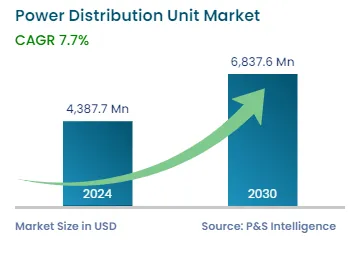

Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | 4,387.7 Million |

| 2030 Forecast | 6,837.6 Million |

| Growth Rate(CAGR) | 7.7% |

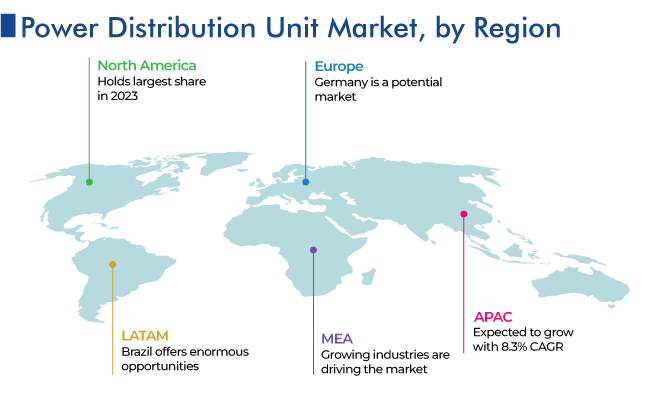

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12702

Get a Comprehensive Overview of the Power Distribution Unit Market Report Prepared by P&S Intelligence, Segmented by Type (Basic, Metered, Switched, Monitored, Automatic Transfer Switch, Hot-Swap, Dual-Circuit), Phase (Single-Phase, Triple-Phase), Power Rating (Up to 120 V,120-240 V,241-400 V, Above 400 V), End User (Telecom & IT, BFSI, Healthcare, Manufacturing & Processing Industries, Automotive, Government & Defense, Energy), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 4,387.7 Million |

| 2030 Forecast | 6,837.6 Million |

| Growth Rate(CAGR) | 7.7% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global power distribution unit market size stood at USD 4,387.7 million in 2024, which is expected to reach USD 6,837.6 million by 2030, advancing at a CAGR of 7.7% between 2024 and 2030. This is due to several factors, including cost-effective IT operations, the growing end-use industries, and the increasing number of data centers. Also, the market is projected to be driven by the developments of cloud computing, virtualization, and alternating-phased power throughout the projection period.

Moreover, the number of data centers has grown significantly as a result of global technical innovation and increased digitization. Also, expanding businesses are changing their attention away from traditional practices to investing in new energy infrastructure and energy consumption optimization, which is projected to accelerate the expansion of this industry. The electrical supply in data centers can be managed by power distribution units (PDUs). They are not intended for monitoring or remote access, instead, they are made to offer ordinary electrical outlets for data center equipment. Also, real-time monitoring and remote access capabilities are offered by more sophisticated PDUs.

PDUs are often mounted directly onto a rack to control and distribute energy. Alternating current (AC) or direct current (DC) might be the electric source, which may originate from generators, utility power sources, uninterruptible power supply (UPS) systems, or some other backup sources. PDUs are also made to handle electrical needs that are often far bigger than those met by power strips and handle protectors found in homes and offices.

Significant Rise in the Number of Data Centers

The increase in data generation is a result of a rise in the volume of unstructured data, process automation in the power sector, and machine sensor data. Due to the significant surge in data volume, worldwide economic growth, and an increase in the number of internet users, the demand for data centers is growing rapidly.

Moreover, with the virtualization and greater adoption of coupled with the increasing number of people becoming online in emerging nations, the development of advanced technologies such as the Internet of Things (IoT), robotics, and artificial intelligence, and the automation in several sectors such as automobile, the number of data centers is expanding, which, in turn, is projected to have a beneficial effect on the market for power distribution units, as data centers are the primary application for PDUs.

For instance, by 2025, it is expected that data output would amount to 175 zettabytes. Also, companies like Google, Amazon, and Microsoft are all building their data centers in areas like North America and Asia-Pacific to meet the rising demand.

Based on type, the market is categorized into basic, metered, switched, monitored, automatic transfer switch, hot swap, and dual circuit. Among these, during the projected period, the monitored category is expected to witness the highest CAGR, of 8.8%, from 2024 to 2030. This is because metered PDUs offer access to power data and remote monitoring anytime and wherever needed. Thus, these are used in a variety of end-use industries.

While the switched category is set to have a significant share of the market. This is because switched PDUs provide capabilities including lights-out management of a data center or distant branch office, remote monitoring and administration, rebooting linked network equipment and servers, assigning certain access permissions to particular outlets or groups, and may receive SNMP warnings. Thus, power needs for high-voltage and high-amperage branch circuit protection can be met. Also, the growth in IT infrastructure and the globalization of cloud computing have raised the requirement for effective and strategic server administration. Hence, the use of switched PDUs has increased as a result of these considerations.

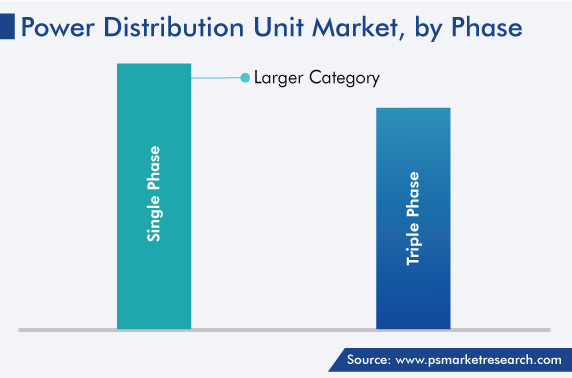

Based on phase, the market is bifurcated into single-phase and three-phase. Between the two, the single-phase is a larger category, with a market share of 65% in 2023. This is because small companies drive the demand for single-phase power distribution units since the single-phase power supply is restricted to residential use. This includes four wires in total, including a ground wire, a neutral wire, and 2 active wires. However, a major challenge in single-phase power distribution systems is that they cannot provide continuous electricity at 60 Hz.

Based on power rating, the market is classified into up to 120 V, 120–240 V, 240–400 V, and above 400 V. Among these, the above 400 V category is set to have the fastest growth. This can be because companies utilize a variety of industry-standard connectors during installation to save money and time. With resettable circuit breakers, PDUs with above 400 V also provide speedy recovery from overload incidents. For instance, Eaton 400–500 V three-phase power distribution systems are intended for use with all three-phase power sources and three-phase UPS systems.

Moreover, PDUs with this power rating offer power distribution, load profiling, voltage transformation, status monitoring, metering, and simple extension without expensive electrical modifications. Additionally, these are in demand because they provide fundamental capabilities needed to deliver affordable and reliably dependable power supply in hyperscale data centers.

Based on industry, the market is categorized into IT & telecom, BFSI, healthcare, manufacturing & processing, automotive, government & defense, and energy. Among these, the IT & telecom industry accounted for the largest share of the market in 2023. Also, it is projected to record the highest CAGR, of 9.0%, from 2024 to 2030.

The telecom sector has undergone a rapid evolution due to technological advancements and lightning-fast innovation. The telecom business is under a lot of strain from fierce competition, picky clients, developing technology, regulatory obstacles, and declining profitability. However, the increase in the mobile device market opens doors for the telecom & IT sector by increasing the number of people connected through smartphones each year. This is fueling the expansion of the global telecommunications business. Also, companies that deal with internet services, telephone lines, cloud computing, and data centers make up the telecom and IT sector.

Drive strategic growth with comprehensive market analysis

Globally, the North American power distribution unit market accounted for the largest revenue share, of 45%, in 2023. This is due to the presence of key industry players in the U.S. and Canada, increased expenditures in end-use sectors including healthcare, telecom & IT, and BFSI, and the expansion of IT infrastructure.

Moreover, the healthcare industry presents market potential due to the rising need for life-saving machinery that needs a consistent power source to perform its essential functions. In addition, the need for PDUs in the BFSI industry is being driven simultaneously by the ongoing rise in data transfer over the internet and the expanding IT infrastructure.

Whereas, the APAC market is projected to grow at the highest CAGR, of 8.9%, during the forecast period. This can be a result of the expanding IT and telecommunications sectors in countries like China, India, Japan, and South Korea, the growing end-use industry, and improving the lifestyle of people in the region.

This report offers deep insights into the power distribution unit industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

Based on Phase

Based on Power Rating

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages