Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4.5 Billion |

| 2030 Forecast | USD 11.9 Billion |

| Growth Rate(CAGR) | 17.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 10328

Get a Comprehensive Overview of the Millimeter Wave Technology Market Report Prepared by P&S Intelligence, Segmented by Component (Antennae & Transceivers, Frequency Sources, Communication & Networking Devices, Imaging Components, RF Devices, Sensors & Controls), Product (Scanner Systems, Radars & Satellites, Telecommunication Systems), Frequency Band (24-57 GHz, 57-86 GHz, 86-300 GHz), License Type (Light, Unlicensed, Fully Licensed), End User (Telecom & Datacom, Military, Defense, & Aerospace, Automotive, Industrial, Consumer, Medical), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 4.5 Billion |

| 2030 Forecast | USD 11.9 Billion |

| Growth Rate(CAGR) | 17.6% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

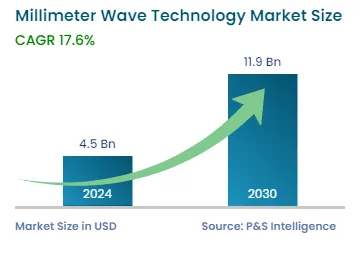

The global millimeter wave technology market size was USD 4.5 billion in 2024, which is projected to reach USD 11.9 billion by 2030, propelling at a CAGR of 17.6% during 2024–2030.

This has a lot to do with the fact that this technology is crucial in the telecommunications, aerospace, and healthcare sectors. The increasing adoption of monitoring systems, imaging devices, advanced security measures, smartphones, tablets, and electronic devices is driving the market growth.

A lot of products are dependent on this technology, such as phones, vehicles, and medical equipment, as all of them work under the extremely high frequency (EHF) range, of 30– 300 GHz, and carry wavelengths of 1–10 nm. The primary objective of this technology is to ensure high-speed wireless communication. Moreover, it enables secure data transmission, which plays an important role in multiple activities, including video streaming, gateway transactions, file downloads, and real-time data transfer.

In addition, the millimeter wave spectrum is imperative for meeting the data and security needs of future technologies and applications, due to its potential of handling great data volumes at high speeds and minimal latency. As societies throughout the world are growing dependent on digital technologies, the requirement for data-intensive applications, such as virtual reality devices, real-time design software, and internet of things (IoT), will mandate a re-evaluation of data flow management.

Additionally, frequencies of 28 GHz and 39 GHz are crucial for the development of 5G networks in the mmWave spectrum. These frequencies perform well in catering to the surging data needs of mobile-first users, connected homes, augmented and virtual reality devices, cloud gaming systems, autonomous vehicles, IoT sensors, and other cloud-connected devices. With the help of these frequencies, people can transmit data at extremely high speeds and at great volumes.

Furthermore, this technology is scalable to a great extent, thus ensuring connectivity to billions of devices, as well as enabling a secure and fast network that facilitates reliable speeds. With the advent of this advance network, various industries are seeing a revolution, and it is also changing the way people live, work, learn, and engage in fun activities, by providing the uninterrupted delivery of rich, data-intensive content at fast speeds and minimal network latency.

Growing Usage of Data-Intensive Applications Drives Market

The increasing adoption of data-intensive applications, the surging acceptance of smart devices, and the improving wireless technologies are the primary factors driving the need for the millimeter wave technology. These applications demand high-speed communication with faster data transmission, high bandwidth, and the potential to handle massive amounts of data, especially for high-resolution media. This technology is fully able to meet these requirements, which is why it is important for the deployment of .

Moreover, the continuous testing of 5G networks is adding to the demand for this technology. Countries with a sound infrastructure and cutting-edge technology are actively seeking to deploy 5G networks, which require the low-latency processing of large data volumes. Further, high frequencies are greatly needed for this technology so networks are able to provide high-speed data transfer over short distances. Overall, these high frequencies are needed to ensure seamless wireless communication performance in 5G networks.

Additionally, the work-from-home model has become common among MNCs in many countries. IT, BPO, and many other kinds of companies are making considerable efforts to ensure a smooth transition to the work-from-home model for employees. However, these circumstances lead to the possibilities of network bottlenecks. In order to achieve an optimum performance, both employers and employees need to upgrade their network speeds. Therefore, ISPs are finding areas of full nodes and dividing them, to deliver optimal services.

Furthermore, the military and defense sector is witnessing a significant growth in the demand for this technology. The sector has requirements for enhanced satellite communications, radar systems, and electronic warfare. This technology is crucial for aspects such as transmitting orders, military intelligence, and enabling the setup of operational commands during war situations.

Based on component, the antenna and transceiver components category accounts for the largest revenue share. This has a lot to do with the fact that mmWave radio lines are important for backhaul solutions in the telecommunications infrastructure, particularly for cellular wireless access. 5G uses millimeter waves with frequency bands 10 times higher than conventional networks.

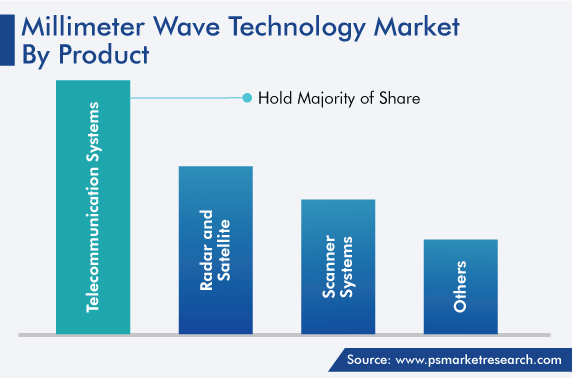

The market, on the basis of product, is led by the telecommunications equipment category, with a revenue share of 70% in 2022, owing to the increasing number of smartphone users across the world.

Moreover, enterprise-level data centers are extensively adopting this technology. A continuous bandwidth above 24 GHz is mandatory to meet the high-volume data requirements of 5G services. Research and development experts have performed tests and proved that this technology can attain multigigabit-per-second data rates, thus enabling high-speed wireless communication.

Furthermore, new tactics are coming to light in the competitive picture of the market. One such tactic is using sub-6-GHz bandwidths for the uplink and mmWave technology for the downlink. Millimeter wave bands are utilized in a variety of communication scenarios, including point-to-point, inter-satellite, and point-to-multipoint communications.

The second-largest share of the market is captured by radar and satellite systems. This is due to the increasing focus of nations on developing their intelligence and defense capabilities, where satellite communication plays an important role.

On the basis of frequency band, the 24–57 GHz category is the leading contributor to the market. This is because the 24–57 GHz frequency spectrum range is mostly used for mobile and radio services.

This spectrum range has gathered considerable attention from many economies worldwide due to the rising adoption of IoT devices, the expanding 5G connectivity, and the surging demand for broadband services in both the commercial and residential sectors.

Moreover, networking technology companies are intently looking for the competence of these frequency bands and scouting opportunities across industries. Additionally, the frequency spectrum consists of licensed bands, which helps explore applications not only in telecommunications but also in satellite communications, the automotive sector, and other related fields.

Telecom and datacom is the largest revenue contributor, with a share of 40% in 2022, and it is expected to witness the same pattern in the coming years. This is owing to the fact that the 5G technology is being massively deployed across various locations as it can deliver extraordinarily high data speeds and capacities. Moreover, the technology acts as a baseline for wireless and mobile networks, enabling data speed of up to 10 Gbps.

Drive strategic growth with comprehensive market analysis

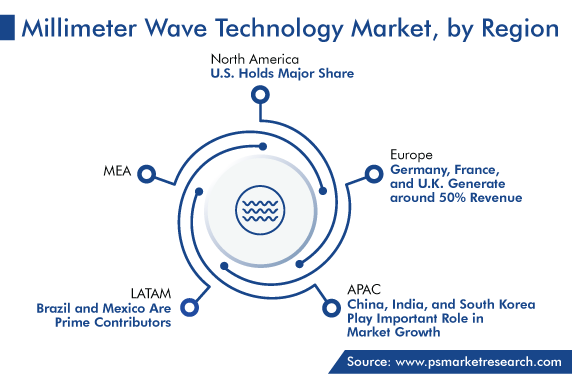

Globally, the APAC millimeter wave technology market is expected to dominate in the coming time.

This is due to the increasing deployment of 5G networks, which provide enhanced security and faster data access to smartphone and IoT device users. Further, there has been an incessant surge in the demand for high-speed networks to support smart applications in both the commercial and residential sectors, thus adding to the industry revenue growth in the region.

North America holds the largest market share. This is because of the surging adoption of advanced technologies, especially 5G; existence of several prominent industry players, and giant investments in the development of 5G technology by telecom leaders, such as AT&T, Ericsson, T-Mobile, and Qualcomm.

Europe has the third-highest demand for this technology globally. This is owing to the widespread deployment of the 5G infrastructure for the public and private sectors and the accessibility of high-frequency bands in the region. For example, the U.K. has selected particular frequency bands, such as 57–66 GHz, 1–76 GHz, and 81–86 GHz, specifically for commercial mmWave usage and the rest for the public domain.

The advancement of 5G has been high-paced in Europe, owing to the increasing digital interaction of consumers and the rapid rise in the use of innovative technologies. For instance, the luxury vehicles market in Europe is witnessing significant growth, thereby resulting in the sale of internet-connected cars, which demand great data speeds and, ultimately, propel the market growth in the region.

This report offers deep insights into the millimeter wave technology industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Base on Component

Base on Product

Base on Frequency Band

Base on License Type

Base on End User

Geographical Analysis

The millimeter wave technology market size stood at USD 4.5 billion in 2024.

During 2024–2030, the growth rate of the millimeter wave technology market will be 17.6%.

Telecom and Datacom is the largest application area in the millimeter wave technology market.

The major drivers of the millimeter wave technology market include the surging adoption of daily-use and data-intensive applications, the widespread testing of 5G technology, and technological advancements.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages