Report Code: 11758 | Available Format: PDF | Pages: 220

Endoscope Market Research Report: By Type (Esophagoscope, Arthroscope, Colonoscope, Bronchoscope, Cystoscope, Laryngoscope, Laparoscope, Colposcope), Application (Gastroenterology, Orthopedic, Pulmonology, Urology, Gynecology), End User (Hospitals, Specialty Clinics, Diagnostic Centers), Geographical Outlook (U.S., Canada, Germany, France, U.K., Italy, Spain, China, Japan, India, Australia, Brazil, Mexico, Saudi Arabia, South Africa, U.A.E.) - Global Opportunity Analysis and Growth Forecast to 2024

- Report Code: 11758

- Available Format: PDF

- Pages: 220

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

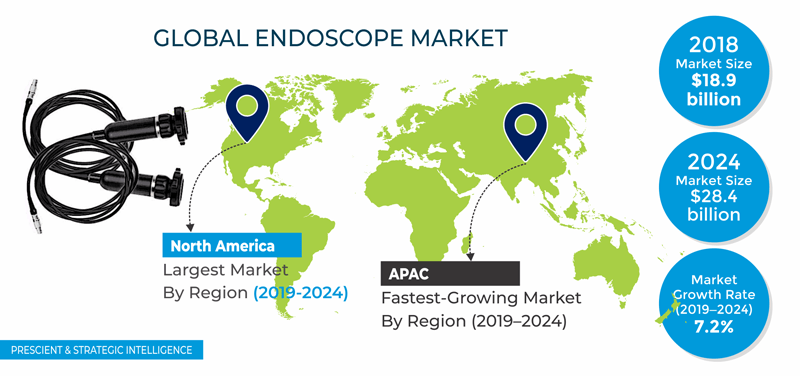

The endoscope market size was $18.9 billion in 2018, and it is expected to reach $28.4 billion by 2024, displaying a CAGR of 7.2% during 2019–2024.

Geographically, North America is expected to generate the highest revenue in the coming years. This can be attributed to the growing geriatric population, rising incidence of chronic ailments, and increasing number of hospitals in the region. Besides, the presence of leading market players, constant technological advancements, and improving healthcare services will facilitate the market growth.

The American Cancer Society (ACS)’s 2018 data reveals that colorectal cancer was the second-leading cause of cancer deaths in the U.S. and that it mostly affects the elderly. Further, the American Hospital Association (AHA) reported that the number of hospitals in the U.S. grew from 5,534 in 2016 to 6,200 in 2017, thus driving the sale of endoscopes in the region.

Market Dynamics

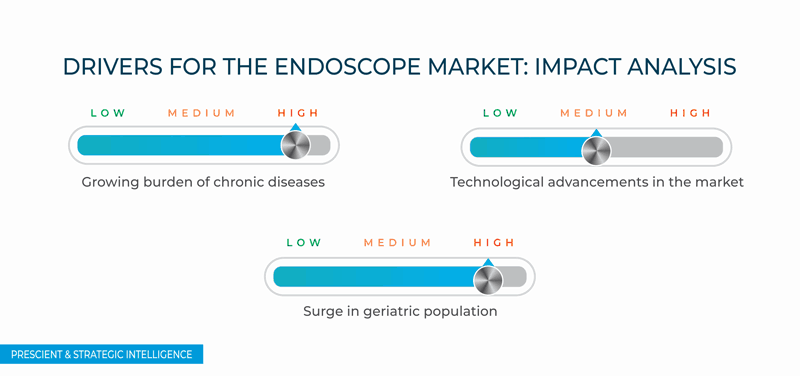

The large-scale adoption of endoscopes and continuous technical evolution have resulted in the development of advanced products that can be utilized in all healthcare units. For example, in February 2019, PENTAX Medical, which is a subsidiary of HOYA Corporation, introduced its argon plasma coagulation (APC) and integrated electrosurgical platforms, ENDO PLUS and ENDO ARC, which address coagulation concerns and offer electrosurgical capabilities. Such technological developments by endoscope market players have become a key reason behind the rising popularity of new-generation endoscopes among healthcare professionals.

The soaring cases of chronic illnesses, such as cardiovascular diseases (CVDs), respiratory diseases, and cancer, will fuel the demand for advanced endoscopy equipment in the coming years. The Heart Disease and Stroke Statistics 2018 report of the American Heart Association (AHA) says that the U.S. recorded 836,546 CVD deaths, which accounted for about one in every three deaths in the country.

Similarly, according to the 2017 estimates of the Canadian Cancer Society, cancer was the leading cause of mortality in Canada, and nearly one in four individuals died from it, which amounted to 30.2% of the deaths in the country. Other leading causes of death in Canada are CVDs, accidents, and chronic lower respiratory disorders. The increasing cases of these conditions are resulting in a rise in the volume of endoscopy procedures, thus propelling the endoscope industry growth.

Manufacturers of medical devices are focusing on reducing the production cost, by relocating their manufacturing plants to areas with cheap labor and raw materials. Moreover, the incentives and tax relaxations offered by governments of developing nations are the biggest attractions for companies in the endoscope market. For instance, in 2017 the National Health and Family Planning Commission (NHFPC) of China introduced an incentive scheme to encourage the establishment of medical device production plants in the country. Since then, numerous overseas companies have moved their production base to the country to gain a competitive edge in its market.

Segmentation Analysis

The esophagoscope category, under the type segment, accounts for the largest share in the market for endoscopes due to the vast prevalence of chronic diseases and high focus on their early diagnosis and treatment.

The gastroenterology category, within the application segment, will record the fastest growth till 2024 due to the soaring incidence of colon polyps, pancreatitis, colitis, and peptic ulcers. Besides, the rising number of colorectal cancer cases will boost the growth of this category.

The hospitals category generates the highest revenue under the end user segment. This is because of the spurring number of hospitals across the globe, where a significant number of endoscopy procedures are performed.

Geographical Analysis

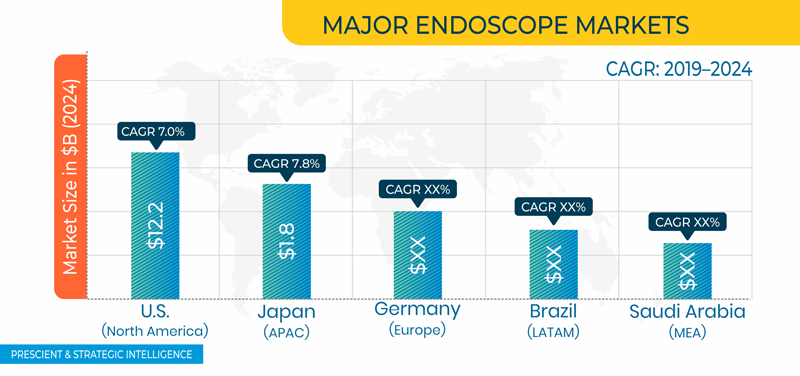

North America is the largest user of endoscopes, and it will account for an over 47.7% market share in 2024. This can be credited to the rapid technological developments, existence of major market players, large number of hospitals, improved healthcare infrastructure, high prevalence of chronic illnesses, and vast population of the elderly. The U.S. holds the dominant endoscope market position in the region due to the increasing cases of respiratory and gastrointestinal diseases, escalating geriatric population, and mounting number of hospitals.

In the coming years, Asia-Pacific (APAC) will demonstrate the fastest growth in the market for endoscopes because of the booming healthcare spending, amplifying awareness regarding the early diagnosis of diseases, and burgeoning cases of chronic ailments. Moreover, in India and China, the advancing healthcare infrastructure and ongoing technological developments are the key growth drivers for the market. Among APAC countries, India will record considerable growth due to the expanding patient pool and surging government initiatives to raise awareness about the advantages of early disease diagnosis.

Competitive Landscape

Some of the giant players which are contributing to the growth of the endoscope market are Boston Scientific Corporation, Smith & Nephew plc, Stryker Corporation, Medtronic plc, Olympus Corporation, FUJIFILM Holdings Corporation, and KARL STORZ SE & Co. KG. CONMED Corporation, HOYA Corporation, Cantel Medical Corp., B. Braun Melsungen AG, Maxer Endoscopy GmbH, SMART Medical Systems Ltd., and GI Supply Inc. are some other players operating in the market.

Recent Strategic Developments of Endoscope Market Players

In the recent years, the major players in the endoscope market have actively engaged in mergers & acquisitions to gain a competitive edge. For instance, in March 2018, Boston Scientific Corporation acquired EMcision Limited, a private company located in the U.K. and Canada. The acquisition expanded Boston Scientific Corporation’s endoscopy portfolio by adding the Habib EndoHPB probe, a novel endoscopic bipolar radiofrequency device, which coagulates the tissue in the gastrointestinal tract. The Habib EndoHPB probe is used by physicians in the treatment and palliative care of patients living with pancreaticobiliary cancers.

Key Questions Addressed in the Report

- What is the current scenario of the endoscope market?

- What are the emerging technologies for the development of the endoscope market?

- What are the historical size and the present size of the categories within the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market share?

The endoscope market will generate revenue of $28.4 billion by 2024.

The endoscope industry was worth $18.9 billion in 2018.

The endoscope market will grow at a CAGR of 7.2% from 2019 to 2024.

Geographically, the endoscope industry will register the fastest growth in APAC and highest revenue in North America in the coming years.

The rising prevalence of chronic diseases, such as cardiovascular diseases, respiratory ailments, and cancer, is the biggest growth driver for the endoscope market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws