Report Code: 12265 | Available Format: PDF | Pages: 213

Saudi Arabia Digital Transaction Management Market Research Report: By Industry (BFSI, Healthcare, Retail, IT & Telecommunication), Organization Size (SMEs, Large Enterprises), Solution (Authentication, Document Archiving, Digital Signature, Workflow Automation, DMS) - Industry Analysis and Growth Forecast to 2030

- Report Code: 12265

- Available Format: PDF

- Pages: 213

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

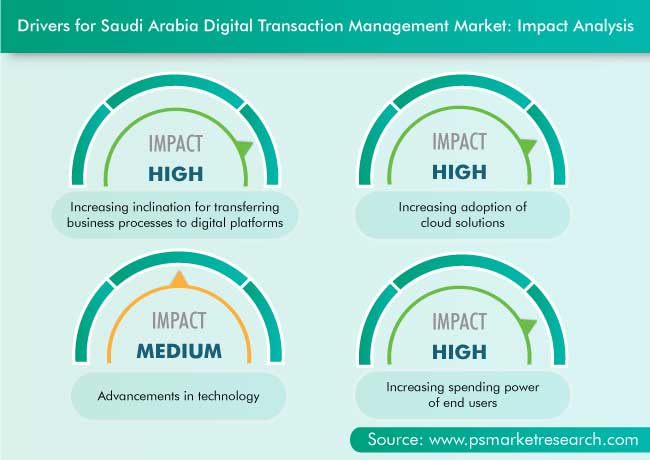

The digital transaction management market of Saudi Arabia generated revenue of $60.88 million in 2020, and it is expected to grow at a CAGR of 35.7% during 2020–2030. The key factors responsible for the growth of the market include the increasing inclination for transferring business processes to digital platforms, increasing adoption of cloud solutions, advancements in technology, and rising spending power of end users.

In the first half of 2020, the country’s economy shrank due to the pandemic, but in the second half, it grew by 2.1%, mainly due to digitalization. Digital transactions contributed 17.7% to the Saudi gross domestic product (GDP) in 2020, and this share is expected to reach 19.4% by 2025. This has pushed the government, businesses, and organizations to devise the best digital strategies and allocate the necessary resources to national digital transformation programs. These factors reflect the positive growth in the DTM market during the pandemic and in the coming years as well.

Banking, Financial Services, and Insurance (BFSI) Industry Accounts for Largest Market Share

The BFSI category held the largest share in the market in 2020, based on industry. This is majorly attributed to the rising demand for these solutions in banks and finance companies, who are rapidly shifting their operations to digital platforms to offer customers more convenience and easier access to their services.

Moreover, in June 2020, the Saudi Arabian Monetary Authority (SAMA) deployed the blockchain technology to deposit a part of the $13.3-billion (SAR 50 billion) liquidity package, which was injected by it into the banking sector to enhance the latter's capabilities to continue providing credit facilities. Likewise, these organizations are adopting advanced DTM technology to manage the rising usage of smart contracts and other kinds of online transactions in the country.

The digital signature category held the largest share in the market in 2020, based on solution. This is majorly attributed to the fact that digital signing cuts the time and efforts spent on contract management and internal compliance. From day-to-day paperwork and company documents and settlements all the way to executive and board records and shareholder meeting documentation, high-value records can be handled and protected from unauthorized access using digital signatures.

The large enterprises category accounted for the larger share in the DTM market in 2020, based on organization size. This was primarily due to the strong need for the efficient management of a large number of transaction workflows and ensure efficient and cost-effective business processes. Additionally, DTM helps in speeding up the signing of business agreements and contracts by digitizing the process in a way that is fast, accurate, and secure.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$60.88 Million |

Market Size Forecast in 2030 |

$1,288.27 Million |

Forecast Period CAGR |

35.7% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Regional Breakdown; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Industry; By Organization Size; By Solution; By Region |

Market Size of Geographies |

Central; Western; Eastern; Southern |

Explore more about this report - Request free sample

Central Region of Saudi Arabia Leads Market

Geographically, the central region of Saudi Arabia generated the highest revenue in 2020 in the market for DTM, owing to the presence of large banks, including Al Rajhi, Arab National Bank, BSF, Riyad Bank, Samba Financial Group SJSC, Saudi British Bank, Saudi Investment Bank, and Alinma Bank. Additionally, the central region of the country is home to a large number of hospitals, including Al Jazeera Hospital, Prince Mohammad Bin Abdul Aziz Hospital, King Salman Bin Abdulaziz Hospital, Prince Sultan Military Medical City, and King Saud Medical City.

Additionally, the central market is expected to witness the fastest growth during the forecast period (2021–2030). This can be ascribed to the rapid adoption of digital services among organizations, growing information technology (IT) spending, rising support from the government to small and medium-sized enterprises (SMEs), and surging focus of corporations on business improvement and expansion.

Increased Focus of Government in Digitization Is Key Trend of The Market

Saudi Arabia maintains a robust digital infrastructure, which has enabled it to face the COVID-induced crises by ensuring business continuity and educational operations and allowing citizens to meet their requirements and carry on with their daily lives. Moreover, the country has improved the quality of digital services by partnering with the private sector to provide fiber-optic network coverage to more than 3.5 million homes, increasing the internet traffic during the pandemic by 30%, and increasing the internet speed from 9 Mbps in 2017 to 109 Mbps in 2020.

Moreover, the Saudi Vision 2030 strategy establishes information and communication technology (ICT) as a central pillar for the country’s future development. A number of Saudi ministries have been actively pursuing an ICT agenda for a few years, and this work is set to accelerate as they strive to meet the short-term objectives recently defined by the National Transformation Programme (NTP). Thus, the NTP has laid the foundation for digital-transformation-led innovation, which is why it has been recognized as an emerging trend in the digital transaction management market of the country.

Rapid Transfer of Business Processes to Digital Platforms and Adoption of Cloud Solutions Boosting Market Growth

Digital transformation helps businesses in streamlining the existing processes, which leads to the growth of the digital transaction management market. For instance, in April 2021, Saudi Payments, under the supervision of the Saudi Central Bank, launched 'sarie', an instant payment system, in cooperation with IBM Corporation and Mastercard Inc. This collaboration would promote payment innovations in the kingdom and align with Saudi Payments' aim to improve the country’s financial ecosystem mainly through the adoption of faster payments and improvements to banking reconciliation. Moreover, this system supports all Saudi banks and their customers.

Further advancements in technology are paving the way for more-secure DTM solutions, which is bolstering the market for DTM. Digital developments have led to revolutionary technologies, such as smartphones, smart machines, and digital currencies, and changed cultures and concepts. Additionally, the mobile platform is becoming popular for digital transactions and customer-facing process automation. According to a release in ARAB NEWS, in September 2021, the value of mobile-based (point-of-sale [POS]) transactions reached around $10.0 billion in Saudi Arabia, rising by 18% from the previous year.

Market Players Involved in Product Launches, Partnerships, and Collaborations to Gain Competitive Edge

The Saudi Arabian DTM industry is fragmented due to the presence of several key players. In recent years, players in the market have been involved in product launches, partnerships, and collaborations in order to attain a significant position. For instance:

- In September 2021, PandaDoc Inc., an all-in-one document workflow automation platform, launched PandaDoc to enable developers to build and integrate customizable document workflows and e-signature capabilities into their products, applications, and websites. The end-to-end application programming interface (API) allows businesses to focus on their major competencies, while offering frictionless interactions with documents to their partners and customers.

- In September 2021, airSlate Inc., a workflow automation solution company, announced that its e-signature solution, signNow, has partnered with TechSoup, a network facilitating the distribution of technology solutions to nonprofit organizations. With this integration, TechSoup’s network of around 1.6 million Saudi Arabian nonprofits can access signNow at a discount, thus allowing for efficient workflows with donors and volunteers and increasing cost savings.

Key Players in Saudi Arabia Digital Transaction Management Market Are:

- DocuSign Inc.

- Adobe Inc.

- HelloSign

- PandaDoc Inc.

- eMudhra Inc.

- Arabian Internet and Communications Services Company (solutions by stc)

- Baud Telecom Company (BTC Networks)

- airSlate Inc.

- OdooTec KSA

- Fastman

Market Size Breakdown by Segments

The global Saudi Arabia digital transaction management market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Industry

- Banking, Financial Services, & Insurance (BFSI)

- Healthcare

- Retail

- IT & Telecommunication

Based on Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Based on Solution

- Authentication

- Document Archiving

- Digital Signature

- Workflow Automation

- Document Management System (DMS)

Geographical Analysis

- Central Saudi Arabia

- Eastern Saudi Arabia

- Western Saudi Arabia

- Southern Saudi Arabia

The DTM market in Saudi Arabia is set to witness a CAGR of 35.7% between 2020 and 2030.

The healthcare sector is the most-lucrative for Saudi Arabian DTM industry players.

The central region of the kingdom will continue to dominate the DTM market in Saudi Arabia till 2030.

The digitization of businesses is the biggest Saudi Arabian DTM industry trend.

The DTM market in Saudi Arabia is fragmented.

Related Reports

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws