Report Code: 11116 | Available Format: PDF

Protein Expression Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2024-2030

- Report Code: 11116

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

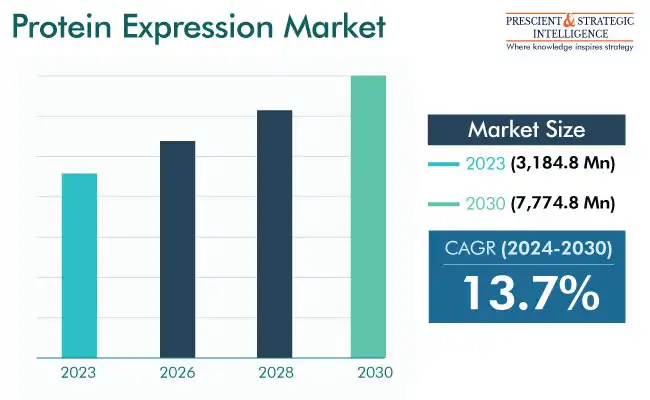

The size of the protein expression market has been estimated at USD 3,184.8 million in 2023, and it will touch USD 7,774.8 million by 2030, powering at a rate of 13.7% between 2024 and 2030.

The increasing significance of protein-centric therapeutics, along with the increasing funding by biopharmaceutical firms in R&D, is a key growth factor of this industry. Additionally, by wreaking havoc around the world, COVID-19 made it necessary to evaluate the differential expression of genes in patients, to obtain knowledge of the illness pathogenesis as well as genetic factors.

Increasing Interest in Protein Biologics Is Key Driver

Biologics, including vaccines, blood and its components, and modified medicinal proteins, can treat most chronic conditions, including cancer, autoimmune disorders, and heart diseases, as well as protect against infections. The FDA approved 50 new drugs in 2021, 14 of which were biologics, including hormones, monoclonal antibodies, pegylated proteins, and enzymes, which required protein translation.

Moreover, sotrovimab, tocilizumab, and a combination of bamlanivimab with etesevimab have been issued EUAs for COVID-19 prophylaxis post possible exposure to the virus. Therefore, the growing number of biologics under development is driving the demand for the consumables, instruments, and reagents used for protein expression procedures.

Arrival of Microfluidics To Create Opportunities

Because the demand for biopharmaceuticals has been rising rapidly and production technology is also advancing, the protein expression industry has grown rapidly. One developing trend in this industry is microfluidics, which relates to working with fluids with micro-scale devices. This allows small volumes of fluid to be fine-tuned, which is necessary for protein expression.

With microfluidic devices, it is possible to fabricate small channels and chambers, within which proteins can be expressed. Thus, A large number of health conditions can quickly be screened in a short time. Further, results of recent studies indicate that DBM screening is an effective means for developing cell factories capable of producing and releasing foreign proteins. At the level of a single cell, the Microfluidic Antibody Capture tool is being used to measure both protein translation and phosphorylation.

The usage of this technology for protein expression provides the potential to transform how proteins are manufactured, making the process much quicker and cheaper. With the continued improvement in this technology, the protein expression market will get numerous growth opportunities in the coming years.

Therapeutic Application Is Major Contributor

On the basis of application, the therapeutic category leads the industry in 2023, and it will remain in the lead in the years to come. This will be because protein therapeutics have many advantages compared to traditional medicines. They can be better tailored to the target and are highly effective with a low risk of adverse effects. In addition, they can be utilized for protein replacement when the body is deficient in that particular protein.

The major driver for this category is the strong interest of companies in developing protein-based therapeutics, since these drugs must go through a shorter approval period and enjoy stronger patent protection.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,184.8 Million |

Revenue Forecast in 2030 |

USD 7,774.8 Million |

Growth Rate |

13.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

Prokaryotic Expression Systems Category Leads Market

The prokaryotic category, based on system, leads the industry, based on expression system. The biggest advantage of expressing proteins in prokaryotic systems is substantial production of recombinant protein in a short period and at a lower expense.

The mammalian category will advance at the highest CAGR in the coming years. This is because a number of pharmaceutical firms have adopted mammalian expression systems for their ability to produce proteins transiently or in completely formed cell lines. These systems are preferred by companies developing vaccines, the demand for which continues to grow with the looming threat of pandemics.

Reagents Is Leading Offering Category

In 2023, the reagents category, based on offering, accounts for the largest share. Reagents are required in significant volumes for protein expression, for proper folding and conformation. The skyrocketing demand for protein expression in proteomics and genomics research, as well as the booming biopharmaceutical and biotechnology industries, drives the market in this category.

Further, the demand for reagents is growing among companies that produce antibodies, to whom pharmaceutical and biopharmaceutical businesses are increasingly outsourcing protein expression and production. Likewise, many firms are using strategic means to boost their market share. For instance, in August 2022, BioIVT announced its acquisition of Cypex, to enhance its ADME product line, which are used in biopharmaceutical R&D.

Pharmaceutical & Biotechnological Companies Hold Largest Share

The pharmaceutical and biotechnological companies category, based on end user, accounts for the largest share. The growing use of cell cultures in developing catalog and personalized drugs and the increasing use of proteins in innovative ways in medicine are helping in this growth. To create more value in drugs and ensure protein stability, these businesses are utilizing the available proteins with gene variations, along with new protein designs.

Moreover, the contract research organizations category is likely to propel at the highest CAGR in the years to come. CROs offer many specialized services to pharmaceutical and biotechnological firms at low prices, thus offering the latter an advantage. Thus, with more pharma and biopharma companies outsourcing drug R&D activities, CROs’ purchase of the products and services used for protein expression will rise.

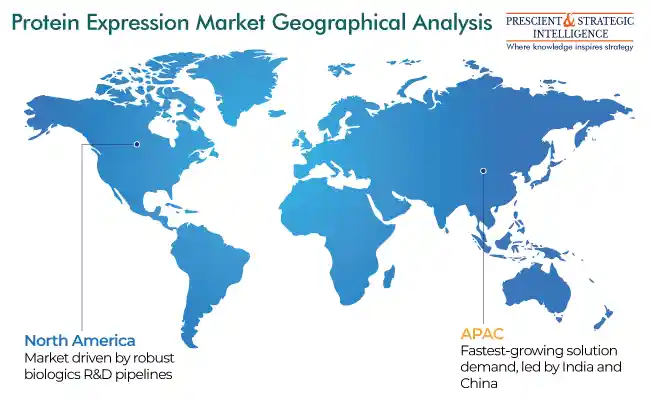

North America Is Dominating Market

In 2023, North America dominates the industry, attributable largely to the high concentration of the key industry players, who are receiving increasing funding for research and development. Moreover, this growth is owed a great deal to the sturdy biosimilar pipelines and the strategic partnerships between corporations and research institutions to produce innovative drugs quickly. This cooperation has created an atmosphere in which breakthrough discoveries can be made and further increased the region's competitive advantage in the global industry.

APAC is likely to advance at the highest compound annual growth rate in the years to come. This will be because of the wide increase in the acceptance of protein expression for different applications in China and India. In addition, the rising emphasis on genomics and proteomics research, along with the growing count of academic organizations’ initiatives for advancements in protein therapeutics, will create growth opportunities. Further, the large geriatric population and increasing incidence of chronic diseases drive the market by propelling the demand for better treatments, especially recombinant proteins.

Major Players in Protein Expression Market

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Merck & Co. Inc.

- Merck KGaA

- New England BioLabs Inc.

- Promega Corporation

- Takara Holdings Inc.

- Oxford Expression Technologies

- Cinven Group Ltd.

- QIAGEN N.V.

- Danaher Corporation

- Lonza Group AG

- Becton, Dickinson and Company

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws