Market Statistics

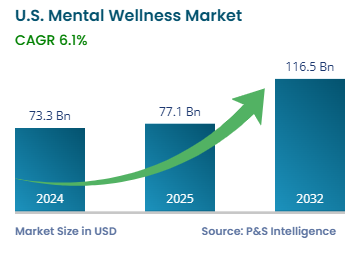

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 73.3 Billion |

| 2025 Market Size | USD 77.1 Billion |

| 2032 Forecast | USD 116.5 Billion |

| Growth Rate(CAGR) | 6.1% |

| Largest Region | South |

| Fastest-Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13361

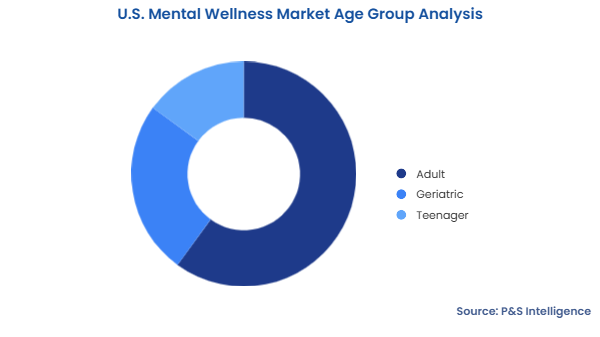

This Report Provides In-Depth Analysis of the U.S. Mental Wellness Market Report Prepared by P&S Intelligence, Segmented by Disorder (Depression, Anxiety, Schizophrenia, Substance Use Disorder, Bipolar Disorder, Alcohol Use Disorder, Post-Traumatic Stress Disorder, Eating Disorders), Type (Senses, Spaces, and Sleep, Brain Boosting Nutraceuticals & Botanicals, Self-Improvement, Meditation and Mindfulness), Age Group (Adult, Geriatric, Teenager), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 73.3 Billion |

| 2025 Market Size | USD 77.1 Billion |

| 2032 Forecast | USD 116.5 Billion |

| Growth Rate(CAGR) | 6.1% |

| Largest Region | South |

| Fastest-Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. mental wellness market size was USD 73.3 billion in 2024, and it will grow by 6.1% during 2025–2032, reaching USD 116.5 billion by 2032.

The market is driven by the increasing penetration of smartphone, network coverage advancements, and surging incidence of health issues, which affect mental wellbeing. The growing awareness of personalized care and managing stress also propels the market.

Moreover, it includes a wide range of areas, such as therapy, wellness programs, digital mental health tools, supplements, and services that support emotional, mental, and social well-being.

The demand for mobile applications, online therapy services, and virtual mental wellness is growing because people are looking for convenient and flexible ways to manage mental health.

With people engaged with digital platforms, mental health care becomes more normalized. Being able to easily access resources reduces stigma and encourages more people to get the support they need for their mental and emotional health. On such platforms, people can describe their problems and get advice in privacy and, often, anonymously. Certain apps also enable patients to mention their symptoms, based on which they are suggested changes in their diets and other daily activities.

In June 2023, Comvest Partners announced the acquisition of Your Behavioral Health, thus expanding its outpatient and telehealth services.

People are starting to realize the importance of mental health and the way it affects overall wellbeing. As a result, there is a greater demand for solutions that support mental wellness in simple, inclusive, and creative ways.

In addition, the increasing awareness of workplace stress and burnout and their impact on employee performance drives the adoption of mental wellness programs in organizations. As per the Occupational Safety and Health Administration (OSHA), 80% of the employees in the country report workplace stress.

Electronic devices, such as fitness trackers, smartwatches, and other wearables, are becoming more advanced in tracking physical health and wellness metrics. Many of these devices now include features for monitoring sleep patterns, blood pressure, heart and respiratory rates, and other factors that act as markers of mental wellness.

Furthermore, as more people become aware of mental health, schools and universities are focusing more on supporting students’ mental wellbeing. Many of them offer counseling services, hold workshops, and host programs to help reduce stress amidst increasing peer pressure.

The disorders analyzed here are:

The types analyzed here are:

The age groups analyzed here are:

Drive strategic growth with comprehensive market analysis

The regions analyzed in this report are:

The U.S. mental wellness market is fragmented because of the presence of several players offering a variety of solutions and services. The mobile apps segment is fragmented because a huge variety of such apps exist on app stores, which are downloadable for free or for monthly premiums. Additionally, numerous companies offer wearable devices and sensors for monitoring sleep patterns, pulse, breathing rate, blood pressure, and other markers of mental health. Moreover, with the rising awareness of mental health, a large number of Yoga and meditation centers are opening across the country.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages