Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,612.8 Million |

| 2030 Forecast | USD 4,337 Million |

| Growth Rate(CAGR) | 8.8% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12595

Get a Comprehensive Overview of the Mobile Video Surveillance Market Report Prepared by P&S Intelligence, Segmented by Offering (Hardware, Software, Services), Application (Buses, Transport Vehicles, Police Vehicles, Drones), Vertical (Law Enforcement, Industrial, Military & Defense, First Responders, Transportation), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,612.8 Million |

| 2030 Forecast | USD 4,337 Million |

| Growth Rate(CAGR) | 8.8% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

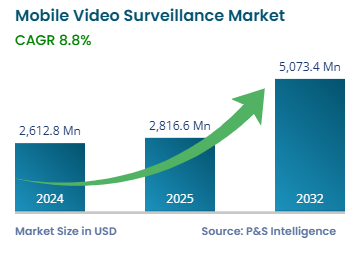

The mobile video surveillance market size stood at USD 2,612.8 million in 2024, and it is expected to advance at a compound annual growth rate of 8.8% during 2024–2030, to reach USD 4,337 million by 2030.

The increase in the demand for these solutions can be attributed to the rising use of the internet, coupled with the burgeoning adoption of tablets and smartphones, which, in turn, will drive the demand for a higher storage capacity. Over the years, the market has grown because of the strong need for wireless video streaming with a camera transmitting the live feed directly to a control center.

Moreover, many key players are heavily investing in R&D and various other strategies to allow themselves to offer innovative surveillance systems. For instance, Axis Communications launched the next generation of its AXIS M11 Box cameras in June 2022. They offer high-resolution images even in inadequate light and include a CS-mount offering support for motorized i-CS lenses, for zooming.

Essentially, the growth in the demand for these devices can be attributed to the rising security and safety concerns in various countries. With the increasing usage of smartphones and mobile applications for addressing security issues, this form of video surveillance could be a promising method of ensuring public good.

The adoption of body-worn video cameras by police forces is one of the key trends. Besides mobility, body-worn cameras aid in recording an event as viewed by a police officer. The usage of drones by police forces in various countries, such as the U.K. and the U.S., to extend their coverage is another trend. Along with this, the rapid adoption of HD recording cameras is boosting the growth of the market. 1080p cameras are increasingly being adopted as they provide a detailed clip of an incident.

The use of AI in cameras aids in taking better photos, by optimizing the camera settings accordingly and identifying objects and scenes intelligently. Before the integration of AI, video monitoring was a passive tool and required constant monitoring to ascertain the existence suspicious activities. With the integration of AI in video examination, systems can monitor a specific activity and respond accordingly. A comprehensive AI-integrated system also contains programs to analyze the camera’s audio and images, to recognize humans. The increasing demand for real-time and remote access among users, to continuously observe industrial sites, is another key opportunity solution providers can leverage.

In addition, various technological advancements are revolutionizing video surveillance, including high-resolution cameras and improved video compression, which allows one to analyze a wider field of view than before. Artificial intelligence algorithms can then be applied to spot patterns, faces, and objects, which enhances the quality and value of that observation.

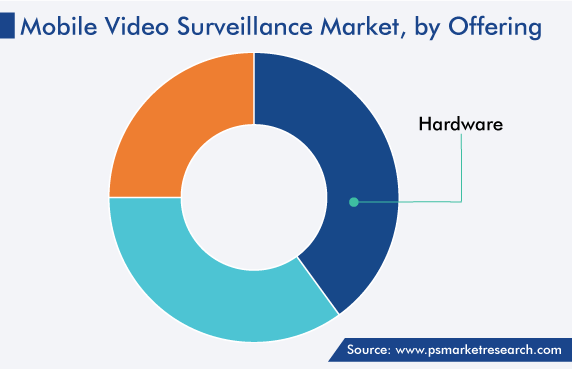

Based on offering, the hardware category holds the major share, of 42%, ascribed to the advancements in cameras, such as enhanced recording quality in low light, integrated motion sensors for object tracking, data encryption and other cybersecurity measures, in-built microphones to record audio along with the video, and support for both Wi-Fi and cellular networks.

Further, the increasing adoption of mobile video surveillance systems worldwide is attributed to the reducing prices of such cameras, which will further increase the demand for storage solutions at the highest CAGR during the forecast period.

Additionally, IP cameras offer better functionality at a low cost, including capturing images at a higher frame rate and resolution, which is driving the growth in their sales. The adoption of such solutions for sharper, HD digital images and the advancements in video analytics and neural networks aid in transitioning from analog to IP cameras. These devices transmit digital signals and offer a greater reel detail, which makes them more suitable for facial recognition or detection of license plate numbers.

Buses are the major application, attributed to the need for recording the activities inside them. The idea is to ensure security by preventing unlawful activities, enabled by the detection of criminals, and provide a secure and safe environment to passengers. Thus, the demand for such solutions is increasing among bus transit systems and at bus stations. Various fleets of trucks, school buses, and security vans use these systems to record live happenings and gather real-time information. Such systems are ideal for accurately tracking location, ensuring safety and security, improving communications, and for passenger information systems, public announcement systems, and fleet management applications.

The transportation vertical is expected to hold the largest share, of more than 60%, owing to the continuous efforts of transport authorities, governments, and companies to provide more-flexible and convenient technologies in order to offer passengers protection from thefts, fraud, vandalism, and terrorism. With the use of smartphones and tablets, the concept of the real-time monitoring of live video feed comes within reach. The feed can be accessed through mobile devices, such as smartphones, tablets, and laptops, connected to the internet, which aids in enhancing public safety and security by providing timely intervention in any unwanted incident.

The deployment of these systems on mass transit vehicles has increased in the past few years with the strengthening focus on enhancing the security and safety of people. Moreover, both interior and exterior cameras can be integrated, based on the type of vehicle. The interior cameras monitor passengers and personnel and also share valuable information, to reduce crime and acknowledge liability claims from both customers and personnel. On the other hand, the exterior cameras’ function is to monitor the vehicle’s operations and deliver evidence in the event of an accident. The majority of these systems support HD recording and capture reels at anywhere between 20 and 30 frames per second. The captured reel is recorded on a digital video recorder (DVR) located remotely, such as at a zonal transportation control center.

Another significant application of such systems is in military & defense, because it is easy to deploy and integrate drones into the Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) system. They are also used to carry out a variety of missions, such as illegal traffic monitoring, mountain search and rescue, supporting ground forces, and intelligence gathering. In addition, they help prevent the entry of refugees in crucial areas, including border areas and military base camps, monitor peace treaties, ensure security, and enable resource exploration and target tracking.

Drive strategic growth with comprehensive market analysis

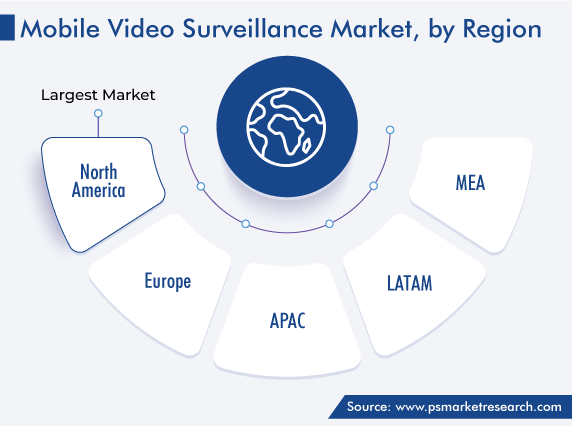

North America has the leading position in the mobile video surveillance market, and it will hold the same position till 2030, with a value of USD 1,080 million, attributed to the rapid adoption of advanced technologies. The region has also witnessed various criminal and terrorist attacks in the past few years. Therefore, the increasing use of these cameras along international and state borders will propel the demand for them in the region in the forecast period.

In North America, the U.S. holds the leading position, and it will grow with a CAGR of around 8.7%, attributed to the rising criminal activities and border trespassing. The growth in the country is also driven by the rising installation of equipment for the purpose of reconnaissance. In addition, the deployment of smart transportation systems in the country, including automatic toll collection systems and automated speed limit enforcement cameras, boosts the demand for such solutions for license plate recognition and vehicle speed detection.

The increasing requirement for safety in high-risk areas, integration of IoT, and surge in the pace of transition from analog to IP cameras also propel the growth in the country. Moreover, the rapid development of smart cities is expected to offer various opportunities.

The report analyzes the impact of the major drivers and restraints on the mobile video surveillance industry, to offer accurate market estimations for 2019–2030.

Based on Offering

Based on Application

Based on Vertical

Geographical Analysis

The market for mobile video surveillance solutions was worth USD 2,612.8 million in 2024.

The mobile video surveillance industry CAGR for 2024–2030 will be 8.8%.

The market for mobile video surveillance solutions is driven by the increasing crime rate and rising risk of terror attacks.

The transportation vertical dominates the mobile video surveillance industry.

North America is the largest market for mobile video surveillance solutions, and APAC will witness significant growth.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages