Report Code: 12896 | Available Format: PDF | Pages: 280

SiC Wafer Polishing Market Size and Share Analysis by Process Type (Mechanical, Chemical-Mechanical, Electropolishing, Chemical, Plasma-Assisted), Product Type (Abrasive Powders, Polishing Pads, Diamond Slurries, Colloidal Silica Suspensions), Application (Power Electronics, LED, Sensors and Detectors, RF and Microwave Devices) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12896

- Available Format: PDF

- Pages: 280

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

SiC Wafer Polishing Market Outlook

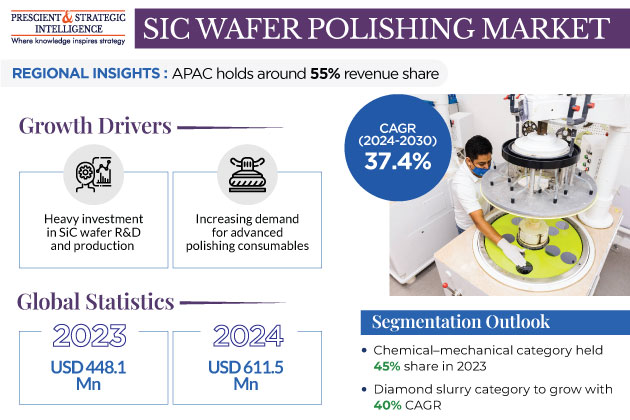

The global SiC wafer polishing market size was USD 448.1 million in 2023, and this number is expected to increase to USD 4,116.7 million by 2030, advancing at a CAGR of 37.4% during 2024–2030. This can be ascribed to the burgeoning consumption of consumer electronics associated with the rising disposable income, increasing demand for advanced polishing consumables, and growing semiconductor industry.

Furthermore, the growing usage of power electronics, especially in developing nations, such as China, India, and South Korea, owing to the rising infrastructure development activities, and increasing population is the key factor driving the market growth.

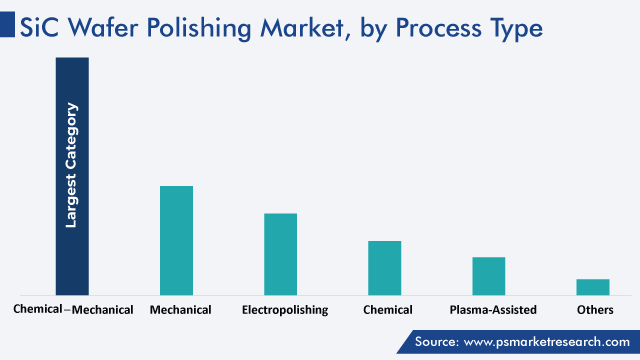

Chemical–Mechanical Polishing Dominates Market

Chemical–mechanical polishing accounted for the highest revenue contribution, with a share of 45%, in 2023, and it is expected to maintain its position during the forecast period.

- The process is quite common in the manufacturing of reliable and fine-quality devices as it eliminates faults and contaminants from silicon carbide wafers with high effectiveness.

- This makes it more suitable for semiconductor manufacturers who are looking for optimal solutions for wafer polishing.

Moreover, the electropolishing category contributes significant revenue to the market in 2023.

- This is because it enhances surface smoothness and reduces roughness.

- This is why it is used for polishing and deburring products that are delicate or have complicated shapes.

Heavy Investment in SiC Wafer R&D and Production Drives Market Growth

Several companies are strongly focused on investments in SiC wafer R&D and production. For instance, in March 2023, Resonac Corporation stated that it has developed third-generation high-grade silicon carbide (SiC) epitaxial wafers for power semiconductors and started mass production. The HGE-3G is of greater quality than the second-generation high-grade SiC epi-wafer, which had been produced in high volumes over decades.

Similarly, in September 2022, in Roznov, Czech Republic, onsemi unveiled its expanded silicon carbide (SiC) fabrication facility. By the end of 2024, this expansion will have increased the site's production capacity by 16 times, offering 200 more employments. Over USD 150 million has already been invested by onsemi in the Roznov facility, and it planned to spend an additional USD 300 million through 2023.

Diamond Slurry Category Will Grow at High Pace

The diamond slurry category will register the fastest growth during the forecast period, at a CAGR of 40%.

- Diamond slurry products are gaining popularity due to their exceptional ability to regulate material removal rate, as well as outstanding planarization, which enhances device performance, along with the production.

- In addition, the demanding requirement for SiC-based high-frequency and power electronics devices are accomplished through their remarkable surface smoothness and accurate material removal.

The polishing pads category will contribute significant revenue to the market during the coming years.

- This can be ascribed to the growing semiconductor industry and integration of semiconductors in consumer electronics, including LED luminaires, smartphones, and all other digital appliances, at an extensive level.

- In addition, these pads are hugely used in semiconductor chip manufacturing, along with other advanced wafer polishing applications.

The abrasive powders category generates the largest chunk of the market revenue, a trend that will likely be maintained during the forecast period.

- This is because these products offer improved polishing precision and remove surface imperfections, defects, and roughness from wafers.

- Additionally, such powders are widely used because they are compatible with SiC’s characteristics, which allows for effective polishing without damaging the material.

Advancement of Polishing Products

Due to the technological development in polishing products, they are being used in several applications, such as power electronics, LEDs, and RF devices. Polishing products include abrasive powders, diamond slurries, and pads. Several electronics and semiconductor manufacturers prefer advanced products to attain higher productivity and precision during wafer fabrication.

Moreover, modern polishing consumables offer high precision, along with uniformity. The quality of the wafer can be improved with the use of advanced consumables, which enable greater control over planarization, surface roughness, and material removal rates. These properties are important for SiC wafers, which is why in order to achieve these characteristics, they need meticulous polishing.

In addition, costs can be lowered and productivity can be enhanced with the help of modern polishing consumables. Further, they aid in minimizing material wastage and polishing time, thereby improving the efficiency of the entire process.

Power Electronics Significantly Contributes to Market

The power electronics category held a revenue share of 60% in 2023, and it is expected to have a significant CAGR over this decade.

- This is because silicon carbide wafers have high thermal conductivity and a broad bandgap, which makes them suitable for power electronic components that require superior performance at high temperatures.

- The high adoption of energy-efficient medical devices, EVs, and consumer electronics and the growing industrial applications are responsible for the category’s growth.

Moreover, the LEDs category will register substantial growth during the prediction period.

- This can be attributed to the high usage of such diodes in the automobile industry and the rising preference for smart lighting as well as smart homes.

- SiC wafers of LEDs are polished to ensuring the efficient emission of light by Advancing the light extraction and reducing light absorption.

| Report Attribute | Details |

Market Size in 2023 |

USD 448.1 Million |

Market Size in 2024 |

USD 611.5 Million |

Revenue Forecast in 2030 |

USD 4,116.7 Million |

Growth Rate |

37.4% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Process Type; By Product Type; By Application; By Region |

Explore more about this report - Request free sample

Increasing Demand for Electronic Products Drives Market Growth

Consumer electronics, such as tablets, smartphones, laptops, and EVs, are increasingly relying on SiC-based power electronics. These components offer higher efficiency and faster switching, making them ideal for portable devices. As the demand for these electronic products increases, so will the need for enhanced polishing solutions.

Additionally, consumers are preferring energy-efficient devices, for which SiC-based components are employed in the electronics. Moreover, the increasing demand for compact ICs is stimulated by the technical developments in consumer electronics, including tablets, smartphones, and televisions, as well as the emergence of wearable devices and smart homes.

Hence, the burgeoning demand for consumer electronics, coupled with the advantages of SiC wafers in enhancing device performance and efficiency, is expected to fuel the SiC wafer polishing market as the consumer electronics industry continues to grow and evolve.

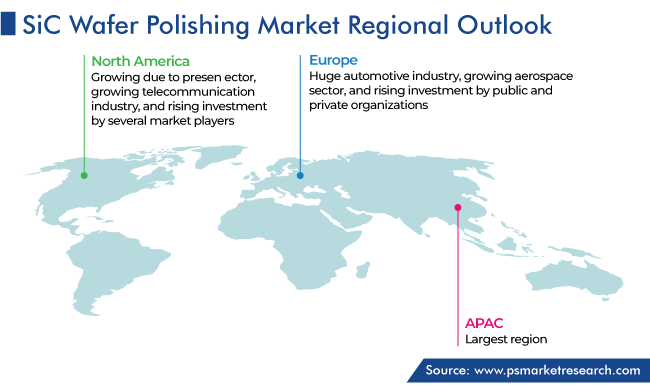

APAC Will Contribute Most Revenue in Coming Years

APAC will hold the largest share and register the highest growth rate during the prediction period, of 55%. This can be ascribed to the increase in the pace of economic development in emerging economies, including China, India, and South Korea; burgeoning end-use industries, high number of semiconductor and consumer electronics manufacturers, and increasing consumer spending, coupled with the rise in per capita income.

Furthermore,

- China, India, Japan, and South Korea contribute the majority of revenue to the regional market.

- This can be ascribed to the presence of a well-established electronics industry, mounting adoption of advanced technology, rise in R&D investment by end-use industries, expansive consumer base, and growing industrial sector, along with high-volume availability of raw material.

- China is the major manufacturer and distributor of semiconductors across the globe.

- The growing demand for LEDs in emerging nations owing to the increasing population and mounting number of smart city projects will further contribute to the market advance.

North America also held a significant revenue share in 2023, and it is further expected to maintain its position during the forecast period. This is due to the presence of numerous industry players, well-established manufacturing sector, growing telecommunication industry, and rising investment by several market players.

Moreover,

- The U.S. contributed the higher revenue in 2023, and it is further expected to maintain its position during the coming years.

- The country is home to numerous prominent players and is witnessing the increasing manufacturing of semiconductor ICs for automobiles.

Additionally, the European region is expected to grow significantly during the forecast period. This can be ascribed to the huge automotive industry, which requires a massive volume of semiconductors; growing aerospace sector; and rising investment by public and private organizations.

- Germany contributed the highest revenue in 2023 in the region, and it is further expected to maintain its dominance during the coming years.

- This is due to the high acceptance rate of advanced technology in consumer electronics, rising number of vehicle assembly units, and increasing count of local manufacturers.

Growing Semiconductor Industry Boosts Market Advance

The semiconductor industry is growing at a high pace, which directly propels the wafer polishing market. The growth in the industry can be attributed to the increasing consumption of electronics devices across the world, burgeoning usage of such semiconductors in automotive electronics for several systems, including navigation control, collision detection, and infotainment, and wireless communications, growing demand for industrial electronics, and rising data storage. Furthermore, semiconductors are widely employed in wearable, web-integrated, wireless healthcare devices and 3D printing of human organs and medical devices, which further contributes to the market growth.

Top SiC Wafer Polishing Solution Providers:

- Kemet International Ltd.

- Entegris Inc.

- Iljin Diamond Co. Ltd.

- 3M Company

- Engis Corporation

- Ferro Corporation

- DuPont de Nemours Inc.

- SKC Inc.

- FUJIFILM Holdings America Corporation

Market Size Breakdown by Segment

This report offers deep insights into the SiC wafer polishing market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Process Type

- Mechanical

- Chemical–Mechanical

- Electropolishing

- Chemical

- Plasma-Assisted

Based on Product Type

- Abrasive Powders

- Polishing Pads

- Diamond Slurries

- Colloidal Silica Suspensions

Based on Application

- Power Electronics

- LED

- Sensors and Detectors

- RF and Microwave Devices

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The SiC wafer polishing industry will attain USD 4,116.7 million by 2030?

The SiC wafer polishing market will advance at a remarkable CAGR of 37.4%.

The key drivers are the growing need for consumer electronics, the requirement for higher-grade polishing materials, and the fast growth of the semiconductor industry.

A notable trend is the adoption of SiC-based semiconductors in industrial power electronics, tablets, smartphones, laptops, and electric vehicles (EVs), driven by their enhanced performance and power efficiency.

The Asia-Pacific region leads the market.

Another significant driver is the growing preference for power-efficient devices, especially in consumer electronics, which utilize SiC components, further boosting the demand for state-of-the-art polishing solutions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws