Report Code: 12900 | Available Format: PDF | Pages: 290

Marine Onboard Communication and Control Systems Market Size and Share Report by Type (Communication Systems, Control Systems), Platform (Commercial, Defense), End User (OEM, Aftermarket) - Global Industry Demand Forecast to 2030

- Report Code: 12900

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

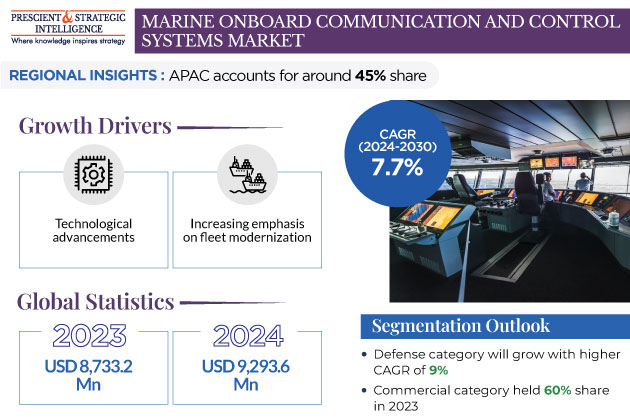

The marine onboard communication and control systems market generated revenue of USD 8,733.2 million in 2023, which is expected to witness a CAGR of 7.7% during 2024–2030, reaching USD 14,496.2 million by 2030. It is due to the increasing emphasis on fleet modernization, technological advancements in marine communication & control solutions, rising global trade, surging demand for better connectivity and higher automation in maritime vessels, for improved safety and efficiency, and escalating demand for satellite communication systems.

Additionally, there is a great concern for the environment and fuel efficiency. The adoption of modern control systems is increasing to reduce emissions and enhance fuel efficiency.

Growing Marine Fleet Size Is Driving Market

- The demand for different kinds of marine vessels is on the rise due to the growing volume of seaborne trade.

- The expansion of global trade mandates a higher capacity for goods transportation via ships.

- Therefore, there is a huge demand for new bulk carriers, cargo ships, container ships, and oil & gas tankers, and the modernization of old ships with the latest technologies.

- Currently, for navigation, enhanced communication, and engine safety & efficiency, new vessels are being integrated with automation identification systems, propulsion control systems, and integrated bridge systems.

Further, specialized vessels are required for offshore activities, such as renewable energy setup installation and oil & gas exploration. This has expanded the demand for fleets that cater to these industries and contributed to the total increase in the marine fleet size. Other vessels, such as offshore support vessels, high-tech research vessels, and LNG carriers, are also required in large numbers, which further propels the market.

Passenger shipping is also playing a crucial role in the growth of the market as there is a growing need for larger, more-advanced cruise ships and ferries to handle the increasing number of passengers.

- Aging vessels are usually retrofitted or replaced to follow the current industry standards, which are often governed by the strict regulations on efficiency.

- Consequently, novel technological models are being used to replace fleets’ older and less-technologically sophisticated ships.

- Economic growth and Industrialization are also driving growth as economic development in emerging markets has raised the scale of marine transportation due to the rising raw material demands.

- This has further led to the need for a larger fleet with the capacity to transport higher volumes of commodities.

Since it is essential to ensure the safety, efficiency, and effective management of these vessels, there is a simultaneous need for modern communication and control systems as the marine fleet size expands to fulfill these numerous needs.

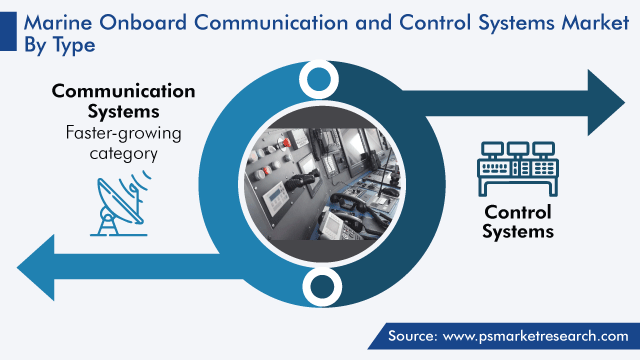

Communication Systems Growing with Highest Rate

On the basis of type, communication systems are expected to witness the higher CAGR, of 8%, from 2024 to 2030. This growth will be due to the rising need for effective communication for navigation and maintaining smooth maritime traffic, safety, connectivity, coordination, and operational efficiency at sea. For safe navigation, dealing with emergencies, coordinating ship operations, and maintaining contact between vessels and shore-based authorities, effective communication is essential in the marine industry. Globally, defense forces, governments, and businesses are making investments in these systems to guarantee safe and efficient marine operations.

- Modern navigation and control systems are being incorporated into ships for smooth data transmission and coordination between various onboard systems, to enhance operational efficiency and safety.

- These advanced communication systems facilitate real-time data transmission, improved decision-making, and operational efficiency.

- By providing better connectivity for private communications, information access, and productive teamwork among crew members, modernized onboard communication systems contribute to improving crew wellbeing.

- Improved communication systems increase efficiency in operations as well, which enhances cost-effectiveness.

The strict regulations and guidelines related to marine safety and security, such as those enforced through the Global Maritime Distress and Safety System (GMDSS), need vessels to have effective communication systems.

- A lot of technological advancements have been happening in communication technology of late, which has resulted in the development of complex and efficient systems for marine applications.

- These advancements include radio communication, very small aperture terminal (VSAT), IoT, and satellite communication.

- Digital transformation is a key factor driving the adoption of communication systems in the marine industry that support data analytics, remote monitoring, and predictive maintenance.

Commercial Category Is Dominating Market

Based on platform, the commercial category dominated the market, with a share of 60%, in 2023. This is because of the essential role of these systems in supporting logistics, global trade, and operation of the commercial vessels, which are used in the transportation of goods across seas, as well as for tourism. Commercial vessels comprise passenger vessels, such as ferries, yachts, and cruise ships; and cargo vessels, including tankers, bulk carriers, container vessels, and dry cargo ships, and some other specialized vessels.

- Advanced control and communication technologies are deployed on commercial ships and boats for navigation, safety, and operational efficiency.

- The incorporation of satellite communication systems, novel technologies, and instant monitoring devices enhances vessel performance and guarantees compliance with the changing regulatory guidelines for various kinds of marine vessels.

Defense Category Is Expected To Have Highest CAGR

Based on end user, the defense category will have the higher CAGR, of 9%, from 2024 to 2030. The need for secure, advanced, reliable communication and control systems in naval vessels remains paramount for defense capability modernization globally. The demand for different integrated systems that offer secure communication, navigation, and other mission-critical functionalities is being driven by security concerns and navies’ expanded objectives. Globally, defense forces are making a lot of investments in the advancement of instant surveillance systems, satellite communications, and integrated control systems.

- Marine control systems also fulfill all the regulatory compliance.

- For this, navies are adopting different propulsion control systems, monitoring systems, and engine controls.

- The navy’s fleet’s modernization is further facilitated by the incorporation of AI and cybersecurity technologies.

- The market is expanding due to the emerging demand for modified, secure communication systems for a range of navy and marine operations.

Original Equipment Manufacturers Will Dominate Market

On the basis of end users, original equipment manufacturers (OEMs) dominated the market, with a share of 70%, in 2023. This is due to their technologically advanced offerings and established market presence. They provide a wide range of integrated solutions, such as communication systems, navigation systems, control systems, and automation solutions, which attract customers looking for a complete package of onboard systems. OEMs maintain high quality in their products through rigorous testing and quality control procedures. Their reputation for providing high-quality products and services allows them to stay ahead of the competition.

- OEMs have strong capabilities in developing communication and control systems with novel technologies.

- Research and development is underway to create advanced and safe systems for the specific needs of the marine industry.

- OEMs provide systems that adhere to marine safety protocols.

- The strong global presence of these companies with extensive service networks helps them increase customer satisfaction and loyalty by providing maintenance and aftersales services.

In the marine industry, OEMs collaborate with system integrators, shipbuilders, and other stakeholders to provide complete, specialized solutions for many kinds of vessels. OEMs are adapting to the emerging demands of customers for advanced technology. They are incorporating new technologies, such as IoT, AI, and cybersecurity measures, into their systems to remain ahead of the competition.

| Report Attribute | Details |

Market Size in 2023 |

USD 8,733.2 Million |

Market Size in 2024 |

USD 9,293.6 Million |

Revenue Forecast in 2030 |

USD 14,496.2 Million |

Growth Rate |

7.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Platform; By End User; By Region |

Explore more about this report - Request free sample

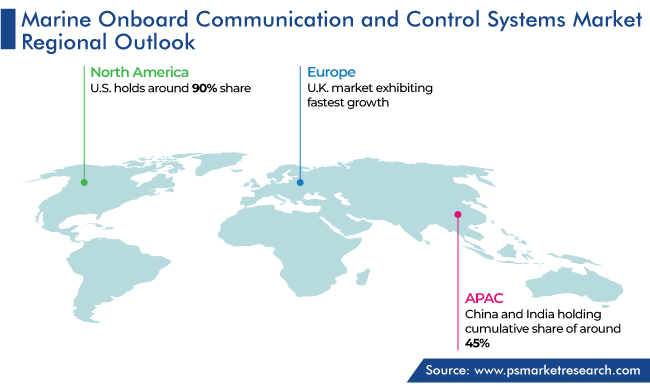

APAC Is Set To Dominate Market

Geographically, the APAC region dominates the marine onboard communication and control systems market, with a share of 50%, in 2023.

- This is ascribed to the expanding shipping activities, growing economies, defense modernization efforts, and advancing technologies.

- The primary reason for the dominance of the region on the market is the increasing marine fleet size for different seaborne trades.

- The government initiatives to improve marine safety, port infrastructure, and compliance with international marine regulations also propel the demand for modern communication and control systems.

Further, the naval fleets of regional countries are being modernized with cybersecurity and artificial intelligence technologies. In this region, South Korea is a lucrative market as it is one of the largest shipbuilders on earth. APAC countries also face marine security challenges, such as territorial disputes, piracy, and illegal activities at sea. This mandates investments in advanced technologies for surveillance and security purposes, which adds fuel for the overall growth of the region.

Competitive Analysis

The market is being driven by the research being conducted by the major players for product development, to meet the changing requirements of the commercial and defense shipping sectors.

Recent Developments

- In June 2023, Kongsberg presented its new K-Chief marine automation system for effective marine operations. This automation system provides all integrated Kongsberg equipment onboard.

- In June 2023, ST Engineering advanced its NERVA ship management system, to provide centralized control and monitoring of platform systems and sensors.

- In May 2023, ABB launched ABB Dynafin, to enhance the efficiency of ships.

Top Providers of Marine Onboard Communication and Control Systems Are:

- Emerson Electric Co.

- Wartsila

- Kongsberg

- ABB Ltd.

- Northrop Grumman Corporation

- Airbus SE

- Alphatron Marine B.V

- Applied Satellite Technology Ltd.

- Cobham Limited

- Furuno Electric Co. Ltd.

- Garmin Ltd.

- General Dynamics Corporation

- Honeywell International Inc.

- Intellian Technologies Inc.

- Iridium Communications Inc.

- Jotron AS

Market Breakdown

This fully customizable report gives a detailed analysis of the marine onboard communication and control systems market from 2017 to 2030, based on all the relevant segments and geographies.

Segment Analysis, By Type

- Communication Systems

- Control Systems

Segment Analysis, By Platform

- Commercial

- Defense

Segment Analysis, By End User

- OEM

- Aftermarket

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

The industry for marine onboard communication and control systems will reach USD 9,293.6 million in 2024.

The marine onboard communication and control systems market value will reach USD 14,496.2 million in 2030.

The APAC market for marine onboard communication and control systems is the largest.

The expanding marine fleet size is a key marine onboard communication and control systems industry driver.

Commercial hold the larger marine onboard communication and control systems market share.

OEMs is the leading end user in the marine onboard communication and control systems industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws