Report Code: 12887 | Available Format: PDF | Pages: 290

Spatial Genomics & Transcriptomics Market Size and Share Analysis by Technique (Spatial Transcriptomics, Spatial Genomics), Product (Instruments, Consumables, Services), Application (Translational Research, Drug Discovery), End User (Academic and Research Institutes, Contract Research Organizations, Pharmaceutical and Biotechnology Companies) - Global Industry Demand Forecast to 2030

- Report Code: 12887

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Spatial Genomics & Transcriptomics Market Overview

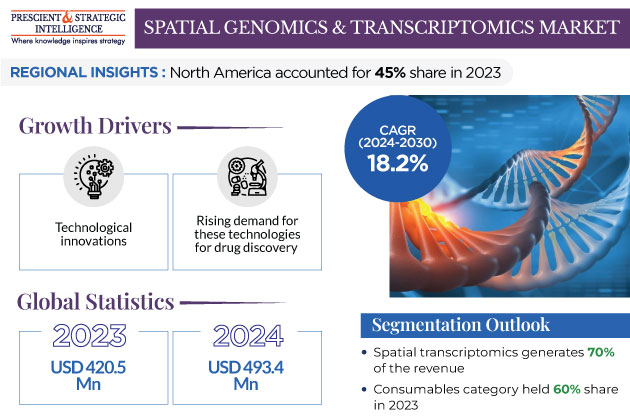

The global spatial genomics & transcriptomics market generated revenue of USD 420.5 million in 2023, which is expected to witness a CAGR of 18.2% during the forecast period (2024–2030), reaching USD 1,348.5 million by 2030. The growth of this industry is majorly driven by the rising demand for these technologies for drug discovery, clinical diagnostics, and carrier screening and increasing prevalence of genetic disorders. Furthermore, the continuous technological innovations in NGS platforms and increasing count of initiatives and funding from government and private bodies for large-scale biotechnology projects are the key factors leading to the expansion of the market.

- Spatial omics involves the determination of high-throughput omics data derived from tissue and cell specimens, along with data on the organizational structure of the cell content.

- Furthermore, the market is seeing the introduction of new technologies as a result of the convergence of modern high-throughput sequencing techniques with established imaging modalities for determining the positions of the DNA and RNA.

- If used properly, spatially resolved omics could help in the creation of new approaches to disease management.

The government-approved R&D investments, rising demand for early disease detection and effective corrective care, and development of innovative biologics all contribute significantly to the market growth. Additionally, the major market competitors are enlarging their spatial transcriptomics and genomics footprint through strategic alliances and partnerships with other participants.

- For instance, Dovetail Genomics declared the global accessibility of its Dovetail HiChIP and Micro-C Kits in February 2020.

Increasing Adoption of Omics in Drug Discovery & Development

In recent years, the primary applications of spatial genomics and transcriptomics have changed from research to drug discovery and development. At the moment, spatial approaches are being used to improve the knowledge of infections, cancer, and neurological illnesses. The requirement for predictive biomarkers of response, which are one of the main unmet clinical needs of cancer patients, is also projected to be addressed by these technologies. By enhancing the understanding of the tumor microenvironment, these biomarkers aid in the development of immunotherapies.

Increasing Research Activity and Funding For R&D

- With the increasing research activities in life sciences, the overall pipeline activity in terms of underdevelopment medicines and clinical trials has risen.

- Furthermore, governments are investing in life sciences R&D projects due to the rising prevalence of infectious and chronic diseases, which necessitate effective treatments.

Life sciences research activities are gaining unprecedented funding and leading to scientific advancements like never before, with which significantly more drugs than before have made it to the market in recent times. For instance, in 2021, more than 2,000 agreements, with a combined value of USD 47 billion, were expected to be finalized in the life sciences industry. In addition, the 15 biggest pharmaceutical firms invested a record USD 133 billion in R&D in 2021, an increase of 44% from 2016.

Spatial Transcriptomics Generates Higher Revenue

Based on technique, spatial transcriptomics generated 70% of the revenue and dominated the market in 2023, and it is further expected to maintain its dominance during the forthcoming period, owing to its greater advantages than spatial genomics during the transcriptomic study of single cells.

- Moreover, the surge in the usage of spatial transcriptomics for in situ sequencing is a key market driver in this category.

- The growth in the usage of this technology can also be attributed to the availability of automated sequencing technologies, such as laser capture microdissection, to address the rising demand for the sequencing of the nucleic acid of single cells or biological specimens.

- A number of organizations involved in the field of genetics have begun to pay attention to the determination of the spatial arrangement of molecules in cell and tissue samples.

- Additionally, the category is being driven by the improvements in genome disruption techniques, such as CRISPR/Cas9, which facilitates the use of spatial tools.

| Report Attribute | Details |

Market Size in 2023 |

USD 420.5 Million |

Market Size in 2024 |

USD 493.4 Million |

Revenue Forecast in 2030 |

USD 1,348.5 Million |

Growth Rate |

18.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Technique; By Product; By End User; By Application; By Region |

Explore more about this report - Request free sample

Drug Discovery Category Expected to Grow Faster

By application, the drug discovery category is expected to grow with faster growth rate, around 20%, during the forecast period. The extensive pharma and biotech research underway for the discovery of novel drugs and the growing count of collaborations between the market players and academic institutes for drug development. In drug discovery and development, this technique is rapidly being adopted especially in high-throughput applications to study the organization of the cells and their structures within tissue and cell species.

- Furthermore, governments and market players are focusing more strongly than ever on drug discovery and development.

- Scientists are adopting this technology for accurate and fast results.

- A new field of scientific study in genomics & transcriptomics has emerged as a result of the development of improved spatial technologies and their usage in the genome analysis of microbial populations.

Diagnostics and disease profiling is expected to register the highest CAGR during the forecast time frame owing to the creation of specialized tools and software for diagnostics. The incidence of viral and pathogenic diseases has increased in recent years, which is creating opportunities for the worldwide market to expand. The adoption of this sequencing technology in clinical diagnostic is, thus, increasing, and various applications have been incorporated into clinical regular practice.

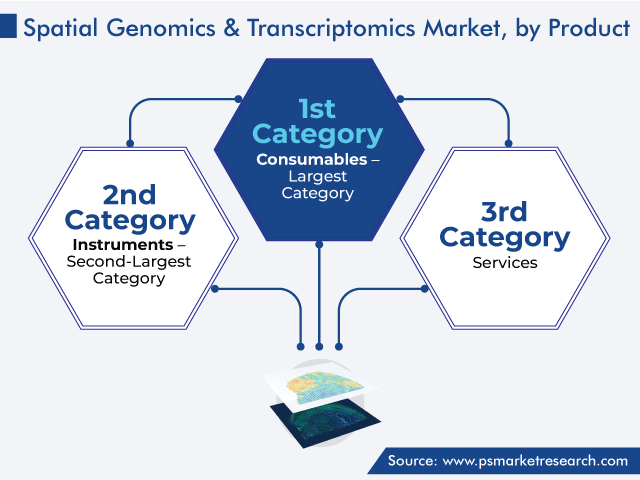

Consumables Category Held Largest Share

The consumables category accounted for the largest share, of 60%, in 2023, and it is further expected to maintain its dominance in the future.

- The growing use of reagents, kits, and other consumables for numerous related applications is set to drive the market growth.

- The availability of a wide variety of consumables for specific applications and the fact that they need to be frequently purchased drive the market.

- Additionally, the development of any new instrument and the upgradation of existing ones have a direct impact on the category’s growth.

- This is because these activities result in the need for newer and more-specific consumables.

The software category is predicted to showcase significant growth throughout the forecast period. Advanced software for data management and interpretation is required as a result of the growing number of genetic research projects. Therefore, in order to remain competitive in the market, companies are increasing the functionality of the software they offer. For instance, Dovetail Genomics increased the scope of its Genome Assembly solutions in January 2020 by incorporating annotations, chromosome-scale assemblies, and 3D genome conformation analyses. Moreover, to increase the scope of its genome assembly services, the company leveraged its Omni-C Technology.

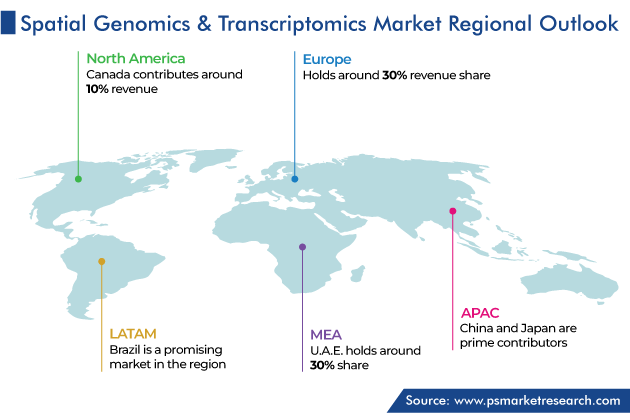

North America Is Prime Revenue Contributor

Geographically, North America held the largest share, of around 45%, in 2023, and it is set to grow at a robust CAGR during the review period.

- This will be due to the substantial research and development activities in the pharmaceutical and biotechnology sectors, as well as the elevating risk of chronic diseases in the region.

- The market growth is also attributable to the existence of well-known healthcare organizations and strong government focus on the establishment of R&D facilities in the region.

- Additionally, the region's rapid embrace of technological advancements and the launch of cell therapies to treat different cancers propel the market.

Furthermore, the spatial genomics & transcriptomics market is expanding in North America due to the increasing use of the NGS technology in genomic and diagnostic research, accessibility of ample research funding, and emergence of advanced NGS data analysis tools. Moreover, the strategic investments in disease pathology research and the increasing focus on transcriptomics R&D drive the market.

The U.S. dominates the regional market owing to its developed healthcare infrastructure, rising adoption of cell therapies for different types of cancers, robust support of the federal government for R&D, and technological advancements in life sciences.

Moreover, Europe is rapidly adopting this technology as numerous players offer the associated products in the region to a large number of research firms.

- Additionally, the region is witnessing quick developments in the spatial genomics and transcriptomics technologies, which are being adopted by all major pharma and biopharma companies for drug discovery.

- Moreover, the expansion of partnerships between European research and healthcare institutions and the providers of genome & transcriptomics solutions is responsible for the market expansion.

Furthermore, Germany is a rapidly growing market in the region owing to the rise in its healthcare budget, increase in the knowledge of patients of early diagnosis of long-term illnesses, and growing adoption of improved technologies for diagnostics.

The market in France is also expected to witness notable growth during the forecast period.

- This can be attributed to the improving healthcare infrastructure, presence of market players offering sequencing technology, and increasing prevalence of chronic diseases.

- The rising adoption of spatial genomics and transcriptomics in drug discovery and development is a key driver.

- The growth in the pharmaceutical and biotechnology industries is Essentially supporting the growth of the market in the country.

Top Providers of Spatial Genomics & Transcriptomics Solutions Are:

- NanoString Technologies Inc.

- 10x Genomics Inc.

- Illumina Inc.

- Bio-Rad Laboratories Inc.

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Cantata Bio LLC

- S2 Genomics Inc.

- Natera Inc.

- Seven Bridges Genomics Inc.

Market Breakdown

The report analyzes the impact of the major drivers and restraints on the spatial genomics & transcriptomics market, to offer accurate market estimations for 2017–2030.

Segment Analysis, By Technique

- Spatial Transcriptomics

- Immunohistochemistry (IHC)

- In-situ hybridization

- Sequencing techniques

- Microscopy-based RNA imaging

- Spatial Genomics

Segment Analysis, By Product

- Instruments

- Consumables

- Services

Segment Analysis, By Application

- Translational Research

- Drug Discovery

Segment Analysis, By End User

- Academic and Research Institutes

- Contract Research Organizations

- Pharmaceutical and Biotechnology Companies

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The industry for spatial genomics & transcriptomics will reach USD 493.4 million in 2024.

The spatial genomics & transcriptomics market value will reach USD 1,348.5 million in 2030.

The North American market for spatial genomics & transcriptomics is the largest.

The increasing need for these technologies for clinical diagnostics, carrier screening, and drug discovery; and the surging incidence of genetic disorders are the key spatial genomics & transcriptomics industry drivers.

Spatial transcriptomics hold the larger spatial genomics & transcriptomics market share.

Academic and research institutes is the leading end user in the spatial genomics & transcriptomics industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws