What is the size of AI in agriculture market in 2024?+

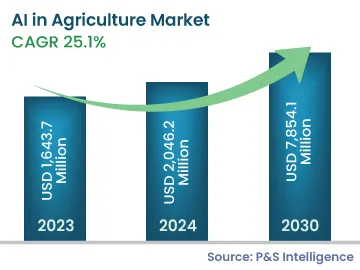

The AI in agriculture market is expected to reach a value of USD 2,046.2 million in 2024.

What will be the CAGR of the AI in agriculture market during the forecast period?+

During the forecast period (2024-2030), the market for AI in agriculture will propel at a CAGR of 25.1%.

What will be the value of the AI in agriculture market in 2030?+

The AI in agriculture industry will reach a value of USD 7,854.1 million in 2030.

Which regional market is leading the AI in agriculture industry?+

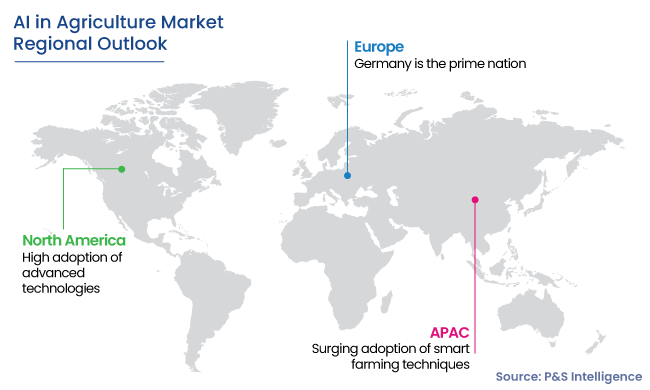

North America is leading the industry for AI in agriculture.

How competitive is the market for AI in agriculture?+

The industry for AI in agriculture is very competitive, with the existence of several international players.

What is the leading application in the AI in agriculture industry?+

Precision farming is the leading application in the AI in agriculture industry.

What is the latest trend in the market for AI in agriculture?+

The increasing utilization of robots in agriculture is the latest trend in the AI in agriculture market.