Report Code: 12849 | Available Format: PDF | Pages: 240

Red Biotechnology Market Size and Share Report by Application (Gene Therapy, Biopharmaceutical Production, Genetic Engineering, Pharmacogenomics, Drug Discovery), Product (Diagnostic Reagents, Human Vaccines, Blood Products, Gene Recombinant Drugs, Personalized Medicines), End User (Biopharmaceutical Industry, CMOs & CROs, Research Institutes) - Global Industry Demand Forecast to 2030

- Report Code: 12849

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Red Biotechnology Market Size & Share

The global red biotechnology market revenue has been estimated at USD 576.7 billion in 2023, which is expected to witness a CAGR of 10.8% during the forecast period (2024–2030), to reach USD 1,172.3 billion by 2030. The market growth is ascribed to the increasing use of genetic engineering to produce biologic drugs and the growing demand for personalized medicines.

Moreover, the growing demand for it in drug discovery, clinical trials, diagnostics, and carrier screening and the surging cases of genetic disorders propel the market growth. Additionally, effective product development and genetic engineering pertaining to new medicines for the treatment of life-threatening diseases are the major advantages of red biotechnology.

Furthermore, the rising pace of technological innovations in gene sequencing platforms, growing funding from government and private bodies for large-scale biotechnology projects, and significant popularity of red biotechnology in various applications, such as poultry farming, veterinary sciences, and tissue engineering, lead to the expansion of the market. Additionally, key surgical implements, such as spinal discs, skin, artificial bones, and cartilage, are produced with tissue engineering. Similarly, tissue implantation can be done by using tissue engineering.

Moreover, the rising prevalence of cancer and the growing utilization of this technology in cancer research and diagnostics are the key growth drivers. Additionally, these technologies are used for the production of combination vaccines, such as those that target diphtheria, Hepatitis A, Hepatitis B, and polio at once.

The increasing number of initiatives for R&D by key players, especially in the area of stem cells, is one of the key trends in the red biotechnology market. In the same way, the COVID-19 pandemic and an increasing number of research studies exploring the utilization of this technique for developing diagnostic tools, medicines, and vaccines support the market growth.

Rapid Expansion of Biopharmaceutical Sector

The growing R&D effort by the key biopharma firms, with the robust support of governments, drives the market. This is itself in view of the rising prevalence of chronic illness and infectious diseases, which is why companies are expanding their research efforts for developing new drug molecules. As per reports, the number of biotech patents applied per year has been growing at 25% since 1995, and there are currently more than 1,500 biomolecules undergoing clinical trials.

Red biotechnology is extensively utilized in the development of human vaccines and antibiotics, new drugs, molecular diagnostic techniques, and regenerative therapies, which has been driving the market.

Rising Prevalence of Chronic Diseases

The need for innovative drug molecules, especially biologics, is driven by the increase in the number of people with chronic diseases globally, which is, in turn, propelling the adoption of red biotechnology. Chronic diseases are currently the major cause of death among adults in almost all countries. Globally, approximately one in three adults suffer from multiple chronic conditions. Further, according to a survey, chronic diseases, including cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes, kill 50 million people every year. Hence, the rise in the incidence of chronic and rare diseases and the resulting increase in the need for diagnosis and treatment are likely to drive the global red biotechnology market during the forecast period.

| Report Attribute | Details |

Market Size in 2023 |

USD 576.7 Billion |

Market Size in 2024 |

USD 633.1 Billion |

Revenue Forecast in 2030 |

USD 1,172.3 Billion |

Growth Rate |

10.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Application; By Product; By End User; By Region |

Explore more about this report - Request free sample

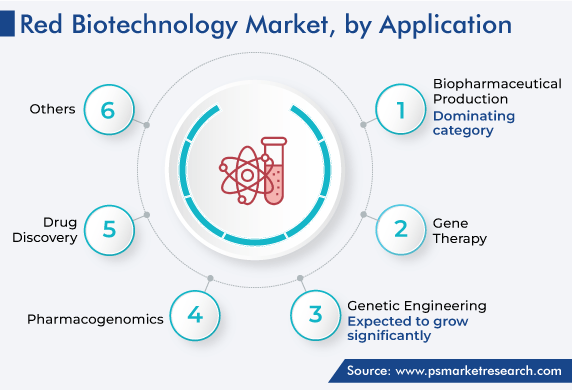

Biopharmaceutical Production Has Largest Market Size

On the basis of application, biopharmaceutical production accounted for the largest revenue share, of 25.0%, in 2023, and it is further expected to maintain its dominance in the future. This is owing to the growing demand for antibodies, proteins, DNA, RNA, and antisense oligonucleotides for therapeutic and diagnostic purposes. In the coming years, biopharmaceutical production is expected to witness tremendous growth owing to the increasing R&D activities in this field of medicine. This is itself on account of the rising production of antibiotics and other kinds of biologics for chronic diseases.

Moreover, the rising production of combination vaccines makes the biopharmaceutical category strong. This is because these vaccines have the possibility of booting immunity against several diseases with one formulation. Additionally, there have been significant developments in the field of gene therapies. For instance, in May 2022, Novartis AG received the USFDA approval for CAR-T cell therapy, KYMRIAH (tisagenlecleucel). It is a CD19-directed, genetically modified autologous T-cell immunotherapy for B-cell precursor acute lymphoblastic leukemia that is refractory or has relapsed in patients at least 25 years old.

The gene therapy category will witness the fastest growth during the prediction period. This is owing to the rising prevalence of genetic disorders and cancers, against which gene therapy displays efficiency by replacing a faulty gene or adding a new gene, in an attempt to cure the disease or improve the body’s ability to fight it. Moreover, in this regard, red biotechnology is being used for research to understand the genetic basis of inherited diseases.

Human Vaccines Accounted for Largest Share

The human vaccines category accounted for the largest revenue share, of 30.0%, in 2023, and it is further expected to maintain its dominance during the forthcoming period. This is owing to the rising frequency of infectious disease outbreaks and surging cases of chronic diseases. About 40 infectious diseases have caused devastation in the recent past, including Zika, MERS, SARS, Ebola, chikungunya, swine flu, avian flu, and COVID-19, most recently. Many researchers and experts have warned of future pandemics and epidemics to be even more lethal than COVID-19.

The rising prevalence of these infectious diseases will ensure a growing demand for vaccines in the future. The recombinant DNA technology is a boon to those looking to produce new-generation vaccines, and the red biotechnology is utilized in the recombinant DNA technology. Additionally, the prevalence of new diseases will impel new R&D funding initiatives, a strong pipeline of new molecules, and new opportunities for vaccinating large populations. Aided by government efforts, R&D for the discovery of effective vaccines utilizing red biotechnology has already begun.

The diagnostic reagents category is set to register the highest growth rate over the forecast period. This is owing to the rising demand for reagents in hospitals and clinical laboratories for diagnostic purposes. Researchers and scientists also use reagents to know the epidemiology of diseases. Essentially, the rising frequency of infectious disease outbreaks has led to the utilization of diagnostic reagents in high volumes at permanent and temporary healthcare facilities and clinical laboratories.

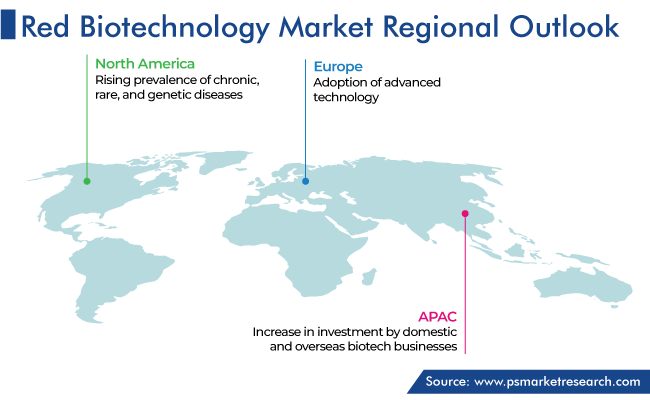

North America Is Prime Revenue Contributor

Geographically, North America had the largest share, of around 55%, in 2023, and it is projected to grow at a robust CAGR during the review period. This can be attributed to the rising prevalence of chronic, rare, and genetic diseases, surging count of R&D initiatives, and high technological advancement rate in the healthcare industry of this region. According to the American Cancer Society, over 1.95 million new cancer cases were expected to be diagnosed in the U.S. in 2023. This greatly highlights the need for red biotechnology for developing new and effective biologic products for treatment.

Therefore, the increasing spending on research and development on cancer diagnostics and therapeutics is expected to boost the growth of the red biotechnology market in North America. Additionally, the rise in the adoption of advanced technologies for the production of gene therapies is propelling the regional market.

Moreover, Canada is a significant contributor due to its developed healthcare infrastructure, large pool of patients with chronic and infectious diseases, robust support of the government for care enhancement, and existence of a large number of medical research institutes in the region.

Furthermore, the strategic approaches of the key players make the regional market profitable. For instance, in January 2023, Illumina Inc. announced its collaboration with Nashville Biosciences LLC and Amgen Inc. to whole-genome-sequence 3,5000 DNA samples. This cohort will be the largest ever dataset of genomes of this kind till date. The sample cohort is primarily made up of DNA from African-Americans, who are currently under-represented in research on genomics, including studies on drug target discovery.

Top Providers of Red Biotechnology Products Are:

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Merck KGaA

- AstraZeneca PLC

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Regeneron Pharmaceuticals Inc.

- Gilead Sciences Inc.

- Novartis AG

Market Breakdown

This report offers deep insights into the red biotechnology market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Applicatio

- Gene Therapy

- Biopharmaceutical Production

- Genetic Engineering

- Pharmacogenomics

- Drug Discovery

Segment Analysis, By Product

- Diagnostic Reagents

- Human Vaccines

- Blood Products

- Gene Recombinant Drugs

- Personalized Medicines

Segment Analysis, By End User

- Biopharmaceutical Industry

- CMOs & CROs

- Research Institutes

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for red biotechnology solutions valued USD 576.7 million in 2023.

In 2030, the red biotechnology industry revenue will be USD 1,172.3 million.

Biopharmaceutical production is the largest application in the market for red biotechnology solutions, while gene therapy has the highest CAGR.

The red biotechnology industry is propelled by the rising need for biopharmaceuticals to tackle the increasing burden of chronic and infectious diseases.

Human vaccines hold the largest share in the market for red biotechnology solutions.

CMOs and CROs are witnessing the fastest red biotechnology industry growth.

North America generates the highest revenue, while APAC is the fastest-growing market for red biotechnology solutions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws