Report Code: 12224 | Available Format: PDF | Pages: 362

- Home

- Chemicals and Materials

- Polyethylene Glycol Market

Polyethylene Glycol Market Size and Share Analysis by Form (Opaque Liquid, White Wax Solid, Flake/Powder), Grade (PEG 200, PEG 300, PEG 400, PEG 400 FCC Grade, PEG 3350, PEG 4000, PEG 6000), Application (Medical, Construction & Infrastructure, Industrial, Personal Care) – Forecast to 2030

- Report Code: 12224

- Available Format: PDF

- Pages: 362

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The polyethylene glycol market size was around $4,534.8 million in 2021, and it will grow at a CAGR of 4.8% during 2021–2030. The major factors driving the market are the rising consumption of polyethylene glycol as a specialty solvent and surface-active agent in creams & lotions, toothpastes, shampoos, deodorants, conditioners, lipsticks, bath oils, soaps, and detergents.

With the increasing use of water-based coatings, paints, and inks in the construction industry, the APAC market has shown extensive growth in the past few decades, which is why it holds the largest share in the market. Additionally, the expansion of the paper industry in China and India is expected to boost the demand for the chemical, as it is used in the production of paper and ceramics as a color stabilizer.

Furthermore, the hydraulic fracturing technology has increased the production of unconventional resources, such as shale gas and tight oil, which is expected to augment the availability of the petrochemicals used in the production of PEG and open up new market opportunities.

During the COVID-19 pandemic, manufacturing sector faced challenges due to the stringent lockdowns in most countries. Moreover, the closure of international borders severely affected the economy. However, polyethylene glycol is widely used in drugs as a carrier molecule, and further, two FDA-approved vaccines, of Pfizer and Moderna, have it. Thus, there has been an overall positive influence on the market.

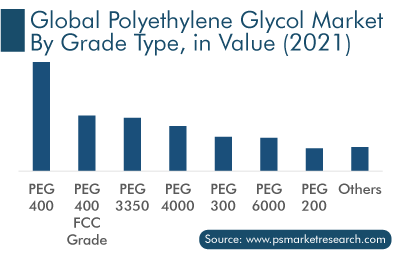

PEG 400 Is Highest Revenue Generator in Market

The PEG 400 category held the largest polyethylene glycol market share over the past few years, and it would grow at a significant CAGR, of over 5%, during 2021–2030, based on grade. This will mainly be due to the fact that PEG 400 is a low-molecular-weight grade with low toxicity. Additionally, it is hydrophilic in nature, which allows for its usage in the manufacturing of drugs to increase the bioavailability and solubility of weakly water-soluble drugs. It is also used in ophthalmic solutions for relief from the irritation, burning, and/or discomfort that one experiences following the drying of the eyes.

The opaque liquid category held the largest share in the polyethylene glycol market in 2021, based on form. This was mainly due to the high usage of this form of polyethylene glycol in the pharmaceutical industry as a release agent and excipient for capsules.

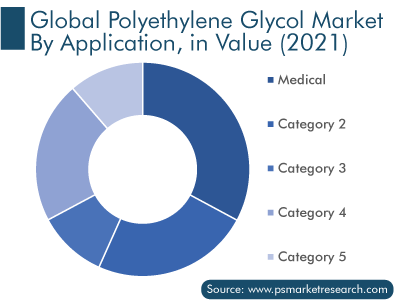

Increasing Usage of Polyethylene Glycol in Medical Sector Leads To This Application’s Domination

Based on application, the medical category held the largest market share in 2021, and it is expected to witness a CAGR of around 5% during the forecast period. This is attributed to the usage of PEG as a dispensing agent, solvent, and delivery liquid for medications and ointments; filler for tablets, and suppository base in ophthalmic solutions and for treating constipation. Moreover, the usage of polyethylene glycol instead of mono-ethylene glycol (MEG) in the pharmaceutical industry is set to impact the market positively.

Growth in Pharmaceutical Industry Is Driving Market

The pharmaceutical industry’s growth in emerging economies, including China, India, and Brazil, coupled with the increasing expenditure on technological advancements, is expected to drive the market. PEG is used as an inactive ingredient in the pharmaceutical industry, including as a solvent, surfactant, plasticizer, ointment, and suppository base for tablets and capsules. The outbreak of new diseases and surging cases of obesity, skeletal problems, cardiovascular diseases, and hypertension contribute to the increasing healthcare expenditure across the globe, which, in turn, will propel the demand for this chemical.

North America Held Significant Revenue Share

Geographically, North America accounted for around 30% of the polyethylene glycol market value in 2021. The second-largest share of the continent is majorly attributed to the high production of crude oil in the region. According to the U.S. Energy Information Administration, the current crude oil production is around 11 million barrels per day. Moreover, the strong growth in the cosmetics & personal care and food industries in the region is driving PEG usage. The cosmetics & personal care business in the region is growing due to customers’ rising demand for multifunctional personal care products, busy lifestyles, and increasing employed population.

| Report Attribute | Details |

Historical Years |

2017-2021 |

Forecast Years |

2022-2030 |

Market Size in 2021 |

$4,534.8 Million |

Revenue Forecast in 2030 |

$6,909.6 Million |

Growth Rate |

4.8% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Form; By Grade; By Application; By Region |

Explore more about this report - Request free sample

Technological Advancements in Manufacturing Process Are Key Trend

Polyethylene oxide, or high-molecular-weight polyethylene, is synthesized by suspension polymerization. It is necessary to hold the growing polymer chain in the solution during the polycondensation process. The reaction is catalyzed by magnesium or aluminum. To prevent the coagulation of polymer chains from the solution, chelating additives, such as dimethylglyoxime, are used. Nowadays, various R&D activities are underway to find new ways to produce polyethylene that can be eco-friendly, cheap, and energy-efficient. Hence, technological advancements in the manufacturing process are a key trend in the market.

To Increase Market Share, Companies Involved in Various Strategic Developments

Major players in the polyethylene glycol market have been involved in a variety of strategic developments to remain competitive. For instance:

In February 2021, Clariant launched a line of Vita 100% bio-based polyethylene glycols and surfactants to tackle climate change, by helping in eliminating fossil-based carbon from the value chain.

In September 2019, BASF SE announced the expansion of its Verbund plant in Belgium, to increase the production capacity of ethylene oxide and its derivatives. Further, the company’s manufacturing capacity increased by nearly 400,000 metric tons per year for the respective goods as a result of the investment of more than $570.2 million.

Top Polyethylene Glycol Producers in Market Are:

- BASF SE

- The Dow Chemical Company

- Croda International plc

- INEOS Group Ltd.

- India Glycols Limited

- Liaoning Oxiranchem Inc.

- Jiangsu Haian Petroleum Chemical Factory

- Clariant Ltd.

- Huntsman Corporation

- AkzoNobel N.V.

Market Size Breakdown by Segment

The research offers the market size of the global polyethylene glycol market for the period 2015–2030.

Based on Form

- Opaque Liquid

- White Wax Solid

- Flake/Powder

Based on Grade

- PEG 200

- PEG 300

- PEG 400

- PEG 400 FCC Grade

- PEG 3350

- PEG 4000

- PEG 6000

Based on Application

- Medical

- Construction & Infrastructure

- Industrial

- Personal Care

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

The 2021 size of the market for polyethylene glycol was $4,534.8 million.

PEG 400 is the most popular among the end users in the polyethylene glycol industry.

In the market for polyethylene glycol, the largest, second-largest, and third-largest shares are held by APAC, North America, and Europe, respectively.

Technological advancements in the manufacturing process are trending in the polyethylene glycol industry.

COVID-19 had mixed impact on polyethylene glycol market.

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws