Report Code: 11455 | Available Format: PDF | Pages: 266

Aortic Valve Market Research Report: By Valve Type (Tissue/Biological, Mechanical), Suture Type (Sutured, Sutureless), Procedure (Open Surgery, Minimally Invasive Surgery), End User (Hospitals, Ambulatory Surgery Centers) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 11455

- Available Format: PDF

- Pages: 266

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Aortic Valve Market Overview

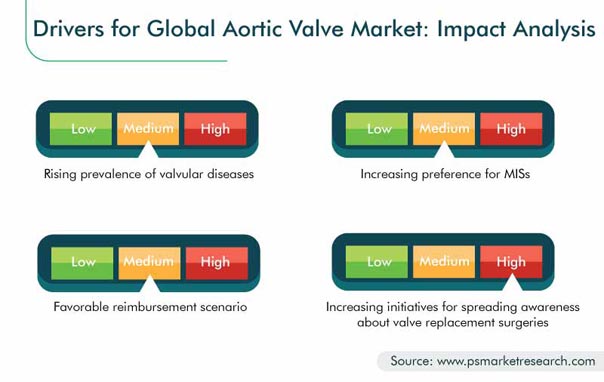

The global aortic valve market size was $7,568.3 billion in 2019, which is set to progress at a CAGR of 13.2% during the forecast period (2020–2030). The rising prevalence of valvular diseases and initiatives being taken for creating awareness on valve replacement are boosting the demand for these products in the market.

Due to COVID-19, the aortic valve market witnessed a negative impact across the globe during the first two quarters of 2020, primarily due to the lockdown and non-operational hospitals in several countries. The lockdown led to the reduced trade of a number of products, including aortic valves, as a consequence of the reduced demand, closure of manufacturing facilities to protect workers, constraints in the handling capacity of goods at ports, and widespread financial distress.

.jpg)

Segmentation Analysis

Tissue/Biological To Be Largest Category in Market

On the basis of valve type, the tissue/biological valve type is expected to dominate the aortic valve industry during the forecast period. This can be mainly attributed to the advancements in technology and rising adoption of such valves. Moreover, the increase in the geriatric population and rise in the prevalence of cardiovascular diseases are the main factors driving the growth in the tissue/biological aortic valve category.

Sutureless Bifurcation To Witness Faster Growth during Forecast Period

In the aortic valve market, the sutureless bifurcation is projected to witness significant growth during the forecast period. This can be mainly ascribed to the advantages of these valves over sutured valves, such as a decrease in the duration of cardiopulmonary bypass (CPB) and cross-clamping.

Minimally Invasive Surgery (MIS) Expected To Be Larger Category in Industry

MISs for aortic valve implantation held the larger share in the aortic valve market in 2019, under the procedure segment. This can be attributed to the fact that MISs cause lesser trauma to the patient and facilitate quicker recovery, than invasive procedures, such as open-heart surgeries. Moreover, MISs require relatively shorter hospital stays; hence, are economically viable.

Hospitals To Be Faster-Growing Category Due to Rise in Healthcare Expenditure

Based on end user, hospitals are expected to be the faster-growing category in the aortic valve market during the forecast period. This can be attributed to the fact that these are the most advanced healthcare facilities that also offer the best possible patient care. In addition, an improving healthcare reimbursement structure, coupled with the rising healthcare expenditure, is expected to drive the hospitals category at a robust pace during the forecast period.

Geographical Outlook

Europe – Largest and Fastest-Growing Region in Industry

Europe accounted for the major share in the aortic valve market in 2019, and it is expected to continue to dominate the global industry throughout the forecast period. This is mainly due to the presence of an advanced healthcare infrastructure, high healthcare spending, growing geriatric population, and surging prevalence of chronic and lifestyle-associated diseases in the region. Moreover, a significant prevalence of aortic stenosis, emergence of effective treatments, such as transcatheter aortic valve replacement (TAVR), and rising initiatives for creating awareness about valve replacement surgeries are some of the key factors characterizing the European market.

Trends & Drivers

Product Launches Are Key Trend in Market

Product launches are one of the major trends being observed in the aortic valve market. Manufacturing companies operating in this market are continuously developing new and innovative products, in response to the increasing demand for aortic valves across the globe. For instance, in April 2018, Boston Scientific Corporation announced the receipt of the FDA approval for the LOTUS Edge Aortic Valve System. Delivered via a minimally invasive procedure, this TAVR product is approved for patients with severe aortic stenosis, for whom surgical valve replacement via open-heart surgery would be too risky. The launch of such advanced products has helped medical practitioners provide effective treatment to patients.

Surging Prevalence of Valvular Diseases Is Key Factor Driving Market

Aortic stenosis and aortic regurgitation are the major issues which create the need for heart valve replacement. It has been observed that the population at risk of aortic stenosis is rising. According to the estimates by John Muir Health, a non-profit integrated system for doctors, hospitals, and other healthcare providers, every year, more than five million people are diagnosed with heart valve diseases, such as aortic stenosis. It further reported that 1.5 million people in the U.S. are diagnosed with aortic stenosis each year. The prevalence of this condition increases with age; thus, the rising geriatric population is a significant factor behind the aortic valve market growth.

Increasing Initiatives for Spreading Awareness about Valve Replacement

The increasing support from government organizations across the globe is playing a pivotal role in the growth of the aortic valve market. There are various initiatives being undertaken to increase the awareness about aortic valve replacement procedures. For instance, Valve for Life is an initiative in Europe, launched by the European Association of Percutaneous Cardiovascular Interventions (EAPCI), in 2015. This initiative is aimed at improving the access to transcatheter valve procedures in Europe, raise awareness about valvular diseases, improve the educational standards for healthcare practitioners, diminish gender and age discrimination in access to care, and reduce obstacles for therapy implementation. Such initiatives have increased the awareness about the management of valvular diseases, which is subsequently driving the aortic valve market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$7,568.3 Million |

Forecast Period CAGR |

13.2% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Analysis, Company Share Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Valve Type; Suture Type; Procedure; End User; Geography |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, Spain, Japan, China, Taiwan, Brazil, Mexico, South Africa |

Secondary Sources and References (Partial List) |

American College of Cardiology, American Heart Association, European Heart Network, European Society of Cardiology, International Diabetes Federation, National Center for Biotechnology Information, Organization for Economic Co-operation and Development, United Nations Department of Economic and Social Affairs, World Health Organization |

Explore more about this report - Request free sample

Rising Preference for MISs Is Expected To Boost Market Growth in Developing Economies

In recent years, the demand for MISs in developing nations has increased significantly, which has further supported the growth of the aortic valve market. This can be attributed to the fact that MISs, unlike open surgeries, involve a smaller number of less-invasive incisions, thus reducing trauma. TAVR is an MIS for the replacement of damaged or diseased valves. According to the National Center for Biotechnology Information (NCBI), TAVR has the potential to make conventional aortic valve replacement surgeries obsolete and emerge as the new golden-standard procedure for the treatment of aortic stenosis.

TAVRs are less invasive than conventional AVR procedures, and the chances of comorbidities and mortality are significantly lesser for symptomatic severe aortic stenosis patients undergoing TAVRs. Therefore, the increasing preference for and awareness on MIS are expected to drive the aortic valve market during 2020–2030.

Market Players Launching New Products and Services to Gain Competitive Edge

The global aortic valve market is consolidated, with the presence of few key players, such as Edwards Lifesciences Corporation, CryoLife Inc., LivaNova PLC, and Medtronic plc. In recent years, major players in the aortic valve industry have taken several strategic measures, such as product launches and successful pursuance of approvals from various health organizations across the world, to gain a competitive edge in the market.

- In June 2020, Edwards Lifesciences Corporation announced that it has received the Chinese regulatory approval for the Edwards SAPIEN 3 transcatheter heart valve, for the treatment of patients suffering from severe, symptomatic aortic stenosis (AS), who are unable to undergo open-heart surgery or for whom such invasive procedures are considered highly risky.

- In December 2019, CryoLife Inc. announced that it has received the authorization from the U.S. Food and Drug Administration (FDA) pursuant to an Investigational New Drug (IND) application, to begin the PROACT Xa clinical trial, a prospective, randomized trial to determine if patients with an On-X mechanical aortic valve can be maintained safely and effectively on apixaban (Eliquis), rather than warfarin.

- In September 2019, Medtronic plc announced the FDA approval and U.S. launch of the Evolut PRO+ TAVR system. The Evolut PRO+ TAVR system provides a low delivery profile and added surface area contact between the valve and the native aortic annulus, to further advance valve sealing performance.

The Key Players in the Aortic Valve Market include:

-

Boston Scientific Corporation

-

Edwards Lifesciences Corporation

-

CryoLife Inc.

-

Medtronic plc

-

LivaNova PLC

-

Abbott Laboratories

-

JenaValve Technology Inc.

-

Thubrikar Aortic Valve Inc.

-

LifeNet Health Inc.

-

Coroneo Inc.

-

Anteris Technologies Ltd.

Aortic Valve Market Size Breakdown by Segment

The aortic valve market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Valve Type

- Tissue/biological

- Mechanical

Based on Suture Type

- Sutured

- Sutureless

Based on Procedure

- Open Surgery

- Tissue/biological

- Mechanical

- Minimally Invasive Surgery (MIS)

- Transfemoral aortic valve replacement (TF-AVR)

- Transapical aortic valve replacement (TA-AVR)

Based on End User

- Hospitals

- Ambulatory Surgery Centers (ASCs)

Geographical Analysis

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- North America

- U.S.

- Canada

- Asia-Pacific (APAC)

- Japan

- China

- Taiwan

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- South Africa

The aortic valve industry is expected to advance at a CAGR of 13.2% during 2020–2030.

The U.S. will generate the maximum revenue for the aortic valve market.

The aortic valve market is consolidated in nature.

Aortic valve industry players are focusing on the successful pursuance of approvals from different health organizations, to launch products.

The European aortic valve market is the most lucrative for investments.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws