Market Statistics

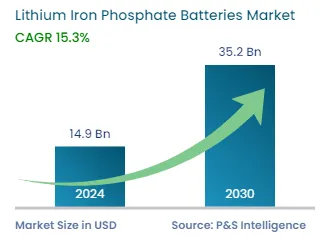

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 14.9 Billion |

| 2030 Forecast | USD 35.2 Billion |

| Growth Rate(CAGR) | 15.3% |

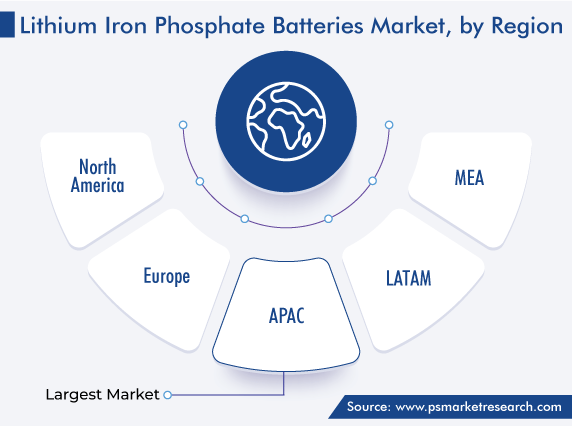

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12543

Get a Comprehensive Overview of the Lithium Iron Phosphate Batteries Market Report Prepared by P&S Intelligence, Segmented by Design (Cells, Battery packs), Voltage (Low, Medium, High), Capacity (0-16,250 mAH, 16,251- 50,000 mAH, 50,001- 100,000 mAH, 100,001-540,000 mAH), Industry (Automotive, Power, Industrial, Aerospace, Marine), Application (Portable, Stationary), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 14.9 Billion |

| 2030 Forecast | USD 35.2 Billion |

| Growth Rate(CAGR) | 15.3% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global lithium iron phosphate batteries market was valued at USD 14.9 billion in 2024, which is projected to reach USD 35.2 billion by 2030, advancing at a CAGR of 15.3% during 2024–2030. This is ascribed to the growing industrial automation space, increasing demand for LFP batteries in the automotive sector majorly in EVs, and innovative developments in lightweight materials. Moreover, in this decade, significant progress has been made in battery energy storage technologies, resulting in an increase in energy density and a cost reduction of about 85% for battery packs.

Numerous initiatives have been implemented in the U.S. to increase the demand for lithium ferro phosphate batteries. In 2022, a new LiFePO4 battery manufacturer intended to build a gigafactory in the country. In addition, in order to establish U.S.-based supply agreements, American Battery Factory (ABF) is actively in communication with pack integrators, energy storage solution providers, and other organizations. The first ABF manufacturing location as well as upcoming agreements will be disclosed in the upcoming months. ABF is still actively looking for new factory locations all around America.

Moreover, in October 2022, grants totaling USD 2.8 billion were given to the domestic battery industry by the U.S. Department of Energy. Around 20 companies, from significant raw material manufacturers to battery recyclers, will receive grants covering the whole supply chain for battery raw materials. Also, the U.S. military and government will deploy the LFP batteries in EVs, energy storage systems, and other applications.

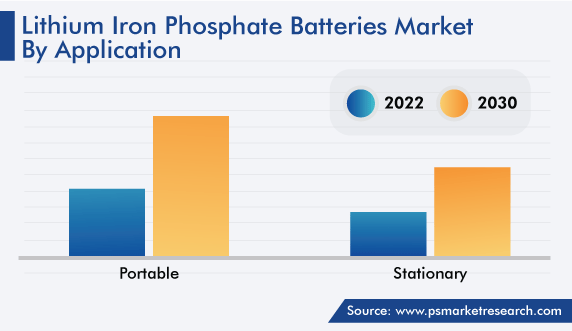

The portable category held a larger revenue share, of more than 60%, in 2022. This is mainly due to the rising adoption of EVs, HEVs, and PHEVs. Companies that provide EV charging infrastructure solutions are developing a portable charger that can charge EVs quickly on the go, similar to the power bank that is carried by smartphones. The regular AC/DC chargers that call for lugging EVs to charging stations are substantially slower than these portable ones.

For instance, ZipCharge's Go is a mobile, wheeled power bank that can charge EVs wherever the car is parked. It is roughly the size of a compact suitcase. The Go can be charged in any regular outlet, wheeled to the car, and connected to the vehicle with a type-2 standard cable. The Go can extend the range of any electric or plug-in hybrid vehicle by 20–40 miles, depending on the vehicle.

The high voltage category accounted for the largest revenue share in 2022. The pressure on the automotive industry to innovate and create solutions that appeal to a wider audience is driving the trend toward the adoption of high-voltage batteries. Since these batteries have a quicker rate of discharge, they should, in theory, be better suited for use in machinery that needs a lot of power in a short amount of time.

Moreover, high-voltage batteries are lighter than ordinary batteries with the same capacity and have a higher discharge platform. Overall, the additional voltage slightly enhances appliance performance. The energy density of these batteries is likewise very high. They offer a longer battery life while producing more power since they can give more capacity under the same usage conditions.

The automotive category held the largest revenue share, of more than 34% in 2022. This can be attributed to the surging use of EVs as a result of supportive government policies, as demand for lithium ferrous phosphate battery in the automotive sector majorly in EVs is increasing. Many EV support policies have been implemented in recent years in several countries, which increase the acceptance of several electric car models.

The initial adoption of LDVs was sparked by significant financial incentives, which also supported the expansion of the EV manufacturing and battery industries. In order to close the price gap with conventional automobiles, measures mostly purchasing subsidies and/or vehicle purchase and registration tax rebates were put in place.

Moreover, the role of EVs has increased as a result of the gradually stricter fuel economy and tailpipe CO2 limits. Today, these criteria apply to roughly 85% of all automobile sales globally. The promotion of EV sales in the European Union, which saw the greatest yearly gain in 2020 to reach 2.1 million units, was greatly aided by CO2 emissions rules. In addition, EV sales rose in 2021, despite the Covid-19 pandemic-related economic slowdown. For instance, India sold 104 thousand EVs in 2021, compared to a total of 517 thousand registrations over the previous 3.5 years.

100,001–540,000 mAh battery capacity held the largest revenue share in 2022. This is explained by the widespread use of batteries with this capacity in several kinds of EVs, including hybrid and plug-in electric vehicles. The sales of electric vehicles (including completely electric and plug-in hybrids) doubled to a new high of 6.6 million in 2021. Moreover, in 2021, in China, sales of EVs nearly tripled to 3.3 million, making up about half of the global demand. Also, the sales amplified significantly in both the U.S. and Europe (by 65% to 2.3 million).

In order to stay competitive in today's business environment, manufacturers must be nimble and adaptable to changes in contemporary technology. Manufacturing machinery from the past is still entirely manual and functions as a collection of unrelated assets. Industrial producers are trying more and more to achieve higher efficiencies through cost reduction and automation as customer demands rise. Industrial automation solutions have been used by industry leaders to modernize their traditional production value chains. Computer-aided devices are now being used to run industrial operations, and the results have been astounding.

Industrial automation for manufacturers and service lines entails the integration of computer-aided devices, control systems, and sensors at various operational levels, complemented by data analytics and artificial intelligence. This technology ecosystem of linked devices through software integration allows for full control of mechanisms within the plant, as well as allowing operations to be carried out through mechanized schedules.

Not just in manufacturing, but also in discrete, process, and hybrid industries, industrial automation components and solutions are widely used. By 2030, the sector might be worth around USD 16 trillion to the world economy. Using automation technologies has a wide range of benefits, including cost, error, and time savings; enhancements to working capital management, production quality, and safety; and reliability of process decisions.

Drive strategic growth with comprehensive market analysis

The APAC lithium iron phosphate batteries market held the largest revenue share, of around 49%, in 2022. This is due to the development pertaining to EV charging infrastructure in China, Japan, and India. China has made considerable advancements; 65% of all public EV charging stations worldwide are located in China, while the majority of the rest of the world is still working to construct the infrastructure required to support anticipated future EV usage. China has excelled in improving the production and sale of electric vehicles.

By 2030, China wants 40% of all new cars sold will be electric vehicles, which means a lot more cars will need to be charged. The country wants to have a sufficient charging structure in place by 2025 to accommodate more than 20 million cars. Presently, over 70% of 810,000 public charging stations in China are in densely inhabited coastal areas. Additionally, according to Ministry data, there were 10.01 million NEVs (BEVs, PHEVs, and FCEVs) on Chinese roads. By 2025 and 2030, this number is predicted to rise to 25 million and 80 million, respectively.

Moreover, by 2050, the Japanese government intends to become carbon neutral. The government gave a total of over USD 900 million in subsidies for the development of EV charging stations in 2021 to help the market for electric vehicles grow.

Moreover, investment in electrified transportation solutions in India is also driving the APAC market. India entered the top three auto markets in the world in 2022 and has since expanded. The Government of India is promoting the use of electric vehicles in order to decrease fuel consumption and enhance the environment because there are over 400 million people who need transportation options. India is one of a select group of nations that supports the global EV30@30campaign in order to accomplish this. By 2030, this initiative wants at least 30% of new cars sold to be electric.

In addition, with the opportunity of 100% FDI, increased efforts to advance charging infrastructure, and new manufacturing centers, the Indian electric car sector is gaining momentum. Further, the presence of regulations that favor higher concessions for electric two-wheelers, federal subsidies, and a rise in localized ACC battery storage manufacturing drive the EV industry in the country.

Many top battery manufacturers, including Amara Raja Batteries, have followed incentives to direct new investments toward green technologies. In addition, Tesla Inc., an American manufacturer of electric vehicles and sustainable energy, has announced the incorporation of Tesla India Motors and Energy Pvt Ltd. in Bengaluru to signify the company's debut in the Indian market.

This fully customizable report gives a detailed analysis of the lithium iron phosphate battery industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Design

Based on Voltage

Based on Capacity

Based on Industry

Based on Application

Geographical Analysis

The lithium iron phosphate batteries market size stood at $14.9 billion in 2024.

During 2024–2030, the growth rate of the lithium iron phosphate batteries market will be around 15.3%.

Portable is the largest application area in the lithium iron phosphate batteries market.

The major drivers of the lithium iron phosphate batteries market include the surging industrial automation space, developments in lightweight materials, and the rising need for LFP batteries in the automotive industries.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages