Market Statistics

| Study Period | 2019 - 2030 |

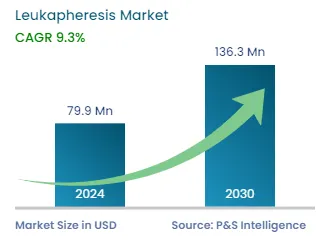

| 2024 Market Size | USD 79.9 Million |

| 2030 Forecast | USD 136.3 Million |

| Growth Rate(CAGR) | 9.3% |

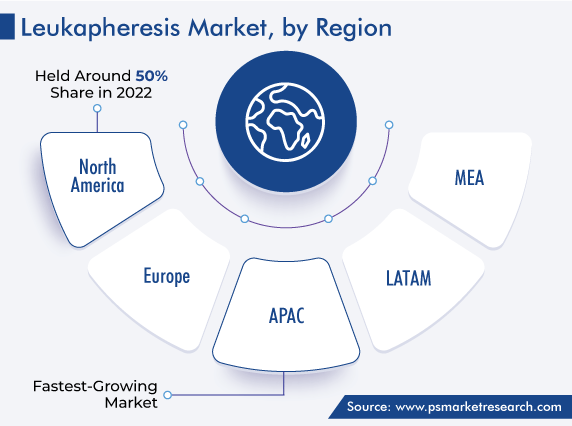

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12556

Get a Comprehensive Overview of the Leukapheresis Market Report Prepared by P&S Intelligence, Segmented by Offering (Devices, Disposables), Application (Therapeutic, Research), End user (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Hospitals and Transfusion Centers, Blood Component Providers and Blood Centers), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 79.9 Million |

| 2030 Forecast | USD 136.3 Million |

| Growth Rate(CAGR) | 9.3% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global leukapheresis market generated revenue of USD 79.9 million in 2024, which is expected to witness a CAGR of 9.3% during 2024–2030, to reach USD 136.3 million by 2030. This can be ascribed to the escalating incidence of leukemia and other hematologic diseases, increasing count of government initiatives for raising cancer awareness, rising volume of blood donations worldwide, rapidly advancing technologies, and surging R&D on leukopaks and their usage in clinical research.

Leukapheresis is a procedure used to treat chronic lymphocytic leukemia (CLL) and other kinds of blood cancer.

Hence, the rise in the number of leukemia patients due to the sedentary lifestyles, smoking, and exposure to radiation and specific chemicals is driving the growth of market. Additional risk factors for lymphomas and leukemias include infection by Epstein–Barr virus, HIV, and human T-cell lymphoma/leukemia virus.

The Leukemia & Lymphoma Society reports that leukemia is the sixth-most-common cancer in terms of the number of deaths worldwide. One diagnosis of leukemia, myeloma, or lymphoma is made in the country every three minutes. In all, 186,400 persons are estimated to have been diagnosed with these three diseases combined in 2021, making 9.8% of all the 1,898,160 new cancer cases that year.

Moreover, after the U.S. and China, studies indicate that India has the highest recorded rate of blood cancers, which affect more than 70,000 men and women nationwide.

Furthermore, leukemia is the most-frequent malignancy found in children and adolescents in the U.S. (28% and 13%, respectively), according to the American Cancer Society. Acute lymphocytic leukemia (ALL) is the most common in children, and leukapheresis has proved to be the most-effective treatment for it. It is performed to remove the extra WBCs from children with this cancer, as well as to collect stem cells from kids, for use in treating other cancers. Therefore, the potential of this procedure beyond the treatment of blood-borne disorders bodes well for the market.

Moreover, the rise in the geriatric population leads to an increase in the cases of blood cancers. Research has established that acute myeloid leukemia (AML) is majorly found in older people and is uncommon before the age of 45. The average age of people upon being first diagnosed with AML is about 68 years. But, AML can occur in children as well.

The WHO predicts that by 2030, one in six people would be 60 years of age or older. By this time, this population will have rapidly increased to 1.4 billion from 1 billion in 2020; moreover, it will double by 2050. Additionally, by 2050, there will be 426 million people of age 80 years or more.

Governments have taken different initiatives for the treatment of leukemia, by initially making people aware of this disease. Additionally, governments and regulatory bodies in different nations have launched many reimbursement policies and set up dedicated cancer hospitals and oncology centers.

For instance, the National Health Mission, an overall population health management scheme of India, launched a program to prevent and treat non-communicable diseases in 2010, with a focus on building the physical environment, developing human resources, and promoting health through early detection, management, and referral. The government has created constituent organizations at the national, state, and district levels for program management and providing services for early diagnosis, treatment, and follow-ups for non-communicable diseases. Under this initiative, free diagnostic services and medications are provided.

The market is bifurcated into devices and disposables, depending on product, of which disposables held the dominating share in 2022, a situation that will likely remain unchanged. The increasing demand for leukapheresis disposables as a result of the rising leukemia prevalence is the major driver for the growth of this market. In addition, the correct usage of a variety of disposables has the benefit of lowering the danger of infections during blood transfusions.

Moreover, companies are expanding their production capacity of leukapheresis disposables to cater to the growing demand for them worldwide. For instance, Fresenius Kabi opened another unit at its transfusion and apheresis disposables facility in Santa Domingo, Dominican Republic, in January 2020.

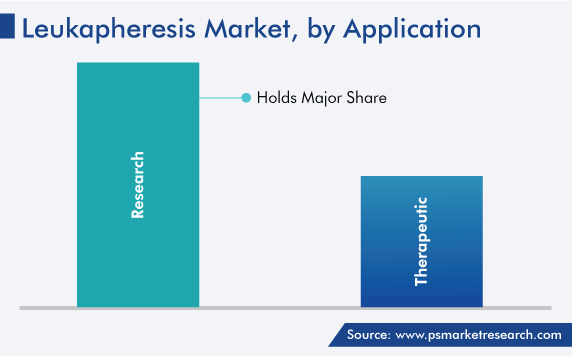

The research application category held the larger revenue share, around 80%, in 2022, and it is further expected to maintain its dominance in the coming years. This is mostly due to the rising usage of leukapheresis products for the creation of cell-based immunotherapies, surging need for leukopaks in scientific research, and escalating adoption of leukapheresis-derived primary cells in pharmaceutical research and development.

The therapeutic application category will show healthy growth during the forthcoming period. This is attributed to the robust global network of companies offering leukapheresis equipment and disposables for therapy. Moreover, hospitals are rapidly acquiring leukapheresis equipment to treat patients for a range of blood-borne disorders.

Drive strategic growth with comprehensive market analysis

Geographically, North America accounted for the largest share, of around 50%, in 2022, and it is projected to grow at a robust CAGR during the forecast period. This will be due to the substantial research and development activities in the pharmaceutical and biotechnology sectors. This region also has a stronghold due to the presence of a large number of industry players and healthcare providers, the high count of ongoing CAR T-cell therapy clinical trials, as well as the elevated risk of pandemics and communicable diseases. Additionally, the region's rapid adoption of new technologies and the rising prevalence of chronic diseases support the expansion of the regional industry.

Moreover, the recent strategic developments by the players in the region are a key factor for the market growth. For instance, in January 2019, Key Biologics LLC and Cascade Regional Blood Services (CRBS) signed a multi-year agreement to supply blood products and materials that are essential for research and product development to academic, pharmaceutical, and biotech researchers. The agreement comprises cooperative donor recruiting, product distribution, and marketing in the U.S., and it is focused on the collection of mononuclear cells via leukapheresis.

Moreover, the American Red Cross is currently undertaking renovation at its Red Cross Mary Coultrap Johnson Blood and Platelet Donation Center. The USD 2-million product includes a new blood donation facility spanning 8,000 square feet, 12 beds for whole blood donation, 15 apheresis donor beds for plasma and platelet donation, two beds for collecting white blood cells from donors via leukapheresis, and 10 health history rooms.

The APAC market is expected to witness the fastest growth during the forecast period, mainly on account of the improving healthcare infrastructure, increasing prevalence of leukemia in the region, rising per capita income, and growing geriatric population. Additionally, the market is growing due to the government programs to support healthy lifestyles and raise awareness and the technological improvements in hematology. Moreover, the expansion in the network of cancer hospitals and blood donation and processing centers in this region contributes to the market's growth.

Within the region, China will show significant growth for this market, due to its advancing healthcare infrastructure, surging cases of blood cancers, especially leukemia; and evolving government policies for cancer treatment reimbursement.

Based on Offering

Based on Application

Based on End user

Geographical Analysis

Disposables dominate the market for leukapheresis solutions.

In 2030, the leukapheresis industry will value USD 136.3 million.

The 2024 size of the market for leukapheresis solutions was USD 79.9 million.

The leukapheresis industry is growing with the rising incidence of blood-borne diseases.

North America is the largest market for leukapheresis solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages