Market Statistics

| Study Period | 2019 - 2030 |

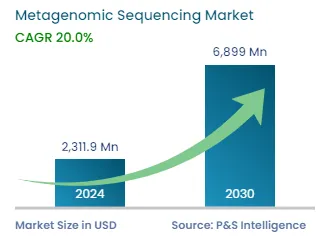

| 2024 Market Size | USD 2,311.9 Million |

| 2030 Forecast | USD 6,899 Million |

| Growth Rate(CAGR) | 20% |

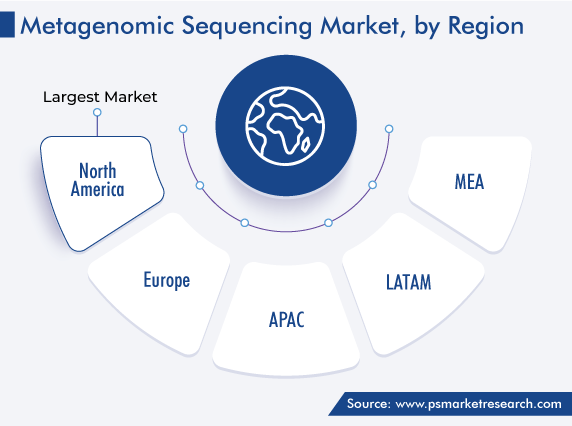

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12562

Comprehensive Overview of the Metagenomic Sequencing Market Report (2019-2030), Segmented by Application (Drug Discovery, Clinical Diagnostic, Soil Microbiome Applications, Industrial Applications, Ecological and Environmental Applications, Veterinary Applications), Workflow (Sample Processing & Library Preparation, Sequencing, Data Processing & Analysis), Technology (Shotgun Metagenomic Sequencing, 16S rRNA Sequencing, Metatranscriptomics, Whole-Genome Sequencing, De Novo Assembly), Offerings (Reagents & Consumables, Instruments, Services, Analysis & Data Interpretation Solutions).

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,311.9 Million |

| 2030 Forecast | USD 6,899 Million |

| Growth Rate(CAGR) | 20% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global metagenomic sequencing market generated revenue of USD 2,311.9 million in 2024, which is expected to witness a CAGR of 20% between 2024 and 2030, reaching USD 6,899 million by 2030. This can be ascribed to the declining cost of this technique. Moreover, the adoption of this technique is rising in agricultural biotechnology, wherein it enables the analysis of whole genomes in an environmental sample without the requirement for culturing.

This industry is majorly driven by the growing demand for the associated techniques in drug discovery, clinical diagnostics, and carrier screening, in part, due to the increase in the prevalence of genetic disorders. Furthermore, the continuous advancements in NGS platforms, high requirement for such technique in several fields, and increasing funding by private and government organizations to encourage large biotechnology projects are leading to the expansion of the market.

The rising interest of researchers in the application of metagenomics in numerous domains, including metatranscriptomics, metaproteomics, and metabolomics, has a significant impact on the industry. Additionally, the availability of cloud computing technology for data management provides lucrative opportunities to market participants. Moreover, the market is booming as a result of the recent significant decrease in the cost of genome sequencing, brought about by technological advancements, and the rising adoption of DNA sequencing for research.

Numerous market players have launched metagenomic programs for efficient mutation monitoring, to aid in the creation of vaccines for infectious diseases. For instance, in December 2021, scientists from the University of Calgary conducted a study on the use of the approach for the detection of COVID-19 and its variants. The study came to the conclusion that when the disease first appears, the metagenomics technique can be helpful.

Furthermore, it is projected that the strategic efforts made by academic institutions and industry players to promote breakthrough technologies would assist the market growth. Although it is forecast that the sequence analysis business would expand fast as a result of the low pricing, variable expenses have a significant impact on revenue generation. Metagenomics sequencing is a useful addition to PCR-based diagnostic procedures because of its lowering cost and increasing sensitivity. As a result, clinics are using a variety of genomics services more frequently.

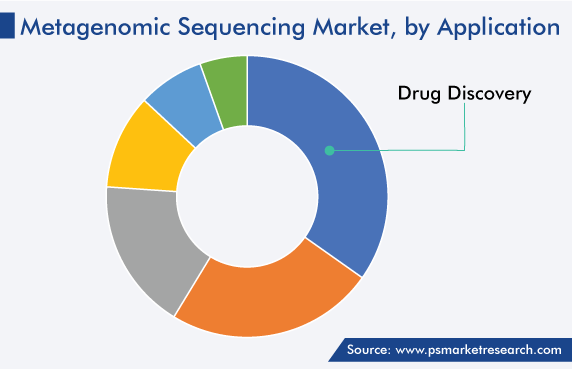

By application, the drug discovery category accounted for the largest revenue share, of more than 26%, in 2022, and it is further expected to maintain its dominance during the forthcoming period. This can be attributed to the increasing research activities in the pharmaceutical and biotechnical industries for novel drug discovery, often as part of collaborations among market players and academic institutes.

Around the world, governments and market players are strongly focusing on drug discovery and development, which is why scientists are adopting the metagenomic technology for accurate and fast results. Many new applications for this type of sequencing, such as the genome analysis of microbial populations, have emerged as a result of the development of improved technologies.

The clinical diagnostics category is expected to register the highest CAGR during the forecast period, owing to the creation of tools and software for genomic research and rising incidence of infectious diseases.

The shotgun technique accounted for the largest share in the metagenomic sequencing market. It is further expected to maintain its dominance during the forthcoming period, owing to the advantages offered by this procedure over other techniques and the surge in the number of genomic-based research activities conducted by academic and research institutes.

This method allows for the reading of all the genomes contained within a DNA molecule. For instance, a paper published by the Arthritis & Rheumatology journal in July 2022 claims that the genetic makeup and the presence of a disease have an effect on the composition of the gut microbiota. To achieve this outcome, the shotgun technique was used in the study.

Further, the whole-genome sequencing method would witness significant growth in the industry during the forthcoming period. Companies are working hard to expand their product portfolios offered for diagnosing uncommon diseases. Moreover, researchers are rapidly adopting this method due to its clearance in DNA profiling. For instance, in June 2021, Pacific Biosciences and the Rady Children's Institute for Genomic Medicine collaborated on whole-genome sequencing research. The program was designed to boost the success rates of treating rare disorders and find the potential disease-causing genetic variations.

The sequencing category accounted for the largest share in 2022 in the workflow segment, and it is further expected to maintain its dominance in the future. Sequencing techniques are frequently used by healthcare institutions and research scientists for genetic studies, which is a crucial component of genetic testing. The cost of sequence modeling has fallen by about 28% yearly due to technological advancements, which would drive its adoption.

According to a report published in September 2022, African countries underperformed in the sequencing of genomes during the early days of COVID-19. However, more than 100,000 genomes from the region have been sequenced till date as a result of the increased funding.

The data processing & analysis category will show significant growth due to the rising complexities in maintaining the read data of billions of sequences. Hence, in order to extract relevant information, the data must be reduced to a meaningful nucleotide sequence confirming the stated premise. Different software is created and committed to a certain function, in order to evaluate the massive volumes of this data, which is a key factor driving the growth in the usage of the technology.

Drive strategic growth with comprehensive market analysis

Based on Application

Based on Workflow

Based on Technology

Based on Offerings

Geographical Analysis

In 2024, the market for metagenomic sequencing solutions valued USD 2,311.9 million.

Agricultural biotechnology applications are trending in the metagenomic sequencing industry.

The market for metagenomic sequencing solutions is driven by the government investments for healthcare R&D and rising prevalence of genetic and infectious diseases.

Drug discovery is the largest application in the metagenomic sequencing industry.

North America is the largest market for metagenomic sequencing.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages