Online Pharmacy Market Future Prospects

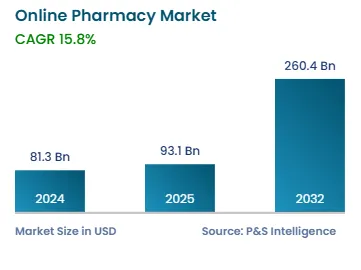

The global online pharmacy market size stands at USD 81.3 billion in 2024, which is expected to reach USD 260.4 billion by 2032, advancing at a CAGR of 15.8% during 2025–2032. This is ascribed to the rising number of internet users, widening access to online services, and the surging use of e-prescriptions in hospitals and other healthcare settings.

Furthermore, the increase in teleconsultation and diagnostic support drives the e-pharmacy market growth. Over the years, healthcare facilities for the management of chronic diseases have been the hallmark of medical care. However, since the introduction of telehealth/teleconsultation, treatment pathways have changed all over the world. Nowadays, e-prescriptions can be generated through remote consultation, which can be used to purchase drugs through online pharmacies. This has led to savings in patients' time and an increase in the efficiency of healthcare providers.

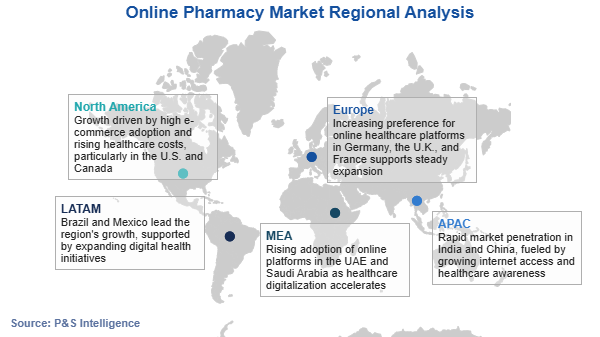

Further, there is the active involvement of companies integrating their electronic health record (EHR) platforms with telehealth, which further boosts the market growth. The shortage of healthcare professionals in some regions is prompting the adoption of telehealth services. For instance, the U.S. would witness an estimated shortage of 37,800–124,000 physicians by 2034, including shortfalls in both primary and specialty care.

Furthermore, due to the unavailability of certain medications in retail pharmacy stores, a large patient pool worldwide prefers to order them online and have them home-delivered. Furthermore, e-pharmacies reduce chronically ill patients' and elderly citizens' reliance on third parties to obtain medicines and healthcare supplies.

The COVID-19 pandemic had a significant impact on the e-pharmacy market, due to the increase in consumer preference for online purchase of drugs coupled with social distancing norms, and the emergence of various online pharmacies. Moreover, the additional benefits offered by various e-pharmacies also shifted consumers toward the online purchase of drugs. For instance, CVS Pharmacy has upgraded its CarePass membership program with prescription delivery within hours. Additionally, the company has exempted the delivery charges for CarePass members with an eligible prescription.

Further, the online sales of various healthcare items, such as face masks, hand sanitizers, antibacterial creams, and drugs, also burgeoned during the pandemic.