Market Statistics

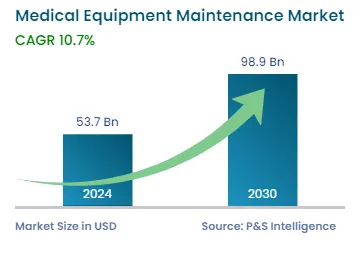

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 53.7 Billion |

| 2030 Forecast | USD 98.9 Billion |

| Growth Rate(CAGR) | 10.7% |

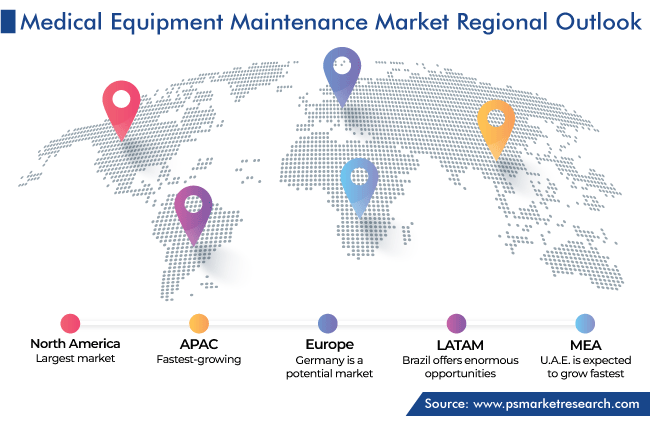

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 11124

Get a Comprehensive Overview of the Medical Equipment Maintenance Market Report Prepared by P&S Intelligence, Segmented by Type (Imaging, Electromedical, Life Support, Surgical, Dental), Service Type (Preventive and Predictive, Corrective, Operational), Service Provider (OEMs, ISOs, In-House), End User (Public-sector Organizations, Private-sector Organizations), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 53.7 Billion |

| 2030 Forecast | USD 98.9 Billion |

| Growth Rate(CAGR) | 10.7% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global medical equipment maintenance market was valued at USD 53.7 billion in 2024, which is expected to grow at a CAGR of 10.7% during 2024-2030, reaching USD 98.9 billion by 2030. The major factors responsible for the growth of the market include the advancements in medical devices, stringent regulatory environment, and rising awareness about preventive maintenance across the globe.

Technological advancements in all kinds of medical devices can be witnessed globally, resulting from the significant investment in research and development (R&D) activities. Owing to this, a number of products that offer more-accurate and faster clinical procedures are being adopted to provide better healthcare to patients. The global medical device industry is highly diversified, with market players manufacturing a variety of devices to diagnose and treat patients suffering from different conditions. No matter how advanced they are, medical devices have a certain life span and require maintenance or replacement, in some cases, after a certain period. Therefore, the growing medical device industry is predicted to drive the demand for equipment maintenance services during the forecast period.

End users in the medical equipment maintenance market are becoming more inclined toward entering into multi-vendor contracts, in order to reduce the complexities and additional expenses associated with separate services provided under agreements with the manufacturers of medical equipment. For instance, GE Healthcare, the healthcare division of General Electric Company, offers the Assure Point multi-vendor service for imaging equipment, regardless of the manufacturer. In June 2019, GE Healthcare added more than 6,000 multi-vendor parts and six new functions to its online Service Shop, with the aim to provide greater availability of parts.

Rapid advancements in medical devices, including diagnostic equipment, are being witnessed in the healthcare sector, globally. With the global medical device industry being highly diversified, key players are developing high-quality diversified products using advanced technologies resulting from significant investments in research and development (R&D) activities. Medical devices have a certain life span and require maintenance or replacement, in some cases, after a certain period.

Newer equipment offers improved implant imaging, reduced susceptibility challenges, pulmonary imaging opportunities, enhancements in liver imaging, larger bores, and artificial intelligence. Therefore, the expanding medical device industry is predicted to drive the growth of the medical equipment maintenance market during the forecast period.

The emphasis on cleanliness in healthcare facilities is increasing, with many prestigious organizations issuing guidance for improving the cleanliness regimen and preventing infections. For instance, the World Health Organization has issued guidelines for hospital hygiene and infection control, which emphasize equipment maintenance. Owing to this, healthcare providers are increasingly adopting maintenance services for various devices to increase their useful life and ensure the safety of the personnel and patients. Such factors are expected to significantly boost the growth of the medical equipment maintenance market during the forecast period.

The FDA approved 37 medical devices in 2022 in the categories of lab tests, , lung , stents, heart monitors, leadless pacemaker systems, software, spinal stimulation systems, and many more. This rise in the number of medical devices in use will, in turn, drive the demand for their maintenance.

In November 2022, Sonablate Corp., a focused ultrasound technology company, announced a three-year contract with Agiliti, a provider of healthcare technologies and services, to deploy Sonablate’s HIFU devices throughout their network. Agiliti assists over 9,000 healthcare providers across the country with accessing, managing, maintaining, and mobilizing essential medical equipment, in order to lower costs, boost operational efficiencies, and support the best possible patient results.

Moreover, in November 2022, in an effort to improve access to healthcare in underprivileged regions, Siemens Healthineers announced that it has reached an agreement to supply more than USD 140 million worth of medical equipment to U.S.-based healthcare provider Atrium Health over the next 10 years.

Based on equipment type, the imaging equipment category is expected to dominate the medical equipment maintenance market during the forecast period. The leading position of the category is attributed to the extensive use of imaging equipment for various medical conditions, including cancer and neurological diseases.

Based on service type, the preventive and predictive services category is expected to witness the fastest growth in the medical equipment maintenance market during the forecast period. This would mainly be due to the wide range of services offered by service providers in this category, which generates immense cost savings for public- and private-sector organizations.

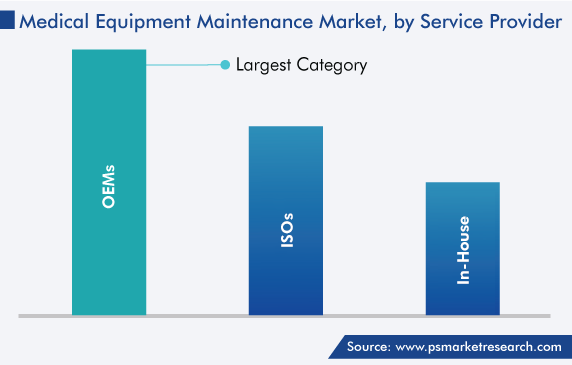

In 2023, the global medical equipment maintenance industry generated the highest revenue in the category of OEMs, based on service provider, owing to advanced and faster maintenance services offered by them. Based on the type of OEM, multi-vendor is expected to be the higher-revenue-generating category in the global market till 2030. It is also projected to be the faster-growing category during the forecast period, mainly on account of a wider portfolio of services provided by them as compared to single-vendor OEMs.

Public-sector organizations are the dominant end users in the global market for medical equipment maintenance, both in terms of growth and size. This leading position of the category is due to the fact that public-sector organizations operate a greater number of medical centers than private-sector organizations, thereby generating a higher demand for maintenance services than the private sector. In addition, the increasing number of government hospitals and rising healthcare support provided by governments to patients lead to a higher usage of medical devices by these end users, thereby further supporting the market growth.

Drive strategic growth with comprehensive market analysis

North America accounted for the major share in the medical equipment maintenance market in 2023, and it is expected to continue to lead the industry throughout the forecast period. This would be due to the growing geriatric population, increasing number of hospitals, rising disease burden, and increasing adoption of medical imaging systems.

According to an article published by the U.S. Census Bureau, the older North American population is expected to outnumber the younger population by 2030. The region will have 78 million people aged 65 years and above, whereas the population under the age of 18 years will be 76.7 million.

Moreover, the region is expected to witness an increase in the number of hospitals. According to the data published by the American Hospital Association, there were 6,093 registered hospitals in the U.S. in 2022. Thus, with the increase in the number of hospitals, the demand for medical equipment maintenance is also likely to rise in the region owing to the number of medical devices under extensive use for diagnosis and treatment.

Globally, APAC is expected to advance with the highest CAGR in the medical equipment maintenance market during the forecast period. The major factors responsible for this growth would be the increasing number of diagnostic tests performed in the region and rising prevalence of chronic diseases that require medical devices for early diagnosis.

Moreover, the number of hospitals in the region is increasing annually. For instance, the total number of hospitals in China has risen significantly over the last decade, from roughly 18,700 in 2005 to about 27,600 in 2015 and approximately 35,394 in 2020.

This fully customizable report gives a detailed analysis of the medical equipment maintenance industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Type

Based on Service Type

Based on Service Provider

Based on End User

Geographical Analysis

Market Players Are Engaging in Mergers and Acquisitions to Gain Competitive Edge

In recent years, players in the market have been actively involved in mergers and acquisitions to stay ahead in the competition.

The market for medical equipment maintenance services will generate USD 98.9 billion by 2030.

ISOs are gaining prominence in the medical equipment maintenance industry because of the cost-effectiveness of their services over those offered by OEMs.

APAC will be the fastest-growing market for medical equipment maintenance services.

Predictive maintenance and equipment insurance are the biggest trends in the medical equipment maintenance industry.

Imaging equipment dominates the market for medical equipment maintenance services.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages