Sustainable Fuel Market Trends and Growth Drivers

Growth in Usage of Green Hydrogen Is Key Trend

Green hydrogen, produced using , is one of the most-significant trends in the sustainable fuel market, driven by the increasing demand for zero-emission and carbon-neutral fuels.

Government polies are one of the key factors propelling green hydrogen demand. Many private companies are investing in the development of hydrogen production and storage infrastructure and policies. The European Union, Japan, the U.S., and Australia have set ambitious targets for hydrogen production and usage for achieving net-zero emissions.

In support, the National Green Hydrogen Mission of India is envisioned with an investment of INR 17,490 crore for electrolyzer manufacturing and green H2 production till 2029–30. Similarly, with the support of Germany, Austria, and Italy, the United Nations Industrial Development Organization (UNIDO) launched its Global Programme for Hydrogen in Industry in 2021 to enable emerging economies lessen the difficulties in green hydrogen production and supply.

Moreover, in November 2023, the World Bank proposed the creation of 10 GW of green hydrogen production capacity worldwide via projects ranging from 100 MW to 1 GW. Hence, the global drive for energy resilience and recent advancements in electrolyzer technology and decreasing renewable energy costs make it more scalable and viable.

Global Push for Decarbonization Is Major Market Driver

Governments across the world have set ambitious carbon reduction targets and are providing subsidies and financial incentives to encourage the use of renewable energy. According to the IEA, 2023 saw a 410-million-tonne increase in worldwide GHG emissions attributable to energy generation alone, which reached a new record of 37.4 billion tonnes.

The International Energy Agency (IEA) states that in Net-Zero Emission (NZE) by 2050 Scenario, the demand for hydrogen, biofuels, and hydrogen-based fuels would need to double from current levels by 2030 and double again by 2050.

Sustainable fuels are frequently seen as eco-friendly alternatives, especially when they are obtained from renewable materials, such as energy crops and agricultural waste, instead of fossil fuels. The International Renewable Energy Agency (IRENA) states that sustainable aviation fuel (SAF) could represent a significant portion of global aviation fuel demand in the coming decades. As per the U.S. Department of Energy (DoE), apart from reducing emissions, SAF also burns cleaner in the aircraft jet engines as it contains fewer aromatic hydrocarbons.

A key initiative in this regard is the 2024 pilot project involving the jack-up vessel crew and technicians from Vestas using a blend of conventional and sustainable ATF in helicopters that will ferry them to and from the Baltic Eagle wind farm.

Similarly, the DoE, USDA, and DoT have signed an MoU and launched the SAF Grand Challenge to reduce the cost, expand production, and improve the sustainability of SAF.

Additionally, in January 2024, India’s Ministry of Petroleum and Natural Gas launched the first pilot project to use ethanol to produce SAF. This came at the heals of the first trial of SAF in India on a flight to Delhi from Pune in 2023.

High Production Costs Present Market Challenges

The higher production cost of sustainable fuels compared to traditional fuels is one of the most-significant challenges for the market growth. Green hydrogen and SAF production technologies are still in the early stages and have not fully reached an economically viable scale.

An increase in production and advancement in technology may lead to a fall in the price, but it requires high investments in equipment, production plants, and storage & supply infrastructure. The slow adoption of sustainable fuels due to the high production cost is especially visible in price-sensitive industries, such as transportation and aviation. For instance, ATF accounts for up to 40% the operational spending of airlines worldwide.

Challenges such as the low energy density of some sustainable fuels also need to be overcome. For instance, hydrogen has a lower mass density as compared to conventional fossil fuels, requiring more space and higher pressures for storage and transportation. This further increases the cost of hydrogen storage and transportation, which are ultimately offloaded to the end customer.

The limited awareness among the consumers and industry stakeholders, lack of incentives, and cost concerns are a few other reasons of the low adoption rate of sustainable fuels. These barriers make it more difficult for sustainable fuels to compete with conventional fossil fuels in terms of efficiency, cost, and availability. As per the IEA, in 2022, average prices of conventional and bio-based diesel in Europe were USD 1 and USD 1.7 per liter, respectively. Moreover, prices in the U.S. stood at USD 1.1 and USD 2 for conventional and bio-based diesel, respectively.

Regional Analysis

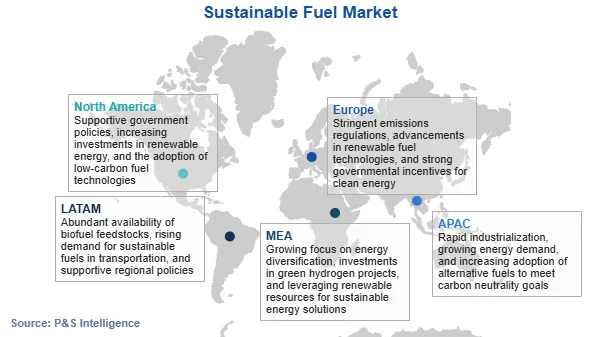

North America dominates the global sustainable fuel market with around 30% revenue share in 2024.

The Renewable Fuel Standard (RFS) in the United States has played a major role in boosting the biofuels market by mandating the use of renewable fuels in the transportation industry.

Innovation in bioethanol and renewable diesel production technologies has significantly improved the efficiency and economic viability of sustainable fuels. The regional sustainable fuel market is expanding, driven by key providers such as ADM (US), INFINIUM (US), and Air Products and Chemicals, Inc. (US), who are fostering the market's growth by creating opportunities for sustainable fuel projects.

APAC is the fastest growing regional market. This is because many APAC countries, majorly China and India, have strong government support for renewable energy and sustainability initiatives, including incentives, long term commitments, and subsidies to reducing emissions.

China is the largest market in the APAC region for sustainable fuels and made large number of investments in renewable energy and sustainable fuel technologies. Its commitment to achieving carbon neutrality by 2060.

India is the fastest-growing country in APAC for sustainable fuels. India has been rapidly growing up its renewable energy production and biofuel initiatives to meets its growing energy demands and climate goals.

The regions and countries analyzed for this report include:

North America (Largest Regional Market)

- U.S. (Larger Country Market)

- Canada (Faster-Growing Country Market)

Europe

- Germany (Largest Country Market)

- U.K. (Fastest-Growing Country Market)

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific (APAC) (Fastest-Growing Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

South Korea

Latin America (LATAM)

- Brazil (Largest Country Market)

- Mexico (Fastest-Growing Country Market)

- Rest of LATAM

Middle East and Africa (MEA)

- South Africa (Largest Country Market)

- U.A.E. (Fastest-Growing Country Market)

- Saudi Arabia

- Rest of MEA