North America Electric Scooters and Motorcycles Market Analysis

The North American electric scooters and motorcycles market size was valued at USD 727.9 million in 2023, and it is expected to grow at a CAGR of 18.4% during 2024–2030, to reach USD 2,360.5 million by 2030.

The growth is predominantly driven by government support, both at the federal and state levels. To boost the adoption of EVs, subsidies and tax rebates are being offered on their purchase. Besides, non-monetary incentives, such as the provision of special lanes and licensing benefits, are encouraging the adoption of battery-operated two-wheelers in North America. Moreover, the growing need for sustainable urban mobility infrastructure is driving the transition from the conventional to the electrical mode of transport in the region.

In addition, there has been a significant rise in the investments in R&D on such two-wheelers by the key stakeholders in the region. This has led to a rise in the number of startups offering such scooters for ride-sharing purposes. For instance, Lime has proposed to invest $50 million to expand its shared EV network, which involves the addition of a new model and an almost doubling of the number of cities in which the company operates.

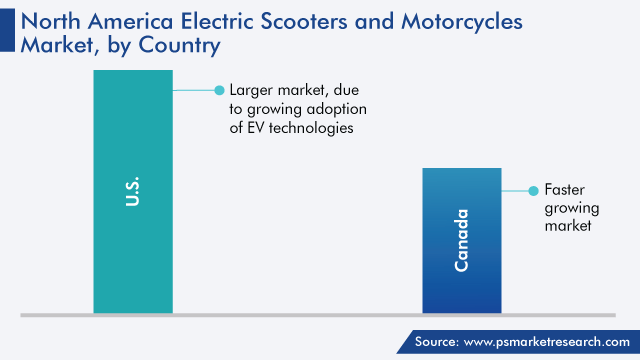

In North America, the U.S. alone accounts for over two-thirds of the total sales. In California and Massachusetts, tax rebates are available for the adoption of battery two-wheelers.