Market Statistics

| Study Period | 2019 - 2030 |

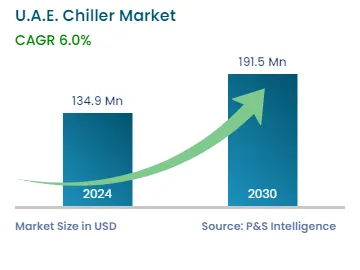

| 2024 Market Size | USD 134.9 Million |

| 2030 Forecast | USD 191.5 Million |

| Growth Rate(CAGR) | 6% |

| Largest City | Dubai |

| Fastest-Growing City | Abu Dhabi |

| Nature of the Market | Consolidated |

Report Code: 11653

Get a Comprehensive Overview of the U.A.E. Chiller Market Report Prepared by P&S Intelligence, Segmented by Chiller Type (Screw, Scroll, Absorption, Centrifugal, Reciprocating), End User (Commercial, Industrial, Residential), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 134.9 Million |

| 2030 Forecast | USD 191.5 Million |

| Growth Rate(CAGR) | 6% |

| Largest City | Dubai |

| Fastest-Growing City | Abu Dhabi |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The U.A.E. chiller market is estimated to have generated a revenue of USD 134.9 million in 2024, and it is expected to grow at a CAGR of 6.0% during the forecasted period, to reach USD 191.5 million by 2030. This is ascribed to the rising hospitality sector, overall growth in the sector of construction, and the surging requirement for chillers from the transportation industry in the country.

Moreover, the market is growing in the country due to the booming business opportunities in cities such as Dubai and Abu Dhabi, the surging requirement for district cooling units and inverter chillers, rapid industrialization, and the panoramic development in the sector of construction.

For instance, the Dubai Food Park (DFP), a state-of-the-art food park, is currently under development in Dubai Wholesale City. It is devised to be situated close to the Expo 2020 site and is expected to be valued in billions. The DFP is considered to meet the increasing requirement for food in the country. This project was initiated in the previous year and is forecasted to take 10 years to conclude. Similarly, Dubai hosted the World Expo 2020, which led to the rise in the construction industry and the development of commercial infrastructure, projects correlated to tourism, and the transportation sector.

Therefore, the market is forecasted to evolve as a result of hiking in the requirements from several end-use industries. In addition, when there is planning for the infrastructure expansion by operators, the demand for chillers is increasing. Further, in the country, there is extremely high temperature throughout the year. It is also projected that the country will witness a significant rise in temperatures, by about 2.21 oC by 2050, mainly in the summer season. With the increase in temperature, the demand for chillers is surging, as cold water produced by them is engaged for providing air conditioning in buildings.

However, the rising electricity consumption is one of the major worries in the country. The electricity demand is very high in the summer season, due to the extensive use of air conditioners. Thus, the U.A.E. is concentrating on the use of renewable sources of energy. The nation is witnessing an annual average global solar radiance of 6 kWh/m2/day. To use this energy, the government launched 'Energy Strategy 2050', which focuses on promoting renewable energy.

Thus, the inclination toward solar-powered chillers has been observed in the U.A.E. This is also because of the surging need for cost-effective cooling systems and the requirement to reduce energy consumption. Also, these chillers use energy that comes from waste heat, such as heat generated from solar panels or steam from industrial processes. Hence, the sale of solar energy-driven chillers is projected to witness high growth in the country during the forecast period.

Based on chiller type, the centrifugal category is forecasted to present immense opportunities in the market during the forecast period. The acquisition of high-energy productivity magnetic centrifugal chillers with a compact energy footprint in lieu of conventional centrifugal chillers is the most remarkable trend being observed in the market. For instance, in February 2023, Trane, one of the top players of chillers in the country, inscribed an agreement with the Emirates Central Cooling Systems Corporation, to provide environment-friendly centrifugal chillers with an entire capacity of 110,000 RT to Empower.

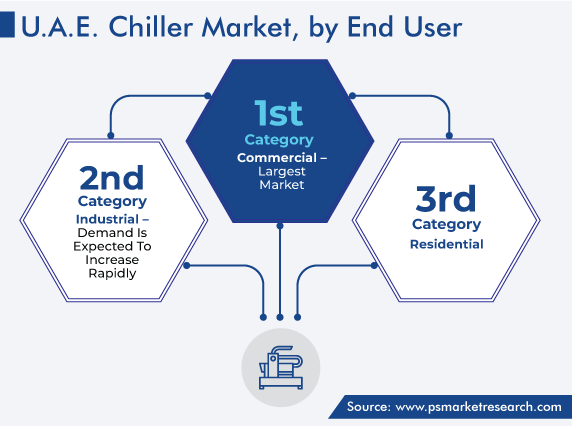

Based on end user, the commercial category holds the largest revenue share in the market. This is because of the high adoption of chillers in several commercial applications, such as hotels, commercial buildings, offices, hospitality, supermarket/hypermarkets, healthcare facilities, and government buildings, and enormous investments for the development of hotels and hike in figures of hotel construction projects.

Based on commercial end user, the hospitality sector dominates the market. This is because the sector has inscribed noteworthy growth in the current years. For instance, as per the World Travel and Tourism Council, the sector of travel and tourism has contributed significantly to the GDP of the country. Also, chillers are acquiring resistance in the industry of hotels for the purpose of cooling. In the U.A.E., Dubai reports for the immense quantity of hotel construction projects. Notable hospitality players, such as Hilton Hotels & Resorts, Marriott International, and Accor S.A., are developing themselves for the upcoming invasion of tourists.

For instance, in April 2023, a Dubai-based Hospitality Management Holding (HMH) Group initiated 18 new hotels in the Arabian Travel Market, while during its engagement in the ATM-2023, the Group will exhibit its projects in the hospitality sector between the region and sign new association agreements. The Group will take advantage of the platform to showcase its futuristic strategies and evolutionary plans in foreign markets. The HMH Group supervises 13 hotels and resorts in and outside the U.A.E., with a total inventory of 2032 rooms.

Drive strategic growth with comprehensive market analysis

Based on region, Dubai is considered the principal market in the country for chillers. This is because of the high growth in construction activities due to the World Expo event that happened in 2020. Moreover, on a long-term basis, the Dubai government put efforts toward diminishing the dependency on the oil and gas sector and focusing on the development of other sectors such as tourism and hospitality. The government is inscribing more than 150 major hotel projects in response to the forthcoming paramount event in Dubai, to cater to the requirement for approaching tourism invasion. Thus, these factors drive the demand for chillers in this region.

This report offers deep insights into the U.A.E. chiller industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Chiller Type

Based on End User

Regional Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages