Report Code: 11101 | Available Format: PDF

Surgical Staplers Market Size and Share Report - Global Trends, Strategic Developments, Segmentation Analysis, and Forecast to 2030

- Report Code: 11101

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Surgical Staplers Market Size & Share

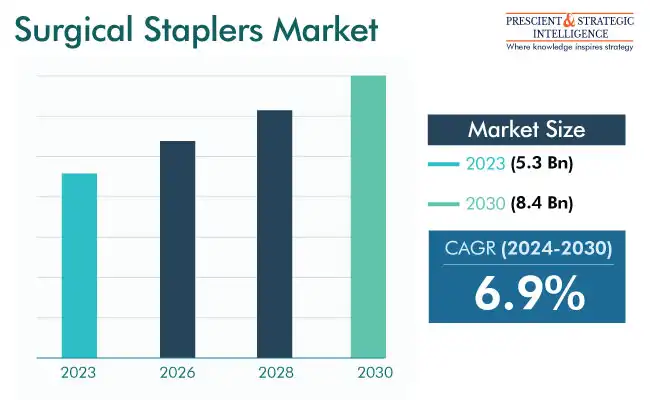

The size of the surgical staplers market was USD 5.3 Billion in 2023, and it will power at a rate of 6.9 % from 2024 to 2030, reaching USD 8.4 Billion by 2030.

The market advance is ascribed to the growing preference for staplers over sutures. With technological advances, many market players are commercializing staplers, to cater to the increasing demand from surgeons around the world. These devices are employed across various medicine branches, for example gynecology, thoracic, and gastrointestinal surgeries, along with tissue & wound management processes.

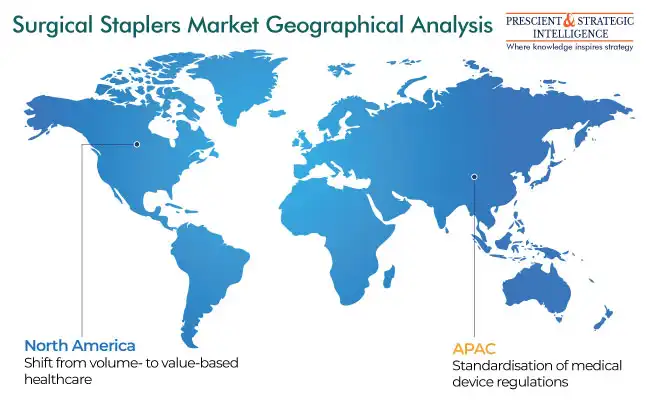

Geographical Insights

Due to the increase in the number of surgical procedures, rising adoption of enhanced technologies, and growing popularity of non-invasive methods, North America is the leader of the industry. The high obesity incidence, existence of all major medical consumables companies, and regulatory approval for less-invasive procedures are also responsible for the significant share of this continent in the industry. Further, dedicated devices are now available for thoracoscopic and laparoscopic procedures that use surgical staplers.

Additionally, with the shift of the regional healthcare industry to value-based care, the volume of minimally invasive surgeries is increasing. These procedures are also widely popular among patients as they entail lower blood loss from smaller incisions, shorter hospital stays, less risk of post-operative complications, less pain and scarring, and, above all, cost-effectiveness. Staplers are preferred over sutures in minimally invasive procedures, which is why the increasing popularity of these surgeries drives the regional market.

APAC will have the fastest growth in the years to come since India, China, and Japan have enormous patient populace.

- Moreover, these instruments were classified as drugs under the Cosmetics and Drugs Act in India in 2011.

- There is a good chance for industry expansion, as surgeries are being performed more frequently, cost of healthcare is skyrocketing, and public consciousness of their usage is growing.

As a result, industry stalwarts are spending to strengthen their foothold in the region. For instance, Johnson & Johnson has educated 8,000 doctors in cutting-edge surgical devices, such as non-invasive surgery staplers, in India. Initiatives such as this not only help advance the knowledge of doctors on advanced surgical technologies but also serve as an effective marketing tool for companies’ products.

Trends & Dynamics

The persistent technical advances will drive the industry expansion. With the evolving healthcare fields, medical device manufacturers are focusing on the creation of staplers with advanced safety features, ergonomics, and precision. The incorporation of modern imaging technologies, robots, and artificial intelligence is also improving the designs of staplers.

Additionally, the snowballing trend of disposable and single-use surgical instruments can be credited to their minimized requirement for sterilization, cleaning, and maintenance. The augmenting emphasis on decreasing the risk of hospital-acquired infections and enhancing workflow in healthcare settings will aid in the development of the industry.

- The requirement for surgical stapling will also grow because of the increase in the count of bariatric procedures and the use of advanced technologies to conduct endoscopic procedures.

- Furthermore, the introduction of powered surgical devices and the increasing requirement for tissue & wound management products would propel acceptance of surgical staplers.

Originally, sutures were extensively used for wound closure; however, staplers have gradually overtaken sutures. Apart from being a tedious procedure, the sutured sites might have wound leakage and separation, while surgical staplers provide better accuracy, speed, and effective wound closure.

Another major driver for this market is the growing geriatric population. These people are at a high risk of diseases that require surgery, and often, their wounds do not heal on their own or take longer to heal. This makes effective wound closure with staplers and sutures necessary for these people. For the same reason, the elderly have begun to prefer minimally invasive surgeries, during which staplers are preferred over sutures.

| Report Attribute | Details |

Market Size in 2023 |

USD 5.3 Billion |

Revenue Forecast in 2030 |

USD 8.4 Billion |

Growth Rate |

6.69% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Segmentation Analysis

Based on end user, ambulatory surgery centers will have the fastest growth in the years to come. This can be credited to the scarce economic resources, particularly in developing and underdeveloped economies. This makes the cost-effective ASCs more popular among patients, who also get the advantage of shorter wait times and quicker procedures.

Hospitals will continue to account for the largest share in this segment till 2030.

- Most of the surgeries, especially the complex, open ones, are performed at hospitals, as ASCs and independent clinics often do not have the professionals or the equipment to handle these procedures.

- Moreover, only large and well-funded hospitals can afford the expensive surgical robots, which is why MISs are also majorly performed here.

Powered staplers will have the fastest growth in the industry, under segment by technology. They are an ideal solution to the issue of fatigue in doctors because of the high volume of surgical procedures taking place in emergency wards and operating rooms. These variants offer effortlessness in wound closure, without the requirement of manual firing force. Further, they come in numerous sizes, which gives doctors a better choice when performing complex surgical procedures.

These variants even have advanced features nowadays, including real-time feedback and safety mechanisms. In addition, their usage leads to quicker procedures, low risk of human error and accidental injuries, and less pain and blood loss.

Disposable staplers are both the larger and faster-growing category within the usage segment, because of the growing prevalence of surgical site infections.

- Their usage also helps in preventing the spread of infections to the medical staff from patients.

- The dominance of this category is also a result of the rising usage of single-use staplers in complex procedures, particularly heart surgery.

- Moreover, for minor injuries and post-operative wound closure, biodegradable staplers are preferred.

The application segment receives the highest revenue from the abdominal & pelvic category. This is attributed to the rising volume of weight loss surgeries, itself due to the increasing incidence of obesity.

- The World Health Organization (WHO) says that more than 1 billion people are overweight globally.

Obesity not only leads to the loss of productivity but also emotional trauma and anxiety among patients. Additionally, obesity is a major risk factor for more-serious diseases, especially of the heart and bones & muscles.

Top Surgical Staplers Producers:

- Johson & Johnson Services Inc.

- Intuitive Surgical Inc.

- Stryker Corporation

- Smith & Nephew Plc

- CONMED Corporation

- CareFusion Corporation

- 3M Company

- BioPro Inc.

- Meril Life Science Pvt. Ltd.

- Zimmer Biomet Holdings Inc.

- Frankenman International Ltd.

- Welfare Medical Ltd.

- Reach Surgical Inc.

- Medtronic plc

- Purple Surgical Inc.

- Dextera Surgical Inc.

- B. Braun Meslungen AG

- Grena Ltd.

- Integra LifeSciences Holdings Corporation

- Touchstone International Medical Science Co. Ltd.

- Becton, Dickinson and Company

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws