Market Statistics

| Study Period | 2019 - 2030 |

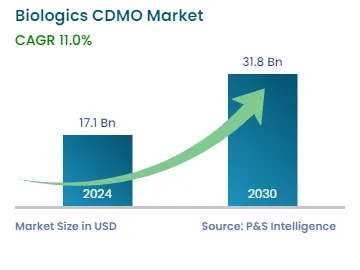

| 2024 Market Size | USD 17.1 Billion |

| 2030 Forecast | USD 31.8 Billion |

| Growth Rate(CAGR) | 11% |

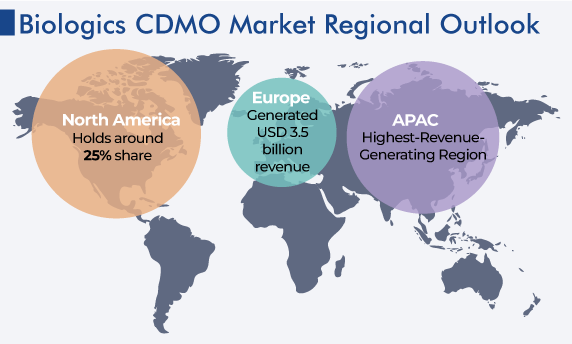

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12310

Get a Comprehensive Overview of the Biologics CDMO Market Report Prepared by P&S Intelligence, Segmented by Product Type (Drug Product, Drug Substance), Cell Line Type (Microbial, Mammalian, Viral Vector & Other Modalities), Service Type (Clinical, Commercial), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 17.1 Billion |

| 2030 Forecast | USD 31.8 Billion |

| Growth Rate(CAGR) | 11% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global biologics CDMO market is estimated to have generated USD 17.1 billion in 2024, and it is predicted to reach USD 31.8 billion by 2030, advancing at a CAGR of 11.0% during 2024–2030. This is due to the surging incidence of chronic diseases, rising outsourcing of R&D activities, companies involved in partnerships with biologics CDMOs to introduce novel products, and the growing geriatric population.

Large pharma firms are motivated to eliminate the risk of R&D efforts and upsurge the speed to market their drugs that are life changing, while continuously decreasing the cost of manufacturing and development. The increasing number of biotech and specialty firms are moving towards service providers to avoid the high-fixed cost of in-house development, manufacturing, and expertise required to get their molecules through clinical development. The complexity of new molecular entities (NMEs) development is growing, which in turn, is creating a demand for niche competencies and capabilities which pharmaceutical firms prefer to access externally rather than incorporate in-house.

In addition, high internal fixed cost bases associated with internal capabilities limit their ability to scale up and down based on the size and nature of their pipeline and ever-changing requirements. To pharmaceutical companies, CDMOs offer this flexibility and agility to spend a large portion of their profits and capital on R&D to create better drugs at lower costs, so the strategic use of external CDMO partners grants companies a substantial competitive advantage. Companies that engage CDMOs early in the R&D process are involved in the development of intellectual property (IP), the filing of patents for customers, and the assistance of customers in protecting their IP.

Moreover, pharmaceutical companies are consolidating their supplier base and prefer to work with CDMOs that provide services such as drug substance and drug product development as well as manufacturing. To meet this market demand, CDMOs are expanding their capabilities across all stages of development and commercialization in order to eliminate the need for technology transfer and serve customers end-to-end. Thus, the shift in preference toward CDMOs is another major market trend.

During the pandemic, the heightened need for vaccines and therapeutic antibodies positively affected the market. Furthermore, the pandemic revealed supply chain flaws and the world’s reliance on emerging markets, such as China and India, for APIs and generics. These factors have impelled countries to boost domestic manufacturing, to meet the supply, which CDMOs can benefit from.

APAC is an evolving market, attracting many biologics CDMOs. In the region, there is a huge population that is continuously rising, in turn, demanding improved medicine access. Further, the growth of the regional market is driven by the increasing pharmaceutical affordability, as a result of the emergence of low-cost generics. Also, increased per capita GDP, healthcare programs sponsored by governments, and rapid urbanization lead to expanded access to doctors and pharmacies for substantial portions of the population, making CDMOs affluent.

For instance, India is an outstanding market for CDMOs, as it has received FDA approvals for a gigantic number of drug items and has a skilled and highly qualified workforce. As the ease of access to healthcare advances in developing countries and the number of generic manufacturers in India rises, there will be a huge rise in the local CDMOs business, and India can handle a huge number of products more cost-effectively. Essentially, the market growth is due to the expansion of healthcare infrastructure in the country.

In LATAM, the geriatric population is on the rise. For instance, the demographic of Brazil is shifting toward a more aging population and is expected to have around 65 million people of age 60 years or above by 2050. Moreover, the geriatric population in Mexico rose from 7.04% in 2017 to 7.32% in 2021 of the total population. The geriatric population is more prone to chronic illnesses, due to low immunity and reduced lung capacity. Thus, the growing aging population is adding healthcare expenses for patients, making it difficult for them to meet requirements, due to the high cost of treatment with branded drugs. Therefore, the patients are demanding low-cost bioequivalent branded drugs, which can be easily accessed and affordable.

Besides, due to unhealthy diets, alcohol consumption, and lack of physical activity, there is a huge number of cases of chronic ailments, such as diabetes and CVDs, which have become the main cause of death in Mexico. Thus, the rising prevalence of chronic diseases will boost the demand for biologics CDMO in the region.

Rising Outsourcing of R&D Activities

The growing biopharma sector is bringing extraordinary demands for biologics outsourcing services. Small and medium-sized biotech firms are turning to taking outsourcing services, because of their lack of limited capacity and R&D capabilities. In the meantime, large biopharma firms are also outsourcing R&D activities to biologics CDMOs providing complete solutions to decrease cost of R&D, mitigate risks, and focus on their core competencies while improving efficiency. Thus, the global biologics outsourcing sector is anticipated to grow at a noteworthy rate in the future.

The pharmaceutical industry invested more than $45 billion in 2020 in Europe for researching, developing, and bringing new medicines. The increase in demand for pharmaceutical drugs and biologics and the advanced production requirements have prompted CDMOs to engage in R&D activities. Moreover, R&D supports the development and testing of novel therapies, product portfolio expansions, and clinical testing for safety and marketing. Hence, the increasing investment in research and product development will propel the growth of the market.

Moreover, the demand for clinical services is increasing in the market, due to the adoption of the outsourcing strategy by biopharmaceutical organizations to mitigate the accompanying risks in the drug development phase with bio-CDMOs’ low development costs and high expertise. In addition, the increasing number of collaborations with small and clinical-stage biopharma enterprises, which account for a significant portion of the biopharma clinical pipeline, enhances the growth of the market.

The drug substance category dominates the market, with revenue of $8,525.4 million in 2023. The increase in biologics approvals, especially from the FDA; strong clinical pipelines; and lower failure rates of biologic drugs contribute to drug substance demand. Biologics market growth also spurs the development of processes involved, which are often outsourced to CDMOs by small and mid-sized pharma companies. Outsourced biologic development activities include assay development and toxicology studies to the master cell bank establishment.

Expertise in a range of formulations, such as prefilled syringes, single-line multiple-infusion bags, inhalers, and dual-barrel syringes, is necessary for the current market landscape. It parallels pharmaceutical companies’ increasing focus on co-formulations, as combination therapies prove to be more effective than standalone treatments. Besides the required tools and expertise to facilitate complex biologics’ development and drug substance manufacturing, the flexibility to offer different dosing formulations, to improve biologics’ clinical results, is a vital differentiator for global market participants for biologics CDMO.

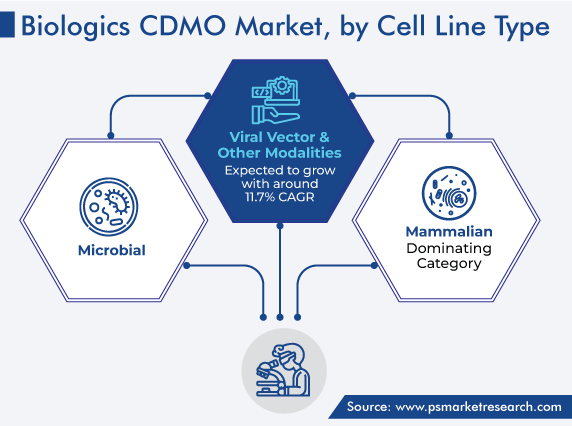

The mammalian cell culture is estimated to have held the largest market share, of around 56%, in 2023. This is due to the development of more-complex biologics, such as antibody–drug conjugates and bi- and tri-specific antibodies. Additionally, pharmaceutical companies’ increasing dependence on biologics CDMOs is expanding the capacities in this category. For example, major participants, such as Lonza, WuXi Biologics, and Samsung Biologics, are likely to raise their mammalian cell culture capacity by about 30–40% in this decade.

Moreover, microbial cell cultures held the second-largest share of the market in 2022, and their contribution is projected to increase, albeit at a lower rate. This is primarily due to market consolidation, with participants such as Bachem, Corden Pharma, and Polypeptide Group set to dominate this category. This is also because of major biologics CDMO participants’ slow transition from the main microbial cell culture products, such as peptides, growth factors, and single-domain antibodies, to the more-proliferous mammalian cell culture products and promising cell and gene therapies.

Furthermore, the differentiating growth drivers for cell culture market participants are novel expression technologies, enhanced production capacities, long-term contract fulfillment with near-perfect success rates, and flexible business models to engage various pharmaceutical industry participants.

Drive strategic growth with comprehensive market analysis

The North American biologics CDMO market is expected to generate $7,802.9 million revenue by 2030. This can be attributed to the rising aging population, the increasing prevalence of acute and chronic diseases, and the surging R&D expenditure of pharma and biotech companies. For instance, the U.S. demographics for the aged population of 65 years and above increased to 55 million in 2021 from 50 million in 2018.

As per the CDC, chronic diseases, such as cancer, heart disease, and diabetes, were the leading causes of death in the U.S. and cost more than $4 trillion in 2021 to healthcare systems. Also, according to an article published by Partnership to Fight Chronic Disease (PFCD), around 45% of the U.S. population has at least one chronic ailment, and by 2025, around 165 million Americans will be suffering from more than one chronic disease. The huge burden of cost regarding the treatment of a large number of chronic cases has created an urge from patients as well as healthcare systems to seek alternatives to the high-cost branded drugs.

With the rising demand for CDMO facilities, companies are investing in the region. For instance, Fujifilm is investing $2 billion to expand its CDMO capabilities in the U.S. Similarly, AGC Inc. announced to expand the manufacturing capacity of its biopharmaceutical CDMO business subsidiary, in the U.S., for cell and gene therapy applications. The company also expands the capacity of its virus vector manufacturing facility at Longmont, Colorado, the U.S.

This report offers deep insights into the biologics CDMO industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product Type

Based on Cell Line Type

Based on Service Type

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages