Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 407.8 Million |

| 2030 Forecast | USD 546.3 Million |

| Growth Rate(CAGR) | 5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12696

Get a Comprehensive Overview of the Natural Fiber Composite Market Report Prepared by P&S Intelligence, Segmented by Type (Wood, Cotton, Flax, Kenaf, Hemp), Resin Type (PP, PE, PA), Technology (Injection-Molding, Compression-Molding, Pultrusion), Application (Automotive, Electronics, Sporting Goods, Construction), Matrix (Inorganic Compound, Natural Polymer, Synthetic Polymer), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 407.8 Million |

| 2030 Forecast | USD 546.3 Million |

| Growth Rate(CAGR) | 5% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The natural fiber composites market generated revenue of USD 407.8 million in 2024, which will reach USD 546.3 million by 2030, advancing at 5.0% CAGR between 2024 and 2030. This is ascribed to the rising demand for sustainable and eco-friendly materials in various industries and the numerous advantages of natural fiber composites (NFCs).

They integrate natural fibers, such as hemp, flax, jute, and kenaf, with a polymer matrix to create lightweight, sturdy, and environment-friendly materials.

The growing awareness amongst consumers and manufacturers regarding the environmental impact of traditional materials is fueling the usage of NFCs. They offer several benefits over conventional composites, inclusive of a smaller carbon footprint, decreased energy consumption during production, and better recyclability. As result, industries such as automobile, construction, aerospace, and consumer goods are adopting these materials in increasing quantities in their products.

The automobile sector, particularly, has emerged as a strong driving force for the natural fiber composites market. The stringent regulations aimed at lowering carbon emissions and enhancing fuel performance have forced vehicle manufacturers to use lightweight alternatives in place of standard materials. Here, NFCs prove useful by offering mix of strength, low weight, and sustainability. Therefore, they are being utilized in various automobile applications, such as interior components, door panels, seat backs, and trunk liners.

Another key factor contributing to the increase in NFC consumption is the growing focus on research and development. Manufacturers are making significant investments in creating new and advanced natural fibers with enhanced compatibility with polymer matrices. They are also optimizing their manufacturing strategies to fulfill the unique necessities of different industries. This continuous innovation is expanding the range of applications for natural fiber composites and driving the market growth.

The automotive industry is a significant driving factor for the natural carbon fiber composites market. With the rising concerns about greenhouse gas emissions, fuel efficiency, and sustainability, automobile OEMs are actively looking for lightweight substances to reduce the weight of automobiles and enhance their overall performance.

One of the primary advantages of NFCs for the automotive industry is their amazing strength-to-weight ratio. These composites are enormously lightweight, but they possess exceptional strength and stiffness, which makes them perfect for the structural components of vehicles. By incorporating NFCs, automakers can extensively reduce the weight of automobiles, which leads to an improved fuel efficiency and reduced carbon emissions.

Moreover, natural carbon fiber composites (NCFCs) offer amazing impact resistance, which is important for ensuring passenger safety in vehicles. The high electricity absorption capacity of these composites makes them effective in absorbing and dispersing impact, thereby saving passengers in the event of a crash.

In addition to weight loss and safety advantages, NCFCs provide flexibility and versatility in automotive design. They can be molded into complex shapes and incorporated into numerous parts of the car, such as frame panels, chassis components, indoors trims, and structural reinforcements. This flexibility lets manufacturers and engineers optimize the usage of materials in modern and efficient automobile designs.

Furthermore, the usage NCFCs in the automotive industry aligns with the rising client demand for sustainable and low-emission vehicles. As customers become increasingly environmentally aware, they will choose automobiles made of lightweight and sustainable materials. NCFCs, being derived from renewable resources, make significant contributions in minimizing the environmental impact of vehicles during the course of their lifecycle.

The need for recyclability is a significant driver for the natural fiber composites market. The ability to recycle and reuse NFCs addresses environmental issues, promotes sustainable practices, and gives monetary advantages all through the value chain.

Unlike traditional carbon fiber composites, which can often be tough to recycle due to the complex and energy-intensive processes involved, the natural variants can be recycled to yield higher amounts of ingredients. These composites can go through mechanical recycling, wherein they are chopped, ground, and shredded into smaller pieces, which could be used to extract useable material.

Recyclability gives several environmental benefits, the biggest of which is the reduction in the dependence on virgin raw materials. By recycling NFCs, the demand for new raw materials is reduced, which helps maintain natural resources and lower the environmental impact of their extraction and processing. Moreover, recycling facilitates prevent composite waste from entering landfills, thus mitigating the problem of waste accumulation and minimizing the discharge of harmful materials into the environment.

Economies are targeting the creation of a closed-loop system, where materials are continuously reused, thus reducing waste and promoting resource efficiency. Being easily recyclable, NFCs contribute in achieving a more-sustainable and circular technique for material utilization.

Recyclability, additionally, brings financial benefits to the natural fiber composites market as reprocessing composite waste reduces the cost associated with waste disposal and landfilling. Additionally, recycled NFCs can be obtained at a lower cost in comparison to their virgin counterparts, which makes the former even more attractive for various industries. The ability to be reprocessed expands the market possibilities and enhances the competitiveness of the material.

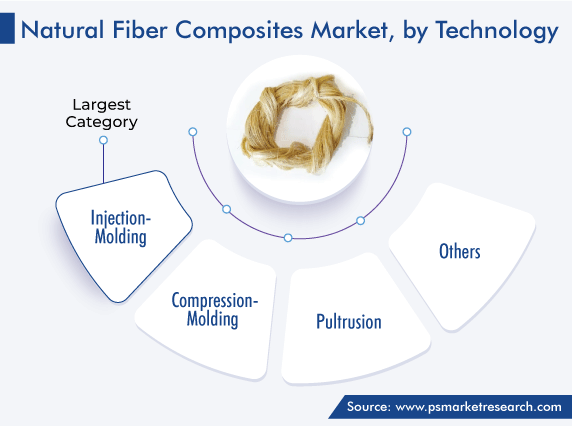

Injection-Molding Category Held Largest Share

Based on technology, the injection-molding category accounted for the largest share, of around 50%, in the market in 2023, and it will further maintain its dominance in the future. This is because, by using this technology, this material can be utilized for mass production. The process involves injecting molten material into a mold or hollow space, to create products with complex shapes.

Injection-molding offers high manufacturing performance and cost-effectiveness. It allows for the mass production of components with consistent quality and more precision, which makes it appropriate for various industries, such as automotive, construction, and packaging.

Furthermore, the adaptability of injection-molding plays an important role in its market dominance. The potential to mix natural fibers with thermoplastic polymers through the injection-molding technique opens up possibilities for developing lightweight, durable, and sustainable products.

Additionally, this method allows for the production of delicate and complicated shapes with exceptional surface finish. This makes it rather appropriate for manufacturing parts and components that require a precise geometry and visual appeal. In industries such as automotive and aerospace, in which both functionality and design are crucial, injection-molded NFCs offer a compelling solution.

The automotive industry, specifically, drives the demand for injection-molded NFCs. With the strengthening emphasis on weight reduction, fuel efficiency, and sustainability, automakers are looking for the latest materials and fabrication techniques. Natural fiber composites processed by injection-molding offer a combination of a low weight and eco-friendliness for diverse automobile components, including interior trims, door panels, and structural reinforcements.

Drive strategic growth with comprehensive market analysis

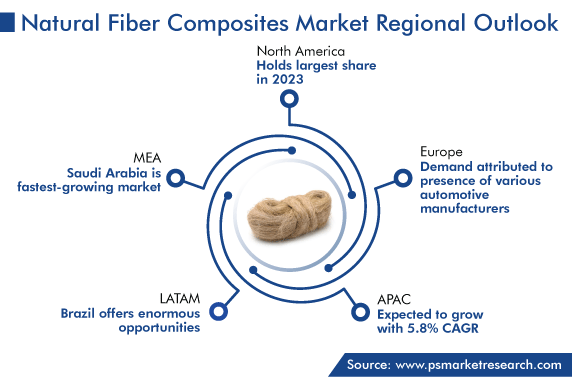

APAC held a significant share in the market, of around 20%, in 2023. This is because of the region's strong economic growth and the increasing consumption of natural fiber composites in various industries, such as automotive, electronics, and construction.

The rampant infrastructure development and authorities’ supportive initiatives for R&D on sustainable materials have created a supportive environment for the adoption of NFCs in the region, led by India, China, Japan, Malaysia, and South Korea. These countries are also making huge investments in research and development for new ways of utilizing eco-friendly materials in construction projects and the automotive industry.

Due to the rising demand for lightweight and electric vehicles, high investments in research and development in various industries, such as healthcare and automotive; presence of key players, and high adoption of advanced technologies in the region.

Europe has been at the forefront of sustainable practices and environment-friendly technologies. The region has a strong focus on decreasing carbon emissions, promoting the economy, and investing in renewable resources. These elements create a good environment for the usage of natural fiber composites across numerous industries, such as automotive, production, aerospace, and consumer goods. The construction industry is also adopting NFCs for applications such as insulation, decking, and furniture.

European countries, including Germany, France, the Netherlands, and the U.K., had been actively making an investment for utilizing NFCs and other cleaner materials in infrastructure projects. This becoming possible due to the collaborations between industries, market players, and government organizations to advance NFC technologies.

This fully customizable report gives a detailed analysis of the natural fiber composites industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Type

Based on Resin Type

Based on Technology

Based on Application

Based on Matrix

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages