Report Code: 11783 | Available Format: PDF | Pages: 320

Fraud Detection and Prevention Market Share Analysis by Offering (Software, Services), Type (Internal, External), Deployment (On-Premises, Cloud), Platform (Web-Based, Mobile-Based), Enterprise Size (Large Enterprises, Small & Medium Enterprises), Vertical (Banking, BFSI, Retail, IT & Telecom, Government/Public Sector, Healthcare, Manufacturing), Threat Type (Account Takeover and Scanning, Digital Ad Fraud, Content Integrity Scamming, Wire and Automated Clearing House Fraud and Card Cracking, Price Scraping, New Account Fraud, Phone Call Fraud, Acquirer and Merchant Fraud), Application (Identity Theft, Payment Fraud, Money Laundering) - Global Industry Demand Forecast to 2030

- Report Code: 11783

- Available Format: PDF

- Pages: 320

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The global fraud detection and prevention market generated revenue of USD 27.9 billion in 2023, which is expected to witness a CAGR of 19.0% during 2024–2030, to reach USD 94.2 billion by 2030. This is ascribed to technological advances, the rising number of internet users, the increasing cases of offline and online fraud targeting the geriatric population, and the surging need to protect banking and financial industries. This also helps in following all regulations and procedures that would be needed in order to identify, monitor, evaluate, and prevent fraud.

Additionally, the number of online applications has increased, which leads to the rise in the usage of illegal websites and applications. Numerous sectors like retail, e-commerce, and manufacturing are facing losses since there are a lot of fraudulent platforms. Owners of these fraudulent websites and apps imitate authentic retail stores and home delivery service providers to betray customers and earn money through illegal transactions. It is very common in the banking area, where a large number of consumers depend on websites and applications to analyze online transactions, make complaints, and provide feedback.

Furthermore, various strategies such as collaborations, product launches, and mergers and acquisitions are being implemented by several key industry players to drive the growth of the market.

Hybrid and Analytical Approach Leading the Market

The hybrid and analytical approach focuses on combining multiple fraud detection techniques into one technical solution by leveraging the strengths of various methods, creating a comprehensive robust fraud prevention strategy. This integrated mechanism swiftly connects to each application of fraud detection and analyses the preventions needed to cure that respective fraud. Some of the players operating in this marketplace, such as TransUnion LLC, SAS Institute Inc., and Experian, offer a hybrid analytical approach to help customers make instant decisions about their real-time transactions. This solution also helps enterprises view constantly evolving fraud tactics and protect their assets, customers, and reputations more effectively.

Rise in Demand for Big Data Analytics and Cloud-Based Security Solutions

Big data analytics plays a huge role in simplifying large piles of data to draw exact consensus with real-time monitoring. It allows financial institutions to identify patterns and anomalies to gain a deeper understanding of suspicious activities and take immediate actions to prevent fraudulent transactions. Large information examination likewise helps in recognizing any provisos in frameworks that could be the justification for disappointment, which, in the event that not adjusted before, may prompt the development of new misrepresentation patterns. Additionally, this model assists with being familiar with huge misfortunes and sensitive information with the assistance of authentic and constant information.

The advancements in computerized reasoning and artificial intelligence are other main considerations that are assisting in driving the development of the market. Through the uses of different innovations like PC vision and public language handling, computerized reasoning has a more extensive assortment of utilization that helps associations speed up functional cycles and restrict the gamble of extortion. For instance, according to the AI Index 2021 annual report, private AI investment expanded by 9.3% in 2020.

In addition, machine learning algorithms differentiate patterns and glitches within data. They can recognize any inconsistencies or unsure exercises from verifiable information. ML models can likewise work progressively, supporting the instant identification of potential fraud as the transaction occurs. These models can make speedy choices by breaking down different factors and data of interest in milliseconds. One significant component of ML is its capacity to persistently adjust and gain from new information. Also, fraudsters assault with new highlights that advance over the long haul, and ML frameworks can help by adjusting new misrepresentation patterns and examples by refreshing the model with the most recent information.

| Report Attribute | Details |

Market Size in 2023 |

USD 27.9 Billion |

Market Size in 2024 |

USD 33.1 Million |

Revenue Forecast in 2030 |

USD 94.2 Billion |

Growth Rate |

19.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Offering; By Type; By Deployment; By Platform; By Enterprise Size; By Vertical; By Application; By Threat Type; By Region |

Explore more about this report - Request free sample

Services Category To Witness Faster Growth

The service category is projected to grow at a higher CAGR, of 19.2%, during the forecast period. This can be due to technological advances, the ability to monitor all the time, and flexibility. To create a robust framework, organizations need integration, consulting, and training services. Further, organizations are prioritizing cyber security services to safeguard their defense against unwanted access and data manipulation, indicating a focus on protecting confidential information.

Cloud Category Is Expected To Grow Fastly

The cloud category will grow faster in the coming years. This can be attributed to several factors such as increased scalability, flexibility, and data security, along with easy adaptability, and increased workloads and data volume across both government and education sectors. Furthermore, continuous advancements in artificial intelligence (AI) and data analytics can be another significant driver that promotes the increasing adoption of cloud-based solutions by SMEs, who have limited budgets for security spending and may lack the robust IT development required for on-premises development.

SMEs To Record Faster Growth

The SMEs category is poised to witness a higher growth rate, of 19.4%, in the upcoming years. This trajectory growth can be ascribed to the escalating incidences of fraud cases in operating market scenarios, the rapid growth of digitalization, and the growing reliance on the extended usage of tools and platforms within SMEs.

Additionally, the business activities of SMEs in cross-border trade contribute to the breaching of confidential and private transactional details. Hence, the need for fraud detection and prevention solutions to identify, access, mitigate, and report fraudulent activities is increasing. Also, these solutions serve as vital sources for safeguarding the interests of SMEs, thus providing them a safe space to navigate the intricate web of fraud threats that arise in the global business arena.

BFSI Holds the Largest Market Share

The BFSI category recorded the highest revenue in the fraud detection and prevention market. This is ascribed to the rapid digitalization and electrification process in recent years. Fraud detection and prevention is the biggest action-oriented program of the banking and financial sector, counting for huge investments in both on-premises and cloud security systems. This solution also helps in reducing the number of online transaction frauds, such as insurance claim fraud, card-related fraud, and loan fraud, in this sector. As per the Federal Trade Commission, customers reported losing $8.8 billion to investment scams in 2022, a rise of more than 30% over the preceding year.

Furthermore, the digitization of technologies has also increased the risk of cheating, due to the nature of online payments and the absence of safe servers. To safeguard against these threats and deal with customer expectations, the adoption of fraud prevention and authentication solutions has seen rapid emergence in the BFSI sector. These solutions also play a pivotal role in providing effective solutions to safeguard the overall interest of consumers against financial and digital fraud.

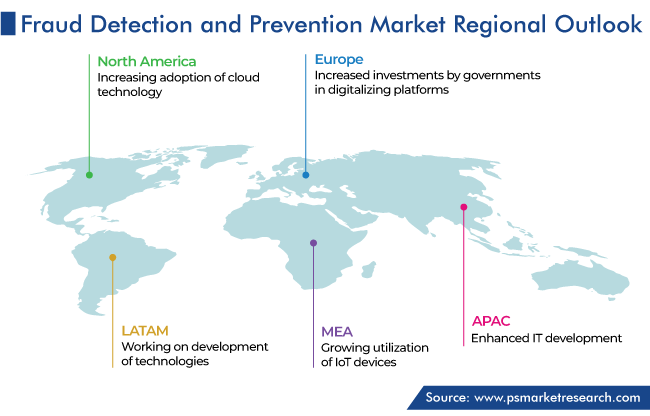

North America Holds Largest Share

Geographically, North America currently is the largest fraud detection and prevention market. This is due to the increasing adoption of cloud technology by business firms for several operations, thus contributing to an increase in the number of fraudulent activities. Moreover, the robust increase in research and development with the integration of developed and secure networks along with the IoT will facilitate market growth in the region. For instance, well-known companies in North America like Google, Apple, and Samsung are concentrated on advanced mobile payment gateways and in this way contributing to a high demand for such types of solutions in the region.

Organizations in both the U.S. and Canada are progressively highlighting the adoption of fraud detection and prevention solutions to protect vital information from cyber threats. According to the FBI’s Internet Crime Report 2022, 800,944 complaints of cybercrime were reported to the FBI by the public and the potential total loss increased to $10.2 billion in 2022, up from $6.9 billion in 2021. California, Texas, and Florida had the highest number of cybercrime victims in the U.S.

Thus, both the U.S. and Canadian governments are significantly shaping the policies to form diverse strategies, focusing on the establishment of secure and resilient payment platforms that involve cutting-edge fraud prevention solutions.

Whereas, APAC is expected to be the fastest-growing market in the coming years. This can be attributed to enhanced IT development, batch streaming, expanding establishment by large enterprises, and surging requirements for real-time fraud detection to protect small and medium enterprises in the region. In addition, the acceptance of biometric and advanced analysis methods to counter fraudulent activities has risen in the region. Also, the increasing implementation of improved AI, facial recognition, and voice recognition solutions in APAC is aimed at securing customer data.

Moreover, India, China, Singapore, and South Korea are the hotspots for international IT outsourcing. This has made the region more sensitive to fraudsters as the exchange of huge confidential data takes place. However, Singapore has incorporated stringent regulations to safeguard itself from data breaches. It has imposed the most substantial penalty in the Asia-Pacific area, which amounts to around USD 1 million for the data breach, as per the country’s data protection act. Also, the regulatory framework instructs companies operating in Singapore to develop fraud prevention measures.

In addition, the European market will also be experiencing a significant growth rate in the coming years. This can be due to several aspects like increased investments by the governments in digitalizing platforms, manufacturing, and healthcare industries.

Key Players Offering Fraud Detection and Prevention Solutions Are:

- IBM Corporation

- RELx

- Experian PLC

- Fiserv Inc.

- Sas Institute Inc.

- ACI Worldwide Inc.

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the fraud detection and prevention industry from 2017 to 2030, based on all the relevant segments and geographies.

Based on Offering

- Software

- Services

Based on Type

- Internal

- External

Based on Deployment

- On-Premises

- Cloud

Based on Platform

- Web-Based

- Mobile-Based

Based on Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Based on Vertical

- Banking, Financial Services & Insurance (BFSI)

- Retail

- IT & Telecom

- Government/Public Sector

- Healthcare

- Manufacturing

Based on Threat Type

- Account Takeover and Scanning

- Digital Ad Fraud

- Content Integrity Scamming

- Wire and Automated Clearing House (ACH) Fraud and Card Cracking

- Price Scraping

- New Account Fraud

- Phone Call Fraud

- Acquirer and Merchant Fraud

Based on Application

- Identity Theft

- Payment Fraud

- Money Laundering

Geographical Analysis

- North America

- U.S

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E

The fraud detection and prevention market size stood at USD 27.9 billion in 2023.

During 2024–2030, the growth rate of the fraud detection and prevention market will be around 19.0%.

BFSI is the largest vertical in the fraud detection and prevention market.

The major drivers of the fraud detection and prevention market include the increasing usage and development of machine learning (ML) and artificial intelligence (AI) for reducing fraudulent activities, the surging number of phone scams targeting the elderly population, and the growing imperative to safeguard online banking and insurance sectors.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws