Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2167.9 Million |

| 2030 Forecast | USD 2711.2 Million |

| Growth Rate(CAGR) | 3.8% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Report Code: 12646

Get a Comprehensive Overview of the Vinyl Sulfone Market Report Prepared by P&S Intelligence, Segmented by Type (Divinyl Sulfone, Phenyl Vinyl Sulfone, Methyl Vinyl Sulfone, Vinyl Sulfone Ester), Application (Dyestuff, Chemical Intermediates, Proteomics), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2167.9 Million |

| 2030 Forecast | USD 2711.2 Million |

| Growth Rate(CAGR) | 3.8% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

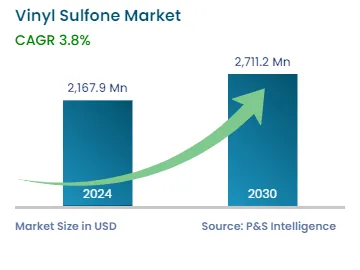

The global vinyl sulfone market size stood at 2167.9 million in 2024, and it is expected to advance at a compound annual growth rate (CAGR) of 3.8% between 2024 and 2030, to reach USD 2,711.2 million by 2030.

Vinyl sulfone is an organic chemical compound that is used in the manufacturing of reactive dyes. Reactive dyes are majorly used in the textile industry for dyeing and tinting textiles. In developing countries, the changing buying behavior of the textile industry is increasing the demand for dye raw materials and intermediates, such as vinyl sulfone.

Moreover, this chemical is used for the production of pesticides for agriculture and gardening to control insects that wound damage plants. It is also used in the leather and paint and coating industries. Furthermore, the adoption of such chemicals in personalized therapeutics, diagnostics, and medicine will also boost the market growth.

The rising disposable income of people and the growing social media usage influence them to spend more on apparel for the enhancement of their life. Thus, the demand for reactive dyes is rapidly increasing in the growing textile industry. Moreover, at present, there are a large number of useful reactive dyes in the market with different features and for different purposes. The recycling of old clothes is also propelling the need for such chemicals. Hence, these factors are contributing to the growth in demand for vinyl sulfone in this industry.

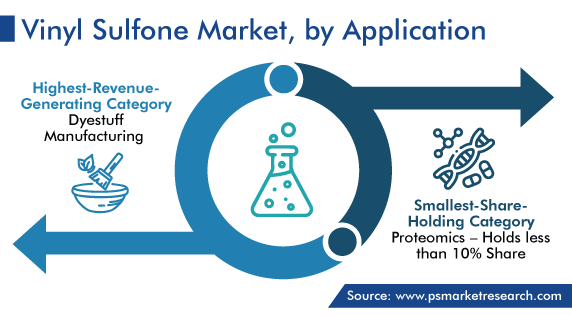

Based on application, the market is categorized into dyestuff manufacturing, chemical intermediate, proteomics, and others. Among these, the dyestuff manufacturing category accounted for the largest revenue share, more than 55%, in 2022, and it is also expected to remain the largest over the next few years. This is due to its increasing demand from several industries such as textile, paper, paints & coatings, printing inks, and food. Moreover, companies are increasing their investment in the research and development of natural and non-toxic dyes, significantly due to the innovation in textile chemistry.

Furthermore, the rapidly growing urban population, the surging launches of new textile products, and the rising number of e-commerce users are boosting the demand for clothes, which, in turn, drives the need for dyestuff from apparel manufacturing companies, as it consumes less water.

Based on type, the phenyl vinyl sulfone category is expected to witness significant growth in the coming years. This can be primarily because it is an intermediate and raw material adopted in pharmaceuticals, agrochemicals, dyestuff, and organic synthesis. Also, the chemical is used in the synthesis of reactive dyes, which are widely utilized in the textile industry, and as a building block for several organic substances, participating in nucleophilic addition reactions, cycloaddition reactions, and polymerization reactions.

Drive strategic growth with comprehensive market analysis

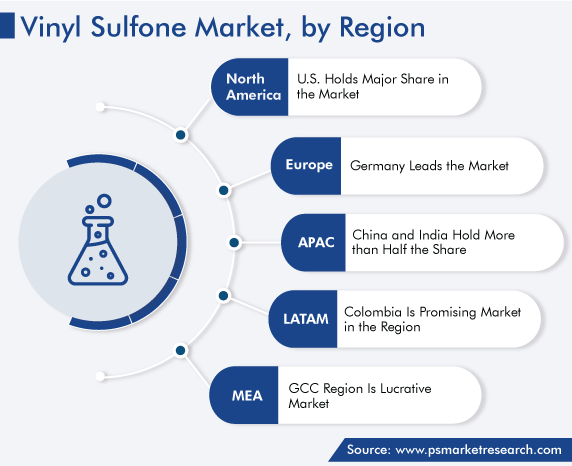

The APAC region accounted for the largest market share, around 40%, in 2022, and it is further expected to remain the largest over the next few years. This is ascribed to the growing textile and leather industries mainly in China and India, which, in turn, the demand for dyes is extensively rising, which are made up of vinyl sulfone. In addition, the agriculture sector is also boosting the demand for this chemical because it is widely adopted for making pesticides.

Additionally, the demand for dyes is increasing because several foreign brands are establishing their manufacturing plants in APAC and the presence of several local apparel manufacturers in the region. Furthermore, governments also support the market by mandating the adoption of low-volatile organic compounds and eco-friendly chemicals.

In APAC, India is a key market. This is because people are more active on social media and online e-commerce platforms for shopping or surfing, which is also increasing the demand for clothes. For instance, there are more than 470 million social media active users in the country, and almost 85% of the total amount of e-commerce is spent on apparel. In India, Gujarat and Maharashtra are the key producers of dyes because of the easy availability of raw materials in these states.

Moreover, the textile industry is rapidly growing in the region, due to the easy availability of labor, raw materials, and land at a low cost, the growing interest in the fashion society, huge domestic buyers’ demand, the adoption of foreign culture, and government supports toward this industry. For instance, India is the second-largest producer and exporter of textiles across the globe, as it has a huge base of raw materials such as wool, silk, jute, and cotton, which is propelling the textile industry, and in turn, driving the need for reactive dyes made up of vinyl sulfone.

In addition, in 2021, the Indian government approved a package of USD 1445.08 million (INR 10,683 crore) for the textile industry to boost exports, especially garments and made-ups. In 2022, the government also launched Scheme for Integrated Textile Parks (SITP) to encourage more employment and provide livelihoods in the textile industry. Some of the schemes, which are also supporting the textile industry, include Scheme for Capacity Building in Textile Sector (SAMARTH), Amended Technology Up-gradation Fund Scheme (ATUFS), National Technical Textile Mission, Production Linked Incentive (PLI) Scheme, and Special Package for Textile and Apparel Sector.

China is the largest market for vinyl sulfone in the APAC region, as the regional textile and leather industries are rapidly growing, due to the low-cost labor, large production of leather, high demand for natural and synthetic fiber, and government support. Moreover, in China, the need for reactive dyes is growing from several end-use industries, such as textile, paper, and leather, and the country is also the largest producer and exporter of textiles across the globe. Thus, the rising production of reactive dyes is driving the need for such chemicals in the nation.

The North American market is expected to rise at a significant growth rate during the forecast period. This can be attributed to the presence of major industry players, the rise in the number of online buyers of clothes, and the high demand for organic chemicals for the manufacturing of apparel in the region. Most of the dye intermediates are used by the textile industry, due to the increasing demand for clothes in North America.

For instance, in the U.S., in 2022, there were 265 million online buyers and more than 71% of them are female, and this number is projected to increase to 283 million by 2025. Out of 71%, more than 35% of female users are buying clothes online. All of these are the key factors propelling the demand for reactive dyes, which, in turn, drive the regional market growth.

Based on Type

Based on Application

Geographical Analysis

The vinyl sulfone market size stood at USD 2167.9 million in 2024.

During 2024–2030, the growth rate of the vinyl sulfone market will be 3.8%.

Dyestuff manufacturing is the largest application area in the vinyl sulfone market.

The major drivers of the vinyl sulfone market include the chemical is widely used in the production of reactive dyes, which are broadly adopted in the textile industry, and it is also used in the production of pesticides, which are utilized in agriculture fields and home gardening.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages