Report Code: 12799 | Available Format: PDF | Pages: 260

Surgical Procedures Market Size and Share Analysis by Type (Gastrointestinal, Cardiovascular, Dental, Cosmetic, Urologic, Ophthalmic, Orthopedic, ENT, OB-GYN), Provider (Physician Offices, Hospitals, Ambulatory Surgery Centers), Gender (Male, Female), Age Group (Under 14, 14-49, 50-64, 65-74, 75-80, Above 80) - Global Industry Demand Forecast to 2030

- Report Code: 12799

- Available Format: PDF

- Pages: 260

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Surgical Procedures Market Size & Share

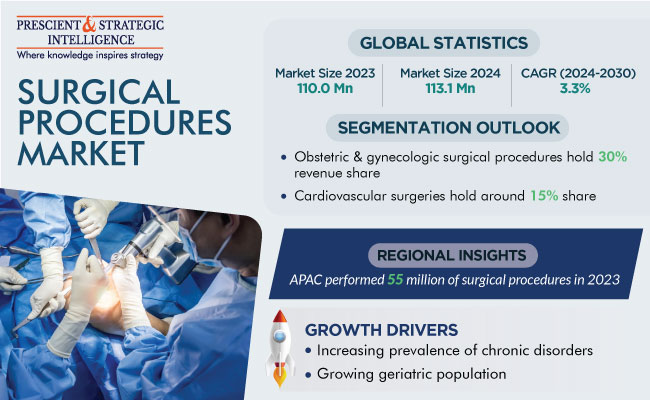

The surgical procedures market size was 110.0 million procedures in 2023, which is projected to witness a CAGR of 3.3% during 2024–2030, reaching a count of 137.5 million by 2030.

The growth can be primarily ascribed to the increasing chronic disorder prevalence, especially cancer and CVDs; and the rising geriatric population, which is highly susceptible to gastric disorders, intestinal disorders, ocular disorders, and other health conditions. Further, the technological advancements in surgical procedures will lead to the growth of the market in the coming years.

Elderly people are more susceptible to chronic diseases, such as cancer, diabetes, neurological disorders, and cardiovascular diseases, which results in the increasing demand for surgical procedures. In the same way, the low immunity levels make the aging population more prone to infections, thus leading to a rise in the count of surgical procedures.

Obstetric & Gynecologic Surgical Procedures Account for Largest Share

The obstetric & gynecological category held the largest market share, of around 30%, in 2023, as a result of the surging prevalence of gynecological disorders, such as endometriosis, polycystic ovary syndrome (PCOS), ovarian cysts, ovarian and uterine cancer, chronic pelvic pain, pelvic inflammatory disease, adenomyosis, and uterine fibroids.

For instance, in November 2022, according to an article published in the Frontiers in Medicine Journal, the estimated prevalence of uterine fibroids is between 40–60% among women under the age of 35 and 70–80% among women over the age of 50, with the overall estimated incidence of 20–70%. Additionally, as per the same source, African-American women in the U.S. are more likely to have this condition, with the prevalence estimated at 59%.

Additionally, women are going for cesarean section surgeries without any clinical signal or recommendation by doctors, to eliminate the pain of a normal delivery. According to new research by the WHO, more than 1 in 5 (21%) of all the childbirths happen via C-section surgeries, and this number is expected to rise significantly worldwide, with roughly a third (29%) of all births being cesarean sections over the coming years.

Moreover, the increasing pace of technological advancements in gynecological devices, which are helping improve the surgical procedures, is leading to the growth of the market. In addition to that, the development of advanced imaging devices, such as 3D endoscopes, which offer a high-resolution visualization up to 4K, supported by additional information on depth, anatomical details, and orientation in the surgical field, is helping surgeons and contributing to the growth of the market.

For instance, in March 2022, Endoluxe launched Endoluxe eVS, which is a high-definition wireless endoscopy camera with TowerTech. It is designed for all endoscopic procedures utilized in gynecological, urological, ENT, orthopedic, and general surgery.

Ophthalmic Surgical Procedures Will Experience Fastest Growth

The ophthalmic category is projected to observe the fastest surgical procedures market growth, at a CAGR of around 3.7%, during the forecast period. This is attributed to the rising prevalence of several ophthalmic disorders, including cataracts, glaucoma, and diabetic retinopathy.

Moreover, the market in this category is growing due to the rising population of the elderly and the increasing prevalence of eye conditions as a result of the longer screen time and diminishing eyesight. The volume of surgeries for cataracts, glaucoma, detached retinas, retinal tears, diabetic retinopathy, and nearsightedness or farsightedness, thus, continues to increase.

| Report Attribute | Details |

Market Size in 2023 |

110.0 Million Procedures |

Market Size in 2024 |

113.1 Million Procedures |

Revenue Forecast in 2030 |

137.5 Million Procedures |

Growth Rate |

3.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Provider; By Region |

Explore more about this report - Request free sample

Cardiovascular Surgeries Hold Third-Largest Market Share

The cardiovascular category occupied the third-largest revenue share, of around 15%, in 2023. This has been a result of the growing number of people suffering from cardiovascular diseases, such as coronary heart disease, stroke, peripheral arterial disease, and aortic valve disease.

Moreover, due to the advancement in surgical procedures, heart transplantations are widely performed to treat the complexities of ischemic heart disease, valvar heart diseases, and congenital heart diseases. Therefore, the increasing number of patients suffering from heart disorders will boost the demand for cardiovascular surgeries, in turn, driving the growth of the surgical procedures market.

Rising Prevalence of Cancer Driving Market Growth

The increasing prevalence of cancer is projected to fuel the growth of the global surgical procedures market in the forecast period. The most-common malignancies in solid organs are breast & colon cancers, are mostly diagnosed at the early stage and can be removed through resections, which is providing prominent growth opportunities to the market.

According to a journal published by the American Cancer Society, in 2022, new cancer diagnoses numbered at approximately 1.9 million, while deaths from this disease stood at 609,360 in the U.S. Among the cancers, the most common in the U.S. are breast cancer, prostate cancer, lung & bronchus cancer, colon & rectum cancer, kidney & renal cancer, bladder cancer, and pelvic cancer.

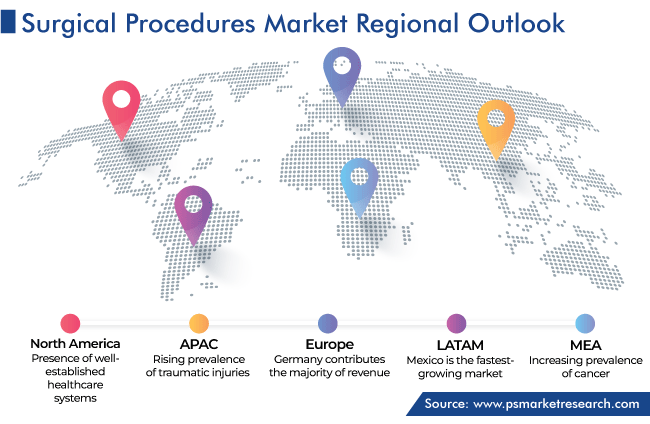

North America Makes Largest Contribution to Global Revenue Generation

North America dominated the surgical procedures market, with a share of 50%, in 2023, owing to the presence of well-established healthcare systems, increase in the prevalence of diseases, such as gastrointestinal, cardiac, and orthopedic disorders; higher adoption rate of technologically advanced devices, and shift in the preference toward outpatient surgeries.

Moreover, the U.S. contributes the majority of the revenue to the North American market, owing to the surging burden of diseases requiring surgical procedures, rising awareness regarding minimally invasive procedures, and growing health consciousness among individuals.

In addition to that, the growth in the trend of medical tourism in emerging economies, such as India, China, Thailand, Brazil, Malaysia, Mexico, and South Korea, is leading to the increasing number of surgical procedures and offering wide opportunities for market growth in these countries. According to the report of the Organisation for Economic Co-operation and Development (OECD), healthcare is costlier in developed countries. Therefore, developing countries, such as India and Colombia, are popular destinations to get certain surgeries, because of the availability of high-quality care at lower costs.

Adoption of Outpatient Surgeries Providing Lucrative Opportunities

The high number of outpatient surgeries is providing considerable growth opportunities to the market. Outpatient surgeries are termed ambulatory surgeries, day surgeries, day case surgeries, and same-day surgeries, as they do not mandate an overnight stay at the hospital. The common surgical procedures conducted at outpatient facilities include tonsillectomy, gallbladder removal, hernia repair, various cosmetic surgeries, cataract surgery, and mole removal.

Nowadays, medical procedure count is rising at outpatient facilities because of technological advancements, including the emergence of minimally invasive surgeries, and the availability of value-based care incentives. Various government reimbursement policies and private health plans are accepted at cost-effective care settings, of which outpatient facilities are a kind. Additionally, health systems have started collaborating with independent physician practices, which has increased the number of services provided in outpatient settings.

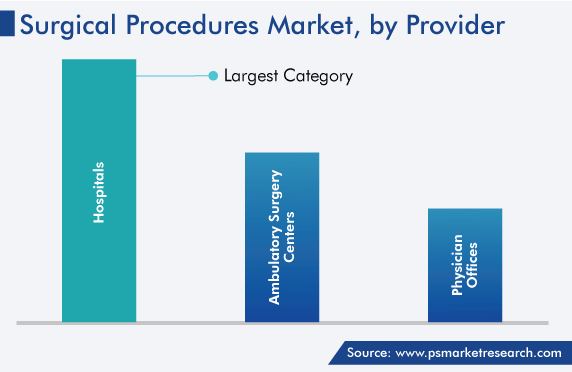

Hospital Category Will Maintains Its Dominance

The hospital category led the market in the end user segment, with a share of around 45%, in 2023, and this situation would remain unchanged during the forecast period. The drivers for the industry growth in this category are the large number of surgeries performed in these healthcare facilities worldwide, with the growing incidence of several chronic disorders.

Moreover, the wide availability of skilled surgeons, high patient preference and satisfaction, technical support for complex procedures, increase in the awareness of the availability of innovative surgical instruments, and the upgradation in the level of services provided at hospitals are contributing to the growth of the category.

Furthermore, the existence of expansive super-specialty hospitals in the advanced economies, such as the U.S. and Canada, along with their propitious outcomes, increases the surgery volume in these settings, owing to the utilization of advanced technologies. These advanced technologies not only facilitate easy treatment but also offer better, faster, and precise results. Thus, hospitals provide better care to patients, which, combined with the favorable reimbursement scenario for such procedures, is further leading to the growth of the category.

Ambulatory Surgery Centers Expected To Show Fastest Growth

The ambulatory surgery centers (ASCs) category is projected to observe the fastest growth, of 3.5%, during the forecast period. This growth is credited to the flourishing number of such centers, increasing popularity of minimally invasive procedures as well as cosmetic procedures, and the cost-effectiveness of the treatments provided at such settings.

Moreover, the growth in this category is due to the lack of available beds and prolonged waiting times in hospitals. In addition to that, people have begun to prefer less-crowded places, which is driving the growth of the category.

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the surgical procedures market from 2017 to 2030, based on all the relevant segments and geographies.

Based on Type

- Gastrointestinal

- Cardiovascular

- Dental

- Cosmetic

- Urologic

- Ophthalmic

- Orthopedic

- ENT

- Obstetric & Gynecologic (OB-GYN)

Based on Provider

- Physician Offices

- Hospitals

- Ambulatory Surgery Centers

Based on Gender

- Male

- Female

Based on Age Group

- Under 14

- 14–49

- 50–64

- 65–74

- 75–80

- Above 80

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The size of the market for surgical procedures in 2023 was 110.0 million procedures.

Obstetric/gynecological, cardiovascular, and ophthalmic are the major types in the surgical procedures industry.

Hospitals are the most-important providers in the market for surgical procedures.

Minimally invasive surgeries, ambulatory and outpatient hospital settings, and medical tourism are the key trends in the surgical procedures industry.

North America dominates the market for surgical procedures, and APAC will witness the highest CAGR.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws