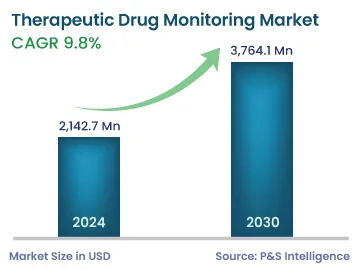

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,142.7 Million |

| 2030 Forecast | 3,764.1 Million |

| Growth Rate(CAGR) | 9.8% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12735

Get a Comprehensive Overview of the Therapeutic Drug Monitoring Market Report Prepared by P&S Intelligence, Segmented by Product (Consumables, Equipment), Technology (Immunoassays, Chromatography–MS), Drug Class (Antiepileptic, Antiarrhythmic, Immunosuppressant, Antibiotic, Bronchodilator, Psychoactive), End User (Hospital Laboratories, Commercial & Private Laboratories), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,142.7 Million |

| 2030 Forecast | 3,764.1 Million |

| Growth Rate(CAGR) | 9.8% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global therapeutic drug monitoring market size was valued at USD 2,142.7 million in 2024, and this number is expected to increase to USD 3,764.1 million by 2030, advancing at a CAGR of 9.8% during 2024–2030. This is ascribed to the increasing demand for genetic testing, improving healthcare infrastructure, advancements in diagnostic technologies, surging R&D spending in healthcare, rising product launches, mounting patient base suffering from chronic diseases, and the presence of supportive government policies and regulatory guidelines regarding the usage of drug monitoring.

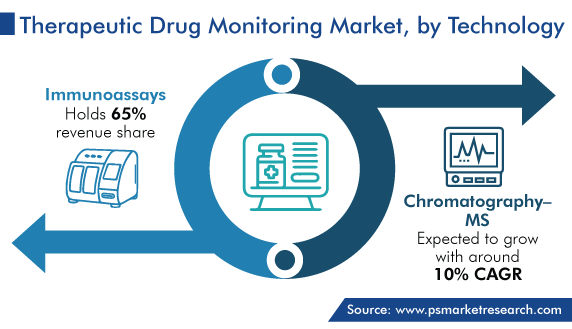

The immunoassays category accounted for the largest revenue share, of 65%, in 2023, and it is further expected to maintain its dominance during the predicted period. This is due to their high availability and increasingly employed in the discovery of drug analysis and drug development. Moreover, this technology finds applications in several areas, such as bioequivalence studies in drug discovery, pharmaceutical analysis including clinical pharmacokinetics, therapeutic drug monitoring, and diagnosis of diseases, in the pharmaceutical industry, as it is an easy and cost-efficient drug monitoring method.

Furthermore, the chromatography-MS category will witness significant growth in the coming years. This can be ascribed to its high reliability, affordability, and availability in automated platforms, along with its huge benefits of advanced HPLC usage in TDM drugs.

The equipment category will register a higher CAGR, of 10.2%, during the forecast period. This can be ascribed to the high R&D spending by medical device manufacturers, the mounting launches of advanced equipment, and the increasing number of laboratories where monitoring tests are performed with the help of special laboratory equipment.

On the other hand, the consumables category held a larger revenue share in 2023, and it is also expected to maintain its position during the predicted period. This is due to the rising prevalence of chronic diseases such as CVDs, neurological disorders, and diabetes; the mounting demand for personalized medication and precision drug dosing; the growing regulatory requirements and guidelines by several professional organizations and regulatory entities regarding the usage of therapeutic drug monitoring; and the technological developments in healthcare such as the development of highly sensitive and specific immunoassays, point-of-care testing devices, and chromatographic techniques.

The surging use of therapeutic drug monitoring for the treatment of cancer, CVD, and other illnesses drives the market. The prevalence of these diseases is rising rapidly across the world. For instance, as per the Centers for Disease Control and Prevention (CDC), one individual dies every 33 seconds from CVD in the U.S. Also, in 2021, around 700,000 people died from heart-related diseases. Moreover, coronary heart disease is one of the common reasons for the death of over 375,000 people in the U.S. In addition, according to the WHO, cancer is also one of the major causes of death across the globe, with a recorded 10 million deaths in 2020.

The commercial & private laboratories category will witness the fastest growth during the forecast period, advancing at a CAGR of 10.4%. This can be due to the growing count of private labs across the globe, the rising demand for genetic testing, improving healthcare infrastructure, their timeliness and efficient test results, enhanced flexibility and customization such as modified reporting formats, and the presence of custom-made testing panels that are demanded by both patients and healthcare providers.

Additionally, such labs have specialized expertise in a specific area of drug monitoring with trained professionals who performs monitoring procedures with the help of advanced equipment, and the increasing R&D spending to develop innovative and advanced methodologies used in drug monitoring in these labs are other factors contributing to the market growth in this category.

Furthermore, the hospital laboratories category held a significant revenue share in 2023, and it is also expected to maintain its position in the coming years. This is due to the rising number of hospitals, increasing government support to build suitable infrastructure and acquiring advanced technology, and high communication flexibility among lab professionals, doctors, and other medical staff. Also, these laboratories provide easy access to patients as well as healthcare providers, as they are located within hospital premises and provide wide benefits to patients admitted in critical care settings.

Anti-epileptics drug class accounted for the highest revenue share in 2023, and it is expected to maintain its dominance during the forecast period as well. This is ascribed to the growing prevalence of epilepsy, the mounting need for individualized dosing, the rising development of anti-epileptic drugs, and the increasing prevalence of recurrent seizures in children, and it also helps access patient compliance with anti-epileptic drug therapy.

On the other hand, the immunosuppressants category will witness significant growth in the coming years. This can be due to the burgeoning rate of autoimmune diseases including multiple sclerosis, rheumatoid arthritis, type-1 diabetes, and others, and the mounting count of organ transplantations across the globe.

Organ transplantation is increasing, owing to organ failure in adults and elderly people. Therapeutic drug monitoring is needed while performing immunosuppressive medications, which is required for managing patients undergoing organ transplantation. Immunosuppressants are one of the major drugs that can be prescribed before a surgical procedure for a smooth transplant and the patient’s body can easily accept the transplanted organ. Also, the administration of such a particular drug is most important because the improper concentration of the drug may lead to adverse effects in patients. So, the role of such drug monitoring is high.

Moreover, the number of transplants is rising across the globe. For instance, according to the UNOS, 42,880 transplants have been done alone in the U.S., which further creates a high demand for drug monitoring.

Drive strategic growth with comprehensive market analysis

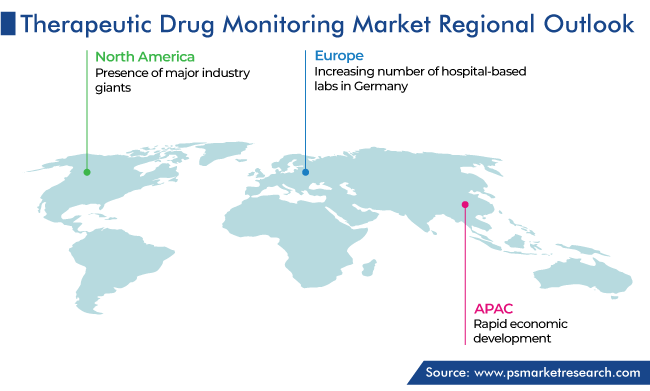

North America accounted for the highest revenue share, of 50%, in 2023, and it is further expected to maintain its dominance during the predicted period. This is due to the presence of major industry giants, government favorable regulations that permit drug monitoring particularly in private laboratories and primary healthcare centers, a large number of organ transplantation procedures, and increasing adoption of therapeutic drug monitoring devices across the region.

On the other hand, the APAC market will register the fastest growth during the predicted period. This can be due to the large patient population base, surging economic development in nations like China, India, Japan, and South Korea, rising consumer spending coupled with mounting per capita income, upsurge in the participation of government and private players in the market, increasing drug profiling processes along with advancements in system engineering and process automation, and rising number of hospital and medical care institutions in the region.

Additionally, the European region contributes significant revenue to the market. This is ascribed to the rising count of advanced healthcare device manufacturers, the growing consciousness regarding wellbeing coupled with higher spending on healthcare services, and the increasing government spending in the healthcare sector in the region.

This report offers deep insights into the therapeutic drug monitoring market, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

Based on Technology

Based on Drug Class

Based on End User

Geographical Analysis

The therapeutic drug monitoring market size stood at USD 2,142.7 million in 2024.

During 2024–2030, the growth rate of the therapeutic drug monitoring market will be around 9.8%.

Hospital laboratories is the largest end user in the therapeutic drug monitoring market.

The major drivers of the therapeutic drug monitoring market include the high adoption of advanced technologies in the healthcare industry, the rising number of industry players across the globe, the increasing requirement for drug development for critical illnesses, the mounting focus on drug monitoring-related R&D, the growing preference for precision medicine, and the increasing government regulatory standards.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages