Report Code: 12820 | Available Format: PDF | Pages: 240

Particle Counters Market Size and Share Analysis by Type (Airborne, Liquid), Application (Cleanroom Monitoring, Drinking Water Contamination Monitoring, Aerosol Monitoring and Research, Indoor Air Quality Monitoring, Contamination Monitoring of Liquids, Chemical Contamination Monitoring), Distribution Channel (Direct, Indirect), Industry (Life Sciences and Medical Device, Semiconductor, Automotive, Aerospace, Food and Beverage) - Global Industry Demand Forecast to 2030

- Report Code: 12820

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Particle Counters Market Size & Share

The global particle counters market is valued at an estimated USD 549.1 million in 2023, which is expected to reach USD 1,069.6 million by 2030, growing at a CAGR of 10.2% during 2024–2030.

The development of end-use industries, including aerospace, automotive, oil & gas, and energy, has been facilitated by the favorable investment conditions. Additionally, the increasing adoption of innovative technologies in the healthcare and industrial sectors is propelling the market. Furthermore, the implementation of stringent regulatory guidelines to ensure a good quality of products, especially food products, is a main factor aiding the particle counters market expansion.

The demand for contaminant-free manufacturing processes in the pharmaceutical, biotechnology, and other industries is another significant driving factor for the sector. This is because of the rising burden of several chronic and infectious diseases, which has led to a tremendous spike in the manufacturing of drugs. This factor acts as a driver because these devices are not only automated but also eliminate human error, thereby ensuring infection control, data accuracy, and reproducibility.

Furthermore, the high potential for the undesirable effects of a medicine has necessitated monitoring throughout the pharmaceutical production process. The requirement for effective monitoring to maintain product safety and quality levels has driven the deployment of particle counters in production and R&D. Essentially, the increasing funding for pharmaceutical R&D and manufacturing, as well as the rising requirement for water disinfection in the working areas in the pharmaceutical and medical device industries, is a major factor driving the growth.

Additionally, the significant rise in the level of indoor pollution has led to an increase in the adoption of these devices. As per the World Health Organization, approximately 3.5 million people die per year due to indoor pollution. Additionally, concerns about hazardous particles’ high concentration have grown as a result of the spread of various severe infectious diseases through the air, which is set to drive the demand for these devices.

Government Regulations to Maintain Air and Water Quality Expected To Drive Product Demand

The size of the particle counters market is set to increase throughout the forecast period due to the implementation of rules for efficient air pollution monitoring and management by governments. In the same way, governments are increasingly imposing regulations to maintain water quality. This is attributable to the fact that over the years, air and water quality has significantly declined because of the growing levels of industrialization.

Additionally, the chance of developing many ailments, including respiratory infections, asthma, and cancer, has grown as a result of the swift degradation of the air quality. The environmental harms of air pollution include the greenhouse effect, altered weather patterns, and lower crop yields. As a result, several nations’ governments are concentrating on efficiently tracking and reducing air pollution and tackling its causes.

For instance, in India, the government has initiated the National Clean Air Programme (NCAP) under the centrally administered Control of Pollution Scheme, with targets to achieve a 20% to 30% reduction in PM10 and PM2.5 concentrations by 2024 from the levels recorded in 2017. It is a long-term, time-bound national strategy to address the country's air pollution issue comprehensively.

| Report Attribute | Details |

Market Size in 2023 |

USD 549.1 Million |

Market Size in 2024 |

USD 596.0 Million |

Revenue Forecast in 2030 |

USD 1,069.6 Million |

Growth Rate |

10.2% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By Distribution Channel; By Industry; By Region |

Explore more about this report - Request free sample

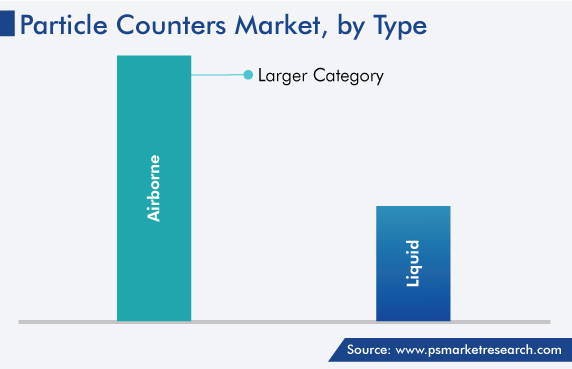

Airborne Particle Counters Dominates Type Segment

The airborne category accounts for the larger share, of 70%, in 2023, because of the significant utilization of airborne particle counters in a wide range of industries, such as pharmaceutical, biotechnology, and electronics.

Further, within this category, portable counters are significantly used for air quality monitoring. This is because they provide a dependable, user-friendly technology for real-time cleanroom particle counting. The localized display of the portable type allows personnel to view the count without leaving the cleanroom, which gives an immediate warning of the contamination risk. In-depth communication and data organization options are also built into these systems.

Moreover, due to their features of spot checks, interior air quality measurements, and extremely flexible usage, their adoption is expected to grow significantly during the forecast period. This would also be a result of the partnerships and collaborations among the players to bring new products to customers. For instance, Particle Measuring Systems (PMS) introduced the new Lasair Pro airborne particle counter in May 2021. The Lasair Pro complies with the international standards on data integrity, while supporting a comprehensive contamination control solution, including portable and remote clean area monitoring.

Additionally, handheld counters contribute to the category’s significant share, owing to their user-friendly nature and affordability. Moreover, these devices are easy to move, thereby conveniently providing average particle counts. They also lower the risk of contamination in cleanrooms by providing the reading on an inbuilt localized display, which, in turn, helps in avoiding repeated entry in and exit out of the premises. Therefore, their usage to determine the indoor air quality has surged drastically in recent times.

In addition, these devices are frequently used by contamination control specialists for routine contamination monitoring and troubleshooting in manufacturing and process environments that demand high levels of cleanliness, including for medical devices, microelectronics, aerospace components, and optics. The certification of cleanrooms or controlled environments to ISO 14644-1 standards on an annual or biannual basis is another major application of these devices.

The liquid particle counters category is expected to witness a high CAGR, of 10.5%, during the projection period. This is because these variants are employed for the monitoring of numerous liquids, including water, hydraulic fluids, and oils, for contaminants. Additionally, the pharmaceutical industry is expected to increasingly use these variants for the monitoring of contamination in injectables, as well as the continuous monitoring of the water used to manufacture pharmaceutical products.

In addition, the online type contributes to the aforementioned category’s fast growth. This is because most external factors, including unwanted contamination, can be avoided, and the results can be instantly compared to the necessary cleaning standards using this system. Furthermore, its ability to optimize time intervals and perform a higher number of sequential tests, to ensure the statistical repeatability and reproducibility of the results, will further drive the demand for it.

Cleanroom Monitoring Leads Application Segment

The cleanroom monitoring category dominates the application segment, with a market share of 25%, in 2023.

Any industry where minute particles disrupt production processes needs cleanroom panels for its systems. In various factories, they regulate temperature, pressure, humidity, and contamination levels. Most cleanrooms vary in size and complexity; for example, those used by the biotechnology and pharmaceutical sectors have more-tightly controlled settings than others. Moreover, the quality of the final product is highly impacted by the cleanroom environment. The significant usage of cleanrooms in various industries has made their monitoring crucial, thereby raising the requirement for particle counting devices for maintaining a sterile environment inside such premises.

The growing incidence of chronic conditions has led to an increase in the demand for medications, which, in turn, has resulted in a rise in the usage of such apparatus in the pharmaceutical industry. Moreover, it cannot afford to compromise on the quality of its final products, which is why it requires high levels of sterility; this has significantly increased the usage of devices for counting airborne and liquid particles here. Furthermore, they also ensure compliance, save downtime, and maintain cleanroom safety.

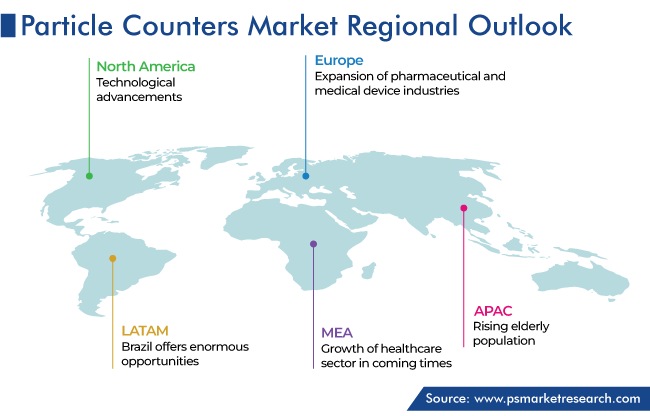

North America Dominates Industry

According to our regional analysis, North America leads the market, with a share of around 55%, in 2023. This is because of the technological advancements in the region, government campaigns to increase public awareness of the value of pollution prevention and control, rising usage of these devices for air pollution monitoring, and significant presence of top pharmaceutical and biotechnological firms in the region.

Moreover, the two economies in this region are also among the largest pharmaceutical markets globally. The U.S. is the world's top pharmaceutical market, whereas Canada is the tenth-largest. Thus, the region’s market growth is attributable to the increasing expenditure on pharmaceutical and biopharmaceutical research and development, as well as the new product approvals and launches. The U.S. has a significant share of the global R&D expenditure, according to the Pharmaceutical Researchers and Manufacturers of America (PhRMA). In 2020, the U.S. biopharmaceutical industry was expected to have spent USD 122 billion on R&D.

Furthermore, the demand for these devices is expected to increase as a result of the rising government spending on air pollution monitoring and management and the surging emphasis on air pollution monitoring in indoor settings.

Europe is expected to hold a significant share as well. This is due to the expansion of the pharmaceutical and medical device industries in the region, which is considerably raising the demand for devices to check for contamination within production plants. Additionally, the rising government backing for pollution control, the presence of a sizable aged population, and the increasing healthcare spending are propelling the market expansion.

Top Particle Counter Providers Are:

- Particle Measuring Systems

- Beckman Coulter Inc.

- RION Co. Ltd.

- Lighthouse Worldwide Solutions Inc.

- TSI Incorporated

- Climet Instruments Company

- Met One Instruments Inc.

- Particles Plus Inc.

- Setra Systems

- Chemtrac Inc.

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the particle counters market, to offer accurate market estimations for 2017–2030.

Based on Type

- Airborne

- Liquid

Based on Application

- Cleanroom Monitoring

- Drinking Water Contamination Monitoring

- Aerosol Monitoring and Research

- Indoor Air Quality Monitoring

- Contamination Monitoring of Liquids

- Chemical Contamination Monitoring

Based on Distribution Channel

- Direct

- Indirect

Based on Industry

- Life Sciences and Medical Device

- Semiconductor

- Automotive

- Aerospace

- Food and Beverage

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The 2030 revenue of the market for particle counters will be USD 1,069.6 million.

The particle counters industry is growing at a CAGR of 10.2%.

The market for particle counters is growing with the rapid industrialization and rising water and air pollution.

By type, the airborne category generates the higher particle counters industry revenue.

The life sciences and medical device industry holds the largest share in the market for particle counters.

Cleanroom monitoring applications dominate the particle counters industry.

APAC will grow the fastest in the market for particle counters.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws