Report Code: 12840 | Available Format: PDF | Pages: 240

Wood-Plastic Composite Market Size and Share Analysis by Material (Polyethylene, Polyvinylchloride, Polypropylene), Application (Building and Construction, Automotive Components, Furniture, Industrial Machinery, Consumer Goods) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12840

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The Wood plastic composite market size stood at an estimated USD 7,489.7 million in 2023, and it is expected to grow at a CAGR of 10.0% during 2024–2030, to reach USD 14,412.9 million by 2030.

Wood plastic composites are firm and smooth pellets created from a mixture of ultra-fine wood particles and biodegradable, renewable, or recycled plastic. They are used in outdoor decking materials, packaging, furniture, automotive components, electrical & electronic items, kitchenware, fencing materials, lawns & gardens, sidings, toys, and various other articles, using extrusion and injection-molding.

Ceramics, plastic–steel, logs, plastics, aluminum alloys, and other comparable composite materials can be replaced in almost all applications by these advanced wood-based materials. Therefore, their usage is progressively increasing in the municipal, residential, environmental protection, sports, and commercial sectors. Further, the advent of the circular economy concept and the growing challenge of resource scarcity have made WPC suppliers and manufacturers aware of the massive future potential of this material.

The market is majorly driven by the surge in the demand for strong, lightweight, and eco-friendly construction materials to match the escalating scale of building & construction activities worldwide. The use of these materials alleviates the dependence upon forest resources amid the alarming global warming and resource depletion issues. Further, the market is propelled by product launches, partnerships, acquisitions, and innovations by the players and the surging awareness of sustainable solutions in the wooden items and other processing industries.

Another reason behind the escalating demand for Wood plastic composites is that they possess properties of two distinct materials: wood and resin materials. The material has a texture and performance similar to wood and good water resistance, and the composite overcomes shortcomings such as perishability, moisture, flammability, and thermoplastics. Therefore, products made from such materials are suitable for places with large temperature differences and high moisture and less-aerated spaces, such as storage rooms and toilets. Further, the progress toward new techniques and optimized production methods and designs for novel applications promises an overall optimistic market potential.

Durability and Low Maintenance Requirement Are Propelling Product Demand

The high durability of these composites is one of the principal factors contributing to their burgeoning consumption, hence making them a lucrative investment area. In addition, the material possesses high resistance against rotting, insects, and degradation due to the unique combination of thermoplastics and wood fibers. Therefore, it becomes an ideal choice for construction applications as it does not break, bend, or fracture easily, unlike lumber and other pure wood products. Currently, WPC doors and decking are becoming rapidly popular in both new and renovated buildings.

Further, the nominal maintenance requirements of the composites drive the demand for them. WPC products, such as doors, boards, and moldings, do not require regular sealing, painting, and other treatments to preserve their aesthetic appearance and sound structure, unlike traditional wood. Additionally, the material has strong resistance to fading, stains, and dampness, which contributes to less maintenance.

Wide Usage of Polyethylene

Polyethylene category held a share of 40% in 2023, and it is expected to grow at a CAGR of 10.2% during the forecast period. Polyethylene is widely adopted due to its versatility, ease of processing, durability, and the physical and weather resistance it offers to the composites. It is extensively used in fencing, decking, outdoor furniture, and other construction applications. Another reason supporting the Wood plastic composite market growth in this category is that when made with PE, these materials can be molded into diverse sizes, forms, and figures, which is why they are increasingly being utilized for making doors and windows. Moreover, PE offers cost-effectiveness and makes Wood plastic composites a promising alternative to plyboard.

Further, polypropylene holds a significant share as it binds the wood fibers, to create durable, weather-resistant, chemical-resistant, UV-stable, and mechanically strong material for similar applications as of polyethylene-based WPCs.

Polyvinylchloride is another major category in this segment as WPCs containing PVC are used in structural and wooden applications, such as railing, window/door profiles, fencing, decking, and interior building components, owing to their strong weather resistance and low cost. However, the trend of using environment-friendly materials makes it less popular option among other alternatives.

| Report Attribute | Details |

Market Size in 2023 |

USD 7,489.7 Million |

Market Size in 2024 |

USD 8,133.8 Million |

Revenue Forecast in 2030 |

USD 14,412.9 Million |

Growth Rate |

10.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Material; By Application; By Region |

Explore more about this report - Request free sample

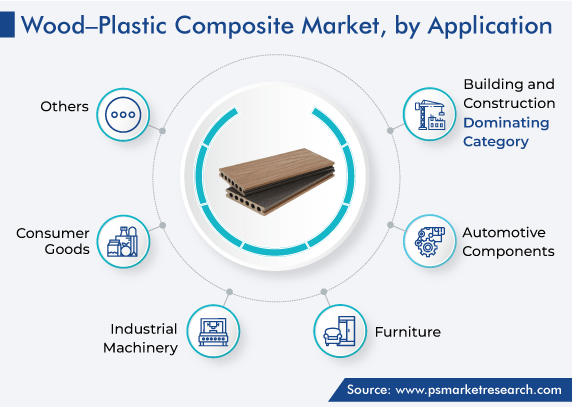

Building and Construction Applications Account for Largest Market Share

The application segment is dominated by building & construction, holding a share of 30% in 2023, due to the extensive use of composites in decking. The use of such materials in decking helps in refining the concrete’s quality and enhancing strength.

The automotive category is another key shareholder in the segment, owing to the enhanced mechanical, thermal, and processing characteristics of such materials, which make them ideal for various vehicle parts. The interior automotive components face substantial thermal changes, which leads to performance challenges for traditional thermoplastics. The augmented thermal stability imparted by the addition of wood improves the product performance of interior components.

Wood Composites Are Sustainable Alternatives

Deforestation accounts for 12% to 20% of the global GHG emissions and is considered the second-largest source of emissions after fossil fuel combustion. The major factor behind the shrinkage of forest lands is the commercial production of timber, agriculture, and livestock rearing.

The production of lumber is one of the biggest contributors to deforestation, as wood is used to make a wide range of products, including paper, furniture, and fabric. As per the Food and Agriculture Organization (FAO), the major consumers of industrial roundwood are the U.S., China, Russian Federation, and Brazil, accounting for 18%, 12%, 9%, and 7% of the global consumption, respectively. Further, in 2022, according to the WWF, more than 16 million acres of forest were lost by the world, an area bigger than West Virginia.

Therefore, to match the growing demand for lumber and reduce the forest dependence, advancements in the physical and mechanical state of wood are helping develop wood-based composites. These advancements include the activation of natural fibers, usage of waste materials, and incorporation of recyclable plastics, as well as those aimed at building up the strength and durability of wood.

These composites are sustainable because the usage of wood waste in their production keeps the carbon sequestration process in flow and does not contribute to additional forest degradation. Additionally, they are most sustainable if made from recycled plastic or any bio-based component and natural additives. However, proper selection of materials and processing conditions are required to get the wood composite with the desired results and properties.

Further, plywood products are often made using harmful chemical resins, such as phenol formaldehyde, and urea formaldehyde, mixed into adhesives. The plywood also emits gases that may have adverse health benefits, such as formaldehyde emissions, high level of exposure to which may lead to certain types of cancer. However, the use of WPCs is safe and harmless to health.

In May 2023, the U.S. Environmental Protection Agency (EPA) proposed amendments to the National Emission Standards for Hazardous Air Pollutants: Plywood and Composite Wood Products (NESHAP), seeking to implement standards for processes with previously unregulated hazardous air pollutant emissions.

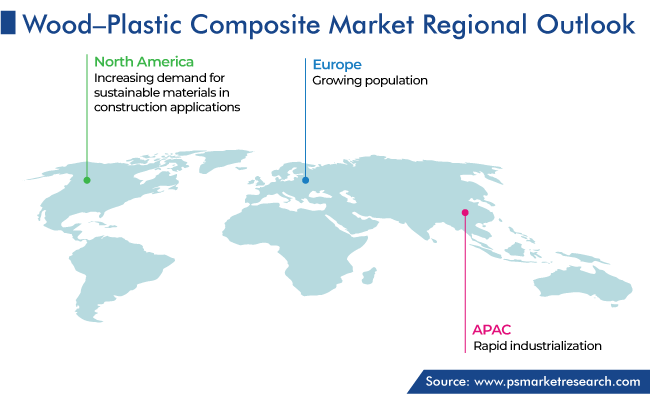

Rise in Infrastructure Activities in APAC Is Expected To Propel Market

North America had a substantial market size, in 2023, owing to the increasing demand for sustainable materials in both residential and industrial construction applications. The sustained economic growth, increasing population, high-volume immigration, urbanization, and favorable lending conditions have stimulated residential construction activities. Further, the market advance is fueled by the aging of houses, which necessitates restructuring and remodeling to repair/replace old components, as well as adding new amenities and outdoor living spaces. Moreover, various energy efficiency improvements mandated by the government are escalating the demand for such green materials.

Moreover, APAC region is expected to exhibit the highest CAGR, of 10.5%, owing to the rapid industrialization, booming construction activities in both the residential and commercial sectors, and urbanization. Further, the Wood plastic composite market is propelled by the rising number of government initiatives for raising awareness of green buildings and cost-effective construction materials.

In this regard, developing countries drive the market owing to the government-supported infrastructure investments. For instance, the 14th Five-Year Plan of China places a strong emphasis on new urbanization, energy, water, and transportation infrastructure projects. Under the proposed plan, China is expected to invest more than USD 4.2 trillion in novel infrastructure. The plan emphasizes the construction of green and net-zero energy buildings (ZEB) and retrofitting of existing buildings and structures.

Further, the giant Wood plastic composite market players in the country, such as Shanghai Seven Trust Industry Co. Ltd. and Nanjing Jufeng Advanced Materials Co. Ltd., produce competitive, high-quality products. Moreover, decking manufacturers in the country have large manufacturing facilities, with the production expenses further reduced by the low labor costs. Further, these firms have access to a wide range of raw materials, such as wood fibers, plastic resins, and additives, which enables them to produce products with the desired properties and features, depending on application. Therefore, the presence of such giant market players, ever-increasing population, and growing demand for green materials in construction activities are expected to propel the market growth.

Key Wood plastic Composite Manufacturers Are:

- Trex Company Inc.

- Oldcastle APG Inc., (MoistureShield)

- UFP Industries Inc

- FIBERON

- The AZEK Company Inc. (TimberTech)

- BEOLOGIC

- FKuR Kunststoff GmbH

- Green Dot Bioplastics Inc.

- JELU-WERK J. Ehrler GmbH & Co. KG

- Advanced Environmental Recycling Technologies Inc. (AERT)

Report Breakdown

This report reveals key trends and opportunities within the wood plastic composite market, providing a detailed segmentation analysis from 2017 to 2030. The breakdown by material, application, and geographical regions offers a comprehensive overview of the market dynamics.

Materials Covered in This Report

- Polyethylene

- Polyvinylchloride

- Polypropylene

Applications of Wood-Plastic Composites Covered in This Report

- Building and Construction

- Automotive Components

- Furniture

- Industrial Machinery

- Consumer Goods

Regions/Countries Reviewed for This Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

In 2023, the market for wood–plastic composites generated USD 7489.7 million.

The wood–plastic composite industry CAGR is 10.0%.

Building & construction application dominates the market for wood–plastic composites.

The wood–plastic composite industry is propelled by the rising demand for sustainable alternatives to pure-wood and petroleum-based plastic products.

APAC is the fastest-growing market for wood–plastic composites.

Wood–plastic composite industry players are launching new products and acquiring competitors.

Polyethylene and polypropylene are significant shareholders in the market for wood–plastic composites.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws