demand for lithium-ion batteries in the coming years.

Additionally, current developments and advancements in technologies in the automotive and battery industries have raised the energy storage capacities of vehicular batteries, such as high energy density lithium-ion batteries, which enhance the traveling range of electric vehicles. Consequently, automakers’ projects to furnish their approaching automobiles with these modern batteries and the availability of fast automotive battery chargers to improve performance are boosting the growth of the market.

Based on vehicle type, the passenger car category accounts for the largest revenue share, advancing at a CAGR of 16.6%, during the forecast period. The rising disposable earnings of consumers, shifting lifestyles, and rapid urbanization are increasing the requirements for passenger cars globally, especially in China. Also, the sales and evolution in the passenger car sector are remarkably influenced by policies and regulations of governments, which are expected to rise in the forthcoming years. Additionally, the electrification of passenger cars and producers’ initiative to introduce cars having a superior range are forecasted to fuel the sales of lithium-ion batteries for such cars.

Additionally, there is a rise in consumers opting for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The glorifying markets for this are the U.S., China, and Europe. For instance, in 2028, the unit sales of electric vehicles are expected to reach 8.77 million vehicles, in China.

Whereas, the commercial vehicle category is expected to witness the fastest growth in the coming years. This can be due to the high utilization of lead-acid batteries in commercial vehicles, progressive electrification of these vehicles globally, and the hike in requirement for substitute of dead lead-acid batteries in such vehicles. The e-commerce and logistics sectors are making a shift toward electric delivery trucks and vans. Major companies like DHL, Amazon, and UPS are allocating investments in electric delivery vehicles with the aim of decreasing their environmental footprint and lowering operational expenses. Electric delivery vehicles offer the benefits of zero emissions in urban delivery scenarios.

Based on battery type, the Lithium Iron Phosphate (LFP) category dominates the market. This is attributed to the rising utilization of LFP batteries by manufacturers of electric buses and electric cars, as these batteries have high energy density and long lifespan along with thermal stability making them less prone to overheating and thermal runaway. For example, the top-selling car models of Tesla, named Model S and Model X, are furnished with LFP batteries and the company confirmed that nearly half of all its vehicles produced last quarter of 2021 had cobalt-free LFP batteries.

Moreover, these batteries can also be utilized without any proper understanding ascribed to the incorporation of power-saving circuitry. Additionally, these batteries can be left to charge, and when the battery has been fully charged, the charger will automatically turn off the power. The life cycle of LFP is greater than that of lithium cobalt oxide (LCO), which can extend beyond the 2000 charge-discharge cycle. This serves as an advantage where battery replacement is expensive or inconvenient. This kind of battery is used in energy storage system (ESS), renewable energy storage, and uninterruptible power supplies (UPS), which is favored in home energy storage solutions and grid energy projects, etc.

Whereas, the lithium nickel manganese cobalt (NMC) category is projected to rise at a significant growth rate during the expected duration. This can be because NMC battery can be utilized as a vitality cell or power cell, has high specific energy density or high specific power, the efficacy of NMC depends on the combination of components such as nickel, manganese, and cobalt.

Based on vehicle technology, the fully electric category accounts for the largest revenue share of 45% in 2023. This is ascribed to the elevated average quantity of batteries used in fully electric vehicles as contrasted to those in HEVs and PHEVs. Moreover, high-rise concerns regarding environmental pollution and excessive subsidies and incentives recommended for the production and purchase of BEVs have underpinned the acquisition of fully electric automobiles.

The success of fully electric vehicles is due to the availability of charging stations, whether at work, public, or home charging. According to the International Energy Agency, by 2030, the Net Zero Scenario will witness the installation of 17 million publicly available charging stations.

Whereas, the plug-in hybrid category is expected to witness significant growth in the coming years. This can be due to the increasing sales of lithium-ion battery-based plug-in hybrid vehicles, as the environmental concerns regarding emissions across the world are rising.

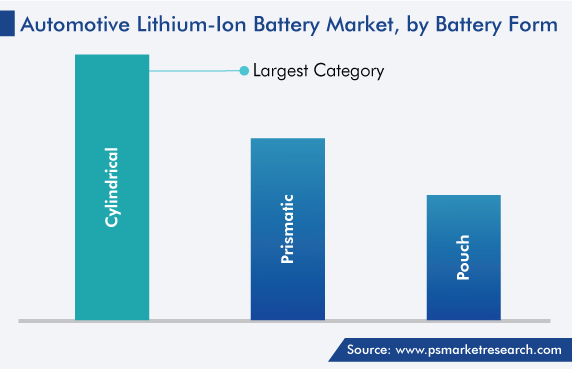

Based on battery form, the cylindrical category is expected to observe the highest growth rate in the coming years. This kind of cell has a tubular shape used in consumer electronics and power tools. The growth can be attributed to rapid heat loss by cylindrical cells during the charging and discharging, their cost-effectiveness, and their surging adoption in several industries, such as energy storage and EV. These cells are renowned for their durability and are often arranged in battery packs for increased voltage and capacity.

Drive strategic growth with comprehensive market analysis

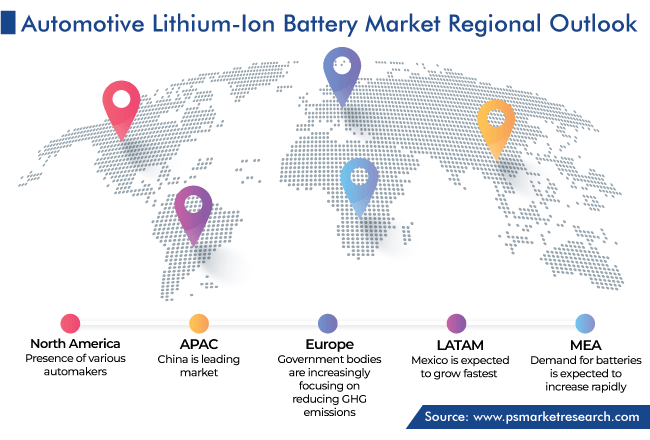

Based on region, APAC leads the lithium-ion battery market, and it is projected to sustain its superiority during the forecasted period as well. This is ascribed to the surging adoption of electric vehicles in countries such as China, Japan, India, Australia, and South Korea, due to the commending government policies that boost their manufacturing and utilization; and the presence of many international and local EV manufacturers in the region, who have created a strong requirement for automotive lithium-ion batteries. According to the International Energy Agency, in China, battery demand for vehicles grew by over 70%, while electric car sales increased by 80% in 2022 relative to 2021. Also, these countries have actively participated in encouraging EV adoption to lower carbon emissions and subordination on fossil fuels for transportation and power generation.

Moreover, the APAC market is expected to observe balanced growth over the projected duration. This can be attributed to the rising usage of lithium-ion batteries in different sectors, such as medical, aerospace & defense, automotive, energy storage, electronics, and data communication & telecom.

On the other hand, the European market for lithium-ion batteries is projected to record the fastest growth in the forthcoming years. This can be due to the high adoption rate of EVs regionally, as government bodies are increasingly focusing on reducing greenhouse gas emissions in the environment in Europe, and the presence of large and leading automobile companies, such as Volkswagen Group and BMW AG, who are highly investing in modern technologies for their EVs.

In addition, several countries in the region, including Germany, France, Spain, the U.K., Norway, Sweden, and the Netherlands, have launched an objective of having zero carbon dioxide emissions by 2030. Furthermore, the rising support from alliances, such as the Association of European Automotive Industrial Battery Manufacturers, is reinforcing the adoption of lithium-ion batteries in the automotive industry.

This report offers deep insights into the automotive Li-ion battery industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Vehicle Type

Based on Battery Type

Based on Vehicle Technology

Based on Battery Form

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages