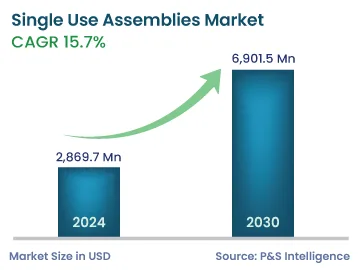

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,869.7 Million |

| 2030 Forecast | 6,901.5 Million |

| Growth Rate(CAGR) | 15.7% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12748

Get a Comprehensive Overview of the Single Use Assemblies Market Report Prepared by P&S Intelligence, Segmented by Product (Bag Assemblies, Filtration Assemblies, Bottle Assemblies, Mixing System Assemblies), Solution (Standard Solutions, Customized Solutions), Application (Filtration, Cell Culture & Mixing, Sampling, Fill-Finish), End User (Pharmaceutical and Biopharmaceutical Companies, CROs & CMOs, Academic & Research Institutes), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 2,869.7 Million |

| 2030 Forecast | 6,901.5 Million |

| Growth Rate(CAGR) | 15.7% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The single-use assemblies market size stood at USD 2,869.7 million in 2024, and it is expected to grow at a CAGR of 15.7% during 2024–2030, to reach USD 6,901.5 million by 2030.

The growth can be primarily ascribed to the rising adoption of these instruments in research activities because of their low risk of cross-contamination. Other factors contributing to the growth of the market are the rising prevalence of cancer and various other diseases and the need of pharma and biotech companies for a rapid transition from small-scale to large-scale production. The increasing adoption of these products among end users is because they can be rapidly deployed for biologics production in bulk.

Increasing Prevalence of Cancer Fuels Single-Use Assembly Demand

The increasing prevalence of cancer boosts the demand for new drugs, which will, in turn, boost the usage of single-use assemblies. In the U.S., around 800,000 males and 900,000 females were diagnosed with cancer in 2022. With the rising cases of cancer, the investments in drug discovery and research activities are growing. In addition, the development of several solutions for the diagnosis of cancer aids in the market expansion. This is because the rising awareness among people and increasing cancer prevalence have increased the pressure on the key players to develop novel and more-effective screening techniques and medications.

Bag assemblies hold the largest share, of 35%, attributed to their low shipping costs due to their lightweight nature over stainless steel cans. Moreover, they do not require cleaning and returning, which saves capital and leads to low maintenance expenses. Among 2D and 3D bag assemblies, 2D bag assemblies are widely used because of their improved safety and greater compatibility with a wide range of chemicals. They also minimize the risk of leakage and contamination.

Moreover, filtration assemblies are expected to grow at the highest CAGR in the coming years, attributed to the rapid expansion of contract manufacturing organizations and operational benefits of disposable filtration units. Moreover, the growing demand for products that can be rapidly adapted to the changing environments and the need for them to be flexible lead to the market growth. The rising requirement for sterilized instruments essentially drives the usage of these products.

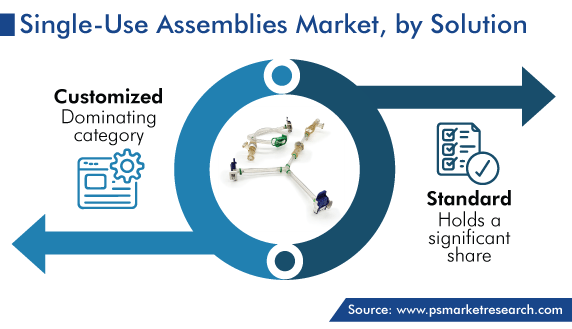

Customized solutions dominate the market, as various end users, including labs, biopharmaceutical and pharmaceutical companies, and academic institutes, are able to incorporate these systems into their unique processes, along with minimizing the inconvenience with cleaning and sterilization and streamlining production. In addition, customization according to their requirements is preferred by most companies. It helps in improving the processes and also provides better results compared to standard solutions.

Standard solutions also held a significant share in the solution segment because they save time, as they are already prepared and are available immediately. This approach also saves money, as customization generally costs extra. Further, standard solutions, which are available in a wide variety, can be stocked up for future use.

Cell culture and mixing is expected to grow at the highest CAGR, of 16.0%, because these devices are used widely for cell expansion, collection, and cryopreservation. The assemblies for cell growth are easy to use and pre-sterilized with gamma radiation, which eliminates the use of an autoclave.

The market in this category is advancing due to the growing research & development investments and the rising demand for biologics. This is a key driver because cell culture is extensively done during the production of biologic drugs, such as vaccines. Hence, the increasing prevalence of chronic diseases and infectious diseases aids the growth of the industry.

The filtration category is also showing considerable growth owing to the time-saving benefit of such single-use assemblies, as they are not like conventional filtration systems, being ready to use. The market for biopharmaceuticals is expanding rapidly, and in order to meet the requirements, manufacturing facilities are being set up at several places, to increase the production of drugs. Single-use assemblies aid biopharma firms in providing the product at a faster rate, which is why the usage of filtration assemblies has increased in order to reduce the risk of contamination.

Pharmaceutical & biopharmaceutical companies are the major end users because of the growing investments, along with acquisitions and collaborations for the development of new drugs. Moreover, the rapid adoption of technologically advanced instruments and standard solutions, because they are always available and compatible with components of various assemblies, drives the market.

Further, these companies are shifting from small-scale to large-scale production. Moreover, in the past few years, the R&D focus of the pharmaceutical and biotech sector has increased, thus propelling the requirement for these assemblies.

Contract research organizations & contract manufacturing organizations are expected to grow at the highest rate in the coming years, owing to their usage of these type of products in various bioprocesses. Moreover, the increasing funding by governments to conduct more clinical trials drives the product demand among biologics CDMOs and CROs.

Drive strategic growth with comprehensive market analysis

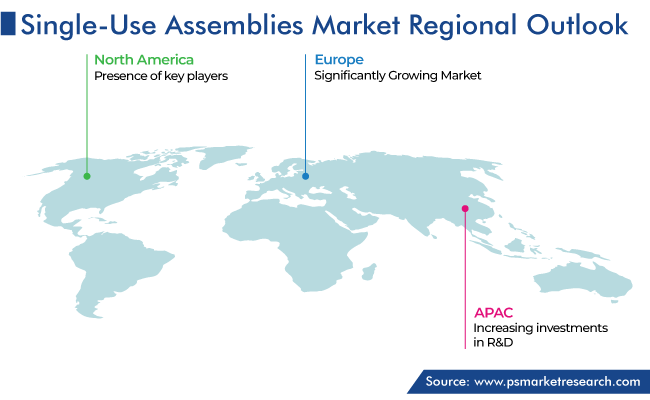

North America has the leading position in the single-use assemblies market, and it will hold the same position till 2030. This is attributed to the presence of key players and the rising prevalence of cancer and various other diseases, such as HIV.

In North America, the U.S. holds the leading position, and it will grow at a CAGR of 15.6% during the forecast period. This is attributed to the presence of a large number of end users and the rapid adoption of advanced technologies in the country. Along with this, the country has an established biopharmaceutical sector, which is leading to the augmenting output of biologics.

Moreover, the rising healthcare expenditure of the population with its increasing disposable income is expected to boost the demand for new drugs in North America.

To cater to these demands, Thermo Fisher Scientific Inc. opened its largest single-use technology manufacturing site in Greater Nashville in August 2022. The 400,000-square-foot facility, built at a cost of USD 105 million, will provide bioprocessing materials for the development of cancer drugs and vaccines.

This report offers deep insights into the single-use assemblies market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

Based on Solution

Based on Application

Based on End User

Geographical Analysis

Market Players Are Involved in Investments and Acquisitions To Expand Sales

Players in the global single-use assemblies market are engaged in investments and acquisitions for expanding their sales. For instance,

The 2024 size of the market for single-use assemblies was USD 2,869.7 million.

The single-use assemblies industry is driven by the growing cancer prevalence and rising R&D and healthcare infrastructure investments.

Bags sell the most in the market for single-use assemblies, while filtration system sales will witness the highest growth rate.

Pharmaceutical & biopharmaceutical companies are the largest end users in the single-use assemblies industry.

The opportunities for the players in the market for single-use assemblies are the best in Asia-Pacific.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages