Report Code: 10173 | Available Format: PDF | Pages: 240

Cleanroom Technology Market Research Report: By Type (Consumables, Equipment), Construction (Standard, Hardwall, Softwall, Pass-Through), End-Use Industry (Pharmaceutical, Biotechnology, Medical Device) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10173

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Cleanroom Technology Market Overview

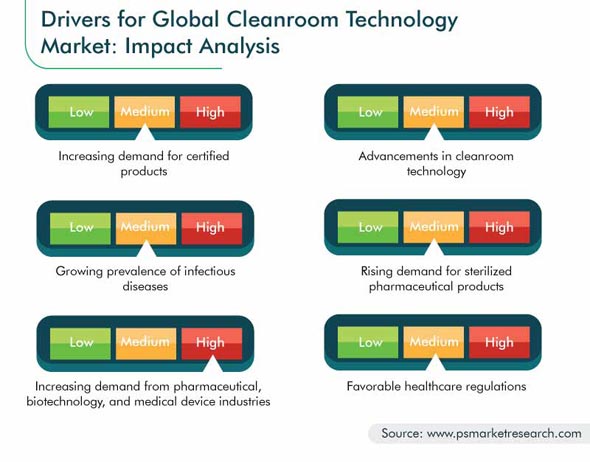

The global cleanroom technology market generated revenue of $4,204.9 million in 2019, and it is expected to advance with a CAGR of 7.0% during the forecast period (2020–2030). The increasing demand for certified products, advancements in the cleanroom technology, growing prevalence of infectious diseases, rising demand for sterilized pharmaceutical products, expanding pharmaceutical, biotechnology, and medical device industries, favorable healthcare regulations, and increasing healthcare expenditure are the key factors driving the growth of the cleanroom technology industry.

Moreover, in the wake of the COVID-19 pandemic, governments of various countries are taking several measures to ensure their economies remain stable. Countries worldwide are currently focused on combating the economic and health threats from COVID-19. Thus, with the growing focus on drug and vaccine development, the cleanroom technology market is expected to witness robust growth in the near future.

Consumables Category Dominated Market in Historical Period (2014–2019)

In 2019, the consumables category held the larger share in the cleanroom technology market, when segmented on the basis of type. This is because consumables comprise safety and cleaning products, which are cheaper and do not require any installation and maintenance, unlike the equipment used in cleanrooms.

Hardwall Cleanrooms To Advance with Highest Growth Rate during Forecast Period

Hardwall cleanrooms are expected to register the fastest growth in the cleanroom technology market during the forecast period, based on construction. The growth in the demand for hardwall cleanrooms can be attributed to their rigid wall construction, which allows for a higher internal air pressure as compared to others, thus proving to be a better alternative.

Pharmaceutical End-Use Industry To Retain Its Dominance during Forecast Period

The pharmaceutical industry contributed the highest revenue to the cleanroom technology market during the historical period, when segmented on the basis of end-use industry. Moreover, the category is expected to retain its market dominance over the forecast period. The market in this category is driven by the presence of a large number of biopharmaceutical companies, for whom maintaining cleanliness and hygiene inside production and research and development (R&D) facilities is of the utmost importance, for the prevention of any infection.

North America – Highest Revenue Contributor to Industry

North America had been the largest contributor to the cleanroom technology market in the historical period. This was buoyed by the fact that apart from the pharmaceutical, medical device, and biotechnology industries, the cleanroom technology finds wide application in the hospitals in the region. Moreover, with the increasing implementation of guidelines pertaining to cleanliness in healthcare and related research facilities, the demand for customized, modular cleanrooms is rising in the region, as they are more suited for clinical environments. Besides, cleanrooms provide a sturdy ceiling grid for use with ceiling-mounted HEPA filtration systems, due to which they are used by various industries, including biomedical, military, and manufacturing, in the region. Therefore, the increasing demand for safety and cleaning consumables is driving the market for the cleanroom technology in the North American region.

Asia-Pacific (APAC) To Advance with Highest Growth Rate in Industry

Globally, APAC is predicted to witness the fastest growth in the cleanroom technology market during the forecast period. This can be majorly attributed to the increasing healthcare expenditure, growing demand for certified products, and rising focus on clean and sterile conditions for product manufacturing. Moreover, the growth in the pharmaceutical, biotechnology, and medical device sectors is contributing to the advance of the industry in the region.

Customized Cleanrooms Are Major Trend in Market

Customized cleanrooms are witnessing an increasing demand in the cleanroom technology market, since product manufacturing and processing need to be carried out in controlled environments, especially in terms of temperature, pressure, humidity, electrostatic charge, and magnetic flux. These conditions can be easily adjusted (as per the industry requirements) inside customized cleanrooms, which comprise ceiling grids, unidirectional plenums, and custom air handling equipment. Customized cleanrooms find applications in the R&D department in various industries, such as pharmaceutical, medical device, and biotechnology. Due to the increasing need for controlled environments in these industries, the demand for customized cleanrooms and associated equipment is on the rise.

Advancements in Cleanroom Technology

The cleanroom technology market has been witnessing various advancements that are helping to develop better-quality sterile products in order to improve the efficiency of cleanrooms. These advancements help provide an ideal, contamination-free environment for R&D and manufacturing applications. Besides, technologically advanced cleanroom products help overcome challenges in the designing and workflow of cleanrooms, which further drives their demand across the world. Moreover, technological advancements in cleanroom equipment, such as heating, ventilation, and air conditioning (HVAC) systems, high-efficiency particulate air (HEPA) filters, and fan filter units (FFUs), are helping in the better maintenance of cleanrooms. These advancements will likely lead to a huge demand for cleanrooms, thus driving the market growth globally.

Growing Prevalence of Infectious Diseases

According to the World Health Organization (WHO), in 2018, around 10 million people were diagnosed with tuberculosis and 1.2 million died of the same. Additionally, over 95% of the tuberculosis deaths occur in low- and middle-income countries. The burden of infectious diseases, including HIV, tuberculosis, malaria, hepatitis B, and neglected tropical diseases (NTDs), is higher in low-income countries due to the high treatment costs and lack of proper healthcare infrastructure. Thus, the rise in the incidence of infectious diseases is a key factor leading to an increase in the demand for medication, which, in turn, is driving the cleanroom technology market.

Rising Demand for Sterilized Pharmaceutical Products

The WHO has set parameters for making sterilized pharmaceutical products, such as quality control, sanitation, sterile preparation, and isolator and blow/fill/seal technology use, to prevent any kind of contamination. All these guidelines and conditions can only be met through the use of cleanroom technologies. Thus, the increasing demand for sterilized pharmaceutical products is resulting in a positive impact on the cleanroom technology market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$4,204.9 Million |

Forecast Period CAGR |

7.0% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Impact of COVID-19, Market Share Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Type, Construction, End-Use Industry, Region |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Japan, China, India |

Secondary Sources and References (Partial List) |

Arts and Humanities Research Council (AHRC), Asia Business Trade Association (ABTA), Biotechnology and Biological Sciences Research Council (BBSRC), British Safety Industry Federation (BSIF), Centers for Disease Control and Prevention (CDC), International Federation of Infection Control (IFIC), Medical Research Council (MRC), Ministry of Health and Family Welfare (MoHFW) of India |

Explore more about this report - Request free sample

Favorable Healthcare Regulations

According to the WHO, quality assurance during the clinical trials of pharmaceutical products is a must, and it should be in accordance with good clinical practices (GCP). Furthermore, according to the Pharmaceuticals and Medical Devices Agency (PMDA), certain guidelines regarding the production of sterile pharmaceutical products have been established, such as requirement for clean areas for manufacturing activities, good enough airflow, to be specified as grade A, and cleaning of product filling/sealing areas. Such stringent regulations imposed on the pharmaceutical industry are favoring the growth of the cleanroom technology market.

Market Players Are Engaged in Mergers and Acquisitions to Gain Competitive Edge

The global cleanroom technology market is fragmented in nature, with the presence of players such as M+W Group GmbH, Ardmac Ltd., Alpiq Holding Ltd., cleanroom.de GmbH, and OCTANORM-Vertriebs-GmbH.

In recent years, players in the cleanroom technology market have engaged in mergers and acquisitions in order to stay ahead of their competitors. For instance:

- In December 2019, DuPont de Nemours Inc. announced that it had signed an agreement to acquire closed-circuit reverse osmosis (CCRO) company , Desalitech Ltd. With this acquisition, the former company intended to provide a robust portfolio of cleanroom technologies to meet its customers' challenges, while advancing sustainability efforts.

- In September 2019, DuPont de Nemours Inc. announced its decision to acquire the ultrafiltration membrane business of BASF SE, including the latter’s international workforce, headquarters, and production site in Greifenberg, Germany, as well as its associated intellectual property.

Some of Key Players in Cleanroom Technology Market Are:

-

M+W Group GmbH

-

Ardmac Ltd.

-

Alpiq Holding Ltd.

-

cleanroom.de GmbH

-

OCTANORM-Vertriebs-GmbH

-

Monmouth Scientific Ltd.

-

Parteco Srl

-

Mach-Aire Ltd.

-

Cleanroom Systems Belgium

-

DuPont de Nemours Inc.

-

Kimberly-Clark Corporation

-

Taikisha Ltd.

-

Illinois Tool Works Inc.

Cleanroom Technology Market Size Breakdown by Segment

The cleanroom technology market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- Consumables

- Safety

- Gloves

- Apparel

- Cleaning

- Wipes

- Disinfectants

- Vacuum systems

- Safety

- Equipment

- Heating, ventilation, and air conditioning (HVAC) systems

- Fan filter units (FFUs)

- High-efficiency particulate air (HEPA) filters

- Laminar air flow systems and biosafety cabinets

- Air diffusers and showers

Based on Construction

- Standard

- Hardwall

- Softwall

- Pass-Through

Based on End-Use Industry

- Pharmaceutical

- Biotechnology

- Medical Device

Geographical Analysis

- North America

- U.S.

- Canada

- Europe Cleanroom

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- Japan

- China

- India

- Middle East and Africa (MEA)

- Latin America (LATAM)

The cleanroom technology market was valued at $4,204.9 million in 2019.

Hardwall cleanrooms offer higher internal air pressure because of their rigid wall construction, which will drive their sale in the cleanroom technology industry 2020–2030.

The pharmaceutical sector will generate the maximum revenue for the players in the cleanroom technology industry during 2020–2030.

The cleanroom technology market is fragmented in nature.

Fan filter units (FFUs), heating, ventilation, and air conditioning (HVAC) systems, and high-efficiency particulate air (HEPA) filters allow for easy cleanroom maintenance.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws