Report Code: 10442 | Available Format: PDF | Pages: 206

Hospital Bed Market Research Report: By Type (General, Pediatric, Birthing, Bariatric, Pressure Relief), Treatment (Acute Care, Long-Term Care, Critical Care), Power (Manual, Semi-Electric, Electric), End User (Hospitals, Home Care Settings, Elderly Care Facilities) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10442

- Available Format: PDF

- Pages: 206

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Hospital Bed Market Overview

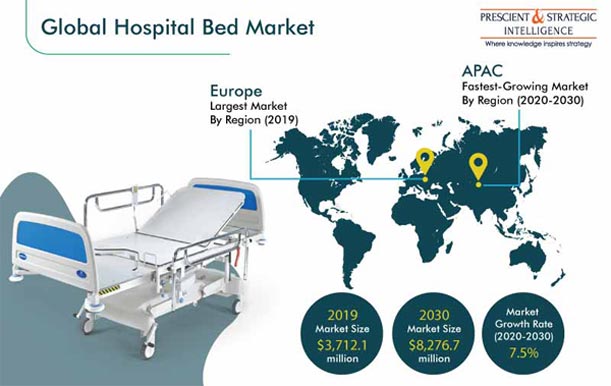

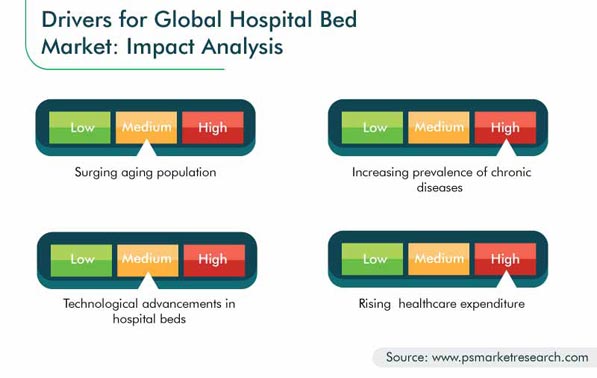

The global hospital bed market size was $3,712.1 million in 2019, and it is predicted to progress at a CAGR of 7.5% during the forecast period (2020–2030). The growth of the market can be mainly attributed to growing aging population, technological advancements, and rising prevalence of chronic diseases. Furthermore, chronic diseases such as heart disease, cancer, and diabetes are the leading causes of death and disability worldwide. According to the data published by the International Diabetes Federation (IDF), in 2019, around 463 million adults (20–79 years) were living with diabetes, and this number is expected to reach 700 million by 2045.

The ongoing COVID-19 pandemic has shown positive impact on the hospital bed industry. The growing number of COVID-19 patients worldwide is the major reason behind the increased demand for these beds. Furthermore, companies are launching new products to meet the demand worldwide. For instance, in April 2020, Stryker Corporation released emergency relief beds to meet the need for beds in hospitals during COVID-19 pandemic.

General Category Is Expected to Be Largest and Fastest-Growing Category in Industry

The hospital bed market on the basis of type is categorized into general, birthing, pediatric, bariatric, pressure relief, and other beds. The general category held the highest market share in 2019, and is projected to witness the fastest growth during the forecast period. General beds are economically priced and are relatively cheaper in comparison to other specialty hospital beds, such as bariatric and pediatric beds, and majorly used by care-takers and general staff in hospitals, clinics, nursing homes, and other medical institutions.

Long-Term Category to Witness Fastest Growth during the Forecast Period

The long-term category based on treatment is expected to witness the highest CAGR during the forecast period in the hospital bed market. This can be mainly ascribed to the rise in number of patients with severe health conditions and those who require long stay in hospitals such as in cases of cancer and other chronic diseases. According to World Cancer Research Fund (WCRF), in 2018, around 17,036,901 new cancer cases were diagnosed. These cases are increasing each year and driving the market for long-term category in the market.

Hospitals Category Accounts for Largest Share

Hospitals are the key end users and held largest share in hospital bed market in 2019. This is mainly attributed to the increase in healthcare expenditure, which has further led to the construction and renovation of old hospitals with the installation of new medical equipment and hospital beds. Moreover, with the rise in healthcare expenditure, several governments are focusing on providing better healthcare facilities to the patients, in terms of increased hospital beds per capita and enhanced care for critically ill patients with the provision of hospitalization facilities, globally.

Manual Category to Dominate the Market during the Forecast Period

The hospital bed market on the basis of power is categorized into manual, semi-electric, and electric. Of these, the manual bed category is expected to dominate the market throughout the forecast period. This can be attributed to the fact that these are preferred choice of end users in developing countries, owing to their availability at lower price as compared to electric and semi-electric beds. In addition, these beds require less maintenance and are, therefore, widely used in hospitals, nursing homes, and home care settings.

Europe—Largest Contributor in Hospital Bed Industry

Europe is the largest contributor to the hospital bed market, in 2019, due to the increasing per capita healthcare spending, surging geriatric population, rising prevalence of chronic diseases, and technological advancements in the region. According to the European Commission, there was an increase in the number of long-term care beds in Romania (13 additional beds per 100,000 inhabitants during the period 2010–2015) and in Austria (23 additional beds per 100,000 inhabitants during the same period). The increasing installation of the hospital beds in these nations has been a major factor for the largest share of Europe in global market.

Asia-Pacific (APAC)—Fastest-Growing Region in the Market

Globally, APAC is expected to advance at the highest CAGR during the forecast period in the hospital bed market. This is mainly due to the growing medical tourism industry, increasing prevalence of chronic diseases, rising aging population, and continuously improving healthcare infrastructure. According to the IDF, 11.3% of the total population in Southeast Asia, that is, 87.6 million people, was diagnosed with diabetes in 2019 and this number is projected to reach 12.6% by 2045. Owing to this, there is a high chance that hospitalization rate would increase in the region, which would boost the demand for hospital beds.

Rising Preference for Home Healthcare Services Is Key Market Trend

Home healthcare is less expensive, more convenient, and effective in comparison to hospital settings. Home healthcare services include nursing care, physical therapy, scheduled doctor visits, home blood collection, geriatric counseling, occupational speech-language therapy, rehabilitative services, and medical social services. According to the Centers for Disease Control and Prevention (CDC), in 2016, in the U.S., there were 12,200 home health agencies. Due to high demand for home healthcare services in the developed nations, various manufacturers are shifting their focus on providing medical beds for home care. Thus, rising preference for home healthcare services is a major trend in the hospital bed market.

Increasing Prevalence of Chronic Diseases Is Driving the Market

Chronic diseases such as cancer, hepatitis, chronic obstructive pulmonary disease (COPD), cardiovascular diseases (CVDs), and viral diseases including Acquired immunodeficiency syndrome (AIDS) cannot be completely cured by medications or prevented by vaccines. According to the World Health Organization (WHO), non-communicable diseases are a leading cause of mortality, that is, 41 million people each year, equivalent to 70% of all deaths in 2018, globally. Thus, in past years, there has been a surge in the treatment options available and awareness among the patients about these options. Therefore, increasing prevalence of chronic diseases is expected to fuel the growth of the hospital bed market across the world.

Technological Advancements in Hospital Beds to Boost Market Growth during Forecast Period

Various technological advancements, such as availability of automatic beds and internet of things (IoT)-enabled hospital beds, are supporting the growth of the hospital bed industry. Players in the market have also come up with hospital beds enabled with power mattresses, which help in the redistribution of pressure and also improve the blood circulation in bedridden patients. For example, Hill-Rom AccuMax Quantum VPC pressure redistribution mattress by Hill-Rom Holdings and PressureGuard Custom Care Convertible mattress by Span-America Medical Systems Inc. are some of the major innovations in the hospital bed market.

Furthermore, old beds are also being replaced by beds with new & advanced features, such as graphical interfaces, novel environment-aware sensors, and actuating solutions. These technologically advanced beds are gaining popularity and are contributing to the growth of the hospital bed market worldwide.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$3,712.1 Million |

Forecast Period CAGR |

7.5% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Type, Treatment, Power, End User, Geography |

Market Size of Geographies |

U.S., Canada, Russia, Germany, U.K., France, Italy, Spain, Japan, China, India, Brazil, Mexico, and Saudi Arabia |

Secondary Sources and References (Partial List) |

American Cancer Society, Asia-Pacific Advanced Network, Institute of Health Metrics and Evaluation, European Heart Network, International Agency for Research on Cancer, International Hospital Federation, Centers for Disease Control and Prevention, International Diabetes Federation, International Atomic Energy Agency, World Health Organization, World Cancer Research Fund |

Explore more about this report - Request free sample

Key Players Endeavoring to Gain Competitive Edge with the Introduction of New and Innovative Products

The global hospital bed market is consolidated in nature, with the few key players such as Hill-Rom Holdings Inc. and Stryker Corporation, which account for majority of the share in the market. In recent years, major players in the market have taken several strategic measures, such as product launches and facility expansions, to gain a competitive edge in the market. For instance, in April 2020, Stryker Corporation released emergency relief bed to meet the need for hospital beds during the COVID-19 pandemic. It aims to manufacture 10,000 beds per week to meet the requirements.

In May 2017, Hill-Rom Holdings Inc. launched Hill-Rom Envella air fluidized therapy bed, a solution for wound care patients. The bed provides better healing environment for the prevention and treatment of advanced pressure injuries.

Moreover, key players are also investing in key emerging economies. For example, in February 2018, Paramount Bed Holdings Co. Ltd. announced a new manufacturing unit in India. With the introduction of a new factory, the company is expected to expand its product portfolio and service offerings in Indian subcontinent.

Key Players in Hospital Bed Market include:

-

Invacare Corporation

-

Paramount Bed Holdings Co. Ltd.

-

Gendron Inc.

-

Medline Industries Inc.

-

LINET spol. S r.o.

-

Savaria Corporation

-

Savion Industries Ltd.

-

Hill-Rom Holdings Inc.

-

Stryker Corporation

-

Getinge Group

-

Joh. Stiegelmeyer GmBH & Co. KG

-

Joerns Healthcare LLC

-

Span-America Medical Systems Inc.

-

Malvestio S.P.A.

-

Merivaara Corp.

-

Antano Group S.R.L.

-

Amico Corporation

-

Midmark Corporation

-

Famed Zywiec Sp.Z. O.O.

-

Besco Medical Co. Ltd.

Hospital Bed Market Size Breakdown by Segment

The hospital bed market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- General

- Pediatric

- Birthing

- Bariatric

- Pressure Relief

Based on Treatment

- Acute Care

- Long-Term Care

- Critical Care

Based on Power

- Manual

- Semi-Electric

- Electric

Based on End User

- Hospitals

- Home Care Settings

- Elderly Care Facilities

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Russia

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific (APAC)

- Japan

- China

- India

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

The hospital bed market is expected to reach $8,276.7 million in 2030.

Hospitals generate the maximum demand for the hospital beds.

The availability of internet of things (IoT)-enabled and automatic beds will supplement the hospital bed industry growth.

Stryker Corporation and Hill-Rom Holdings Inc. are the frontrunners in the hospital bed industry.

The hospital bed market report covers Europe, APAC, North America, MEA, and LATAM.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws