Market Statistics

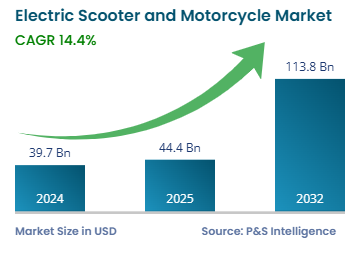

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 39.7 Billion |

| 2025 Market Size | USD 44.4 Billion |

| 2032 Forecast | USD 113.8 Billion |

| Growth Rate(CAGR) | 14.4% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 11115

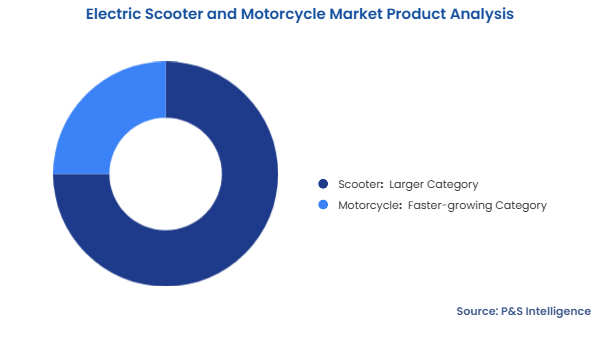

This Report Provides In-Depth Analysis of the Electric Scooter and Motorcycle Market Report Prepared by P&S Intelligence, Segmented by Product (Scooter, Motocycle), Battery Type (Sealed lead acid, Lithium-ion), Voltage (36 V, 48 V, 60 V), Technology (Plug-in, Battery), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 39.7 Billion |

| 2025 Market Size | USD 44.4 Billion |

| 2032 Forecast | USD 113.8 Billion |

| Growth Rate(CAGR) | 14.4% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The electric scooter and motorcycle market was USD 39.7 billion in 2024, and the market size is predicted to reach USD 113.8 billion by 2032, advancing at a CAGR of 14.4% during 2025–2032.

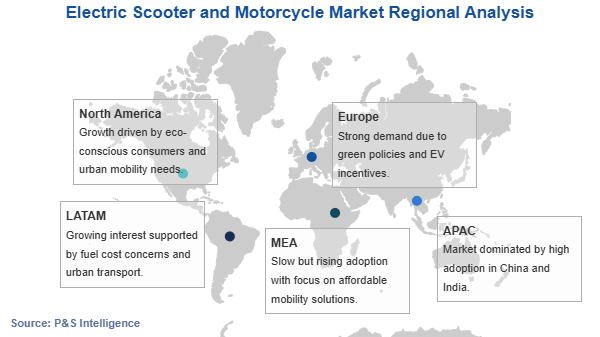

The market expansion of electric two-wheelers occurs because technology advances in battery technology deliver better performance along with reduced cost. The future outlook indicates rising market expansion. Market expansion for electric two-wheelers shows no signs of slowing because battery prices decrease and more people understand environmental concerns while government programs create additional momentum. The combination of smart features with the development of charging infrastructure will improve user experience and convenience to increase adoption rates. Governmental data underscores this trend. National e-scooter trials conducted by the UK Department for Transport examined both traffic mobility and safety results.

These trials have generated important knowledge about what people think about e-scooters as well as the regulatory needs related to their use. Government policies in support of environment-friendly vehicles, primarily in emerging economies of APAC, and the growing e-retailing of electric vehicles are playing a pivotal role in the industry's growth.

The products analyzed here are:

The battery types analyzed here are:

The voltages analyzed here are:

The technologies analyzed here are:

Drive strategic growth with comprehensive market analysis

The APAC region held the largest market share, of 45%, in 2024, and will grow at a higher CAGR, of 16%, during the forecast period. The growth in the regional market can be attributed to rising urbanization, increasing per capita income, and favorable government policies for electric vehicles, which are resulting in the high adoption of electric scooters and motorcycles in the region. The adoption of electric vehicles received accelerated momentum through government initiatives which included subsidies tax exemptions and incentives. China strengthened its market through both emissions control requirements and financial backing programs that supported local EV manufacturers. The manufacturing sector in this area functions through major players Yadea AIMA and Niu Technologies which create affordable electric two-wheeler models to reach more consumers.

Market expansion in this sector advances rapidly because consumers increasingly care about the environment which drives them to adopt eco-friendly solutions for reducing their carbon emissions. Electric scooters and motorcycles have become more functional and desirable because of technological developments that enhanced battery power vehicle distance capabilities and charging system development. The combination of regional economic development and rising disposable incomes allowed consumers to start adopting electric mobility solutions because they now have more funds available to purchase EVs. Asia-Pacific remains the global leader in electric mobility since the region maintains strong market dominance through constant technological advancement coupled with government backing for sustainable transportation adoption.

The regions analyzed in this report are:

The electric scooter and motorcycle industry demonstrates fragmented because multiple manufacturers operate at both global and regional levels. Electric vehicles now dominate the UK market after reaching new registration records for EVs and achieving the lowest COâ‚‚ emission levels for new cars. The UK electric scooter segment includes multiple companies known as Electric Scooters Ltd operating within this market sector. The marketplace demonstrates rapid growth from technological development along with environmental protection efforts combined with government backing. The UK government dedicates £120 million to electric van promotion as well as electric taxi and motorcycle adoption to speed up the shift toward zero-emission vehicles.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages