Market Statistics

| Study Period | 2019 - 2030 |

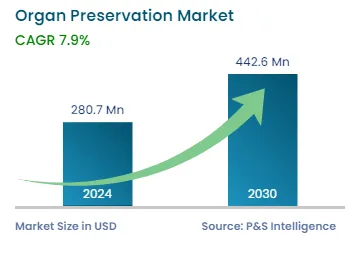

| 2024 Market Size | USD 280.7 Million |

| 2030 Forecast | USD 442.6 Million |

| Growth Rate(CAGR) | 7.9% |

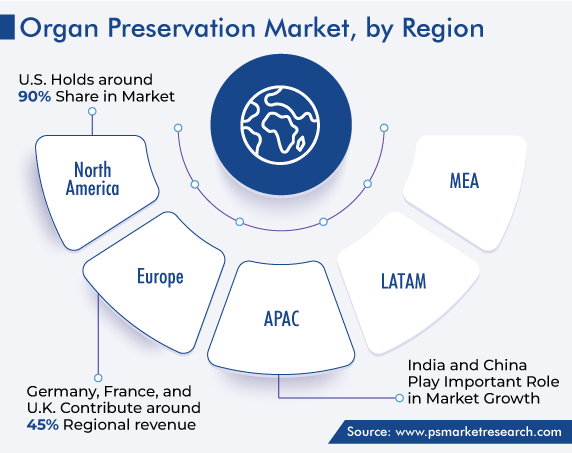

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 11942

Get a Comprehensive Overview of the Organ Preservation Market Report Prepared by P&S Intelligence, Segmented by Solution (University of Wisconsin Solution, Custodial HTK, Perfadex), Technique (Static Cold Storage, Hypothermic Machine Perfusion, Normothermic Machine Perfusion), Organ Type (Kidney, Liver, Lung, Heart, Pancreas), End User (Organ Transplant Centers, Hospitals, Organ Banks), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 280.7 Million |

| 2030 Forecast | USD 442.6 Million |

| Growth Rate(CAGR) | 7.9% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The organ preservation market size stood at USD 280.7 million in 2024, and it is expected to grow at a CAGR of 7.9% during 2024–2030, to reach USD 442.6 million by 2030. This is mainly attributed to the rising cases of multi-organ failure, the increasing number of organ transplants and organ donors, and the growing geriatric population. For instance, as per the United Network for Organ Sharing (UNOS), more than 42,800 organ transplants happened in 2022 in the U.S., a rise of 3.7% as compared to 2021.

Moreover, several initiatives taken by governments to create awareness about organ donation, a surge in healthcare income, and technological advancements, such as better organ transportation facilities and robot-assisted kidney transplants, are expected to propel the market growth throughout the forecast period.

Rising Incidences of Multiple Organ Failure

One of the most common causes of death in ICUs is multiple organ failure, occurring due to septicemia. According to a journal, it is estimated that the fatality rate due to septic shock & multiple organ dysfunction syndromes, if not treated in due time, could be around 28–56%. Moreover, the geriatric population is in danger of developing acute renal failure diagnosed with sepsis, showing a rate of up to 20% of acute respiratory failure. This is because of an age-linked fall in the renal plasma flow and glomerular filtration rate.

Furthermore, diabetes greatly increases the risk of various problems and the failure of multiple organs. Also, the occurrence of liver cirrhosis and tuberculosis among the population is resulting in the failure of organs needing organ transplantation. Hence, such factors are promoting the market for organ preservation.

The UW solution category accounted for the largest revenue share in 2022. This is attributed to the rising adoption of this solution, as it has metabolically inert substrates, including raffinose and lactobionate. These substrates enable less historical damage, improved transplantation outcome, and better physiological function of organs in comparison to other solutions. In addition, it is the most commonly used solution for organ preservation, as it can flush and cold store the liver, kidneys, and pancreas. It is the first intracellular preservation solution and is treated as the standard for the preservation of organs.

Moreover, this solution is ideal for preserving liver grafts of humans, for a time period of more than 15 hours. It permits easy transportation of organs over large distances without causing any damage. Hence, it is especially used for liver preservation resulting in a higher success rate of liver transplantation.

Whereas, the perfadex solution category is expected to exhibit the highest CAGR during the forecast period. This can be due to the specialized formulation of the solution to preserve an organ’s function and integrity, as it is rich in endothelium during cold ischemic storage as well as flushing before reperfusion and transplantation.

The static cold storage category accounts for the largest revenue share, due to its broad applicability and increasing usage and the presence of various players providing static cold storage services. This technique entails the transportation of a donor’s organ on ice and considered a gold standard for preservation in the last decade. Also, this confides in hypothermia to lower the cellular metabolism and demand for oxygen during a prolonged preservation time of organs.

Whereas, the normothermic machine perfusion category is projected to witness the fastest growth during the forecast timeline. This can be because this technique offers ample nutrition and oxygen for the process of aerobic metabolism and decreases the pro-inflammatory response of the liver and the risk of ischemia damage, supporting the graft healing process.

Additionally, the technique is improving the safety of an organ by recreating physiologic conditions by maintaining the average organ temperature consistent during the delivery of important substrates for metabolism, feeding, and oxygenation. Also, for increasing the contingency of long-term graft survival and enhancing the result of marginal donor kidney transplantation, this technique is extensively used. Thus, these factors are expected to boost the market growth in this category in the coming future.

The kidneys category held the largest revenue share, of 30%, in 2022. This is primarily ascribed to the rising number of end-stage renal diseases, which require kidney transplantation for therapeutic treatment. Also, the incidence of kidney failures across the globe is increasing. Kidney disorders usually worsen with time and lead to kidney failure and various other health issues like heart attack and stroke. For instance, an estimated 2 in 1,000 Americans are having end-stage kidney disorders, and approximately 1 in 7 U.S. adults have chronic kidney disease.

Moreover, many public awareness campaigns associated with the benefits of surgical treatment are propelling the growth of the market in this category. For instance, the National Kidney Foundation launched ‘The Advancing American Kidney Health’ initiative for improving the availability of organs accessible for transplant.

Whereas, the heart category is expected to have the fastest growth during the forecast period. This can be attributed to the rising demand for heart transplants. For instance, according to the National Library of Medicine Journal, roughly 2,000 heart transplants are performed every year in the U.S. In addition to that, in 2021, a total of around 4,599 heart transplantations occurred in North America and approximately 2,350 heart transplants were performed in the European region.

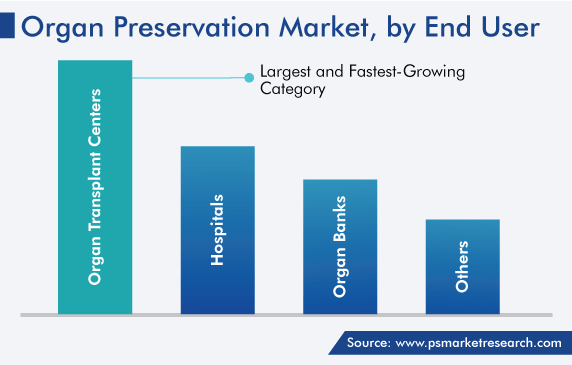

The organ transplant centers category is expected to grow at the highest rate in the market for organ preservation during the forecast period, based on end user. This can be due to the rising number of transplant centers across the world, which are highly equipped with technologically advanced products and the latest techniques. In these facilities, organs can easily be preserved for a long duration and remain viable.

Additionally, the increasing awareness among donors and patients about the availability of specialized surgeons and doctors in these centers for carrying out procedures is fostering the growth of the market in this category. Together with a strong procurement of organs, tissues, and transplantation networks, these centers are engaged in associated research and development that results in technological as well as organ transplantation procedure advancements.

Moreover, due to the increasing government supports for the development of advanced biobanking facilities, healthcare providers are also preferring biobanks along with organ transplantation centers for preserving organs. This is one of the most trending facts observed in the bio-preservation sector. These biobanks are government funded and offer several types of services at a minimal cost.

Drive strategic growth with comprehensive market analysis

North America leads the organ preservation market, with a revenue share of 45% in 2022. This is attributed to the rising need and adoption of organ transplantation due to the occurrence of several chronic disorders in the region and the surging need for preservation solutions for keeping the viability of organs in ex-vivo settings. Additionally, better reimbursement policies, growing acceptance of innovative healthcare technologies, and rising investments for better healthcare infrastructure are fueling the regional market.

Canada contributes around 10% to the North American market. The market is growing due to increased number of transplant patients in the country, even though the organ donor number is less. Therefore, to fulfill the gap, the Government of Canada invested USD 2 million for research on innovative organ and tissue donation projects in April 2022. One such project being undertaken by BI Expertise and Ortho BioMed will receive USD 1 million for over two years, from Health Canada to test and develop prototype tools that utilize artificial intelligence for accurately matching organ donors with recipients.

Moreover, the increasing FDA approvals and the rising number of kidney disorders in the U.S. are driving the market growth. For instance, in September 2021, TransMedics Group Inc. received the FDA-granted premarket approval for its OCS Liver System for the preservation and assessment of donor livers for transplantation from donors after brain death (DBD) and after circulatory death (DCD).

This report offers deep insights into the organ preservation industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Solution

Based on Technique

Based on Organ Type

Based on End User

Geographical Analysis

The organ preservation market size stood at USD 280.7 million in 2024.

During 2024–2030, the growth rate of the organ preservation market will be 7.9%.

Organ transplant center is the largest end user in the organ preservation market.

The major drivers of the organ preservation market include the rapid increase in the number of organ failures across the globe, especially those with chronic kidney disorders and chronic conditions; the growing geriatric population; the rising disposable income in emerging economies; and the surging number of government awareness programs revolving around encouraging organ donations.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages