Report Code: 10351 | Available Format: PDF

Precision Farming Market Report: Size, Share, Strategic Developments, and Growth Potential Estimation, 2023-2030

- Report Code: 10351

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

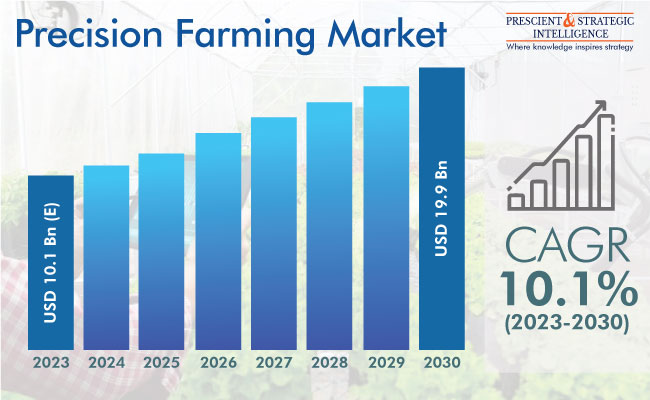

The precision farming market size is estimated at USD 10.1 billion in 2023, and it will reach USD 19.9 billion by 2030, with a CAGR of 10.1% during 2023–2030.

The biggest drivers for the market are the rapid urbanization, growing food demand with the ballooning population, government support for the agricultural sector, enhancing electrification rate and internet availability, surging awareness of advanced agricultural technologies, changing weather patterns, and escalating adoption of IoT and AI in farming.

Adoption of IoT Drives Industry

Precision farming is becoming popular because of the increasing usage of IoT and advanced analytics by farmers. Connected sensors strewn around the fields track the level of moisture and nutrients in the soil and help forecast rain, sunshine hours, and agrochemical requirement. By analyzing the data generated by these sensors, farmers are in a position to utilize resources better and gain healthier and larger yields.

The concept will see a boom in acceptance because it allows farmers to regulate the input of chemicals and utilization of laborers, improve productivity, and lower the costs of production. These approaches support in the collection of relevant data on crop, soil, and local weather forecasts and provide farmers with practical insights.

Further, technological innovations, such as vertical farming, that can increase production and decrease waste, have brought about numerous growth prospects. In the same vein, the increasing investments in guidance systems, driverless tractors, and GPS sensing systems will power the growth of the industry. By integrating AI into agriculture, the requirement for manpower to gain and analyze insights decreases, which improves profitability.

Growing Smartphone Usage Powering Precision Farming Acceptance

The growing adoption of smartphones is one of the strongest drivers for the precision farming market. Many agricultural technology companies have created smartphone applications that allow farmers to monitor the field remotely. Moreover, smartphone apps can be used to control agricultural drones, smart irrigation systems, robotic and autonomous tractors, and sensors and cameras that monitor livestock. Additionally, with the increasing deployment of 5G networks, data sharing between these machines, smartphone apps, and centralized databases will become swifter.

Hardware Has Largest Market Share

Hardware has the largest share of revenue in the offering segment, and this trend will continue till the end of this decade. Hardware for precision agriculture includes a wide range of sensing devices, automation and control systems, antennae, and access points. One among them, a GIS guidance system helps farmers visualize the environment and workflows in the fields. Similarly, the variable rate technology allows users to pinpoint areas that need more seeds and pesticides, thus enabling their appropriate application across the field.

The software category is expected to witness a significant growth rate over this decade. Any kind of computer hardware is ultimately driven by software. Farmers are guided by predictive analytics software on optimal times to plant and harvest, what crops to sow in rotation, and hot to manage soil health. Moreover, cloud-based software eliminates most of the costs incurred in setting up on-site servers, thus making precision farming more accessible for small-scale growers.

Yield Monitoring Is Most-Prominent Application

The yield monitoring category is the largest, and the trend will continue till 2030. It is because IoT and AI help farmers decide on the application of inputs, such as water, micronutrients, pesticides, and fertilizers. Damage to crops can occur due to various factors, including pests, plant diseases, incessant or irregular rainfall, temperature variations, or lack of inputs. By monitoring their crop continuously, farmers can prevent the loss of their yield and avoid a potential financial catastrophe.

The irrigation management category will have a robust growth rate in the future. Smart irrigation includes the usage of weather-based and sensor-based controllers and water meters to ascertain the correct amount of water required for irrigation and the best time for it. Both over and underirrigation can destroy crops, which makes being well-informed about watering really important for farmers.

The weather tracking and forecasting category will also grow at a healthy rate. Instruments that sense heat, UV index, wind speed and direction, and humidity allow the agrarian community to forecast short-term weather on an hourly basis. Furthermore, the introduction of ML techniques and advanced data analytics services has augmented the reliability and precision of weather forecasts, thereby allowing for better farming decisions amidst the changing weather patterns.

| Report Attribute | Details |

Market Size in 2023 |

USD 10.1 Billion (E) |

Revenue Forecast in 2030 |

USD 19.9 Billion |

Growth Rate |

10.1% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

North America Is Largest User of Precision Farming Techniques

North America leads the precision farming market, as it is an early adopter of advanced technologies. The increasing initiatives of the government to assist in the acceptance of modern technologies, along with the improving ICT infrastructure, have contributed to the dominance of the region on the market.

Moreover, for increasing consciousness among farmers, the NIFA, part of the U.S. Department of Agriculture, is engaged in numerous geospatial, sensor, and precision technology projects. Together with Land-Grand universities, NIFA supports farmers in the acquisition of robust sensors, accompanying software, and modeling, monitoring, and measuring tools for various parameters important in agriculture.

In November 2021, Raven Industries, a key precision agriculture technology company in the U.S., was acquired by CNH Industrial for USD 1.2 billion. Similarly, John Deere publicized the purchase of Bear Flag Robotics for USD 250 million in August 2021. Such consolidation moves by the major agricultural technology companies will enable the available of better solutions for precision farming.

APAC Will Have Fastest Market Growth

APAC will have the fastest growth in the market during this decade. A key element powering the development of the regional industry is the growing pace of innovation in the agriculture sector of India, China, and Indonesia. Essentially, the requirement for precision farming equipment is on the rise with the growth in the population in the emerging economies in the region. More people to feed put a lot of pressure on the agriculture sector for boosting output.

Hence, many initiatives have been launched by the government in India and Sri Lanka to encourage the usage of modern precision farming technologies, to maximize the yield of crops. Among these initiatives are PM-KISAN and PMFBY, which are helping drive productivity and incomes for small and large farmers across India.

Key Players in Precision Farming Market

- AgJunction Inc.

- Ag Leader Technology

- CropMetrics LLC

- AGCO Corporation

- Trimble Inc.

- Raven Industries Inc.

- Topcon Corporation

- Deere and Company

- Agribotix LLC

- Farmers Edge Inc.

- DICKEY-john Corporation

- Grownetics Inc.

- The Climate Corporation

- SST Development Group Inc.

- DICKEY-john Corporation

- Bayer AG

- TeeJet Technologies

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws