Market Statistics

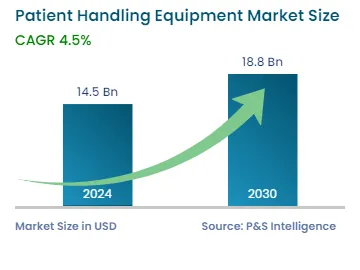

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 14.5 Billion |

| 2030 Forecast | USD 18.8 Billion |

| Growth Rate(CAGR) | 4.5% |

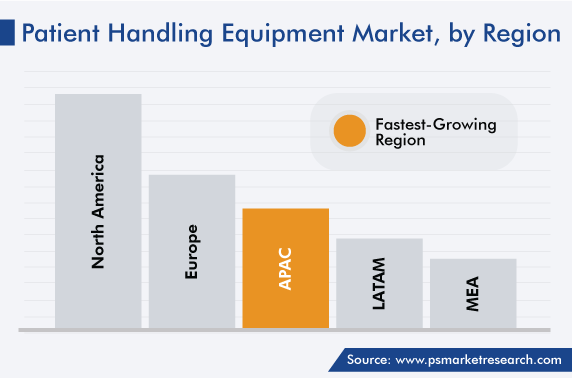

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 10699

Get a Comprehensive Overview of the Patient Handling Equipment Market Report Prepared by P&S Intelligence, Segmented by Type (Patient Transfer Devices, Medical Beds, Mobility Devices, Bathroom & Toilet Assist Equipment, Stretcher and Transport Chair), Type of Care (Long-term Care, Critical Care, Acute Care), End User (Hospital, Home Healthcare, Elderly Care), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 14.5 Billion |

| 2030 Forecast | USD 18.8 Billion |

| Growth Rate(CAGR) | 4.5% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global patient handling equipment market size stood at USD 14.5 billion in 2024, which is expected to reach USD 18.8 billion by 2030, advancing at a CAGR of 4.5% during 2024–2030. This is predominantly due to the rising occurrence of disabilities and road accidents, enhancing post-treatment services, and improving healthcare infrastructure.

Moreover, the implementation of government regulations to ensure the safety of caretakers during the manual lifting process and the surging number of patient admissions in hospitals are expected to propel the sector growth in the forecast period. For example, the National Institute of Occupational Safety & Health has laid down Recommended Weight Limit guidelines for patients’ efficient management in a medical center and to reduce injury risks to practitioners. Additionally, the guidelines set by regulatory bodies such as the CDC, EU-OSHA, and WSHC are fueling the demand for these medical systems.

Furthermore, the mounting number of musculoskeletal disorders, which affect more than 1.5 billion people worldwide, is generating a high demand for appliances for their effective management. Additionally, the snowballing demand and penetration of these systems in emerging economies are set to offer enormous development opportunities.

Although the global patient handling equipment market outlook is growing at a considerable rate in emerging economies, there is still a massive unexplored sector in different countries. With the increasing count of government initiatives and quick economic growth in the APAC region, the prominent players are penetrating the untapped markets in the region.

The markets in countries such as India and China have a huge growth potential, as their healthcare industry is witnessing significant growth. Moreover, the large populations and improving healthcare infrastructure are attracting medical device manufacturers to set up their manufacturing sites in these countries. Moreover, manufacturing medical device products in developing regions tends to decrease the overall cost of manufacturing, thus reducing the cost of the products without altering the quality.

The medical bed category generated around USD around 4 billion revenue in 2022. This is because of the rising number of patients requiring long-term care, technological advancements in ICU beds, increasing investments in therapeutic infrastructure improvement, and escalation in the number of hospital beds all over the world. In addition, the economic liberalization, extensive policy reforms, and the swift increase in the middle-class population, coupled with high buying power, are driving the market size in this category.

The surging adoption of advanced ICU beds comprising various features, such as repositioning support, incessant lateral rotation therapy, electrical bed retraction, and weight-based pressure rearrangement in any bed position, is augmenting the category size. Furthermore, the adoption of electric beds is expected to offer lucrative opportunities in the market in the upcoming period. The integration of these systems with electronic medical records and electronic health records to get a report of parameters such as body temperature, blood pressure, weight, medication dosage, and immunization status is positively impacting the industry progress in this category.

Government bodies around the world are increasing their investments in the establishment of ambulatory facilities. This leads to an increase in accessibility and lowering of treatment costs, which are expected to propel the sector growth in the future. For example, as part of the Affordable Care Act, the U.S. government has launched the Medicare Hospital Readmissions Reduction Program to provide primary care at all accessible point-of-care locations, while reducing avoidable costs, such as those linked to hospital stays and other expenses. These encouraging government initiatives are expected to boost the demand for patient handing devices in healthcare facilities over the upcoming period.

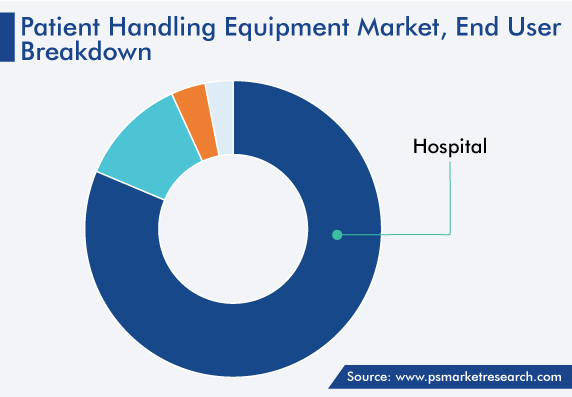

In 2022, the hospital category accounted for the largest market share based on end user. This is on account of the expanding number of community and multispecialty hospitals in developing countries. Additionally, an increase in the emphasis of government and private bodies on regular and timely treatment has caused awareness among the population, consequently propelling the market expansion during the outlook period.

Additionally, the rise in the healthcare expenditure leads to an increase in the affordability and accessibility of treatment and diagnosis of different conditions. Different governments are investing a significant portion of their GDP in public health, thereby leading to industry advancement. The large patient pool, availability of trained professionals, and financial capabilities of hospitals to buy high-end instruments have led to the highest sale of medical instruments to hospitals, which is expected to expand the category size in the forecast period.

Moreover, the home healthcare category held the second largest share, mainly due to the cumulative support from government bodies to reduce the length of patient stay in hospitals. For instance, the New York State Department of Health offers home healthcare programs, which include therapeutic services, adult daycare, and care management by registered nurses to individuals in need.

Further, the existence of beneficial reimbursement policies in the U.S. is driving the market growth in this category. For example, Medicare reimburses 7.5% of the costs of electric beds that can be used in homecare settings, which leads to the high adoption rate of these systems in the country.

The critical care category held a significant revenue share, of around 29%, in 2022. This is due to the surge in the pace of innovations in the devices required for surgical procedures and in ICUs, for an improvement in healthcare. In addition, access to medical data through the use of these advanced devices is augmenting the demand for patient handling systems.

Further, during the pandemic, prominent players have actively participated in the launch of various products for the critical care of patients, which is significantly impacting the patient handling equipment market size. For instance, Koninklijke Philips N.V. introduced Respironics E30 ventilator in April 2020 for the vital care of the population suffering from COVID-19. The ventilator comprises visual and audible alarms and permits high oxygen flow support to the ones suffering from respiratory insufficiency.

Drive strategic growth with comprehensive market analysis

Europe led the market in 2022 with a value of around $5 billion. This is primarily ascribed to the increase in the number of initiatives taken by government as well as non-government organizations related to the adoption of patient managing apparatus in all kinds of medical facilities. Additionally, the existence of major key players in the region, and their various strategic developments, such as product launches, partnerships, collaborations, mergers, and acquisitions, are driving the regional market growth.

Moreover, the demand for patient handling systems is rising in the region due to the presence of a large number of hospitals, elderly care facilities, and trained professionals, increasing need for better services, supportive regulations for patient safety, and growing prevalence of chronic and lifestyle-associated diseases in the region.

The APAC market is set to register the highest CAGR in the forecast period, mainly due to the setup of innumerable medical facilities in the region. In addition, the rapidly growing medical industry, coupled with the government initiatives to offer high-quality products and the increasing prevalence of lifestyle-associated disorders, is driving the regional market evolution.

This report offers deep insights into the patient handling equipment industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

Based on Type of Care

Based on End User

Geographical Analysis

The 2024 value of the market for patient handling equipment was USD 14.5 billion.

The patient handling equipment industry 2024–2030 CAGR will be 4.5%.

Europe is the largest market for patient handling equipment.

The patient handling equipment industry is driven by the rising chronic disease prevalence, geriatric and bariatric populations, and government investments in healthcare.

The market for patient handling equipment is dominated by hospitals and the category is also expected to exhibit the fastest growth.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages