Report Code: 12823 | Available Format: PDF

Routing Market Size and Share Analysis by Type (Wired, Wireless), Placement (Edge, Core, Virtual), Routing (Static, Default, Dynamic), Application (Data Center, Enterprise), Vertical (BFSI, IT & Telecommunications, Healthcare, Education, Residential, Media & Entertainment) - Global Industry Demand Forecast to 2030

- Report Code: 12823

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Routing Market Size & Share

The routing market size stands at an estimated USD 16.3 billion in 2023, and it is expected to grow at a compound annual growth rate of 8.8% during 2024–2030, to reach USD 29.3 billion by 2030.

‘Routing’ refers to the selection of a path for traffic in a network, or between or across multiple networks. The global routing industry is driven by an increase in the volume of media-rich data produced by web applications and the internet. Essentially, the augmenting use of reasonably priced broadband services, with the burgeoning number of internet users, leads to the creation of massive amounts of multimedia material on the internet, which is driving the demand for routers at the global level.

Rising Demand for Mobile Devices

The momentous increase in the number of tablets, smartphones, tablets, and numerous other wireless devices continues is a result of the surging demand for wireless networking solutions. Primarily, the usage of wireless networks is rising with the growing availability of reasonably priced, high-speed wireless broadband services, such as public Wi-Fi hotspots. In turn, the rising number of networking devices has led to vast amounts of multimedia content generation on the internet and mobile apps. With the increase in the need to handle such massive volumes of data, there has been a continuous expansion of data center, server, and cloud computing facilities.

In data centers, routers connect different network segments, diverse network protocols, various network architectures, and media types. Further, these devices connect smaller networks to a large network and break the latter into smaller ones. Hence, with the rapid construction of data centers amidst the flourishing multimedia industry, the usage of these networking devices continues to burgeon around the world.

Growing Smart Home Industry and Advent of Advanced Wi-Fi Technology

The surge in the number of smart homes and the increase in the number of IoT devices propel the requirement for wireless connectivity, which, in turn, is boosting the necessity of wireless routers. The smart home industry is flourishing on the back of the growing importance of remote home monitoring and energy-saving solutions. Thus, Wi-Fi-enabled smart homes are gaining immense popularity as they empower seamless connectivity and control of numerous smart devices inside, for instance, security cameras, smart locks, smart doors, smart voice assistants, smart HVAC, and smart lighting.

Further, the advent of Wi-Fi 6 offers higher speeds, improved capacities, and reduced latency, which benefit smart homes by ensuring smooth communication among connected devices and reducing network congestion. Additionally, the Wi-Fi standards now include orthogonal frequency division multiple access and multi-user, multiple-input, multiple-output features, which augment data transmission efficiency in smart homes. These advancements also enable multiple devices to communicate simultaneously with the Wi-Fi router, thus improving network performance and device responsiveness. Therefore, with the growing requirement for wired and wireless routers for smart homes, the routing market revenue is increasing.

| Report Attribute | Details |

Market Size in 2023 |

USD 16.3 Billion |

Market Size in 2024 |

USD 17.6 Billion |

Revenue Forecast in 2030 |

USD 29.3 Billion |

Growth Rate |

8.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Placement; By Routing; By Application; By Vertical; By Region |

Explore more about this report - Request free sample

Product Launches for Higher Performance and Stability

The growing number of product launches for advanced network connectivity is one of the key reasons behind the market growth. For instance, in September 2023, Qualcomm Technologies Inc. and Charter Communications Inc. announced an alliance to introduce a router to bring Wi-Fi 7 and 10-Gbps Wi-Fi capabilities for both residential users and SMEs.

Moreover, in November 2022, TP-Link Corporation Limited launched Wi-Fi 7 networking solutions, among which Archer BE900 Quad-Band comes with a speed up to 24 Gbps. Further in 2022, Synology Inc. launched its first Wi-Fi 6 routers—WRX560 and RT6600ax—in India. They are designed to offer fast and safe internet connectivity to households and businesses amidst the evolving connectivity requirements.

Similarly, in June 2021, Cisco Systems Inc. introduced a range of industrial routers that brings consistent connectivity to IoT edge applications, to run connected operations in a reliable manner and at scale. The router portfolio features 5G competencies, which allow companies to run processes at scale with the required management tools suitable for both IT and operations.

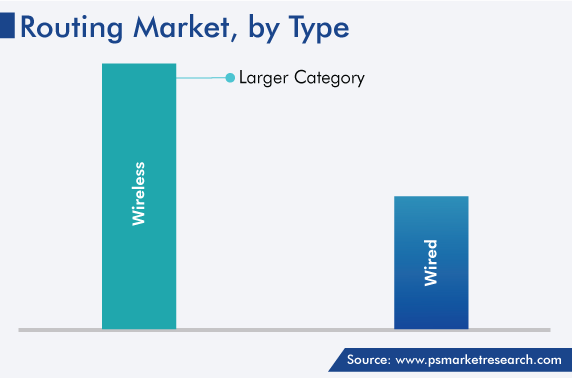

Escalating Demand for Wireless Routers

Wireless routers are expected to dominate the routing market with USD 17.5 billion revenue in 2030. The heightening need for high-speed internet connections and the rising adoption of smart devices are driving the demand for wireless routers that offer smooth connectivity. Essentially, the expansion in the demand for internet-based devices and services and the increase in the popularity of cloud networking, coupled with the rise in the adoption of virtual technologies, boost the demand for wireless routers.

Widespread Use of Edge Routers

The edge router category is likely to hold a considerable share, of 45%, in 2030. Edge computing encompasses the placement of computing resources nearer to the data source or edge of the network, which reduces latency and enables real-time access to computer applications. Therefore, such type of computing resource placement is widely used for IoT, real-time analytics, and content delivery. As IoT has gained high acceptance, the necessity of information communication technologies has augmented significantly. The required competencies and quality of communication vary widely from a single high-speed session to multiple low-speed sessions, depending on devices and applications. With the rising demand for network communication, the sale of edge routers is expected to grow at a rapid rate in the coming years.

In virtual placement, virtualization techniques are used to deploy computing resources, which allows for flexibility and scalability in resource allocation. Such router placement is versatile and can be used in different scenarios. It has often been associated with cloud computing, where virtual machines or containers are deployed dynamically, based on demand.

Traditional core placement is also extensively used, and this category is expected to grow with a considerable rate, during 2024–2030. This approach is particularly used where centralized processing remains effective and latency requirements are not as stringent.

Wide Usage of Routers in Enterprises

Routing plays a central role in both enterprise and data center networks by facilitating the efficient and secure movement of data between various devices and services. The enterprise application category is expected to, therefore, have a substantial market value, of more than USD 11.5 billion, in 2030. This is because these devices are commonly used to connect different segments of the internal network, such as different floors within a building, thereby facilitating seamless network inside.

Routers in enterprise environments often provide services such as virtual private network (VPN) and network address translation (NAT) to ensure protected and effective communication. By leveraging flexible, end-to-end management and efficient application-based traffic routing, software-defined wide-area network (SD-WAN) can be considered for enterprise WAN interconnections in the cloud infrastructure era.

Significant Use of Routing Technology in BFSI Sector

The BFSI sector is expected to dominate the market due to the escalating use of advanced routing solutions here. It is because financial institutions have become more complex and now rely upon cloud solutions and online platforms to communicate transactional changes across the globe. For them, high-speed networks ensure real-time access to market information for customers, traders, and investors. Hence, for the proper transactional communication of the financial organizations, the demand for routers is considerably high, as the BFSI sector requires rapid, low-latency, and secure networks.

The media & entertainment division also holds a large share in the application segment. This is because wired routers are heavily used in professional studios and other fixed installations to ensure stable and high-bandwidth connections in media production environments. These variants are crucial for tasks such as audio production, video editing, and real-time broadcasting. They are usually deployed in concert halls, broadcasting facilities, and theaters, where a stable and dedicated connection is preferred for such applications.

Moreover, wireless routing infrastructure allows for flexibility in on-location shoots and live events, which is why it is predominantly used in mobile production setups, broadcasting, live events, and content distribution. Therefore, with the booming media & entertainment industry, the demand for both wired and wireless routers is growing.

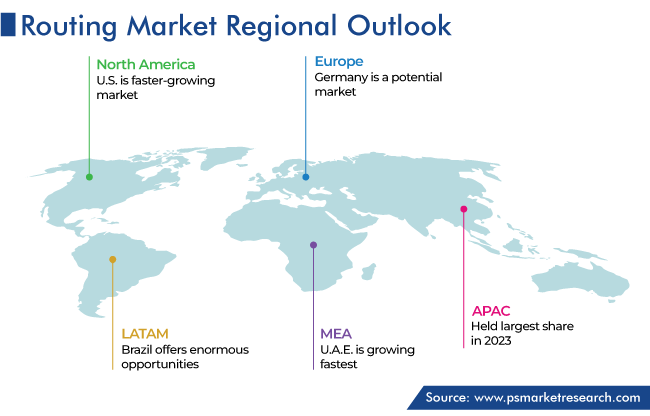

Growing Number of 5G Subscriptions in APAC

As per our geographical analysis, APAC is expected to grow at a considerable rate during the forecast period. This is attributed to the strong growth in the deployment of the 5G technology in Southeast Asia and Oceania. As per the Ericsson Mobility Report, there will be 620 million 5G subscriptions in Southeast Asia and Oceania by the end of 2028. The deployment of the 5G technology has the potential to tremendously influence both wired and wireless connectivity in industrial and technological infrastructure. It can augment wireless connectivity for mobile devices and provide a new potential for content delivery and consumption.

Moreover, in regard to technological advancements in the APAC region, China has taken the lead, notably in the development of cutting-edge technologies, such as 5G and Wi-Fi 6. For instance, in December 2021, China Telecom, a state-owned telecommunications company, collaborated with ZTE Corporation to successfully implement ZTE's advanced core router, ZXR10 T8000, which is safe, reliable, and easy to maintain. The router provides integrated services and supports the full-service operations of China Telecom.

Furthermore, in June 2020, China Mobile introduced the AX3000 Wi-Fi 6router, a product of collaborative efforts with HiSilicon (Shanghai). The router is designed to accompany China Mobile's smart home services, and it possesses 160-MHz bandwidth, hardware acceleration, triple anti-interference capabilities, and chip-level security.

COVID -19 Impact

The pandemic has acted as a catalyst accelerating digitalization across various industries. This is because the demand for wired and wireless routers has been substantially influenced by the changes in work patterns, increased dependence upon digital technologies, and consumer behavior changes. Hence, the demand for both types of routers witnessed a sudden increase for digital transformation, home networking, and the upgradation of the telecommunication infrastructure once the initial lockdowns were lifted.

Key Router Manufacturers Are:

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Juniper Networks Inc.

- Hewlett Packard Enterprise Development LP

- Arista Networks Inc.

- ASUSTeK Computer Inc.

- New H3C Technologies Co. Ltd.

- NETGEAR Inc.

- Nokia Corporation

- Xiaomi Corporation

Market Size Breakdown by Segment

This report offers deep insights into the routing market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

- Wired

- Wireless

Based on Placement

- Edge

- Core

- Virtual

Based on Routing

- Static

- Default

- Dynamic

Based on Application

- Data Center

- Enterprise

Based on Vertical

- BFSI

- IT & Telecommunications

- Healthcare

- Education

- Residential

- Media & Entertainment

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

The market for routers values USD 16.3 million in 2023.

The routing industry will grow by 8.8% by 2030.

Product launches are preferred by the players in the market for routers.

The routing industry is driven by the rising adoption of smart homes, mobile devices, IoT, 5G, and Wi-Fi.

Wireless routers hold the larger share in the market for routers.

The BFSI sector holds the largest routing industry share.

The APAC market for routers is growing rapidly.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws