Report Code: 10081 | Available Format: PDF | Pages: 195

Polypropylene Market Research Report: By Type (Homopolymer, Copolymer, Random, Block), Application (Injection Molding, Film & Sheet, Raffia, Fiber, Blow Molding), End Use (Packaging, Electrical, Medical, Consumer Goods, Automotive, Construction) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10081

- Available Format: PDF

- Pages: 195

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

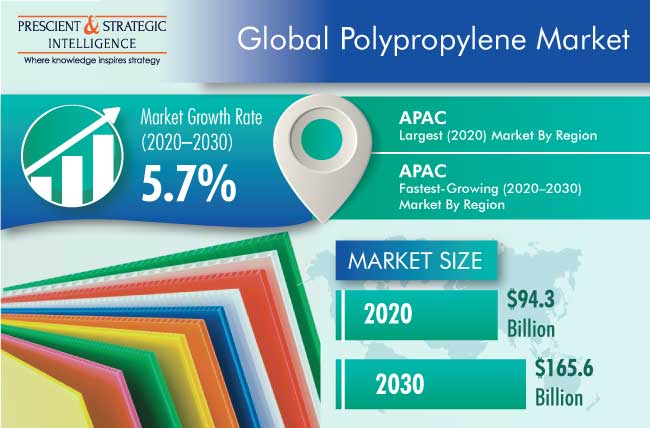

The global polypropylene market was valued at $94.3 billion revenue in 2020, and it is expected to grow at a CAGR of 5.7% during 2020–2030. The major factors driving the growth of the market are the expanding non-woven polypropylene fiber industry, and increasing usage of polypropylene in packaging industry.

Due to COVID-19, the demand for plastics from various end-use industries reduced in 2020. The pandemic, along with the reducing crude price, has dramatically changed the chemical production dynamics. Owing to the implementation of lockdown in various countries, the production plants were shut down in order to curtail the spread of the disease.

The falling demand for polypropylene hit the global polypropylene market in 2020. However, the emergence of new opportunities in the market, including polypropylene gloves, nonwoven polypropylene for N95 masks, and polypropylene plungers in the medical industry, drove the market growth. Apart from this, the falling price of crude oil created opportunities for the production of polypropylene at low prices; however, due to the curtailment of plant operations and hampering of the supply chain, production was somehow not possible. In present times, due to the widespread acceptance of polypropylene in the packaging industry, the market is recovering, and it is expected to witness significant growth in the coming years.

Homopolymers Dominated Propylene Market in 2020

The homopolymer category accounted for the larger value share in the polypropylene market, in 2020, on the basis of type. The homopolymer category is further projected to continue to lead the market during the forecast period. This is majorly attributed to the fact that homopolymer polypropylene has a high strength-to-weight ratio, meaning it is stiffer and stronger than copolymer polypropylene. These properties, combined with good chemical resistance and weldability make it a material of choice in many corrosion-resistant structures.

Injection Molding Category Accounted for Largest Market Share in 2020

The injection molding category accounted for the largest share of the market for polypropylene, both in terms of volume and value, in 2020, and it is expected to retain its dominance in the coming years, on the basis of application. This is attributed to the high-volume consumption of polypropylene in the manufacturing of articles of different sizes and shapes through injection molding to create household goods, automotive & marine parts, and recreational vehicle (RV) products. Hence, the rising demand for molded products, such as rigid containers, will drive the market growth in this category during the forecast period.

Packaging Industry Is Expected To Continue Its Domination during Forecast Period

The packaging category generated the highest revenue in 2020, and it is expected to continue to dominate the polypropylene market during the forecast period, under the end use segment. This is because polypropylene is a widely used plastic for packaging, especially food packaging, where the food and beverages are in direct contact with it. Being a rugged polymer, it is resistant to many chemical solvents, therefore considered safe for several food packaging containers, such as injection-molded pots, thermoformed pots, and thermoformed trays.

Asia-Pacific (APAC) Region Is Expected To Retain Its Top Position during Forecast Period

APAC led the global polypropylene market in 2020, and it is expected to remain the largest market during the forecast period. This is attributed to the increasing government spending on research and development of new polypropylene applications. In addition, the rising consumption of flexible food packaging and electrical components in China is creating a huge demand for polypropylene in the region.

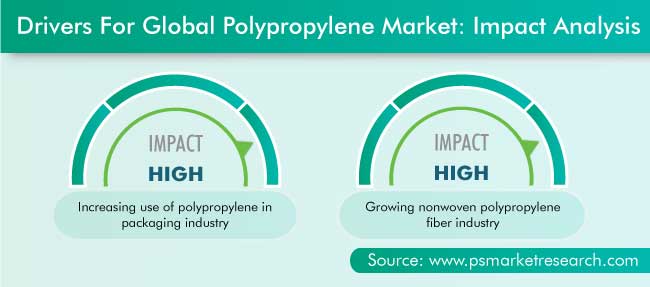

Increasing Use of Polypropylene in Packaging Industry Is Driving Market Growth

The plastic packaging industry is growing at a rapid pace owing to the surging demand for food & beverage and industrial packaging. According to Plastics Europe, an association of plastic manufacturers, global plastic production was 368 million tons in 2019 owing to the rising demand for plastics in the packaging and building & construction markets. Among all types of plastics, polypropylene held the largest share owing to its wide applications in food packaging, hinged caps, microwave containers, pipes, automotive parts, and banknotes.

Furthermore, the advancements in technologies, rise in the consumer demand for health and wellness products, urbanization, busy lifestyle, and increase in the number of single-person households are shaping packaging trends. Brand owners and retailers are also responding to the consumer demand for more-sustainable packaging products, which are produced by polypropylene resin due to its high tensile strength. Hence, the rising demand for rigid sustainable packaging is driving the market for polypropylene.

Growing Nonwoven Polypropylene Fiber Industry Is also Propelling Market

The nonwoven polypropylene fiber industry is growing which is leading to a significant growth of the polypropylene market, owing to the rising demand for polypropylene staple fibers in needle punch durables, which are consumed in the production of geotextiles, vehicle components, coating substrates, indoor & outdoor carpets, blankets, upholstered furnishing, and bedding.

Furthermore, the nonwoven industry majorly serves hygiene and medical applications, therefore, its consumption is surging owing to the rising demand for spunbonded polypropylene for infant diapers, toddler training pants, feminine hygiene pads, and adult diapers. The demand for this plastic in the healthcare and hygiene sector of Asian countries is rising owing to the surging disposable income and hygiene consciousness.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$94.3 Billion |

Market Size Forecast in 2030 |

$165.6 Billion |

Forecast Period CAGR |

5.7% |

Report Coverage |

Market Drivers, Restraints and Opportunities; Revenue Estimation and Forecast; Segmentation Analysis; Country Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Type; By Application; By End Use; By Region |

Market Size of Geographies |

U.S; Canada; Germany, Italy, France, U.K., Spain, Poland, Belgium & Luxembourg, Netherlands, Russia, China, India, Korea, Japan, Thailand, Mexico, Brazil, Argentina, Saudi Arabia, U.A.E., Turkey, Iran, and Africa |

Secondary Sources and References (Partial List) |

Association for Packaging and Processing; Association of Plastic Recyclers; Chemicals & Petrochemicals Manufacturers’ Association; Edmonton Construction Association; Independent Packaging Association; Packaging Industry Association of India; Packaging World; PlasticsEurope; Plastics Industry Association; Society of the Plastics Industry |

Explore more about this report - Request free sample

Market Players Involved in Product Launches to Gain Significant Position

In recent years, players in the polypropylene industry have been involved in product launches in order to attain a significant position. For instance:

- In April 2021, Braskem S.A. launched a carbon-fiber-reinforced polypropylene filament for additive manufacturing. The filament is lightweight and rigid, thus ideal for automotive, aerospace, marine, and sporting goods applications.

- In April 2021, Sulzer Ltd. and Borealis AG launched a new polypropylene foam extrusion technology, enabling lower cost and increased efficiency across the value chain. The companies have completed the development of an advanced process for the cost-effective extrusion of expanded polypropylene (ePP) beads.

Key Players in Global Polypropylene Market Include:

-

LyondellBasell Industries B.V.

-

Sinopec Group

-

SABIC

-

PetroChina Company Limited

-

Braskem S.A.

-

Reliance Industries Limited

-

Total S.A.

-

Exxon Mobil Corporation

-

Formosa Plastic Corporation

-

Borealis AG

-

INEOS Group Holdings S.A.

Market Size Breakdown by Segments

The polypropylene market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Type

- Homopolymer

- Copolymer

- Random

- Block

Based on Application

- Injection Molding

- Film & Sheet

- Raffia

- Fiber

- Blow Molding

Based on End Use

- Packaging

- Electrical

- Medical

- Consumer Goods

- Automotive

- Construction

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- Italy

- France

- U.K.

- Spain

- Poland

- Belgium & Luxembourg

- Netherlands

- Russia

- Asia-Pacific (APAC)

- China

- India

- Korea

- Japan

- Thailand

- Latin America (LATAM)

- Mexico

- Brazil

- Argentina

- Middle East and Africa (MEA)

- Saudi Arabia

- U.A.E.

- Turkey

- Iran

- Africa

The 2030 value of the market for polypropylene will be $165.6 billion.

The polypropylene industry report has four segments: type, application, end use, and region.

Based on region, APAC dominates the market for polypropylene.

The nature of the polypropylene industry is fragmented.

The market for polypropylene is driven by the rising usage of this plastic in packaging applications and advancing nonwoven fiber sector.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws