Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 51.0 Billion |

| 2030 Forecast | 70.6 Billion |

| Growth Rate(CAGR) | 5.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Report Code: 12815

Get a Comprehensive Overview of the Synthetic Fuels Market Report Prepared by P&S Intelligence, Segmented by Type (Extra-Heavy Oils, Gas-to-Liquid Fuels, Biomass-to-Liquid Fuels, Fuel-from-Waste, Fuel-from-Atmospheric Carbon, Shale Oil, Oil Sands, Coal-to-Liquid Fuels), Raw Material (Coal, Natural Gas, Non-Food Crop Sources, Food Crop Sources), Application (Gasoline, Diesel), End Use (Transportation, Industrial, Chemicals), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 51.0 Billion |

| 2030 Forecast | 70.6 Billion |

| Growth Rate(CAGR) | 5.6% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

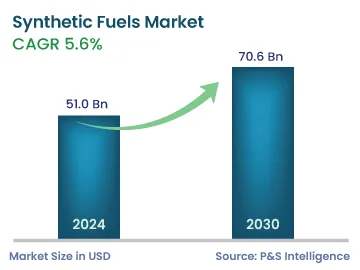

The synthetic fuels market is expected to generate an estimated revenue of USD 51 billion in 2024. Further, during the forecast period 2024–2030, it will grow at a CAGR of 5.6%, to reach USD 70.6 billion by 2030.

The rising demand for these energy sources can be credited to the fact that they are carbon-neutral or low-carbon, which aids in reducing air pollution. In this regard, the rising number of government initiatives to decrease greenhouse gas emissions drive the market. Fossil fuels have a wide range of applications, such as electricity generation (40% of the electrical energy generated globally is from coal), transportation, and domestic purposes (majorly cooking).

However, to make synthetic fuels, clean raw materials are used, i.e., electricity from one of three renewable energy sources—solar, wind, and wave power. This is why the resulting fuels are occasionally referred to as e-fuels.

The transportation category, under the end use segment, holds 40% market share in 2023. The usage of electric vehicles is increasing rapidly around the world, but the transportation industry still depends heavily on fossil fuels. Additionally, internal combustion engines offer added advantages in heavy vehicles and sports cars, or even in remote areas, where the supply of electricity is inadequate. Moreover, the aviation industry needs liquid fuel as it cannot rely completely on electricity. However, the International Energy Agency estimates that in 2021, transportation accounted for more than one-third of the global carbon dioxide emissions.

The carbon footprint of the transportation sector can be decreased if e-fuels are produced with hydrogen from an emission-free source and the carbon dioxide emissions generated in the process were absorbed. Moreover, since the engines of the current cars can consume e-fuels without needing to be modified, there is no need to build new infrastructure or incur significant costs. This factor could continue to drive the market amidst the global shift to EVs.

The industrial category also holds a significant share in the market. As per reports, the CO2 emissions of the industrial sector in 2022 were 9.0 Gt, where electricity and heat generation contributed 15.83 billion tonnes of emissions. This is because fossil fuels have wide usage in industries as energy sources and raw-material.

For instance, by-products of oil are used to produce plastics, chemicals, tars, medicines, and many other products. Moreover, coal is widely used to power machinery in industries, as natural gas and oil are expensive; so, they are unaffordable for many countries. Coal is used as a primary energy source in the cement, steel, and pharmaceutical sectors. Similarly, natural gas (CNG or LNG) is used during the manufacturing of fertilizers, dyes, and plastics, as well as in glass foundries and aluminum smelters, both as a raw material and an energy source.

Therefore, as industries are gradually moving toward renewable and clean energy sources, the demand for syngas and e-fuel will rise. For example, in place of conventional gasoline and diesel, synthetic gasoline and biodiesel can be used, respectively, because they are compatible with all current engines.

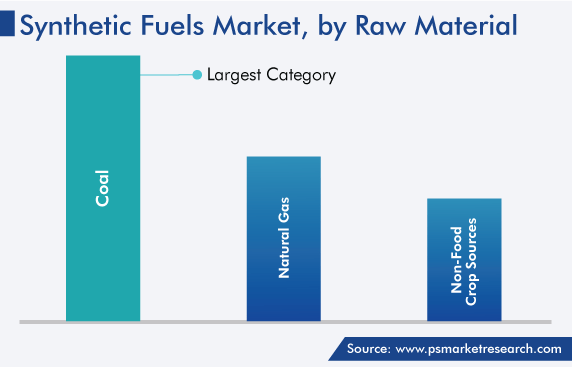

The coal category will dominate the synthetic fuels market, based on raw material, during the forecast period.

As per reports, the worldwide coal reserves in 2020 were 1,074 billion tonnes, the majority of which are in the U.S., China, Australia, and Russia. Coal gasification is acknowledged as one of the most-practical and efficient clean technologies for e-fuel production from this fossilized resource. It also provides a workable way to use coal to satisfy the strict environmental standards. The Indian government is dedicatedly working for encouraging the adoption of the coal gasification process to produce many valuable chemicals.

Globally, one of the most-widely available resources of energy is coal, but its combustion has a high negative impact on the environment. Therefore, the usage of the available coal in the most-efficient and environmentally benign ways is required to fulfill the continuously increasing energy demand. Innovative techniques, specifically gasification, help in producing clean energy by converting coal first to synthetic gas and then to liquid fuel, meanwhile reducing emissions.

The non-food crop category is growing fast, because of the rising concerns over food security. The first-generation processes used sugarcane, corn, soyabean, and rapeseed to produce bio-ethanol, thus reducing global food supplies. In contrast, second-generation biofuels are made by advanced technologies that use residual or non-food parts of crops, such as stems, husk, and leaves. Moreover, advanced technologies, such as thermochemical routes (which can produce ethanol, synthetic gasoline, synthetic diesel, and jet fuel) and gasification (which produces syngas), are being used to process these raw materials into low-carbon sources of heat energy.

Currently, diesel is one of the most-demanded fuels, with up to 28.6 million barrels being consumed daily. Synthetic diesel produced from non-food crops can prove to be a potential replacement for conventional diesel derived from crude oil in the efforts to reduce emissions.

Based on Type

Based on Raw Material

Based on Application

Based on End Use

Drive strategic growth with comprehensive market analysis

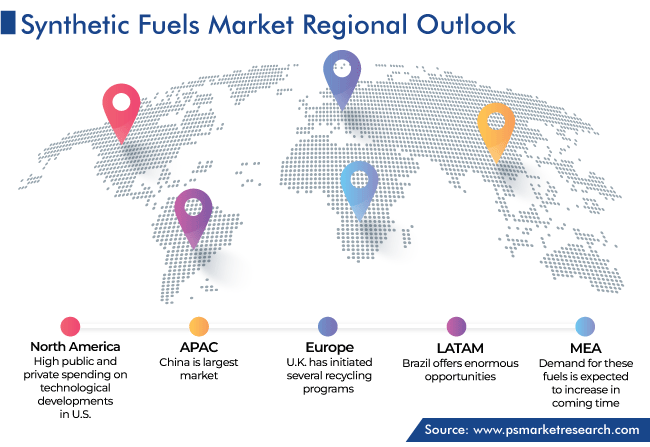

The Asia-Pacific region holds the largest market share, of around 50%, in 2023. Asia has many developing economies, most of which are also highly polluted. To improve the air quality, these countries are working tirelessly to reduce greenhouse emissions, by introducing regulations for industries and at the individual level. Additionally, governments are taking measures to coordinate actions to produce 2G ethanol at scale.

India has promised to cut the carbon footprint of its economic output by 45% by 2030, as part of its Nationally Determined Contributions (NDC). Further, China’s net carbon emission in 2020 was 2,912 million tonnes. Therefore, he country holds the largest market share in APAC for e-fuels, followed by Japan and India.

The North American market will also see fast growth throughout the forecast period. This will be since both the public and private sectors in the U.S. are investing a lot in technological developments to produce more synthetic fuels.

Further, Europe will hold a market share of 30% in 2030. The usage of these carbon-neutral or low-carbon substitutes has been rising since the European Union approved its 2035 ban on cars that create greenhouse gases; the ban does not apply to engines running on synthetic fuels. Additionally, the U.K. has initiated several recycling programs to reduce the amount of municipal solid waste that is disposed of directly. This waste can be used to produce biofuels with appropriate technologies.

For example, Audi runs a power-to-gas e-fuel production facility in Germany. In Europe, e-fuels are receiving a push as a means of lowering transportation-related greenhouse gas emissions and petroleum consumption.

Regions and countries covered in this report;

Explore Synthetic Fuels Companies

The 2030 size of the market for synthetic fuels will be USD 70.6 billion.

Product launches and R&D are trending in the market for synthetic fuels.

The transportation category leads the end use segment of the synthetic fuels industry.

Non-food crop usage is growing fast in the market for synthetic fuels.

APAC is the largest market for synthetic fuels.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages