Market Statistics

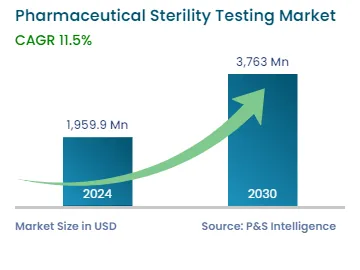

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,959.9 Million |

| 2030 Forecast | USD 3,763 Million |

| Growth Rate(CAGR) | 11.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12675

Get a Comprehensive Overview of the Pharmaceutical Sterility Testing Market Report Prepared by P&S Intelligence, Segmented by Product Type (Kits & Reagents, Services, Instruments), Test Type (Sterility Testing, Bioburden Testing, Bacterial Endotoxin Testing, Container closure Integrity Testing, Antimicrobial Effectiveness Testing, Rapid Micro Testing), Application (Medical Devices, Pharmaceuticals and Biologics), End User (Biotechnology Companies, Pharmaceutical Companies), Type (In-house, Outsourcing), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1,959.9 Million |

| 2030 Forecast | USD 3,763 Million |

| Growth Rate(CAGR) | 11.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global pharmaceutical sterility testing market was valued at USD 1,959.9 million in 2024, which is expected to reach USD 3,763.0 million by 2030, growing at a CAGR of 11.5% during 2024–2030. This is owing to the expansion of biotechnological and pharmaceutical firms, rise in their research and development activities, surge in the prevalence of diseases, and significant government expenditure on the healthcare sector.

The rising prevalence of diseases over the last few years has led to an increase in research and development activities for the production of safe and effective therapeutics. In this regard, the ongoing studies on the prevention of severe viral infections, including the novel coronavirus, and those centered on the development of safe and effective vaccines have a positive impact on the market.

Moreover, the growing burden of severe chronic diseases all over the world has led to an increased dependence on pharmaceuticals. For instance, according to the WHO, chronic diseases kill 41 million individuals every year, thus accounting for approximately 74% of all the deaths across the globe.

Thus, many biopharmaceutical firms are focusing on the production of biologics and biosimilars, such as vaccines, monoclonal antibodies (mAbs), and growth factors. The rising need for the mass production of drugs and biologics due to the growing disease burden is resulting in an increase in the launch of such products. Due to this reason, several countries have shortened their regulatory cycles for the approval of drugs, thereby resulting in accelerated drug launches.

Furthermore, many top biopharmaceutical and pharmaceutical companies are increasingly focusing on the implementation of environmental programs to avoid the risk of contamination in the products and ensure their sterility. Sterility testing helps in ensuring the safety of the products via the early detection of potential contaminants.

Many emerging economies, such as India, China, and Brazil, are displaying a significant growth potential in the market because of the surging research and development activities in healthcare.

Furthermore, the healthcare expenditure in such nations has significantly risen of late. Contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) provide affordable manufacturing and development services to biotech and pharma firms. Sterility testing is an utmost important step during the discovery and development of therapeutics and other pharmaceuticals, as it helps ensure product safety. Hence the rising manufacturing capacities of CDMOs and CROs in developing nations would expand the need for the sterility testing of therapeutics, thereby resulting in market expansion.

Rising Demand for Biopharmaceuticals To Drive Market

The incidence of hematological malignancies is on the rise. According to The Leukemia & Lymphoma Society, every three minutes, a person is diagnosed with myeloma, leukemia, or lymphoma in the U.S. Biopharmaceuticals, such as immune, cell, and gene therapies, are rapidly being adopted as an alternative treatment for hematological cancers. This is because such therapeutics possess high potency and efficiency against such diseases.

Moreover, immune, cell, and gene therapies, which are known as advanced therapeutic medicinal products (ATMPs), are receiving significant attention from people because of the U.S. Food and Drug Administration’s clearance of chimeric antigen receptor T-cell therapies for the treatment of non-Hodgkin’s lymphoma, leukemia, and other blood cancers. Additionally, many advancements have been observed in cellular reprogramming, functional manipulations, and gene editing due to the development of ATMPs and cellular engineering, thereby offering a better future to patients with several ailments.

The above-mentioned advancements are propelling the growth of the pharmaceutical sterility testing market as sterility testing is one of the essential procedures for ensuring the safety of cellular products, before their infusion into patients.

The outsourcing category dominated the type segment, with a market share of 60%, in 2023. This is because outsourcing is gaining significant traction among small and medium-sized pharmaceutical firms due to the advantages offered by them. Moreover, for pharmaceutical firms, outsourcing increases therapeutic expertise and operational efficiency, makes on-demand services available, and aids in the expansion of their geographical presence.

Additionally, many small and medium-sized firms do not have the adequate resources to fulfill their requirements for quality sterility testing and, as a result, prefer outsourcing to pass FDA policies.

Furthermore, such services result in significant time and cost savings as the firms are not required to purchase new instruments for conducting the tests. Moreover, the need to hire and train individuals for the same is also eliminated. Currently, many major firms are focusing on marketing and research and development and, therefore, outsourcing such services.

Still, the in-house category is projected to display significant growth during the projection time frame. This is because it gives firms complete control over the quality of the product and helps in maintaining independence from suppliers, thereby allowing full control over their operations. Moreover, outsourcing organizations take up multiple projects at a time, which can result in delayed services.

Additionally, in-house processes are a strategic move to avoid accidental revelation of company secrets to the competitors, if a supplier works for multiple clients.

On the basis of test type, sterility testing led the market, with a revenue share of 25%, in 2022. For sterility testing, membrane filtration is the most-commonly used test as it offers high sensitivity. Moreover, the increasing demand for the liquid dosage form, along with the suitability of membrane filtration for samples consisting of fungistatic agents, bacteriostatic agents, and preservatives, is propelling the growth of the category.

The growing prevalence of viral diseases over the last few years has led to a rise in the production of vaccines, which, in turn, is resulting in the bacterial endotoxin testing category holding a significant share as well. This is because such testing is needed for all the drugs that are administered through injection and for medical devices as well. The growing focus on the quality of the product, coupled with the increasing pace of medical device launches, is having a positive impact on the growth of the category.

Additionally, the bioburden testing category is predicted to display fast growth during the forecast period. This is because this test is performed on medical equipment and pharmaceuticals, both of which are growing in demand around the world. It is one of the most-important steps of the production process as it allows companies to reduce the likelihood of product recalls.

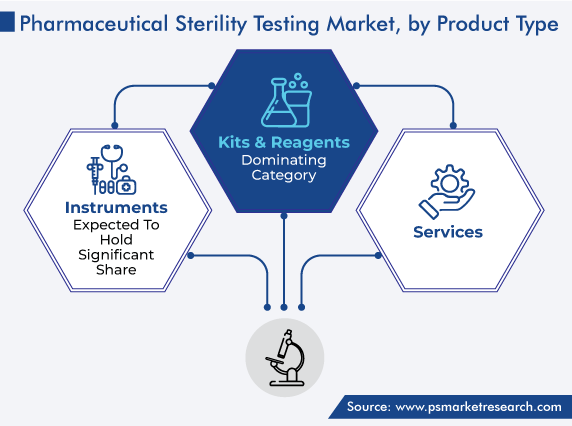

On the basis of product type, the kits & reagents category led the market, with a revenue share of 50%, in 2023, because of the wide availability of such products. Moreover, the ease of utilization and repetitive purchases of these products are propelling the growth of the category.

Additionally, instruments are expected to hold a significant share as well. This is because of the availability of a broad range of products that aid in reducing the risk of false positive and false negative outcomes. Furthermore, instruments, such as sterility testing pumps, are designed to fit effortlessly into most testing units, thereby facilitating safe and streamlined workflows.

Drive strategic growth with comprehensive market analysis

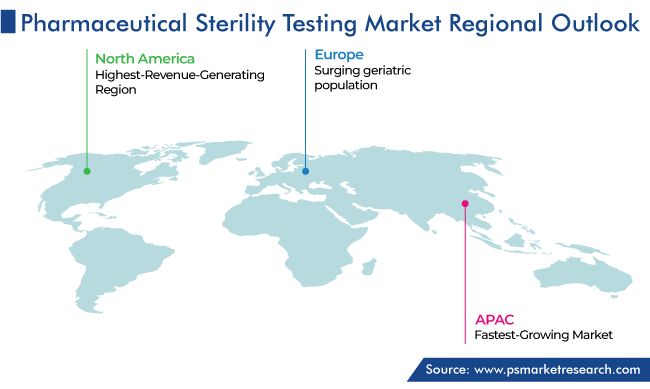

North America led the sector, with a revenue share of 55%, in 2023. The is because of the presence of leading pharmaceutical and biopharmaceutical players, increasing research and development activities in the biotechnology and pharmaceutical sectors, growing count of product launches, high incidence of chronic ailments, and supportive government policies for the setup of research and development facilities in the region.

Moreover, the presence of robust healthcare policies, stringent drug approval requirements, growing public awareness of drug safety, rising adoption of cutting-edge technologies, and the introduction of gene and cell therapies for the treatment of several hematologic malignancies are resulting in the expansion of the regional market.

Furthermore, the rising number of medications launches and the growing focus of major firms on clinical trials due to the significant prevalence of several contagious, non-contagious, and chronic diseases are supporting the market growth. For instance, in March 2022, VBI Vaccines Inc. introduced PreHevbrio in the U.S. as a prophylaxis vaccine for the prevention of hepatitis B in adults aged 18 years and older. The vaccine was given clearance by the U.S. Food and Drug Administration in the year 2021.

Canada’s contribution to the regional market revenue also continues to rise, because of its advanced healthcare infrastructure. Furthermore, the growing adoption of advanced treatments, such as cell therapies, for the treatment of cancer, and supportive government policies for healthcare cost reimbursement, clinical trials, and drug approvals are contributing to the country’s market’s expansion.

Furthermore, the surge in the cases of diabetes and growth in the expenditure by Canadian authorities for research on this disease are having a positive impact on the market. In the last few years, the Canadian government has introduced various budgets favoring the research, development, surveillance, and prevention of diabetes.

Moreover, Europe holds the second-largest share. This is because of the establishment of universal public healthcare systems in many nations in Europe, which has significantly increased the demand for healthcare products. The implementation of strict regulatory policies regarding the safety of drugs is another major factor contributing to the market growth.

Additionally, Germany has been contributing significantly to the market in the region. This is attributable to the growing awareness among the public regarding the harms of consuming tainted medication, increasing healthcare budget, and surging geriatric population and its susceptibility to chronic ailments, which results in its increased dependence on drugs.

Furthermore, France is predicted to display significant growth during the projection time frame. This is because of the surging prevalence of diseases, improving healthcare facilities, and growing biotechnology and pharmaceutical sectors.

This report offers deep insights into the pharmaceutical sterility testing industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product Type

Based on Test Type

Based on Application

Based on End User

Based on Type

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages