Report Code: 10128 | Available Format: PDF

Wax Market Report: Size, Share, Strategic Developments, and Growth Potential Estimation, 2023-2030

- Report Code: 10128

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

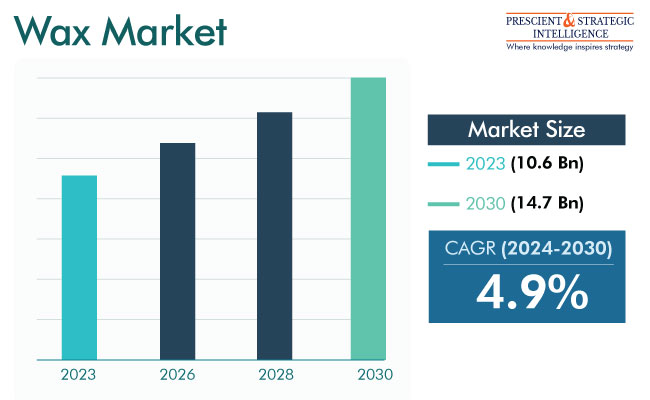

The wax market revenue is estimated at USD 10.6 billion in 2023, and it will advance at a CAGR of 4.9% between 2024 and 2030, to reach USD 14.7 billion by 2030. This can be attributed to the growing demand for this product from several industries due to its water repulsion, great chemical resistance, and high gloss.

Other major driving factors for the market are the increasing demand for it from the packaging and candle industries and the growing use of wax in home decor items, such as scented and colored candles. In the Asia-Pacific region, the growth of the personal care sector is another factor propelling the market.

Wax belongs to the category of organic compounds characterized by their pliability and resistance to water at ambient room temperatures. It is composed of lipids and higher alkanes, which do not dissolve in water, but readily dissolve in non-polar organic solvents. Mineral, natural, and synthetic waxes are derived from hydrocarbon-rich sources, such as petroleum, comprising base oils and natural gas, as well as natural sources, including plants and animals. Microcrystalline and paraffin wax are distillation products of petroleum. Paraffin solidifies into plate-like structures, whereas microcrystalline wax forms small, indistinct needle-shaped structures.

Numerous Applications of Wax Drive Market Growth

Packed food is protected by wax coatings, which also provide gloss, thus improving the package appearance. A smooth coating allows consumers to have better control when opening the package. In food and other industries that utilize packaging materials, wax is suitable as it offers a barrier against moisture. Additionally, being non-sticky, it provides reliability and cost-effectiveness while packing sticky products.

Additionally, in the cosmetics, coatings, polishes, adhesives, plastics, and rubber industries, the water repulsion, anti-blocking, abrasion resistance, chemical resistance, lubricity, high compatibility, low viscosity, and thermal stability of the chemical are highly useful.

Wax also finds extensive use in the paints & coatings and printing inks industries due to its resistance to marks and scratches, durability against rubbing, and effective water repulsion. It is used in a variety of printing inks, including lithographic, letterpress, and flexographic gravure. Some other properties of wax desired in these industries are improvement in friction, anti-sagging, and anti-setting.

Paraffin Wax Accounted for Largest Market Share

The paraffin category holds one of the largest shares in the industry, as paraffin wax has a wide range of applications in numerous industries. For instance, in the packaging industry, it is used to coat packaging material. Additionally, it finds application in electrical insulation and in the lubrication industry because it exhibits excellent heat absorption and retention capabilities.

It also has a low melting point; therefore, it can be applied to the skin safely, without the risk of burns. Therefore, a paraffin bath stands as one of the most-efficient approaches for enhancing blood circulation and alleviating joint discomfort. Moreover, paraffin heat treatment is effective in relieving muscle stiffness and pain associated with arthritis. This is because the heat is transmitted to the affected area during the phase change from liquid to solid in paraffin.

Further, the natural category is expected to grow rapidly over the forecast period. Due to the awareness about the possible side-effects of chemical products, bio-based waxes are in demand among consumers. Hence, a shift to organic or green products is emerging in the wax market. As a result, numerous cosmetics and personal care companies are actively creating products derived from natural and organic sources. Few examples are Weleda Skin Food, consisting of organic sunflower seed oil and beeswax; and Badger Balm Sore Muscle Rub, consisting of cayenne pepper extract and organic beeswax.

Concerns for health and wellness are driving consumers in developed countries to adopt bio-based/natural cosmetics products instead of synthetic ones. This is resulting in the increasing demand for bio-based waxes, such as beeswax, carnauba wax, and candelilla wax, in cosmetic and personal care products, over petroleum-derived alternatives.

Further, the synthetic wax category will continue to hold a considerable share till 2030. This alternative is made via the polymerization of carbon monoxide under high pressure. Its benefits are excellent stability amidst intense polishing and resistance to chemicals, water, and scratches. Polyethylene wax, a kind of synthetic wax, has a lower molecular weight in comparison to microcrystalline, Fischer–Tropsch, and paraffin wax, despite which it is tough.

| Report Attribute | Details |

Market Size in 2023 |

USD 10.6 Billion |

Revenue Forecast in 2030 |

USD 14.7 Billion |

Growth Rate |

4.9% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Wax Is Largely Used In Candles

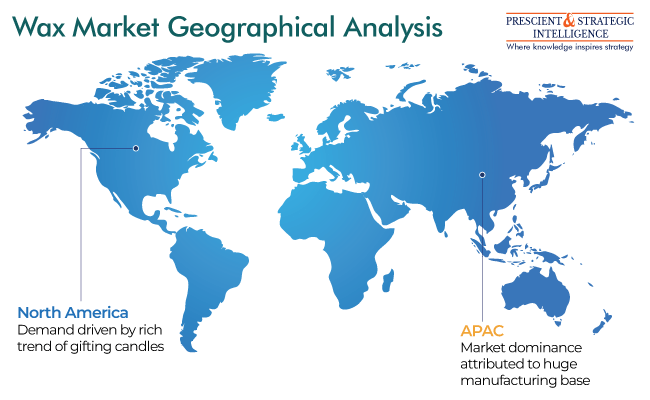

The largest market share of candles, within the application segment, is attributed to the increasing demand for aromatherapy through scented candles for stress reduction and relaxation. Candles come in an array of shapes, sizes, colors, and fragrances, and their product range encompasses taper candles, utility candles, birthday candles, tealight containers, and novelty candles, thus fascinating customers. The trend among people to select candles by fragrance and color, to enhance the ambiance and décor of a room, increases the demand for wax.

According to the National Candle Association, consumers find these products a perfect gift for holidays (76%), housewarming (74%), and adult birthdays (58%). Moreover, more than 10,000 different candle scents are available, and more than 1 billion pounds of wax are used in producing the candles sold each year in the U.S.

Packaging Is Second-Largest Market Shareholder

The packaging category generates the second-highest revenue for the market.

Quality control is of the utmost importance in the food industry, especially in developed countries, where government regulations are stringent. Waxes have good moisture barrier properties, which is why they are utilized in packaging to maintain the quality of food products. The material is especially popular for application on paper and paperboard in the packaging of food. It is also used to coat food products, such as vegetables, cheeses, and fruits, directly.

Cosmetics Are Fastest-Growing Application

The cosmetics category is expected to see the swiftest rise in revenue generation over this decade. In cosmetics, wax is used to thicken and structure formulations, along with for waterproofing and SPF boosting. Additionally, in skincare products, it provides stability and protective and emollient qualities, thus enhancing their viscosity and ensuring a consistent texture. Hence, this chemical is widely used in the manufacturing of lip balms, foundations, sunscreens, lipsticks, and mascara.

Global Major Wax Manufacturers:

- Sinopec Corp.

- China National Petroleum Corporation

- HollyFrontier Corporation

- BP PLC

- Nippon Seiro Co. Ltd.

- Baker Hughes Company

- ExxonMobil Corporation

- Sasol Limited

- The International Group Inc.

- Evonik Industries AG

- BASF SE

- Dow Inc.

- Honeywell International Inc.

- Shell PLC

- Mitsui Chemicals Inc.

- AkzoNobel N.V.

- Lubrizol Corporation

- Cargill Incorporated

- Eni SpA

- Compañía Española de Petróleos, S.A.U.

Asia-Pacific Is Expected To Be Fastest-Growing Region

APAC is the largest market, and it will also witness the highest CAGR over this decade. The market expansion is attributed to the low labor, operational, and raw material expenses, which boosts the production of this material in the region. Additionally, the increasing use of cosmetic items, such as lotions, creams, makeup, and sunscreens, by the younger population in Japan, India, Indonesia, South Korea, and China is projected to fuel the market growth.

The growth will also be due to the presence of major petroleum-wax-producing refineries in China and India. Additionally, according to the Packaging Industry Association of India (PIAI), costs of processing and packaging food in the country can be up to 40% lower than in most parts of Europe. This, combined with India's large population of skilled and unskilled laborers, makes it an attractive venue for investment. The rapid industrialization, increasing demand for wax from several industries, and rising government spending are also key contributing factors. Moreover, the increasing production and consumption of adhesives, cosmetics, and packaging products in the region fuels the market advance.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws