Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,297.1 Million |

| 2025 Market Size | USD 1,394.3 Million |

| 2030 Forecast | USD 2,128.1 Million |

| Growth Rate(CAGR) | 8.8% |

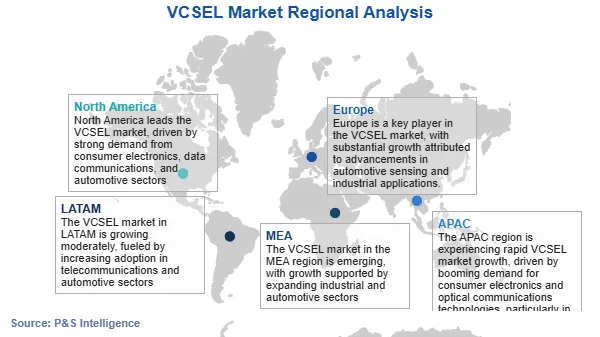

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

| Largest Application Category | Sensing |