Report Code: 10565 | Available Format: PDF

- Home

- Life Sciences

- Medical Gases and Equipment Market

Medical Gases and Equipment Market Size and Share Analysis by Type (Medical Gas, Medical Gas Equipment), Application (Therapeutic, Diagnostics, Pharmaceutical Manufacturing and Research), End User (Hospitals, Home Healthcare, Pharmaceutical and Biopharmaceutical Companies, Diagnostic and Research Laboratories, Academic Institutes and Research Institutes) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 10565

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

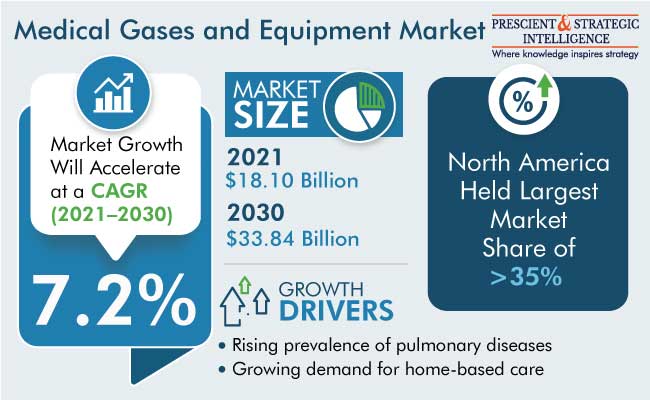

The global medical gases and equipment market size stood at $18.10 billion in 2021, which is expected to reach $33.84 billion by 2030, advancing at a CAGR of 7.20% during 2021–2030. This is primarily ascribed to the rising incidence of chronic diseases all over the world. In addition, the spur in the home healthcare sector size, coupled with technological advancements, is expected to boost the domain progress in the forecast period.

Furthermore, the growing prevalence of respiratory diseases, on account of the growing count of tobacco smokers and mounting pollution levels, and the rising frequency of preterm births are boosting the domain expansion.

Moreover, the active involvement of public organizations to support the adoption of this equipment is propelling the domain size. Additionally, the FDA recently announced the updation of its CGMP regulations to include new labeling, color, and design necessities for oxygen supply closures and compartments, to make them easily distinguishable and reduce the risk of gas pollution.

Pure Gases Being Used the Most

The pure category held the larger share, in 2021, due to the high prevalence of chronic diseases, rising number of hospitalizations, and surging count of road accidents all over the world. Globally, road accidents lead to more than 1.0 million deaths and severe injuries in around 50 million people every year. Thus, the demand for supplemental oxygen is rising exponentially in various healthcare settings.

Based on pure gas type, oxygen accounted for the largest share, in 2021, owing to the presence of a large patient population suffering from respiratory diseases, including COPD, as well as cardiac arrest, significant trauma, and severe bleeding. Moreover, pure oxygen is used in the restoration of the tissue oxygen tension.

In addition, the increasing number of patients requiring emergency care and ambulatory surgeries are burgeoning the category advance. Further, for the treatment of noxious substance poisoning and severe hypoxia, 100% oxygen must be administered through a facial mask. Therefore, owing to the life-saving ability of O2, the category is expected to continue to dominate the segment during the forecast period.

Medical air is set to witness the highest CAGR, of more than 8%, during the forecast period, driven by its wide use in nebulizers for the management and treatment of respiratory patients, patients suffering from oxygen toxicity, and humidity treatment. Additionally, its extensive usage in the NICU and ICU is driving the demand for it.

Based on the form of delivery, high-pressure cylinders are extensively utilized in hospitals and homecare settings. Additionally, the prominent players mainly prefer the delivery of these substances in high-pressure cylinders due to their safety and ease of use.

However, the mixtures category is expected to witness the higher CAGR, in the forecast period. This is because of the snowballing use of lung diffusion mixtures in diagnostic as well as therapeutic applications, including neonatal care, rehabilitation wellness, disability assessment, intensive care, and GI, CVD, and respiratory disease management.

Amongst these mixtures, lung diffusion mixtures are being bought the most, propelled by their rising usage in the calibration of analytical instruments. The lung diffusion mixture comprises carbon monoxide, which is required for the detection of the dispersion in the lungs during the pulmonary function test; and helium, for the determination of the lung volume. Hence, due to the wide applicability of such mixtures, the category is set to grow with a significant rate in the upcoming period.

Medical Gases Are Mainly Employed in Therapeutic Applications

The therapeutic application category accounted for the largest share, of more than 40%, in 2021. This is due to the surging use of medical air, oxygen, carbon dioxide, nitric oxide, and helium as medicine for the treatment of many disorders. Additionally, medicinal oxygen is widely employed in healthcare settings all over the world as complementary to anesthetic agents and in inhalation therapy. Moreover, nitrous oxide is high in demand in hospitals for utilization as an analgesic, anesthetic, and refrigerant in cryosurgical procedures.

The surging adoption of minimally invasive procedures, such as endoscopy, arthroscopy, and laparoscopy, is significantly increasing the usefulness of carbon dioxide as an insufflation air for the broadening and stabilizing of the body cavities, to improve the visibility of the operating area.

The diagnostics category is projected to register the higher CAGR, of more than 8%, in the forecast period, driven by the surging adoption of various gaseous agents in imaging and general laboratory applications. In general laboratories, an aerobic and anaerobic incubator environment is required for the growth and maintenance of microbiological cell cultures, which is supported by oxygen, carbon dioxide, and hydrogen-rich mixtures.

Moreover, the varied usage of these substances in the diagnostics sector, such as of liquid helium to cool the superconductive coils in MRI machines and of test gas for the calibration as well as maintenance of the instruments used for providing inhalable anesthetics, is expected to drive the category’s revenue in the upcoming period.

| Report Attribute | Details |

Historical Years |

2017-2021 |

Forecast Years |

2022-2030 |

Market Size in 2021 |

$18.10 Billion |

Revenue Forecast in 2030 |

$33.84 Billion |

Growth Rate |

7.20% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Regulatory Scenario; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By End User; By Region |

Explore more about this report - Request free sample

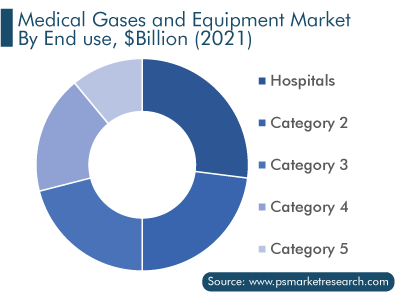

Hospitals Generate Highest Revenue

Hospitals had the largest revenue share in 2021, of more than 27%. This is on account of the rising number of hospitals in both developed as well as developing counties and their wide adoption of nitrogen protoxide, carbon dioxide, liquid nitrogen, and medicinal air in emergency rooms, ICUs, and surgical rooms.

The home healthcare category is set to record the highest CAGR in the upcoming period, owing to the shifting inclination of people toward home-based health services. Moreover, governments have taken various measures to allow people to get long-term care in their homes.

Patients suffering from respiratory diseases, such as COPD, pneumonia, and lung cancer, are turning to portable devices, which will increase the product demand in homecare settings. Moreover, technological advancements have increased the functionality options for a variety of gas handling equipment used in home-based care. In turn, the introduction of lightweight and portable handling equipment has aided in the growth of the home healthcare sector.

Furthermore, the medical gas cylinder technology has advanced dramatically in the last few years. Lightweight, non-limited-life (NLL) composite cylinders have recently entered the sector, and they are expected to play an important role in the development of portable oxygen therapies and other innovative homecare treatments over the next few years. These products provide significant benefits to patients in homecare settings by addressing their desire for a cylinder that is significantly lighter than conventional aluminum cylinders.

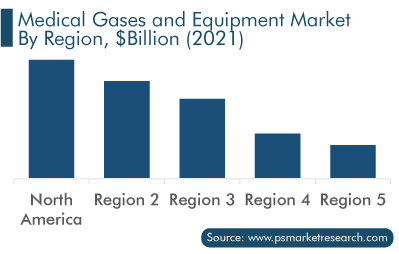

North America Is Market Leader

North America accounted for the highest medical gases and equipment market share, of more than 35%, in 2021, owing to the soaring use of the associated gases for the treatment as well as management of CVDs, asthma, and COPD in hospitals, coupled with the high prevalence of these diseases in the region.

Additionally, the U.S. accounts for the higher sales value in the region, driven by the presence of numerous healthcare facilities. Furthermore, as a result of the current increase in the use of home-based therapy, the medical gas sector in the U.S. is experiencing a rise in standards, analysis, and delivery procedures.

Europe held the second-largest share, in 2021, on account of the presence of various public organizations, such as the Medical Gas Association and European Industrial Gases Association, that frame standard rules and regulations for product manufacturers. Germany, France, and the U.K. together account for the major share in the region, driven by the surging number of hospitals and rising adoption of home-based care in these countries.

Opportunity

The fragmented healthcare industry and high operating margins in emerging economies make them attractive to investors, when compared to developed economies. Countries such as China and India have large populations, and their healthcare infrastructure is improving, thus illustrating an immense growth potential.

Further, manufacturing medical devices in developing regions tends to decrease the overall cost of operations, thus reducing the price of the products without altering their quality. Moreover, with the increasing income and rapid urbanization, the demand for associated gases and equipment is expected to increase in these countries, thus creating ample growth opportunities for the sector.

Top Players in Medical Gases and Equipment Market Are:

- Air Products and Chemicals Inc.

- Praxair Inc.

- L’Air Liquide S.A.

- Taiyo Nippon Sanso Corporation

- Atlas Copco AB

- Linde plc

- SOL Spa

- GCE Holding AB

- Messer Group GmbH

- Matheson Tri-Gas Inc.

Market Size Breakdown by Segment

The study offers a comprehensive market segmentation analysis along with market estimation for the period 2017-2030.

Based on Type

- Medical Gas

- Pure

- By Type

- Oxygen

- Carbon Dioxide

- Nitrous Oxide

- Nitrogen

- Medical Air

- Helium

- By Form of Delivery

- High Pressure Cylinders

- Liquid Tanks

- Bulk Delivery

- By Type

- Mixtures

- Blood-gas Mixtures

- Lung Diffusion Mixtures

- Nitrous oxide-oxygen Mixtures

- Carbon dioxide-oxygen Mixtures

- Laser-gas Mixtures

- Aerobic Mixtures

- Anaerobic Mixtures

- Ethylene Oxide

- Helium-oxygen Mixtures

- Pure

- Medical gas equipment

- Equipment Accessories

- Hoses

- Manifolds

- Regulators

- Flowmeters

- Suction Regulators

- Vacuum Systems

- Outlets

- Monitoring Systems

- Valve with Integrated Pressure Regulator

- Medical Air Compressors

- Oxygen Concentrator

- Cryogenic Products

- Gas Delivery Systems

- Equipment Accessories

Based on Application

- Therapeutic

- Respiratory Diseases

- Cardiovascular Diseases

- Anesthesia

- Cryosurgery

- Diagnostics

- Medical Imaging

- General laboratory Use

- Pharmaceutical manufacturing and research

- Drug Discovery

- Process Development

- Pharmaceutical Manufacturing

- Quality Control

Based on End User

- Hospitals

- Home Healthcare

- Pharmaceutical and Biopharmaceutical Companies

- Diagnostic and Research Laboratories

- Academic Institutes and Research Institutes

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

The market for medical gases and equipment will grow by 7.2% till 2030.

The 2021 value of the medical gases and equipment industry was $18.10 billion.

The market for medical gases and equipment is driven by the rising prevalence of pulmonary diseases and growing demand for home-based care.

Hospitals dominate the medical gases and equipment industry, while home healthcare settings will have the fastest growth.

The market for medical gases and equipment garners significant revenue from the U.S. Germany, France, Italy, China, and India.

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws