Report Code: 11741 | Available Format: PDF | Pages: 260

Speech Analytics Market Size and Share Analysis by Offering (Solution, Service), Deployment Type (On-Premises, Cloud), Enterprise Size (Large Enterprise, SME), Application (Customer Experience Management, Call Monitoring, Agent Performance Monitoring, Risk & Compliance Management), Industry (BFSI, Hospitality, IT & Telecom, Healthcare, Media & Entertainment, Manufacturing, Government, Retail) - Global Industry Demand Forecast to 2030

- Report Code: 11741

- Available Format: PDF

- Pages: 260

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

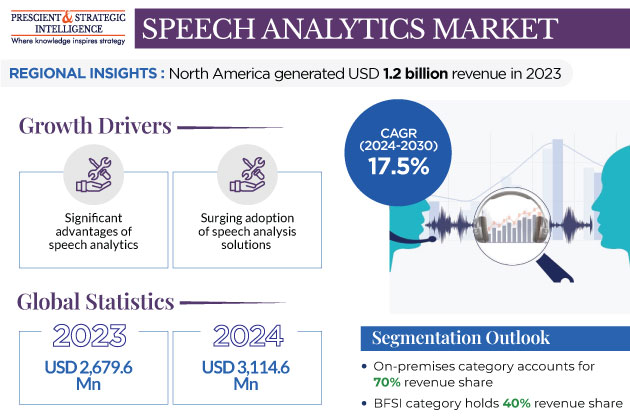

The speech analytics market size was valued at USD 2,679.6 million in 2023, and it is expected to reach USD 8,185.9 million in 2030, advancing at a compound annual growth rate of 17.5% during 2024–2030. This is because a large number of big businesses primarily focus on customer satisfaction, the surging number of contact centers, the growing importance of real-time voice analytics, and the rising regulatory compliance requirements.

- Voice analytics can convert call records into actionable data, and then turn the data into valuable and effective insights across the business.

- The solution is primarily used to manage a wide range of customer interactions.

- In today’s world, businesses around the globe would be with integrated speech analytics through a combination of internally recorded and externally provided data to create cutting-edge solutions to understand customer requirements and minimize overall disruption.

Significant Advantages of Speech Analytics

Speech analytics provide the actionable perceptivity that increases business value and inspires data-driven decision-making to ameliorate individual hand training ways. The need to evaluate contact center effectiveness is necessary to amend client satisfaction. So, through voice analytics, druggies can identify issues that may arise over multiple calls that may not be picked considered as serious problems. With voice analytics results, businesses can understand unexplained client behaviors and better understand their intention and satisfaction situations.

Moreover, by using voice analytics, it can maintain client relations across traditional and colorful digital channels. It is also possible to predict when and if clients will be absent and businesses can find ways to help with similar conditioning. This can also help brands to make better client experience and thereby can take way to help similar activities. This also helps brands to improve client experience and thereby achieve client satisfaction, report client service crime, and correct harmful actions on time. This is one of the major growth drivers in the industry.

In addition, the surging adoption of speech analysis solutions that incorporate advanced technologies such as artificial intelligence and machine learning is driving the market growth. By utilizing these technologies, speech analysis software can accurately interpret human language, identify emotional signals, and make predictions about customer behavior by analyzing both spoken as well as non-verbal communication. The continuous evolution of AI and ML is resulting in more advanced predictive capabilities, which enhances the business value obtained through speech analysis.

Additionally, these technologies enable businesses to gain immediate insights that can be used by their customers to improve their interactions as they unfold. Furthermore, speech analysis solutions on cloud systems offer flexibility, scalability, and cost-effectiveness without the need for IT infrastructure investment or maintenance, making it possible for organizations to conduct their analysis.

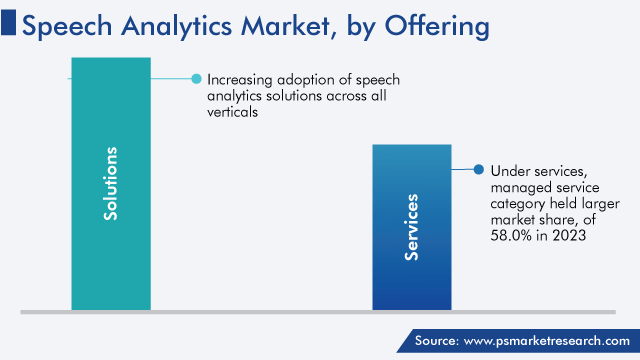

Solutions Category To Witness the Faster Growth

On the basis of offering, the solutions category is expected to witness the highest CAGR of 20% in the coming years.

- This can be because the integration of advanced technologies similar to analytics, natural processing (NLP), and artificial intelligence (AI) into speech analytics is allowing businesses, especially larger ones, to gain deeper perceptivity from voice dispatches.

- This empowers them to harness discussion data for a strategic advantage. Speech analytics results providers feed specific industry needs in sectors like banking and financial services (BFSI), retail, telecommunications, manufacturing, trip, healthcare, life, media, and entertainment.

- Businesses globally are adopting speech analytics by integrating their internally recorded data, social media inputs, and external data sources to gain sophisticated perceptivity, enhancing their understanding of guests and reducing client waste.

- There is a growing demand for a depository to manage perceptivity and aid businesses in enriching their processes to remain competitive.

Whereas, service-based speech analytics refers to a variety of services related to the deployment, use, support, and management of speech analytics solutions within an organization.

- These provide technical support and regular system testing to help businesses avoid downtime and resolve any issues quickly.

- Additionally, they provide the necessary support during the implementation phase and ensure smooth integration of speech analytics solutions into existing systems.

On-Premises Category Holds a Larger Share

The on-premises category accounts for a larger share, around 70%, of the market. This is because on-premises deployment involves setting up and running speech analytics software at an organization’s physical location. This involves obtaining hardware and software licenses as well as taking on maintenance, security, and data governance tasks.

In addition, on-premises adoption of voice analytics is exploding, especially in industries with strict data privacy and security regulations, such as finance and healthcare. This choice improves the flexibility and monitoring of the speech analytics environment. Additionally, small and medium-sized businesses are increasingly adopting on-premises speech analytics solutions.

Whereas, the cloud-based category is projected to record a higher CAGR in the coming years. This can be because cloud-based implementation involves the use of speech analytics software that is hosted on remote servers and accessible over the internet. This approach eliminates the need to obtain and manage on-premises hardware and software licenses, shifting responsibility for maintenance, security, and data management to cloud service providers.

Moreover, the cloud model is gaining popularity across industries, due to its scalability, cost-effectiveness, and ease of access. It is especially attractive to organizations that prioritize flexibility and seek to avoid the complexity of on-premises solutions. Additionally, cloud-based speech analytics solutions are becoming increasingly accessible and viable options for small and medium-sized businesses.

| Report Attribute | Details |

Market Size in 2023 |

USD 2,679.6 Million |

Market Size in 2024 |

USD 3,114.6 Million |

Revenue Forecast in 2030 |

USD 8,185.9 Million |

Growth Rate |

17.5% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Enterprise Size, By Application, By Industry, By Offering, By Deployment Type, By Region |

Explore more about this report - Request free sample

Small and Medium Enterprises Category Showcased Fastest Growth Rate

- The SMEs category is expected to grow with fastest CAGR. For small and medium enterprises, speech analytics plays a key role in providing valuable insights into customer interactions, sentiment, and preferences, allowing SMEs to better understand their customers.

- This understanding allows them to customize their products, services, and customer support to fit their customers’ needs. Through the use of voice analytics, small and medium-sized businesses can increase customer satisfaction, foster loyalty, and gain a competitive advantage in their respective markets.

- With often limited resources, SMEs benefit from the operational optimization capabilities that voice analytics provides, allowing them to streamline customer interactions, identify pain points process bottlenecks, and improve agent performance.

Banking, Financial Services, and Insurance (BFSI) Category Leads the Market

The BFSI category accounts for the largest market share. The growing adoption of speech analytics in the BFSI (banking, financial services, and insurance) industry plays a key role in monitoring customer interactions to ensure compliance with regulatory requirements and regulations such as the Dodd-Frank Act and the Payment Card Industry (PCI) Data Security Standard (DSS).

In addition, the BFSI sector emphasizes customer centricity, prioritizing delivering exceptional customer experiences. Speech analytics help companies better understand customer needs and improve service quality.

Additionally, fraud detection & prevention is of paramount importance in the BFSI sector, and speech analytics tools are excellent in identifying suspicious or fraudulent activity by scrutinizing customer conversations.

Furthermore, speech analytics generates valuable data for market research and competitive analysis in the BFSI sector, allowing organizations to explore new market opportunities, tailor their offerings appropriately, and maintain competitive advantage in a dynamic context.

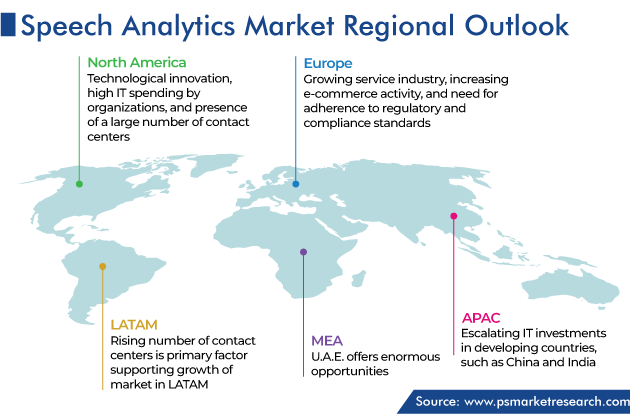

North America Is the Market Leader

North America stands out as the most promising region in various sectors including BFSI, retail and e-commerce, telecommunications, IT, government, healthcare, and life sciences. This area has attracted significant attention, driving the public sector and government to seek innovative technological solutions to serve their vast customer base.

North America has significant influence over the speech analytics industry and this influence is expected to continue its growth trajectory. Notable companies like AWS, with the introduction of AI-powered speech analytics solutions for Amazon Connect, are playing a key role in providing real-time customer insights, facilitating agile agent interactions, and improving customer experience globally.

Moreover, the speech analytics market in North America is growing, due to the increasing government investment in technology and surging appending on digital marketing initiatives. Additionally, the presence of global industry leaders such as AWS, NICE, Verint, Google, and Avaya plays a pivotal role in the widespread adoption of speech analytics solutions in this region, due to which it will witness a growth rate of 15% during the forecasted years.

Some Established Companies in the Market Are:

- NICE Systems Ltd.

- Verint Systems Inc.

- Hewlett Packard Enterprise Company

- Genesys Cloud Services Inc.

- Avaya Holdings Corporation

- Alvaria Inc.

- Castel Communications LLC

- Clarabridge Inc.

- Calabrio Inc.

- Google LLC

- Deepgram Inc.

- Amazon Web Services Inc.

- Intelligent Voice Ltd.

Market Breakdown

This report offers deep insights into the speech analytics market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Offering

- Solution

- Service

- Professional

- Managed

Segment Analysis, By Deployment Type

- On-Premises

- Cloud

Segment Analysis, By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

Segment Analysis, By Application

- Customer Experience Management

- Call Monitoring

- Agent Performance Monitoring

- Risk & Compliance Management

- Others (including Quality Management and Competitive Intelligence)

Segment Analysis, By Industry

- Banking, Financial Services, and Insurance (BFSI)

- Hospitality

- Information Technology (IT) & Telecom

- Healthcare

- Media & Entertainment

- Manufacturing

- Government

- Retail

- Others (including Automotive, Oil & Gas, Energy & Utilities, and Logistics)

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- Turkey

- U.A.E.

- South Africa

- Saudi Arabia

The industry for speech analytics will reach USD 3,114.6 million in 2024.

The speech analytics market value will reach USD 8,185.9 million in 2030.

The North American market for speech analytics is the largest.

Rising acceptance of these solutions and it substantial benefits are the key speech analytics industry drivers.

On-premises hold the larger speech analytics market share.

Solutions is advancing at the highest CAGR in the speech analytics industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws