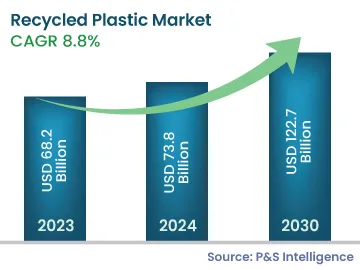

Recycled Plastic Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

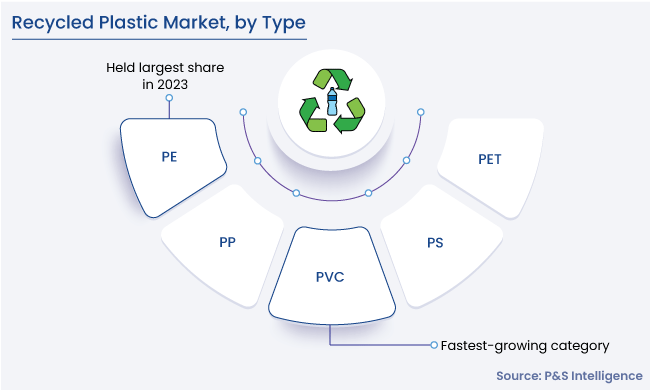

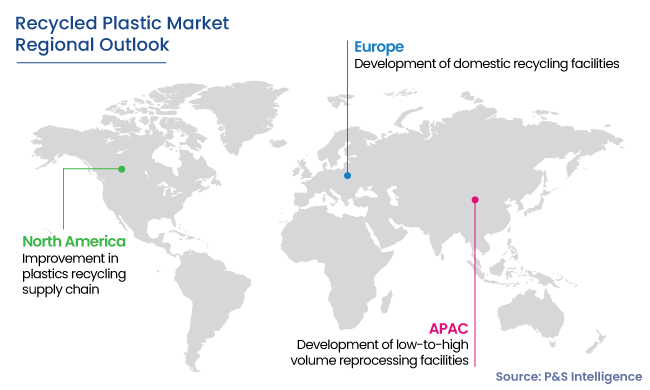

Get a Comprehensive Overview of the Recycled Plastic Market Report Prepared by P&S Intelligence, Segmented by Source (Packaging Materials, Sheets, Pipes, Wires and Cables, Molded Products), Type (Polyethylene Terephthalate, Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene), Industry (Household and Personal Care, Food and Beverage, Construction, Automotive), and Geographic Regions. This Report Provides Insights From 2017 to 2030.